by Calculated Risk on 8/20/2019 09:51:00 AM

Tuesday, August 20, 2019

Existing Home Sales: Lawler vs. the Consensus

The NAR is scheduled to release Existing Home Sales for July at 10:00 AM tomorrow (Wednesday, Aug 20th).

The consensus is for 5.39 million SAAR, up from 5.27 million in June. Housing economist Tom Lawler estimates the NAR will report sales of 5.40 million SAAR and that inventory will be down 1.6% year-over-year. Based on Lawler's estimate, I expect existing home sales to be close to the consensus.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 9 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month the consensus was for sales of 5.34 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 5.25 million, and the NAR reported 5.27 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last 9 years, the consensus average miss was 145 thousand, and Lawler's average miss was 68 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | --- |

| 1NAR initially reported before revisions. | |||

Monday, August 19, 2019

30 Year Fixed Mortgage: 3.5% to 3.625%

by Calculated Risk on 8/19/2019 08:54:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Relatively Steady Despite Bond Market Weakness

Mortgage rates mostly held steady today, despite a move higher in broader interest rate indicators like the 10yr Treasury yield. Treasuries and mortgage rates typically track each other quite well, but that relationship has broken down in recent weeks due to the rapid drop in rates and the increase in volatility. The mortgage sector has a much tougher time adjusting to new realities compared to Treasuries. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]

emphasis added

Housing Inventory Tracking

by Calculated Risk on 8/19/2019 04:46:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was unchanged year-over-year (YoY) in June. That followed ten consecutive months with a YoY increase.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento and Phoenix (through July), and total existing home inventory as reported by the NAR (through June).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 71% YoY in Las Vegas in July (red), the thirteenth consecutive month with a YoY increase. But the YoY change is slowing.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined when oil prices increased. Inventory was up 9.7% year-over-year in Houston in July.

Inventory is a key for the housing market. Right now it appears the inventory build that started last year has ended.

Los Angeles Area Home Sales Unchanged YoY in July, Inventory Down 1% YoY

by Calculated Risk on 8/19/2019 02:24:00 PM

From Pacific Union chief economist Selma Hepp: How are lower interest rates impacting Los Angeles housing markets?

After a large dip in housing market activity starting in the last quarter of 2018 and first quarter of 2019, housing markets in recent months have mostly bounced back to where they were last summer. The number of home sales trends about the same, home prices have recovered to again show annual increases, inventories are scarce, and absorption rates have returned to the same rates.CR Note: there is much more data at Hepp's report.

...

Home sales activity picked up speed in July, after some slowing in June, bringing activity back in line with stronger numbers seen in May. In July, total sales in Los Angeles County trended at the same level as July of last year, [5,417 in July 2019 compared to 5,424 in July 2018] with an increase in sales of homes priced between $1 million and $2 million, up 5 percent year-over-year, being offset by slower sales in other price segments.

…

[F]or-sale inventory is once again trending below last year’s levels with July’s year-over-year decline for the overall inventory down one percent, and inventory priced below $1 million down 5 percent. Declines follow almost a year of year-over-year increases. And the lower priced inventory is now 24 percent below the 2015 levels.

emphasis added

The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA)

by Calculated Risk on 8/19/2019 11:52:00 AM

We all remember the promises for the 2017 Tax Cuts and Jobs Act (TCJA):

1) "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate."

2) Boost business investment

3) Pay for itself (Not increase deficit)

4) Give the typical American household around a $4,000 pay raise

Here are a few quotes from 2017:

"This change, along with a lower business tax rate, would likely give the typical American household around a $4,000 pay raise." Donald Trump, October 19, 2017

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

"I think to the extent we get the tax deal done, the stock market will go up higher." Treasury Secretary Steven Mnuchin, October 2017

The following table shows quarterly real GDP growth (annualized) from the BEA since the TCJA was signed. The average growth in the first six quarters was 2.5% - nothing special - and definitely not the promised "3.5 percent per year on average".

And it appears Q3 2019 will be another slow growth quarter.

Note: There was some pickup in 2018 (as expected), but growth has slowed in 2019.

| Quarter | Real GDP Growth Annualized | |

|---|---|---|

| Q1 2018 | 2.5% | |

| Q2 2018 | 3.5% | |

| Q3 2018 | 2.9% | |

| Q4 2018 | 1.1% | |

| Q1 2019 | 3.1% | |

| Q2 2019 | 2.1% | |

| Q3 20191 | 2.0% | |

| 1 Q3 2019 Estimated | ||

What about investment?

Click on graph for larger image.

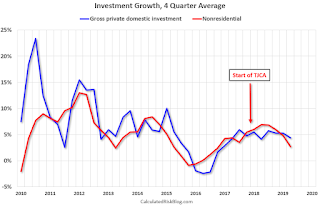

Click on graph for larger image.This graph shows a 4 quarter average growth in Gross private domestic investment (Blue) and Nonresidential Private Investment (Red).

There was a slump in investment in 2015 and 2016 due to the collapse in oil prices, but there has been no discernible pickup in investment growth since the passage of the TCJA.

And what about the deficit?

From the CBO July monthly budget review:

The federal budget deficit was $867 billion for the first 10 months of fiscal year 2019, the Congressional Budget Office estimates—$184 billion more than the deficit recorded during the same period last year. Revenues were $92 billion higher and outlays were $276 billion higher than in the same period in fiscal year 2018.On pace for a trillion dollar deficit for the current fiscal year, up sharply from a few years ago.

Note: The CBO will release updated budget and economic projections this Wednesday.

Note: the Federal government's deficit usually increases sharply during a recession - it is the only entity that can be countercyclical - and the decreases during an expansion. So no one should compare the deficit to 2008 (under Bush) or 2009 (under Obama) during the great recession.

So the TCJA didn't pay for itself and caused a significant increase in the deficit.

In summary, there was no discernible boost in investment. No sustained increase in GDP growth. No $4,000 pay raise. And the TCJA didn't pay for itself (significant increase in deficit).

Phoenix Real Estate in July: Sales up 10% YoY, Active Inventory Down 14% YoY

by Calculated Risk on 8/19/2019 09:37:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 9,192 in July, up from 8,380 in July 2018. Sales were down 1.3% from June 2019 (last month), and up 9.7% from July 2018.

2) Active inventory was at 13,737, down from 16,035 in July 2018. That is down 14.3% year-over-year.

3) Months of supply decreased to 1.96 months in July from 2.12 in June. This is low.

This is another market with increasing sales and falling inventory. With the decline in mortgage rates in August, we will probably see a further pickup in coming months.

Sunday, August 18, 2019

Sunday Night Futures

by Calculated Risk on 8/18/2019 08:24:00 PM

Weekend:

• Schedule for Week of August 18, 2019

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 15 and DOW futures are up 150 (fair value).

Oil prices were up over the last week with WTI futures at $55.23 per barrel and Brent at $59.07 barrel. A year ago, WTI was at $66, and Brent was at $71 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.60 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 23 cents year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 8/18/2019 08:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 10 August

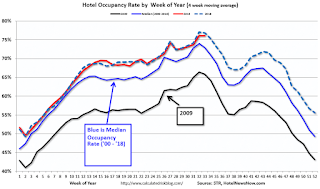

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 4-10 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 5-11 August 2018, the industry recorded the following:

• Occupancy: -1.4% to 74.1%

• Average daily rate (ADR): +0.4% to US$133.36

• Revenue per available room (RevPAR): -1.0% at US$98.88

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years - but has been a little soft YoY in recent weeks.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, August 17, 2019

Schedule for Week of August 18, 2019

by Calculated Risk on 8/17/2019 08:11:00 AM

The key reports this week are July New and Existing Home Sales.

Fed Chair Jerome Powell speaks on Friday at the Jackson Hole Symposium.

Also this week, the BLS will release the preliminary employment benchmark revision, and the CBO will release updated budget and economic projections

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.39 million SAAR, up from 5.27 million last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.39 million SAAR, up from 5.27 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.40 million SAAR.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision.

11:00 AM: CBO to Release Updated Budget and Economic Projections

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of July 30-31, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 220 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for August.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 645 thousand SAAR, down from 646 thousand in June.

10:00 AM: Speech, Fed Chair Jerome Powell, Challenges for Monetary Policy, At the Jackson Hole Economic Policy Symposium: Challenges for Monetary Policy, Jackson Hole, Wyo.

Friday, August 16, 2019

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/16/2019 03:35:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in July

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.40 million in July, up 2.5% from June’s preliminary estimate and up 0.2% from last July’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of June should be about 1.6% lower than last July.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 4.7% from last July.

CR Note: Existing home sales for July are scheduled to be released on Wednesday, August 21st. The early consensus is the NAR will report sales of 5.40 million SAAR (same as Lawler).