by Calculated Risk on 8/19/2019 11:52:00 AM

Monday, August 19, 2019

The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA)

We all remember the promises for the 2017 Tax Cuts and Jobs Act (TCJA):

1) "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate."

2) Boost business investment

3) Pay for itself (Not increase deficit)

4) Give the typical American household around a $4,000 pay raise

Here are a few quotes from 2017:

"This change, along with a lower business tax rate, would likely give the typical American household around a $4,000 pay raise." Donald Trump, October 19, 2017

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

"I think to the extent we get the tax deal done, the stock market will go up higher." Treasury Secretary Steven Mnuchin, October 2017

The following table shows quarterly real GDP growth (annualized) from the BEA since the TCJA was signed. The average growth in the first six quarters was 2.5% - nothing special - and definitely not the promised "3.5 percent per year on average".

And it appears Q3 2019 will be another slow growth quarter.

Note: There was some pickup in 2018 (as expected), but growth has slowed in 2019.

| Quarter | Real GDP Growth Annualized | |

|---|---|---|

| Q1 2018 | 2.5% | |

| Q2 2018 | 3.5% | |

| Q3 2018 | 2.9% | |

| Q4 2018 | 1.1% | |

| Q1 2019 | 3.1% | |

| Q2 2019 | 2.1% | |

| Q3 20191 | 2.0% | |

| 1 Q3 2019 Estimated | ||

What about investment?

Click on graph for larger image.

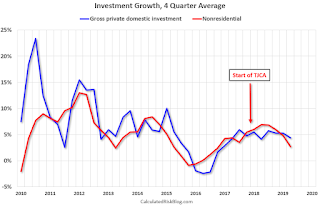

Click on graph for larger image.This graph shows a 4 quarter average growth in Gross private domestic investment (Blue) and Nonresidential Private Investment (Red).

There was a slump in investment in 2015 and 2016 due to the collapse in oil prices, but there has been no discernible pickup in investment growth since the passage of the TCJA.

And what about the deficit?

From the CBO July monthly budget review:

The federal budget deficit was $867 billion for the first 10 months of fiscal year 2019, the Congressional Budget Office estimates—$184 billion more than the deficit recorded during the same period last year. Revenues were $92 billion higher and outlays were $276 billion higher than in the same period in fiscal year 2018.On pace for a trillion dollar deficit for the current fiscal year, up sharply from a few years ago.

Note: The CBO will release updated budget and economic projections this Wednesday.

Note: the Federal government's deficit usually increases sharply during a recession - it is the only entity that can be countercyclical - and the decreases during an expansion. So no one should compare the deficit to 2008 (under Bush) or 2009 (under Obama) during the great recession.

So the TCJA didn't pay for itself and caused a significant increase in the deficit.

In summary, there was no discernible boost in investment. No sustained increase in GDP growth. No $4,000 pay raise. And the TCJA didn't pay for itself (significant increase in deficit).