by Calculated Risk on 3/28/2019 11:00:00 AM

Thursday, March 28, 2019

Kansas City Fed: "Tenth District Manufacturing Activity Accelerated Moderately"

From the Kansas City Fed: Tenth District Manufacturing Activity Accelerated Moderately

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity accelerated moderately, and expectations for future activity also increased.This was the last of the regional Fed surveys for March.

“Factories in the region reported an uptick in growth in March, following three straight months in which the pace of growth slowed,” said Wilkerson. “Plans for both hiring and capital spending picked up.”

...

The month-over-month composite index was 10 in March, up from 1 in February and 5 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factories expanded production of both durable and nondurable goods, particularly food and beverage products, as well as wood, paper, and printing manufacturing. Most month-over-month indexes increased in March, with production, shipments, new orders, order backlog, new orders for exports, and materials inventories rebounding back into positive territory. Most year-over-year factory indexes grew in March, and the composite index rose from 23 to 27. The future composite index also climbed up from 13 to 22, as future factory activity expectations increased across the board.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be at about the same level in March as in February, maybe slightly higher. The early consensus forecast is for a reading of 54.5, up slightly from 54.2 in February (to be released on Monday, April 1st).

NAR: Pending Home Sales Index Decreased 1.0% in February

by Calculated Risk on 3/28/2019 10:04:00 AM

From the NAR: Pending Home Sales Dip 1.0 Percent in February

Pending home sales endured a minor drop in February, according to the National Association of Realtors®. The four major regions were split last month, as the South and West saw a bump in contract activity and the Northeast and Midwest reported slight declines.This was at expectations of a 1% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.0 percent to 101.9 in February, down from 102.9 in January. Year-over-year contract signings declined 4.9 percent, making this the fourteenth straight month of annual decreases.

...

The PHSI in the Northeast declined 0.8 percent to 92.1 in February, and is now 2.6 percent below a year ago. In the Midwest, the index fell 7.2 percent to 93.2 in February, 6.1 percent lower than February 2018.

Pending home sales in the South inched up 1.7 percent to an index of 121.8 in February, which is 2.9 percent lower than this time last year. The index in the West increased 0.5 percent in February to 87.5 and fell 9.6 percent below a year ago.

emphasis added

Q4 GDP Revised Down to 2.2% Annual Rate

by Calculated Risk on 3/28/2019 08:47:00 AM

From the BEA: Gross Domestic Product, 4th quarter and annual 2018 (third estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the fourth quarter of 2018, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.4 percent.PCE growth was revised down from 2.8% to 2.5%. Residential investment was revised down from -3.5% to -4.7%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "initial" estimate issued last month. In the initial estimate, the increase in real GDP was 2.6 percent. With this estimate for the fourth quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE), state and local government spending, and nonresidential fixed investment were revised down; imports, which are a subtraction in the calculation of GDP, were also revised down.

emphasis added

This puts 2018 annual GDP at 2.86%, and Q4-over-Q4 GDP at 2.97%.

Here is a Comparison of Third and Initial Estimates.

Weekly Initial Unemployment Claims decreased to 211,000

by Calculated Risk on 3/28/2019 08:37:00 AM

The DOL reported:

In the week ending March 23, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 221,000 to 216,000. The 4-week moving average was 217,250, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised down by 4,500 from 225,000 to 220,500.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 217,250.

This was below the consensus forecast.

Wednesday, March 27, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 3/27/2019 07:17:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 221 thousand the previous week.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2018 (Third estimate). The consensus is that real GDP increased 2.2% annualized in Q4, down from the initial estimate of 2.6%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 1.0% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March. This is the last of regional manufacturing surveys for March.

Zillow Case-Shiller Forecast: Smaller YoY House Price Gains in February

by Calculated Risk on 3/27/2019 03:41:00 PM

The Case-Shiller house price indexes for January were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: January Case-Shiller Results and February Forecast: Lowest Gains Since 2015

he national housing market’s ongoing, slow march back to “normal” is continuing into the start of 2019 — setting up a spring in which buyers will have more power than they have in years, although they still may need to work hard to find a favorable deal.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to decline to 4.0% in February compared to 4.3% in January.

House prices climbed 4.3 percent in January from a year early, down 4.6 percent from the prior month, according to the Case-Shiller home price index. The last time it advanced this slowly was April 2015.

The Zillow forecast is for the 20-City index to decline to 2.9% YoY in February, and for the 10-City index to decline to 2.4% YoY.

The Zillow forecast is for the 20-City index to decline to 2.9% YoY in February, and for the 10-City index to decline to 2.4% YoY.

March Vehicle Sales Forecast: 16.9 Million SAAR

by Calculated Risk on 3/27/2019 11:26:00 AM

From JD Power: Auto Retail Sales Off to Slowest Q1 Start Since 2013

Total sales in March are projected to reach 1,562,800 units, a 2.1% decrease compared with March 2018. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 16.9 million units, down 400,000 from a year ago.This forecast is for sales to be higher than in January and February, and down from 17.2 million SAAR in March 2018.

New vehicle total sales in Q1 are projected to reach 3,952,100 units, a 2.5% decrease compared to the first quarter of last year.

“This is the first time in six years that Q1 sales will fall short of 3 million units. While the volume story could be better, there is remarkable growth in transaction prices, with records being set monthly. New-vehicle prices are on pace to reach $33,319 in Q1—the highest ever for the first quarter—and it’s more than $1,000 higher than last year.”

…

Given the current weakness and uncertain future, LMC’s forecast for 2019 total light-vehicle sales has been trimmed by 75,000 units to 16.9 million units, a decline of 2.2% from 2018.

emphasis added

Trade Deficit decreased to $51.1 Billion in January

by Calculated Risk on 3/27/2019 08:52:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $51.1 billion in January, down $8.8 billion from $59.9 billion in December, revised.

January exports were $207.3 billion, $1.9 billion more than December exports. January imports were $258.5 billion, $6.8 billion less than December imports.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in January.

Exports are 25% above the pre-recession peak and up 3% compared to January 2018; imports are 11% above the pre-recession peak, and up 2% compared to January 2018.

In general, trade has been picking up, although both imports and exports have declined slightly recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $42.59 in January, up from $50.27 in January, and down from $54.76 in January 2018.

The trade deficit with China decreased to $34.5 billion in January, from $36.0 billion in January 2018.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 3/27/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 22, 2019.

... The Refinance Index increased 12 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

“The spring buying season is off to a strong start. Thanks to an unexpectedly large drop in mortgage rates following last week’s FOMC meeting, purchase applications jumped 6 percent and refinance applications surged over 12 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Rates dropped across all loan types, and the 30-year fixed-rate mortgage is now more than 70 basis points below last November’s peak. The average loan size increased once again to new highs for both purchase and refinance loans, as borrowers with – or seeking – larger loans tend to be more reactive to the drop in rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.45 percent from 4.55 percent, with points decreasing to 0.39 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

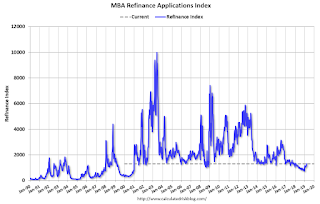

Click on graph for larger image.The first graph shows the refinance index since 1990.

Now that mortgage rates have fallen more than 50 bps from the highs last year, a number of recent buyers will be able to refinance.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 4% year-over-year.

Tuesday, March 26, 2019

Wednesday: Trade Deficit

by Calculated Risk on 3/26/2019 07:33:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $57.4 billion. The U.S. trade deficit was at $59.8 billion in December.