by Calculated Risk on 3/13/2019 10:11:00 AM

Wednesday, March 13, 2019

Construction Spending increased in January

From the Census Bureau reported that overall construction spending decreased in December:

Construction spending during January 2019 was estimated at a seasonally adjusted annual rate of $1,279.6 billion, 1.3 percent above the revised December estimate of $1,263.1 billion. The January figure is 0.3 percent above the January 2018 estimate of $1,276.3 billion.Both private and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $966.0 billion, 0.2 percent above the revised December estimate of $964.2 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $313.6 billion, 4.9 percent above the revised December estimate of $299.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 25% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 4% below the peak in March 2009, and 20% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 6%. Non-residential spending is up 2% year-over-year. Public spending is up 8% year-over-year.

This was above consensus expectations, however spending for November and December were revised up.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 3/13/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 8, 2019.

... The Refinance Index decreased 0.2 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“Led by a 5.5 percent increase in FHA loan applications, purchase activity picked up last week and was almost 2 percent higher than a year ago,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Purchase applications have now increased year-over-year for four weeks, which signals healthy demand entering the busy spring buying season. However, the pick-up in the average loan size continues, with the average balance reaching another record high. With more inventory in their price range compared to first-time buyers, move-up and higher-end buyers continue to have strong success finding a home.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.64 percent from 4.67 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, March 12, 2019

Wednesday: Durable Goods, PPI, Construction Spending

by Calculated Risk on 3/12/2019 05:45:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

Goldman: "The Housing Rebound"

by Calculated Risk on 3/12/2019 12:54:00 PM

Goldman Sachs economists Struyven and Young write: The Housing Rebound.

They see three reasons for a rebound in 2019:

1) Recently high frequently indicators (like starts and permits) have picked up.

2) Mortgage rates have fallen year-over-year. Struyven and Young note: "the headwind from higher interest rates should gradually diminish, as mortgage rates likely peaked late last year." emphasis added

3) Demographics are favorable as a large cohort is moving into the prime home buying age. This is a point I made in Demographics: Renting vs. Owning This is what I wrote:

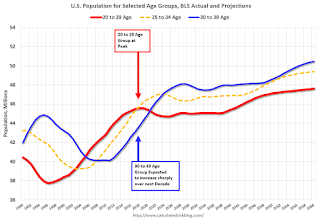

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023. This suggests demand for apartments will soften somewhat.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

Demographics are now positive for home buying, and this is a key reason I expect single family housing starts to continue to increase.

Key Measures Show Inflation about the same in February as in January on a YoY basis

by Calculated Risk on 3/12/2019 11:21:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for February here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.1% annualized rate) in February. The CPI less food and energy rose 0.1% (1.3% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.1%. Core PCE is for December and increased 1.9% year-over-year (January has not been released yet).

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.3% annualized.

Using these measures, inflation was about the same in February as in January on a year-over-year basis. Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

Small Business Optimism Index increased slightly in February

by Calculated Risk on 3/12/2019 09:04:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): February 2019 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index improved modestly in February, increasing 0.5 points to 101.7. Views about future business conditions and the current period as a good time to expand improved as did plans to make capital outlays. Earnings trends weakened, as a million laid off workers and others affected by the shutdown cut back on spending.

..

Job creation broke the 45-year record in February with a net addition of 0.52 workers per firm (including those making no change in employment), up from 0.25 in December, and 0.33 in January. The previous record was 0.51 reached in May 1998.

Twenty-two percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, only 3 points below the record high. Thirtyseven percent of all owners reported job openings they could not fill in the current period, up 2 points from January and 2 points below the record high. br /> emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 101.7 in February.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

BLS: CPI increase 0.2% in February, Core CPI increased 0.1%

by Calculated Risk on 3/12/2019 08:51:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis after being unchanged in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy increased 0.1 percent in February after rising 0.2 percent in January.

..

The all items index increased 1.5 percent for the 12 months ending February, a smaller increase than the 1.6-percent rise for the 12-months ending January. The index for all items less food and energy rose 2.1 percent over the last 12 months, a slightly smaller figure than the 2.2-percent increase for the period ending January.

emphasis added

Monday, March 11, 2019

Tuesday: CPI

by Calculated Risk on 3/11/2019 09:06:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Week Near Long-Term Lows

Mortgage rates were roughly unchanged to begin the week. That means they are staying in line with the lowest levels in more than a year. Only 2 or 3 days have been any better, depending on the lender, and the differences are minimal. [30YR FIXED 4.375 - 4.5%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for February.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

Seattle Real Estate in February: Sales Up 12.1% YoY, Inventory up 164% YoY from Low Levels

by Calculated Risk on 3/11/2019 05:37:00 PM

The Northwest Multiple Listing Service reported Heavy Snowfall Ices February Housing Activity Around Western Washington

Seattle's snowiest month in 50 years had an obvious chilling effect on February's housing activity, agreed officials with Northwest Multiple Listing Service. Statistics for last month show pending sales dropped nearly 14 percent compared to the same month a year ago.The press release is for the Northwest. In King County, sales were down 3.7% year-over-year, and active inventory was up 128% year-over-year.

"The winter weather brought the market to a halt," stated John Deely, principal managing broker at Coldwell Banker Bain. He said last month's series of snowstorms and frigid temperatures had a negative impact on the typical momentum that builds at the beginning of the year.

"Showing activity dropped more than 41 percent the week of the heaviest snow, and weekend keybox activity was down 80 percent," Deely reported. "The end of the month picked up as cabin fever weary buyers unleashed themselves on the burgeoning inventory," he added.

Despite the weather disruptions, brokers added 6,247 new listings to inventory during the month, 1,037 fewer than a year ago. At month end, Northwest MLS members reported 11,275 total active listings, a robust 42.3 percent jump from twelve months ago.

emphasis added

In Seattle, sales were up 12.1% year-over-year, and inventory was up 164% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 2.0 months.

Mortgage Equity Withdrawal slightly positive in Q4

by Calculated Risk on 3/11/2019 11:31:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2018, the Net Equity Extraction was a positive $1 billion, or a 0.0% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 9 of the last 11 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $56 billion in Q4.

The Flow of Funds report also showed that Mortgage debt has declined by $0.36 trillion since the peak.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.