by Calculated Risk on 1/04/2019 01:57:00 PM

Friday, January 04, 2019

How can the unemployment rate increase if the economy is adding so many jobs?

FAQ: How can the unemployment rate rise if the economy is adding so many jobs?

The BLS reported this morning that the economy added 312,000 jobs, but the unemployment rate increased to 3.9% from 3.7% in November.

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

A couple of key concepts (from the BLS):

The CES employment series are estimates of nonfarm wage and salary jobs, not an estimate of employed persons; an individual with two jobs is counted twice by the payroll survey. The CES employment series excludes employees in agriculture, private households, and the self-employed.And the CPS:

emphasis added

Employed people are those who worked as paid employees; were self employed in their own business, profession, or farm; worked without pay for at least 15 hours in a family business or farm; or were temporarily absent from their jobs.So in December, the headline CES number showed a gain of 312,000 non-farm private jobs (by the definitions above). The CPS showed an increase of 142,000 employed people.

The household survey - employment measure includes categories of workers that are not covered by the payroll survey:

the self-employed

workers in private households

agricultural workers

unpaid workers in family businesses

workers on leave without pay during the reference period

Unemployed people are those who had no employment (as defined above) during the reference week; were available for work at that time; and had made specific efforts to find employment in the prior 4 weeks. People laid off from a job and expecting to be recalled are included among the unemployed but unlike the other unemployed, they need not have been looking for employment.

These two surveys are almost always different, and both are useful.

But the unemployment rate increased, even though the CPS showed an increase in employed people. How can that be?

The CPS also showed an increase in the Civilian Labor Force Level by 419,000. And an increase in the number of unemployed people (U-3) of 276,000.

The unemployment rate is a ratio, with the numerator the number of unemployed, and the denominator the Civilian Labor Force - so these changes in both numbers increased the unemployment rate to 3.9% (rounded).

Here are the numbers (000s):

| November | December | Change | |

|---|---|---|---|

| Civilian Labor Force | 162,821 | 163,240 | 419 |

| Unemployed | 6,018 | 6,294 | 276 |

| Unemployment Rate | 3.70% | 3.86% | 0.16% |

If you want more details, see Monthly Employment Situation Report: Quick Guide to Methods and Measurement Issues

So remember, the jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (added jobs and increasing unemployment rate), but over time the numbers will work out.

Q4 GDP Forecasts: Mid 2s

by Calculated Risk on 1/04/2019 12:24:00 PM

From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2018:Q4 and 2.1% for 2019:Q1. [Jan 4 estimate]And from the Altanta Fed: GDPNow

emphasis added

TThe GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.6 percent on January 3, down from 2.7 percent on December 21. The nowcasts of fourth-quarter real consumer spending growth and fourth-quarter real private fixed investment growth decreased from 3.7 percent and 2.7 percent, respectively, to 3.6 percent and 2.4 percent, respectively, after this morning’s Manufacturing ISM Report On Business from the Institute for Supply Management. [Jan 3 estimate]CR Note: These estimates suggest GDP in the mid-2s for Q4.

Comments on December Employment Report

by Calculated Risk on 1/04/2019 10:00:00 AM

The headline jobs number at 312 thousand for December was well above consensus expectations of 180 thousand, and the previous two months were revised up 58 thousand, combined. However, the unemployment rate increased to 3.9%. This was a strong report.

Earlier: December Employment Report: 312,000 Jobs Added, 3.9% Unemployment Rate

In December, the year-over-year employment change was 2.638 million jobs. That is solid year-over-year growth, and makes 2018 the third best year for employment growth in the current expansion (behind 2014 and 2015).

Average Hourly Earnings

Wage growth was above expectations in December. From the BLS:

"In December, average hourly earnings for all employees on private nonfarm payrolls rose 11 cents to $27.48. Over the year, average hourly earnings have increased by 84 cents, or 3.2 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.2% YoY in December.

Wage growth has generally been trending up.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in December to 82.3%, and the 25 to 54 employment population ratio was unchanged at 79.7%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 4.7 million, changed little in December but was down by 329,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. "The number of persons working part time for economic reasons has been generally trending down. The number decreased in December. The number working part time for economic reasons suggests there is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.6% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.306 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.259 million in November.

Summary:

The headline jobs number was well above expectations. However, the headline unemployment rate increased to 3.9%. Also wage growth was above expectations, and above 3% YoY for the third consecutive month.

Overall, this was a strong report. For 2018, job growth was been solid, averaging 220 thousand per month.

December Employment Report: 312,000 Jobs Added, 3.9% Unemployment Rate

by Calculated Risk on 1/04/2019 08:43:00 AM

From the BLS:

Total nonfarm payroll employment increased by 312,000 in December, and the unemployment rate rose to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, food services and drinking places, construction, manufacturing, and retail trade.

...

The change in total nonfarm payroll employment for November was revised up from +155,000 to +176,000, and the change for October was revised up from +237,000 to +274,000. With these revisions, employment gains in October and November combined were 58,000 more than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls rose 11 cents to $27.48. Over the year, average hourly earnings have increased by 84 cents, or 3.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 312 thousand in December (private payrolls increased 301 thousand).

Payrolls for October and November were revised up 58 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December the year-over-year change was 2.638 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in December to 63.1%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in December to 63.1%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 60.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

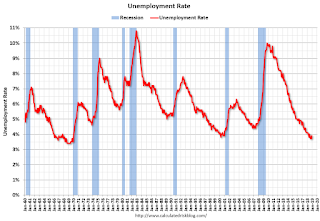

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in December to 3.9%.

This was well above the consensus expectations of 180,000 jobs added, and October and November were revised up 58,000, combined. A strong report.

I'll have much more later ...

Thursday, January 03, 2019

Friday: Employment Report

by Calculated Risk on 1/03/2019 08:02:00 PM

My December Employment Preview

Goldman: December Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

• Early, Reis Q4 2018 Mall Survey of rents and vacancy rates.

• At 10:15 AM to 12:15 PM, Federal Reserve chairs: Joint Interview, Neil Irwin of the NY Times will interview Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen.

Goldman: December Payrolls Preview

by Calculated Risk on 1/03/2019 03:55:00 PM

A few brief excerpts from a note by Goldman Sachs economists Choi and Hill:

We estimate nonfarm payrolls increased 195k in December, somewhat above consensus of +180k. Our forecast reflects a modest slowdown in the trend of job growth, and a weather-related boost worth 25k or more. …

We expect the unemployment rate to remain at 3.7% ... We estimate average hourly earnings increased 0.3% month-over-month and 3.0% year-over-year...

emphasis added

December Employment Preview

by Calculated Risk on 1/03/2019 01:45:00 PM

Note: The Employment report will be released as scheduled, and not postponed by the government shutdown.

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 180,000 non-farm payroll jobs in December (with a range of estimates between 160,000 to 200,000), and for the unemployment rate to be unchanged at 3.7%.

Last month, the BLS reported 155,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 271,000 private sector payroll jobs in December. This was well above consensus expectations of 175,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 56.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 15,000 in December. The ADP report indicated manufacturing jobs increased 12,000 in December.

The ISM non-manufacturing employment index will be released next week.

• Initial weekly unemployment claims averaged 219,000 in December, down from 228,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 217,000, down from 225,000 during the reference week the previous month.

The increase during the reference week suggests a stronger employment report in December than in November.

• The final November University of Michigan consumer sentiment index increased to 98.3 from the November reading of 97.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Looking back at the three previous years:

In December 2017, the consensus was for 190,000 jobs, ADP reported 250,000 private sector jobs added, and the BLS reported 148,000 jobs added.

In December 2016, the consensus was for 175,000 jobs, ADP reported 153,000 private sector jobs added, and the BLS reported 156,000 jobs added.

In December 2015, the consensus was for 200,000 jobs, ADP reported 257,000 private sector jobs added, and the BLS reported 292,000 jobs added.

It appears the consensus is frequently a little high for December.

• Conclusion: In general these reports suggest a solid employment report.

Reis: Office Vacancy Rate unchanged in Q4 at 16.7%

by Calculated Risk on 1/03/2019 12:46:00 PM

Reis reported that the office vacancy rate was at 16.7% in Q4, unchanged from 16.7% in Q3 2018. This is up from 16.4% in Q4 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

The office vacancy rate was flat in the quarter at 16.7%. At year-end 2017 it was 16.4%, while at year-end 2016 it was 16.3%.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.7% in the fourth quarter. At $33.43 per square foot (asking) and $27.13 per square foot (effective), the average rents have increased 2.6% and 2.7%, respectively, from the fourth quarter of 2017, barely above the rate of inflation: 2.5%.

Following three quarters of decelerating occupancy growth, net absorption rose to 7.3 million square feet. The fourth quarter tends to see the highest activity in both office completions and leasing; one year ago, net absorption was 7.6 million square feet, higher than the previous quarters of that year. For construction, office inventory expanded by 10.4 million square feet in the fourth quarter, above the previous quarter’s 8.9 million square feet but below the three prior quarters’ average of 11.9 million square feet.

...

Completions will be higher in 2019 – close to 50 million square feet including 6.7 million square feet in Hudson Yards alone – while office employment is expected to decelerate. This should push vacancy rates up a bit, but rent growth should remain positive and in line with recent growth rates.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.7% in Q4. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased slightly recently.

Office vacancy data courtesy of Reis.

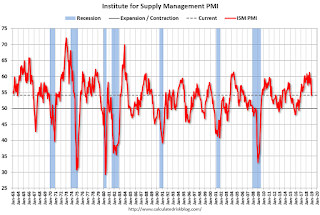

ISM Manufacturing index Decreased Sharply to 54.1 in December

by Calculated Risk on 1/03/2019 10:05:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 54.1% in December, down from 59.3% in November. The employment index was at 56.2%, down from 58.4% last month, and the new orders index was at 51.1%, down from 62.1%.

From the Institute for Supply Management: December 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 116th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The December PMI® registered 54.1 percent, a decrease of 5.2 percentage points from the November reading of 59.3 percent. The New Orders Index registered 51.1 percent, a decrease of 11 percentage points from the November reading of 62.1 percent. The Production Index registered 54.3 percent, 6.3-percentage point decrease compared to the November reading of 60.6 percent. The Employment Index registered 56.2 percent, a decrease of 2.2 percentage points from the November reading of 58.4 percent. The Supplier Deliveries Index registered 57.5 percent, a 5-percentage point decrease from the November reading of 62.5 percent. The Inventories Index registered 51.2 percent, a decrease of 1.7 percentage points from the November reading of 52.9 percent. The Prices Index registered 54.9 percent, a 5.8-percentage point decrease from the November reading of 60.7 percent, indicating higher raw materials prices for the 34th consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 58.0%, and suggests manufacturing expanded at a slower pace in December than in November.

Weekly Initial Unemployment Claims increased to 231,000

by Calculated Risk on 1/03/2019 08:33:00 AM

The DOL reported:

In the week ending December 29, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 216,000 to 221,000. The 4-week moving average was 218,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 1,250 from 218,000 to 219,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

This was above the consensus forecast. Probably most of the increase in claims is related to the government shutdown.