by Calculated Risk on 8/31/2018 04:56:00 PM

Friday, August 31, 2018

Fannie Mae: Mortgage Serious Delinquency rate decreased in July, Lowest since Oct 2007

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 0.88% in July, down from 0.97% in June. The serious delinquency rate is down from 1.00% in July 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency for Fannie Mae since October 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.80% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 5.01% are seriously delinquent, For recent loans, originated in 2009 through 2018 (91% of portfolio), only 0.37% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q3 GDP Forecasts

by Calculated Risk on 8/31/2018 02:47:00 PM

From Goldman Sachs:

We boosted our tracking estimate of Q3 GDP growth by one tenth to +3.0% (qoq ar). [Aug 30 estimate].From Merrill Lynch:

emphasis added

Weak trade data sliced 0.2pp from 3Q GDP tracking, leaving our estimate at 3.3% qoq saar. [Aug 31 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.1 percent on August 30, down from 4.6 percent on August 24. [Aug 30 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.0%. [Aug 31 estimate]CR Note: The range has narrowed, but it is still early. It looks like GDP will be in the 3s in Q3.

Labor Slack and the Participation Rate (Spreadsheet included)

by Calculated Risk on 8/31/2018 12:16:00 PM

Back in June, Politico obtained some responses to questions from Senators by recently confirmed Richard Clarida:

Clarida, who has been nominated for Fed vice chairman, indicated that he believes there’s more slack in the labor market. He noted that the labor force participation rate for prime-age workers, particularly men, has not gone back to pre-recession levels. “I also think this group could represent an additional margin of slack in the sense that some of them could be enticed to reenter the labor force as the demand for labor continues to strengthen,” he said.This is an interesting question.

The decline in the overall Labor Force Participation Rate (LFPR) following the great recession can be divided into three parts: 1) economic weakness, 2) age related demographics, and 3) ongoing trends such as young people staying in school longer, more people working longer, more people taking time off mid-career to travel, and many other reasons.

What we'd like to know - as Clarida noted - is how much of the decline in the LFPR has been due to economic weakness. This would give an idea of how much slack is remaining in the labor market.

Removing the age related demographic changes is straightforward, but accounting for the ongoing trends is much more difficult (but important as the following graphs will show).

The first graph shows the overall participation rate (all civilians 16+ years old) and the employment population ratio.

Click on graph for larger image.

Click on graph for larger image.The Labor Force Participation Rate (Blue) was unchanged in July at 62.9%. This is the percentage of the 16+ year old population in the labor force.

The overall LFPR has declined significantly since the recession, and has been mostly moving sideways recently.

The second graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - just based on changes in age groups.

Important Note on Data: All BLS Population data is based on Census 2014 National Population Projections Tables. These projections probably overstate the current population, especially in the prime working age groups. This analysis did not include corrections to these projections (that Census will address soon).

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.Some analysts just looked at age related demographics to estimate the remaining slack in the labor force participation rate. However, as I've noted many times, there are long term trends that are important too.

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).Using this graph, a couple of years ago when others were arguing that "most of the decline in the labor force participation rate" was due to economic weakness, I argued that most (approximately two-thirds) was related to a combination of demographics and long term trends.

The difference between using just age related demographics, and a combination of Age and Trend, is especially important for prime age workers.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, it appears there is significant labor slack remaining and someone using this graph would expect the prime LFPR to increase to from the current 82.1% to around 83% over the next few years.

However, if we look at the long trends, we wouldn't expect the prime LFPR to increase significantly.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.My estimates of the trends could be off (most groups seem close, although estimates from some groups were way off - like 55 to 59 year old women).

But this analysis suggests the Prime LFPR is close to the expected level and might only increase a few tenths of a percent from here.

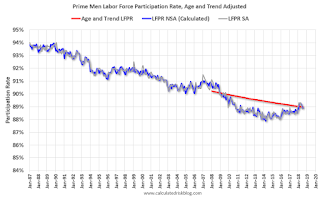

And finally, here is a look at Prime Age Men as Richard Clarida suggested.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, we'd expect the LFPR for prime age men to be increasing slightly. This is because of the older prime workers leaving the labor force and being replaced by younger workers. This suggests significant slack in the labor market for prime age men (as Clarida suggested).

However, if we account for long term trends, there might be little slack remaining for prime age men.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.Looking at this graph (and my trend estimates could be off) there is little slack for prime age men.

Of course long term trends can change. For example, the LFPR for women was increasing for decades, and peaked in the year 2000 at just over 60%, but has declined since then. If we used the period from 1950 to 2000 to predict the LFPR for women today, we would expect something close to 70%. However the LFPR for women in July was only 57.3%.

With the caveat that trends may change and are difficult to forecast, I'd conclude: 1) that long term trends are important for forecasting the LFPR, and 2) there is little slack remaining in the labor market.

Here is my spreadsheet. Please feel free to put in your own estimate of the long term trends.

Hotels: Occupancy Rate Unchanged Year-over-Year

by Calculated Risk on 8/31/2018 08:46:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 19-25 August 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 20-26 August 2017, the industry recorded the following:

• Occupancy: flat at 69.5%

• Average daily rate (ADR): +1.8% to US$127.55

• Revenue per available room (RevPAR): +1.8% to US$88.69

...

STR analysts note that percentage changes in several markets were negatively affected by a comparison with the week of the Great American Eclipse in 2017. emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is close to the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the 4-week average of the occupancy rate will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, August 30, 2018

Friday: Chicago PMI

by Calculated Risk on 8/30/2018 06:45:00 PM

From Merrill Lynch on August NFP:

We forecast that nonfarm payrolls increased by 205k in August ... We take signal from our payrolls tracker based on internal BAC data which increased by 245k in August, though we are fading our official forecast as nonfarm payrolls has tended to grow below trend in August in the first estimate by 40k since 2012.Friday:

...

We expect average hourly earnings to increase by 0.3% mom ... wages should grow by 2.8% yoy ... We look for the unemployment rate to tick down by 0.1pp to 3.8% ... owing to strong job gains and little change in the labor force participation rate at 62.9%.

• At 9:45 AM ET, Chicago Purchasing Managers Index for August. The consensus is for a reading of 63.5, down from 65.5 in July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 95.3.

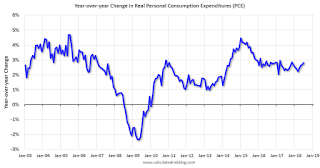

Year-over-year Change in Real Personal Consumption Expenditures (PCE)

by Calculated Risk on 8/30/2018 12:03:00 PM

Earlier I posted a graph showing real monthly personal consumption expenditures (PCE) based on the monthly BEA report.

Here is a graph showing the year-over-year change in real PCE since 2003.

In July, the YoY change was 2.8%, about the same level as for the last few years.

There was a significant decline in real PCE during the great recession, and real PCE was fairly weak during the first few years of the recovery - partially due to the ongoing weakness in housing following the housing bubble and bust.

More recently real PCE has been increasing at a fairly steady rate between 2.0% and 3.0% per year.

Personal Income increased 0.3% in July, Spending increased 0.4%

by Calculated Risk on 8/30/2018 08:50:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $54.8 billion (0.3 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $52.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $49.3 billion (0.4 percent).The July PCE price index increased 2.3 percent year-over-year and the July PCE price index, excluding food and energy, increased 2.0 percent year-over-year.

Real DPI increased 0.2 percent in July and Real PCE increased 0.2 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was at expectations.

Weekly Initial Unemployment Claims increased to 213,000

by Calculated Risk on 8/30/2018 08:33:00 AM

The DOL reported:

In the week ending August 25, the advance figure for seasonally adjusted initial claims was 213,000, an increase of 3,000 from the previous week's unrevised level of 210,000. The 4-week moving average was 212,250, a decrease of 1,500 from the previous week's unrevised average of 213,750. This is the lowest level for this average since December 13, 1969 when it was 210,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 29, 2018

Thursday: Personal Income and Outlays, Unemployment Claims

by Calculated Risk on 8/29/2018 06:21:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

Chemical Activity Barometer "Softens" in August

by Calculated Risk on 8/29/2018 01:42:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Softens as Pace of Growth Slows

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), was flat in August remaining at 122.14 on a three-month moving average (3MMA) basis. This continued a general softening trend since the first quarter. The barometer is up 3.8 percent year-over-year (Y/Y/), a slower pace than of that earlier in the year and similar to that seen in the second half of 2017. The unadjusted CAB also was flat, and follows a 0.3 percent decline in July. August readings indicate gains in U.S. commercial and industrial activity well into the first quarter 2019, but at a slower pace as growth has turned over.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production in 2018 and early 2019, but at a slower pace.