by Calculated Risk on 9/05/2018 07:00:00 AM

Wednesday, September 05, 2018

MBA: Mortgage Applications Decreased Slightly in Latest Weekly Survey

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 31, 2018.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.80 percent from 4.78 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, September 04, 2018

Wednesday: Trade Deficit

by Calculated Risk on 9/04/2018 07:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Snap Back to Recent Highs

Mortgage rates moved higher today, reversing the improvement seen last Friday. The average lender is now back in line with their highest levels of the past few weeks, although that statement requires some qualification. During that time, mortgage rates have been in such a narrow range that we can only measure day-to-day changes in terms of upfront closing costs/credits. Actual interest rates haven't moved, but "effective rates" are back at recent highs. [30YR FIXED - 4.625% - 4.75%]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $50.2 billion in July from $46.3 billion in June.

Update: Framing Lumber Prices Off from Record Highs

by Calculated Risk on 9/04/2018 04:50:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined in August from the recent record highs, but are still up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through August 24, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 11% from a year ago, and CME futures are up about 19% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Construction Spending increased 0.1% in July

by Calculated Risk on 9/04/2018 11:16:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased slightly in July:

Construction spending during July 2018 was estimated at a seasonally adjusted annual rate of $1,315.4 billion, 0.1 percent above the revised June estimate of $1,314.2 billion. The July figure is 5.8 percent above the July 2017 estimate of $1,242.8 billion.Private spending decreased and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $1,010.9 billion, 0.1 percent below the revised June estimate of $1,011.9 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $304.5 billion, 0.7 percent above the revised June estimate of $302.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 17% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 6% below the peak in March 2009, and 16% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7%. Non-residential spending is up 3% year-over-year. Public spending is up 8% year-over-year.

This was below the consensus forecast of a 0.4% increase for July. Also, construction spending for May and June were revised down.

ISM Manufacturing index increased to 61.3 in August

by Calculated Risk on 9/04/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in August. The PMI was at 61.3% in August, up from 58.1% in July. The employment index was at 58.5%, up from 56.5% last month, and the new orders index was at 65.1%, up from 60.2%.

From the Institute for Supply Management: August 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in August, and the overall economy grew for the 112th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The August PMI® registered 61.3 percent, an increase of 3.2 percentage points from the July reading of 58.1 percent. The New Orders Index registered 65.1 percent, an increase of 4.9 percentage points from the July reading of 60.2 percent. The Production Index registered 63.3 percent, a 4.8-percentage point increase compared to the July reading of 58.5 percent. The Employment Index registered 58.5 percent, an increase of 2 percentage points from the July reading of 56.5 percent. The Supplier Deliveries Index registered 64.5 percent, a 2.4-percentage point increase from the July reading of 62.1 percent. The Inventories Index registered 55.4 percent, an increase of 2.1 percentage points from the July reading of 53.3 percent. The Prices Index registered 72.1 percent in August, a 1.1-percentage point decrease from the July reading of 73.2 percent, indicating higher raw materials prices for the 30th consecutive month.

…

"Respondents are again overwhelmingly concerned about tariff-related activity, including how reciprocal tariffs will impact company revenue and current manufacturing locations."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 57.6%, and suggests manufacturing expanded at a faster pace in August than in July.

This was a strong report.

CoreLogic: House Prices up 6.2% Year-over-year in July

by Calculated Risk on 9/04/2018 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: oreLogic Reports July Home Prices Increased by 6.2 Percent, Homeowners Waiting to Sell for Anticipated Increase Return on Investment

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 6.2 percent year over year from July 2017 to July 2018. On a month-over-month basis, prices increased by 0.3 percent in July 2018 compared with June 2018. (June 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the middle of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 5.1 percent on a year-over-year basis from July 2018 to July 2019. On a month-over-month basis, homeprices are expected to decrease by 0.2 percent from July to August 2018. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“With increased interest rates and home prices, the CoreLogic Home Price Index is rising at a slower rate than it was a year ago,” said Dr. Frank Nothaft, chief economist for CoreLogic. “While markets in the western part of the country continue to experience rapid home-price growth, many of those metros are overvalued, and will likely experience a slowdown soon.”

emphasis added

Monday, September 03, 2018

Tuesday: ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 9/03/2018 08:42:00 PM

Weekend:

• Schedule for Week of September 2, 2018

Tuesday:

• At 8:00 AM: Corelogic House Price index for July.

• At 10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July. The PMI was at 58.1% in July, the employment index was at 56.5%, and the new orders index was at 60.2%.

• At 10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 10 (fair value).

Oil prices were up over the last week with WTI futures at $70.01 per barrel and Brent at $78.07 per barrel. A year ago, WTI was at $48, and Brent was at $53 - so oil prices are up 40% to 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.64 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 19 cents per gallon year-over-year.

Sunday, September 02, 2018

Oil Rigs: Increase Slightly

by Calculated Risk on 9/02/2018 07:48:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on August 31, 2018:"That's all, folks!"

• This week marks a psychological turning point in the oil cycle

• Total oil rigs rose, +2 to 862

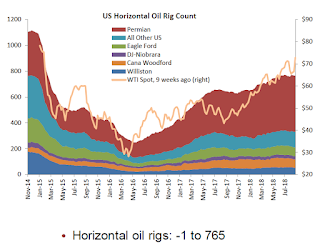

• But horizontal oil rigs declined, -1 to 765

...

• Horizontal oil rigs have gone exactly nowhere in the last 11 weeks at WTI averaging above $68 / barrel.

• Under $68 WTI, the horizontal oil rig count is unlikely to rise further (although oil production will continue to increase at current rig numbers).

• Investors are beginning to appreciate that reviving rig count growth will involve moving to the next level of oil prices, and the back end of the futures curve is swinging up accordingly.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

August 2018: Unofficial Problem Bank list declines to 82 Institutions

by Calculated Risk on 9/02/2018 08:19:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2018. During the month, the list had a decline of seven insured institutions to 82 banks. Aggregate assets were little changed staying at a rounded $57.3 billion after a deduction of $1.3 billion for the removals and an addition of $1.3 billion for asset growth during the second quarter. A year ago, the list held 123 institutions with assets of $28.3 billion.

Actions were terminated against Urban Partnership Bank, Chicago, IL ($442 million); Old Dominion National Bank, North Garden, VA ($222 million); and Providence Bank, Alpharetta, GA ($85 million). Finding their way off the list through merger were One Bank & Trust, National Association, Little Rock, AR ($266 million); Hometown Bank, National Association, Carthage, MO ($182 million); Liberty FSB, Enid, OK ($75 million); and High Desert Bank, Bend, OR ($20 million).

On August 23rd, the FDIC released industry results for the second quarter of 2018 and disclosed that the Official Problem Bank List held 82 banks with assets of $54.4 billion.

Saturday, September 01, 2018

Schedule for Week of September 2, 2018

by Calculated Risk on 9/01/2018 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and non-manufacturing indexes, August auto sales, and the July trade deficit.

All US markets will be closed in observance of the Labor Day holiday.

8:00 AM: Corelogic House Price index for July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July.Here is a long term graph of the ISM manufacturing index.

The PMI was at 58.1% in July, the employment index was at 56.5%, and the new orders index was at 60.2%.

10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $50.2 billion in July from $46.3 billion in June.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 182,000 payroll jobs added in August, down from 219,000 added in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, unchanged from 213 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for index to increase to 56.8 from 55.7 in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 198,000 non-farm payroll jobs in August, up from the 157,000 non-farm payroll jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 198,000 non-farm payroll jobs in August, up from the 157,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decline to 3.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In July the year-over-year change was 2.400 million jobs.

A key will be the change in wages.