by Calculated Risk on 8/24/2018 11:18:00 AM

Friday, August 24, 2018

Q3 GDP Forecasts

From Goldman Sachs:

We lowered our Q3 GDP tracking estimate by one tenth to +3.1% (qoq ar). We also lowered our past-quarter tracking estimate for Q2 by one tenth to 3.9%" [Aug 22 estimate].From Merrill Lynch:

emphasis added

The data added 0.2pp to 3Q GDP tracking, bringing it up to 3.5%. 2Q tracking remains at 4.1%. [Aug 24 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.6 percent on August 24, up from 4.3 percent on August 16. [Aug 24 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.0%. [Aug 24 estimate]CR Note: Still a wide range, and it is early, but GDP in the 3s seems likely.

Fed Chair Powell: "Risk management suggests looking beyond inflation for signs of excesses"

by Calculated Risk on 8/24/2018 10:25:00 AM

Speech by Fed Chair Jerome Powell: Monetary Policy in a Changing Economy. A few excerpts:

Experience has revealed two realities about the relation between inflation and unemployment, and these bear directly on the two questions I started with. First, the stars are sometimes far from where we perceive them to be. In particular, we now know that the level of the unemployment rate relative to our real-time estimate of u* will sometimes be a misleading indicator of the state of the economy or of future inflation. Second, the reverse also seems to be true: Inflation may no longer be the first or best indicator of a tight labor market and rising pressures on resource utilization. Part of the reason inflation sends a weaker signal is undoubtedly the achievement of anchored inflation expectations and the related flattening of the Phillips curve. Whatever the cause, in the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.

...

Let me conclude by returning to the matter of navigating between the two risks I identified--moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating. Readers of the minutes of FOMC meetings and other communications will know that our discussions focus keenly on the relative salience of these risks. The diversity of views on the FOMC is one of the great virtues of our system. Despite differing views on these questions and others, we have a long institutional tradition of finding common ground in coalescing around a policy stance.

I see the current path of gradually raising interest rates as the FOMC's approach to taking seriously both of these risks. While the unemployment rate is below the Committee's estimate of the longer-run natural rate, estimates of this rate are quite uncertain. The same is true of estimates of the neutral interest rate. We therefore refer to many indicators when judging the degree of slack in the economy or the degree of accommodation in the current policy stance. We are also aware that, over time, inflation has become much less responsive to changes in resource utilization.

While inflation has recently moved up near 2 percent, we have seen no clear sign of an acceleration above 2 percent, and there does not seem to be an elevated risk of overheating. This is good news, and we believe that this good news results in part from the ongoing normalization process, which has moved the stance of policy gradually closer to the FOMC's rough assessment of neutral as the expansion has continued. As the most recent FOMC statement indicates, if the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.

The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one. My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.

emphasis added

2018 Jackson Hole Economic Policy Symposium Agenda

by Calculated Risk on 8/24/2018 08:27:00 AM

Note: the presented papers are usually posted to the Kansas City Fed's site fairly quickly. On twitter.

2018 Economic Policy Symposium: Changing Market Structures and Implications for Monetary Policy. Times listed on program are Mountain Standard Time.

From Merrill Lynch on Jackson Hole Symposium:

We expect the papers presented to be primarily academic in nature and of only marginal interest to the markets: this would be consistent with the recent shift away from using Jackson Hole as a forum for policy signaling.

However, two stories will swirl around the meetings. The first is the issue of Fed independence. ... We do not expect Chair Powell to discuss Fed independence in his speech at 10am today, and there will be no Q&A. …

The other issue of interest will be the Fed's tightening plans. In terms of policy rates, in our view the Fed has no reason to deviate from its pace of quarterly rate hikes unless either the macro data slow substantially or core inflation moves substantially higher. The more proximate concern is monetary policy implementation. Specifically, the Fed funds rate continues to move towards the upper bound of the Fed's target range. Mark Cabana has argued that this is because of bank demand for excess reserves in order to satisfy post-crisis regulatory requirements. The risk is that the Fed will have to stop unwinding its balance sheet earlier than the markets are expecting in order to keep the funds rate within the target range. The July / August meeting minutes mention that the Fed will address its operating framework in the fall.

emphasis added

Thursday, August 23, 2018

Friday: Fed Chair Powell Speech, Durable Goods

by Calculated Risk on 8/23/2018 07:22:00 PM

The schedule for the 2018 Jackson Hole Economic Policy Symposium will be released here.

Friday:

• At 8:30 AM ET, Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

• At 10:00 AM, Speech by Fed Chair Jerome Powell, "Monetary Policy in a Changing Economy", At the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyo.

Black Knight: National Mortgage Delinquency Rate Decreased in July, Lowest Since March 2006

by Calculated Risk on 8/23/2018 02:59:00 PM

From Black Knight: Black Knight’s First Look: Increased Mortgage Cures in July Push Delinquencies to Lowest Level Since March 2006; Foreclosure Starts Rise 11 Percent

• Continued hurricane-related cure activity pushed delinquencies to their lowest level in more than 12 yearsAccording to Black Knight's First Look report for July, the percent of loans delinquent decreased 3.4% in July compared to June, and decreased 7.5% year-over-year.

• Foreclosure starts rose 11 percent over June’s 17-year low to 48,300, for the highest total in three months

• Though starts rose nationwide, foreclosure referrals in hurricane-affected areas of Texas increased by a higher-than-average 19 percent

• Fewer completions and an increase in starts caused foreclosure inventory to rise slightly in July, for just the second such increase in the past three years

• Improving delinquencies outweighed the slight increase in foreclosures, bringing the total non-current population (all loans 30 or more days delinquent or in active foreclosure) to a more than 12-year low

The percent of loans in the foreclosure process increased 0.7% in July and were down 27.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.61% in July, down from 3.74% in June.

The percent of loans in the foreclosure process increased slightly in July to 0.57% (from 0.56% in June).

The number of delinquent properties, but not in foreclosure, is down 125,000 properties year-over-year, and the number of properties in the foreclosure process is down 105,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2018 | June 2018 | July 2017 | July 2016 | |

| Delinquent | 3.61% | 3.74% | 3.90% | 4.51% |

| In Foreclosure | 0.57% | 0.56% | 0.78% | 1.09% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,861,000 | 1,925,000 | 1,986,000 | 2,286,000 |

| Number of properties in foreclosure pre-sale inventory: | 293,000 | 291,000 | 398,000 | 550,000 |

| Total Properties | 2,154,000 | 2,216,000 | 2,384,000 | 2,836,000 |

A few Comments on July New Home Sales

by Calculated Risk on 8/23/2018 11:38:00 AM

New home sales for July were reported at 627,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months, combined, were revised down.

Sales in July were up 12.8% year-over-year compared to July 2017. This was strong YoY growth, however this was an easy comparison since new home sales were soft in mid-year 2017.

Earlier: New Home Sales decrease to 627,000 Annual Rate in July.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Note that new home sales have been up year-over-year every month this year (so far).

Sales are up 7.2% through July compared to the same period in 2017. Decent growth so far, and the next month will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors. And new home sales had a strong last few months in 2017, so the comparisons will be more difficult.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Expanded at a Slightly Slower Pace" in August

by Calculated Risk on 8/23/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slightly Slower Pace

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slightly slower pace, while expectations remained solid.The regional surveys for August have mostly indicated somewhat slower growth as compared to July.

“Our composite index came down a bit again in August,” said Wilkerson. “But the pace of growth in regional factories is still at the solid levels that prevailed in late 2017 and early 2018.”

...

The month-over-month composite index was 14 in August, down from readings of 23 in July and 28 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Growth in factory activity remained relatively stable at nondurable goods plants, while durable goods activity slowed slightly, particularly for machinery, computers and electronics. Most month-over-month indexes moderated in August, but were still generally solid. The production, new orders, employment, and new orders for exports indexes all decreased modestly. In contrast, the shipments index rose from 12 to 18 after falling considerably last month. The finished goods inventory index dipped slightly, while the raw material inventory index was unchanged.

emphasis added

New Home Sales decrease to 627,000 Annual Rate in July

by Calculated Risk on 8/23/2018 10:10:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 627 thousand.

The previous three months were revised down, combined (June was revised up, but April and May were revised down).

"Sales of new single-family houses in July 2018 were at a seasonally adjusted annual rate of 627,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.7 percent below the revised June rate of 638,000, but is 12.8 percent above the July 2017 estimate of 556,000. "

emphasis added

Click on graph for larger image.

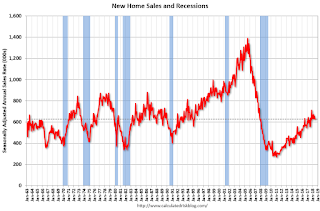

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

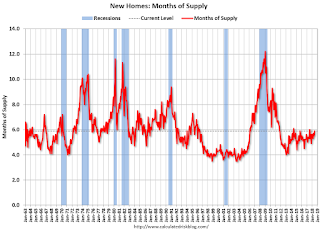

The second graph shows New Home Months of Supply.

The months of supply increased in July to 5.9 months from 5.7 months in June.

The months of supply increased in July to 5.9 months from 5.7 months in June. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of July was 309,000. This represents a supply of 5.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

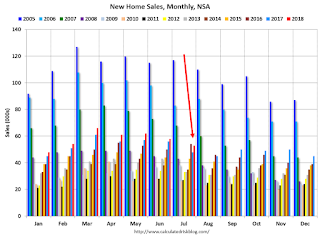

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2018 (red column), 53 thousand new homes were sold (NSA). Last year, 48 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for July was 26 thousand in 2010.

This was below expectations of 648,000 sales SAAR, and the previous months were revised down, combined. I'll have more later today.

Weekly Initial Unemployment Claims decreased to 210,000

by Calculated Risk on 8/23/2018 08:32:00 AM

The DOL reported:

In the week ending August 18, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 2,000 from the previous week's unrevised level of 212,000. The 4-week moving average was 213,750, a decrease of 1,750 from the previous week's unrevised average of 215,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,750.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 22, 2018

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 8/22/2018 08:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 212 thousand the previous week.

• At 9:00 AM, FHFA House Price Index for June 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 648 thousand SAAR, up from 631 thousand in June.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.