by Calculated Risk on 7/24/2018 08:00:00 PM

Tuesday, July 24, 2018

Wednesday: New Home Sales

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: New Home Sales for June from the Census Bureau. The consensus is for 669 thousand SAAR, down from 689 thousand in May.

Has the Housing Market Peaked? (Part 2)

by Calculated Risk on 7/24/2018 04:09:00 PM

On Friday I wrote: Has Housing Market Activity Peaked? I concluded

"I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years."Since then we've seen several reports of softening existing home sales in a number of cities (Seattle, Portland, California, and more). And the NAR reported sales were down year-over-year in June, and probably more important that inventory was up year-over=year for the first time since June 2015.

And the CAR reported California: "Home sales stumble", Inventory up 8.1% YoY

As I noted last Friday, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

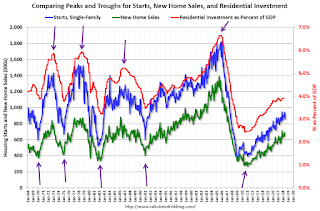

For the bottoms and troughs for key housing activity, here is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

RI as a percent of GDP has been sluggish recently, mostly due to softness in multi-family residential. However, both single family starts and new home sales are still moving up (ignoring month-to-month fluctuations).

Also, look at the relatively low level of RI as a percent of GDP, new home sales and single family starts compared to previous peaks. To have a significant downturn from these levels would be surprising.

So my view remains: I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

Top Twenty GDP Quarters since 2000

by Calculated Risk on 7/24/2018 01:16:00 PM

I expect some really poor analysis after the advance GDP report is released on Friday (the Consensus is the BEA will report real annualized GDP of 4.2% for Q2).

Below is a table of the top 20 quarters since Q1 2000. A 4.2% quarter would be the 9th best since Q1 2000.

As I've noted before, based on demographics, 2% is the new 4% (that is just simple arithmetic). I've also noted that a large government program (such as a war, or a tax cut) can give a short term boost to GDP. So Q2 should be fine, but not a game change.

| Top 20 GDP Quarters since 2000 Real GDP, Annualized Rate | ||||

|---|---|---|---|---|

| GDP | Year | Quarter | President | |

| 1 | 7.8% | 2000 | Q2 | Clinton |

| 2 | 6.9% | 2003 | Q3 | G.W.Bush |

| 3 | 5.2% | 2014 | Q3 | Obama |

| 4 | 4.9% | 2006 | Q1 | G.W.Bush |

| 5 | 4.8% | 2003 | Q4 | G.W.Bush |

| 6 | 4.6% | 2011 | Q4 | Obama |

| 7 | 4.6% | 2014 | Q2 | Obama |

| 8 | 4.3% | 2005 | Q1 | G.W.Bush |

| 9 | 4.0% | 2013 | Q4 | Obama |

| 10 | 3.9% | 2009 | Q4 | Obama |

| 11 | 3.9% | 2010 | Q2 | Obama |

| 12 | 3.8% | 2003 | Q2 | G.W.Bush |

| 13 | 3.7% | 2002 | Q1 | G.W.Bush |

| 14 | 3.7% | 2004 | Q3 | G.W.Bush |

| 15 | 3.5% | 2004 | Q4 | G.W.Bush |

| 16 | 3.4% | 2005 | Q3 | G.W.Bush |

| 17 | 3.2% | 2006 | Q4 | G.W.Bush |

| 18 | 3.2% | 2015 | Q1 | Obama |

| 19 | 3.2% | 2017 | Q3 | Trump |

| 20 | 3.1% | 2007 | Q2 | G.W.Bush |

Richmond Fed: "Fifth District Manufacturing Firms Saw Slowing Growth in July"

by Calculated Risk on 7/24/2018 10:02:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Saw Slowing Growth in July

Fifth District manufacturing expanded at a slower pace in July, according to results of the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell from 21 in June to 20 in July, but it remained in solid expansionary territory. This decrease resulted from a decrease in the employment and shipments indexes, as the other component (new orders) held steady. Firms were optimistic in July, expecting to see robust growth across most indicators in the coming months.All of the regional manufacturing reports for July have been solid so far.

Manufacturing employment growth slowed in July, as the employment index fell from 23 in June to 22 in July. Firms continued to struggle to find workers with the skills they needed and expect this struggle to continue in the next six months.

emphasis added

Black Knight: National Mortgage Delinquency Rate Increased Slightly in June

by Calculated Risk on 7/24/2018 08:39:00 AM

From Black Knight: Black Knight’s First Look: June Sees Fewest Foreclosure Starts in Over 17 Years; Active Foreclosure Inventory Falls Below 300,000 for First Time Since Q3 2006

• Foreclosure starts fell another 3.1 percent in June for the lowest single-month total in more than 17 yearsAccording to Black Knight's First Look report for June, the percent of loans delinquent increased 2.7% in June compared to May, and decreased 1.6% year-over-year.

• Active foreclosures continued to decline as well, falling below 300,000 for the first time in nearly 12 years

• The inventory of loans in active foreclosure has fallen 30 percent (-119k) over the past 12 months

• Delinquencies edged seasonally upward in June, but remain 1.59 percent below last year’s levels

• After rising following the 2017 hurricane season, 90-day delinquencies hit a new post-recession low

The percent of loans in the foreclosure process decreased 4.5% in June and were down 30.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.74% in June, up from 3.64% in May.

The percent of loans in the foreclosure process decreased in June to 0.56%.

The number of delinquent properties, but not in foreclosure, is down 7,000 properties year-over-year, and the number of properties in the foreclosure process is down 119,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2018 | May 2018 | June 2017 | June 2016 | |

| Delinquent | 3.74% | 3.64% | 3.80% | 4.31% |

| In Foreclosure | 0.56% | 0.59% | 0.81% | 1.10% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,925,000 | 1,867,000 | 1,932,000 | 2,178,000 |

| Number of properties in foreclosure pre-sale inventory: | 291,000 | 303,000 | 410,000 | 558,000 |

| Total Properties | 2,216,000 | 2,171,000 | 2,342,000 | 2,736,000 |

Monday, July 23, 2018

Mortgage Rates at Top of Recent Range

by Calculated Risk on 7/23/2018 07:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surge to 1-Month Highs

Mortgage rates rose today at the quickest pace in months, ultimately hitting the highest levels since June 25th for the average lender. While neither of those are "fun" facts for fans of low rates, they are made slightly more palatable by the nature of the recent range.Tuesday:

Specifically, rates hadn't moved very much since late June. The average mortgage seeker will not have seen a change in their quoted interest rate during that time (the only adjustments have been to upfront closing costs/credits). The point is that it didn't require a huge move to be able to say "highest in a month" or "fastest pace in months." [30YR FIXED - 4.625% - 4.75%]

emphasis added

• At 9:00 AM ET, FHFA House Price Index for May 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

Housing Inventory Tracking

by Calculated Risk on 7/23/2018 03:17:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 0.5% year-over-year (YoY) in June, the first YoY increase since June 2015!

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento and also Phoenix (through June) and total existing home inventory as reported by the NAR (through June 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 26% year-over-year in June (inventory was still very low), and has increased YoY for nine consecutive months.

Also note that inventory is still down 11% YoY in Las Vegas (red), but the YoY decline has been getting smaller - and inventory in Vegas will probably be up YoY very soon.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.

California: "Home sales stumble", Inventory up 8.1% YoY

by Calculated Risk on 7/23/2018 02:08:00 PM

The CAR reported today: California home sales stumble in June as median price hits new high for second straight month, C.A.R. reports

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 410,800 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.Here is some data from the NAR and CAR (ht Tom Lawler)

June’s sales figure was up 0.4 percent from the revised 409,270 level in May and down 7.3 percent compared with home sales in June 2017 of 443,120. The year-over-year sales decline was the largest in nearly four years.

…

“California’s housing market underperformed again, despite an increase in active listings for the third straight month,” said C.A.R. President Steve White. “The lackluster spring homebuying season could be a sign of waning buyer interest as endlessly rising home prices and buyer fatigue adversely affected pent-up demand.”

...

Statewide active listings improved for the third consecutive month, increasing 8.1 percent from the previous year. The year-over-year increase was slightly below that of last month, which was the largest since January 2015, when active listings jumped 11.0 percent.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | 0.5% | 8.1% |

A Few Comments on June Existing Home Sales

by Calculated Risk on 7/23/2018 11:59:00 AM

Earlier: NAR: Existing-Home Sales Decline in June, Inventory UP Year-over-year

The big story in the monthly existing home report was that inventory was UP year-over-year for the first time since 2015. I've write more about this.

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in April. The consensus was for sales of 5.45 million SAAR, Lawler estimated the NAR would report 5.35 million SAAR in June, and the NAR actually reported 5.38 million.

2) Inventory is still very low, but increased 0.5% year-over-year (YoY) in June. This was the 1st year-over-year increase since June 2015, following 36 consecutive months with a year-over-year decline in inventory.

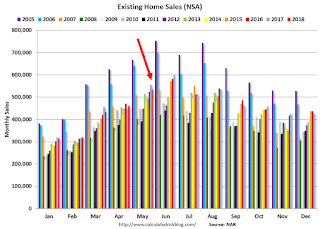

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in June (570,000, red column) were below sales in June 2017 (600,000, NSA).

Sales NSA through June (first six months) are down about 2.2% from the same period in 2017.

This is a small decline - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Decline in June, Inventory UP Year-over-year

by Calculated Risk on 7/23/2018 10:11:00 AM

From the NAR: Existing-Home Sales Subside 0.6 Percent in June

Existing-home sales decreased for the third straight month in June, as declines in the South and West exceeded sales gains in the Northeast and Midwest, according to the National Association of Realtors®. The ongoing supply and demand imbalance helped push June’s median sales price to a new all-time high.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 0.6 percent to a seasonally adjusted annual rate of 5.38 million in June from a downwardly revised 5.41 million in May. With last month’s decline, sales are now 2.2 percent below a year ago.

...

Total housing inventory at the end of June climbed 4.3 percent to 1.95 million existing homes available for sale, and is 0.5 percent above a year ago (1.94 million) – the first year-over-year increase since June 2015. Unsold inventory is at a 4.3-month supply at the current sales pace (4.2 months a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.38 million SAAR) were 0.6% lower than last month, and were 2.2% below the June 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.95 million in June from 1.87 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.95 million in June from 1.87 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 0.5% year-over-year in June compared to June 2017.

Inventory increased 0.5% year-over-year in June compared to June 2017. Months of supply was at 4.3 months in June.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...