by Calculated Risk on 7/16/2018 10:48:00 AM

Monday, July 16, 2018

Earlier from the NY Fed: Manufacturing "Business activity continued to grow at a fairly brisk pace in New York State"

From the NY Fed: Empire State Manufacturing Survey

Business activity continued to grow at a fairly brisk pace in New York State, according to firms responding to the July 2018 Empire State Manufacturing Survey. The headline general business conditions index edged down by over two points to 22.6—still a high level, suggesting a continuation of robust growth. The new orders index dipped three points to 18.2, while the shipments index fell nine points to 14.6, pointing to a modest pullback in growth of orders and shipments.This was slightly above the consensus forecast and a solid reading.

…

The index for number of employees, which had climbed to its highest level of the year in June, edged back two points to 17.2, pointing to ongoing moderate growth in employment. The average workweek index fell six points to 5.6, suggesting more modest increases in hours worked than in recent months.

emphasis added

Retail Sales increased 0.5% in June

by Calculated Risk on 7/16/2018 08:40:00 AM

On a monthly basis, retail sales increased 0.5 percent from May to June (seasonally adjusted), and sales were up 5.9 percent from June 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $506.8 billion, an increase of 0.5 percent from the previous month, and 6.6 percent (±0.5 percent) above June 2017. Total sales for the April 2018 through June 2018 period were up 5.9 percent from the same period a year ago. The April 2018 to May 2018 percent change was revised from up 0.8 percent to up 1.3 percent.

Click on graph for larger image.

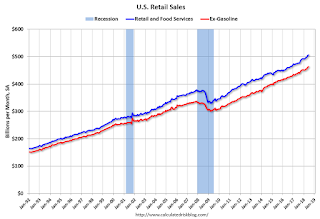

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.47% in June.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.2% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.2% on a YoY basis.The increase in June was slightly below expectations, however sales in April and May, combined, were revised up.

Sunday, July 15, 2018

Monday: Retail Sales, NY Fed Mfg Survey

by Calculated Risk on 7/15/2018 09:13:00 PM

Weekend:

• Schedule for Week of July 15, 2018

Monday:

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for a 0.6% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 21.0, down from 25.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5, and DOW futures are up 65 (fair value).

Oil prices were down over the last week with WTI futures at $70.73 per barrel and Brent at $75.04 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.88 per gallon. A year ago prices were at $2.24 per gallon - so gasoline prices are up 64 cents per gallon year-over-year.

The Longest Economic and Housing Expansions in U.S. History

by Calculated Risk on 7/15/2018 08:19:00 AM

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in March 1991 to a peak in March 2001 (120 months).

2) From a trough in June 2009 to today, July 2018 (109 months and counting).

3) From a trough in February 1961 to a peak in December 1969 (106 months).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current expansion is the second longest, and it seems very likely that the current expansion will surpass the '90s expansion in the Summer of 2019.

As I noted last year in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market. Single family housing starts and new home sales both bottomed in 2011 - so this is just the seventh year of expansion - and I expect further increases in starts and sales over the next couple of years.

Unfortunately we only have new home sales data back to 1963, and the housing cycles aren't as clear as the overall business cycle (dates are approximate). But here are the housing expansions since 1963:

1) From a trough in January 1991 to a peak in November 1998 (94 months). Note: This could be considered all the way until July 2005 (a total of 175 months!)

2) From a trough in February 2011 to today, July 2018 (89 months and counting).

3) From a trough in June 2000 to a peak in July 2005 (61 months).

4) From a trough in September 1981 to a peak in March 1986 (54 months).

5) From a trough in January 1975 to a peak in October 1978 (45 months).

6) From a trough in February 1970 to a peak in October 1972 (32 months).

Usually housing bottoms a few months before the economy bottoms, but peaks a year or more before the economy peaks (this is why housing is a good leading indicator). In general the housing cycle is shorter than the business cycle. By the end of this year, the current housing expansion will be the longest since at least 1963 (unless we consider the previous two cycles as just one - then there is a long way to go!).

Given the number of housing starts and new home sales, there is still room for further expansion.

Saturday, July 14, 2018

Schedule for Week of July 15, 2018

by Calculated Risk on 7/14/2018 08:11:00 AM

The key economic reports this week are June Housing Starts and Retail Sales.

For manufacturing, June industrial production, and the July New York and Philly Fed surveys, will be released this week.

Fed Chair Jerome Powell will testify on the semiannual Monetary Policy Report to the Congress

8:30 AM ET: Retail sales for June will be released. The consensus is for a 0.6% increase in retail sales.

8:30 AM ET: Retail sales for June will be released. The consensus is for a 0.6% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

8:30 AM ET: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 21.0, down from 25.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 78.3%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 69, up from 68 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. This graph shows single and total housing starts since 1968.

The consensus is for 1.320 million SAAR, down from 1.350 million SAAR in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 214 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 22.0, up from 19.9.

10:00 AM: State Employment and Unemployment (Monthly) for June 2018

Friday, July 13, 2018

"Port of Long Beach Sees Busiest Month Ever"

by Calculated Risk on 7/13/2018 05:50:00 PM

From the Port of Long Beach: Port of Long Beach Sees Busiest Month Ever

Container cargo volumes reached record heights at the Port of Long Beach last month, surging past the previous mark and distinguishing June 2018 as the Port’s best month ever.And from Reuters: China's imports to U.S. ports start peaking early amid tariff threat

Trade increased 14.2 percent in June, compared to the same month in 2017. The Port’s terminals moved 752,188 twenty-foot equivalent units (TEUs), 4.4 percent higher than the previous “best month” record set in July 2017.

Chinese imports to U.S. ports rose more than expected in June, suggesting that some retailers moved up orders to insulate themselves from an intensifying trade war that threatens to send up costs on a growing number of consumer products.It appears port traffic is picking up early this year in an attempt to beat the tariffs. I'll post a graph once the Port of Los Angeles reports June traffic.

Retailers such as Walmart Inc and Amazon.com (face uncertainty due to U.S. President Donald Trump’s threat to impose more tariffs on Chinese goods, and the jump in imports from the country was likely because of “pre-emptive buying in anticipation of the tariffs”, said Ben Hackett, founder of international maritime consultancy Hackett Associates.

“This is a bump that isn’t quite normal,” he said.

Looking back 9 Years Ago: The Sluggish Recovery Began

by Calculated Risk on 7/13/2018 01:03:00 PM

Note: This is the 14th year I've been writing this blog. Sometimes it is fun to look back, especially at turning points. Starting in January 2005, I was very bearish on housing - and in early 2007, I predicted a recession.

However in 2009 I became more optimistic. For example, in February 2009, I wrote: Looking for the Sun (Note: that post shocked many readers since I had been very bearish).

And here are a couple of posts I wrote almost exactly 9 years ago on July 15, 2009:

Is the Recession Over?

Show me the Engines of Growth

Back in February I pointed out that I expected to see some economic rays of sunshine this year. But I never expected an immaculate recovery forecast from the FOMC.I also noted - because the recovery would be sluggish, and jobless at first - that I'd expect the NBER to wait some time before dating the recession. The NBER finally dated the end of the recession in September 2010:

Although I've argued repeatedly that a "Great Depression 2" was extremely unlikely, I think the other extreme - an immaculate recovery - is also unlikely.

CAMBRIDGE September 20, 2010 - The Business Cycle Dating Committee of the National Bureau of Economic Research met yesterday by conference call. At its meeting, the committee determined that a trough in business activity occurred in the U.S. economy in June 2009. The trough marks the end of the recession that began in December 2007 and the beginning of an expansion. The recession lasted 18 months, which makes it the longest of any recession since World War II.Along the way, in February 2012, I called the bottom for housing: The Housing Bottom is Here

Currently I'm still mostly positive on the economy. Of course I'm concerned about policy, as I noted earlier this year: When the Story Changes, Be Alert

So I'm currently more concerned, but I'm still not on recession watch. For example this week I wrote Investment and Recessions concluding "there is no recession in sight".

Q2 GDP Forecasts

by Calculated Risk on 7/13/2018 11:17:00 AM

From Merrill Lynch:

We continue to track 3.8% qoq saar for 2Q. [July 13 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 3.9 percent on July 11, up from 3.8 percent on July 6. [July 11 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.8% for 2018:Q2 and 2.6% for 2018:Q3. [July 13 estimate]CR Note: These estimates suggest real annualized GDP in the 2.8% to 3.9% range in Q2.

Housing Inventory Tracking

by Calculated Risk on 7/13/2018 08:05:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year (YoY) change for non-contingent inventory in Houston, Las Vegas and Sacramento (all through June 2018), and also Phoenix (through May) and total existing home inventory as reported by the NAR (through May 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 26% year-over-year in June (inventory was still very low), and has increased YoY for nine consecutive months.

Also note that inventory is still down 11% YoY in Las Vegas (red), but the YoY decline has been getting smaller - and inventory in Vegas will probably be up YoY very soon.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally (and has already bottomed in some areas like California).

Thursday, July 12, 2018

Sacramento Housing in June: Sales Down 3.1% YoY, Active Inventory up 26% YoY

by Calculated Risk on 7/12/2018 06:42:00 PM

Friday:

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (Preliminary for July).

• At 11:00 AM, Federal Reserve Monetary Policy Report to Congress

From SacRealtor.org: June 2018 Statistics – Sacramento Housing Market – Single Family Homes

June closed with 1,767 sales, a 2.1% increase from May’s 1,730. Compared to June last year (1,824), the figure is a 3.1% decrease. Of the 1,767 sales this month, 225 (12.7%) used cash financing, 1,104 (62.5%) used conventional, 302 (17.1%) used FHA, 101 (5.7%) used VA and 35 (2%) used Other† types of financing.CR Note: Inventory is still low, but now increasing significantly year-over-year in Sacramento.

...

Active Listing Inventory increased 6% from 2,509 to 2,660 units. The Months of Inventory, however, remained unchanged at 1.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [CR Note: Active inventory is up 26.4% year-over-year]

The Average DOM (days on market) increased from 20 to 21 from May to June and the Median DOM increased from 9 to 10. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,767 sales this month, 80.1% (1,415) were on the market for 30 days or less and 92.4% (1,632) were on the market for 60 days or less.

emphasis added