by Calculated Risk on 3/06/2018 02:03:00 PM

Tuesday, March 06, 2018

Lawler: Population Outlook: Uncertainty Not Just Related to Immigration Assumptions, But Also Death Rates

From housing economist Tom Lawler: Population Outlook: Uncertainty Not Just Related to Immigration Assumptions, But Also Death Rates

In its latest “Tip Sheet” Census said that it will release new long-term population projections sometime this month. The last official Census long-term population projections were released at the end of 2014, and since then “actual” population estimates have fallen way short of those projections. As I documented in a previous report, the population shortfall from that projection was the result of lower births, higher deaths, and (especially) lower net international migration. I also noted that updated net international migration projections going forward are likely to be massively lower than those shown in the 2014 projections, and that analysts should not just look at the overall population projections but also the net international migration assumptions in assessing the “reasonableness” of the projections.

Another factor that will almost certainly result in lower population projections relative to those from 2014 will be deaths. The 2014 Census population projections assumed that the “death rates” for most age groups, and especially the young to middle age groups, would gradually decline over time. In fact, however, death rates for young and middle age adults have increased considerably since 2014, for some age groups at an alarming rate. As a result, despite lower overall population counts from lower net international migration, the number of deaths has considerably exceeded the Census 2014 projections.

Annual (calendar year) data on US deaths are compiled by the National Center for Health Statistics (NCHS), though data are only available with a considerable lag. For example, the NCHS released a “data brief” on mortality in the US for 2016 last December, and detailed data on US deaths for 2015 were released last year. The NCHS data are used by the Census Bureau to estimate and project the overall US population and the characteristics of the population, though Census must make assumptions for the most recent years. Also, Census death estimates are for the 12-month period ending on June 30th, as opposed to the NCHS calendar-year estimates. Below is a table showing annual deaths from the NCHS; death assumptions from the Census 2014 population projections; and the death estimates from the latest Census population estimates (Vintage 2017).

| 12-month period ending: | NCHS 31-Dec | CB Vintage 2017 30-Jun | CB 2014 Projection 30-Jun |

|---|---|---|---|

| 2014 | 2,626,418 | 2,582,448 | 2,582,858 |

| 2015 | 2,712,630 | 2,699,826 | 2,619,062 |

| 2016 | 2,744,248 | 2,728,714 | 2,649,979 |

| 2017 | 2,744,040 | 2,680,555 |

As the table indicates, Census projections for US deaths have been well south of “actual” deaths. While Census does not release its assumptions about deaths by age group (or other characteristics) in its current “estimates” report, it does show its assumptions for deaths by age in its periodic long-term population projections. The NCHS also releases data on deaths by age groups. Below is a comparison of NCHS deaths by selected age groups with the death assumptions from the Census 2014 population projections.

| NCHS Data on Deaths by Selected Age Groups (Calendar Year) | ||||

|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2016 vs. 2014 | |

| Total | 2,626,255 | 2,712,630 | 2,744,248 | 117,993 |

| 15-24 | 28,791 | 30,494 | 32,575 | 3,784 |

| 25-34 | 47,177 | 51,517 | 57,616 | 10,439 |

| 35-44 | 70,996 | 73,088 | 77,792 | 6,796 |

| 45-54 | 175,917 | 174,494 | 173,516 | -2,401 |

| 55-64 | 348,808 | 357,785 | 366,445 | 17,637 |

| 65-74 | 471,541 | 495,016 | 512,080 | 40,539 |

| 75-84 | 624,504 | 637,566 | 636,916 | 12,412 |

| 85+ | 826,226 | 859,701 | 854,462 | 28,236 |

| Census 2014 Projections of Deaths by Selected Age Group (12-month period ending 6/30) | ||||

|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2016 vs. 2014 | |

| Total | 2,582,858 | 2,619,062 | 2,649,979 | 67,121 |

| 15-24 | 27,542 | 26,966 | 26,150 | -1,392 |

| 25-34 | 43,783 | 43,490 | 43,107 | -676 |

| 35-44 | 66,534 | 64,991 | 63,159 | -3,375 |

| 45-54 | 170,644 | 165,999 | 160,879 | -9,765 |

| 55-64 | 326,669 | 328,230 | 328,830 | 2,161 |

| 65-74 | 453,167 | 469,548 | 485,155 | 31,988 |

| 75-84 | 621,098 | 625,385 | 630,841 | 9,743 |

| 85+ | 840,781 | 861,957 | 879,520 | 38,739 |

As the above table show, the Census 2014 population projections assumed that deaths of people aged 15-44 years old would decline from 2014 to 2016 – reflecting an assumption of declining death rates in those age groups – while NCHS data indicate that deaths in these age groups rose significantly over this period, reflecting sizable increases in death rates. On the next page is a table showing some historical NCHS data on death rates by selected age groups. Note that these death rates are from past reports using available population estimates at the time of the report, and that death rates using revised population estimates would be slightly different for past years. Note also that for 2016 NCHS has only released death rates for newborns and for 10-year age groups, and I have “guesstimated” 5-year age group death rates for 2016 based on the 10-year death rate estimates.

| Deaths per 100,000 population, Selected 5-year Age Groups, NCHS | |||||||

|---|---|---|---|---|---|---|---|

| Age Group | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 (est) |

| 15-19 | 49.4 | 48.9 | 47.2 | 44.8 | 45.5 | 48.3 | 49.0 |

| 20-24 | 86.5 | 86.1 | 84.6 | 83.4 | 83.8 | 89.3 | 90.3 |

| 25-29 | 96.0 | 96.7 | 98.1 | 97.6 | 99.7 | 106.4 | 110.2 |

| 30-34 | 110.2 | 113.0 | 112.9 | 114.8 | 117.3 | 127.4 | 129.7 |

| 35-39 | 138.8 | 140.2 | 140.5 | 141.9 | 147.2 | 154.2 | 157.1 |

| 40-44 | 201.1 | 201.7 | 198.7 | 200.3 | 202.4 | 206.1 | 216.0 |

| 45-49 | 324.0 | 323.5 | 315.7 | 315.1 | 311.3 | 308.7 | 312.5 |

| 50-54 | 491.7 | 494.6 | 491.5 | 491.6 | 491.3 | 493.0 | 493.1 |

| 55-59 | 711.7 | 712.3 | 717.2 | 721.8 | 730.6 | 731.8 | 737.7 |

| 60-64 | 1015.8 | 1005.5 | 1014.0 | 1021.7 | 1032.2 | 1039.3 | 1042.2 |

| 65-69 | 1527.6 | 1502.9 | 1470.2 | 1468.4 | 1454.0 | 1465.6 | 1447.4 |

| 70-74 | 2340.9 | 2306.2 | 2266.7 | 2261.7 | 2246.1 | 2260.1 | 2235.8 |

| 75-79 | 3735.4 | 3685.0 | 3630.9 | 3611.9 | 3560.5 | 3574.1 | 3479.3 |

| 80-84 | 6134.1 | 6116.8 | 6026.1 | 6027.4 | 5944.6 | 5986.2 | 5809.1 |

| 85+ | 13934.3 | 13779.3 | 13678.6 | 13660.4 | 13407.9 | 13637.9 | 13392.1 |

As the table indicates, death rates for all 5-year age groups under 45 years old increased significantly from 2014 to 2016 (especially for 25-34 year olds), while death rates for the elderly actually declined somewhat. This contrasts sharply with the CB 2014 population projections, which assumed that death rates would decline for all age groups save the very elderly.

While it is beyond the scope of this report to discuss why death rates among all but the very old have risen sharply rather than decline as assumed in the CB 2014 population projections (though drug overdose deaths are a significant component – see below), it seems almost certain that the updated population projections will incorporate substantially higher death rates for most of the population – and especially for the “prime” working age population. And, as discussed in an earlier report, the updated population projections will almost certainly assume much lower net international migration assumptions than was the case in the 2014 population projections. This, too, will have a “disproportionate” impact on projections for “young” adults and the “prime” working age population.

| Drug Overdose Deaths by Selected Age Groups, NCHS | |||||||

|---|---|---|---|---|---|---|---|

| 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total | |

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,386 |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,871 |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 46,940 |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,255 |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,480 |

Q1 GDP Forecasts

by Calculated Risk on 3/06/2018 11:18:00 AM

It is just early March, but here are few Q1 GDP forecast.

From Merrill Lynch:

1Q GDP tracking edged down a tenth to 1.8% qoq saar, while 4Q ticked up to 2.7% [March 6 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 3.5 percent on March 1, up from 2.6 percent on February 27.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q1 stands at 3.0%. [March 2 estimate]

CoreLogic: House Prices up 6.6% Year-over-year in January

by Calculated Risk on 3/06/2018 08:51:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose More Than 6 Percent Year Over Year for the Sixth Consecutive Month in January

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2018, which shows home prices rose both year over year and month over month. Home prices nationally increased year over year by 6.6 percent from January 2017 to January 2018, and on a month-over-month basis home prices increased by 0.5 percent in January 2018 compared with December 2017,* according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to increase by 4.8 percent on a year-over-year basis from January 2018 to January 2019, with a 12-month increase of more than 7 percent projected for California, Florida, Nevada and Oregon. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Entry-level homes have been in particularly short supply, leading to more rapid home-price growth compared with more expensive homes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Homes with a purchase price less than 75 percent of the local area median had price growth of 9.0 percent during the year ending January 2018. Homes that sold for more than 125 percent of median appreciated 5.3 percent over the same 12-month period. Thus, first-time buyers are facing acute affordability challenges in some high-cost areas.”

emphasis added

The year-over-year comparison has been positive for almost six consecutive years since turning positive year-over-year in February 2012.

Monday, March 05, 2018

30 Year Mortgage Rates at 4.5% to 4.625%

by Calculated Risk on 3/05/2018 04:49:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Strong, But End The Day Higher

Mortgage rates ended higher today, after financial markets reacted to developments in last week's tariff-related news. Last Thursday, stock prices and interest rates fell in response to the tariff announcement because investors figured it ran the risk of doing more economic harm than good. In general, economic weakness/risks/fear tends to push rates lower.Here is a table from Mortgage News Daily:

Today, congressional leaders made statements that effectively opposed the tariffs as written. In fact, one Republican source said not to rule out "potential action" in the near future if Trump continues with the Tariff plan. Much like the initial news hurt stocks and helped rates last week, the potential reversal or mitigation of that news did the opposite today. Stocks prices and bond yields rose in concert. In general, when bond yields rise enough during the day, mortgage lenders will adjust their rate sheets for the worse (a so-called "negative reprice). Most lenders repriced today, taking rates to higher levels in the early afternoon. [30YR FIXED - 4.5-4.625%]

emphasis added

Update: Framing Lumber Prices Up Sharply Year-over-year, At Record Prices

by Calculated Risk on 3/05/2018 12:58:00 PM

Here is another monthly update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and now prices are above the bubble highs.

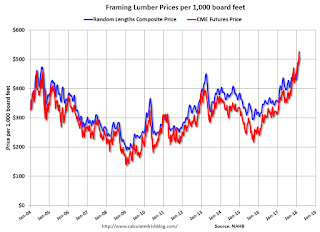

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through February 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 25% from a year ago, and CME futures are up about 45% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Rising costs - both material and labor - will be headwinds for the building industry this year.

ISM Non-Manufacturing Index decreased to 59.5% in February

by Calculated Risk on 3/05/2018 10:03:00 AM

The February ISM Non-manufacturing index was at 59.5%, down from 59.9% in January. The employment index decreased in February to 55.0%, from 61.6%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 97th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 59.5 percent, which is 0.4 percentage point lower than the January reading of 59.9 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 62.8 percent, 3 percentage points higher than the January reading of 59.8 percent, reflecting growth for the 103rd consecutive month, at a faster rate in February. The New Orders Index registered 64.8 percent, 2.1 percentage points higher than the reading of 62.7 percent in January. The Employment Index decreased 6.6 percentage points in February to 55 percent from the January reading of 61.6 percent. The Prices Index decreased by 0.9 percentage point from the January reading of 61.9 percent to 61 percent, indicating that prices increased in February for the 24th consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector reflected the second consecutive month of strong growth in February. The decrease in the Employment Index possibly prevented an even stronger reading for the NMI® composite index. The majority of respondents’ continue to be positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slightly slower expansion in February than in January.

Black Knight Mortgage Monitor: Recent Increase in Rates Cuts Potential Refinance Population by 40%

by Calculated Risk on 3/05/2018 08:47:00 AM

Black Knight released their Mortgage Monitor report for January today. According to Black Knight, 4.31% of mortgages were delinquent in January, up from 4.25% in January 2017. The increase was primarily due to the hurricanes. Black Knight also reported that 0.66% of mortgages were in the foreclosure process, down from 0.94% a year ago.

This gives a total of 4.97% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Homes in Lowest Price Tiers Continue to See Greatest Appreciation, Tightest Affordability

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of January 2018. This month, Black Knight looked at the impact of recent interest rate rises on home affordability. While affordability remains better than long-term averages nationally, home prices at the lower end of the market are less affordable than the national average, particularly for those in lower income levels. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the root of the issue has been the consistently higher-than-market-average rate of home price appreciation among properties in the lowest 20 percent of home prices nationally.

“Prices on Tier 1 properties – those in the lowest 20 percent of home values – have been appreciating at a faster rate than all other tiers for 67 consecutive months,” said Graboske. “The annual rate of appreciation for these homes is 1.9 percent higher than the market average, and more than 3.6 percent higher than that of properties in the top 20 percent of prices (Tier 5). Larger overall increases in value among lower-priced homes is not just a recent trend, though; the same dynamic is observed when looking back over the past 15 years. While the nearly 50 percent increase in the median home price over that period has significantly outpaced the approximately 40 percent growth in the median income, lower interest rates today have more than offset that difference. However, according to Census Bureau data, income growth in the lower quintiles has not kept up with the higher ends of the market. This has clear implications for home affordability in this segment of the population, even more so in light of the 43 BPS increase in interest rates seen in just the first six weeks of 2018.

“Overall affordability remains better than long-term historical averages, even taking the recent rate jump into consideration. Currently, it takes 23 percent of the median income to purchase the median home nationally, which is still 1.9 percent below the averages seen from 1995-2003. But those in lower income levels are much closer – if not above – such long-term benchmarks. It seems evident that further affordability reductions from rising interest rates could put more pressure on lower-income buyers by increasing competition for lower priced homes, as borrowers’ overall buying power is diminished.”

The spike in 30-year fixed mortgage interest rates also had the effect of cutting the population of borrowers with interest rate incentive to refinance by nearly 40 percent in 40 days. Approximately 1.4 million borrowers lost the interest rate incentive to refinance in just the first six weeks of 2018. This leaves 2.65 million potential candidates who could still both benefit from and likely qualify for a refinance at today’s rates, the smallest that population has been since late 2008, prior to the initial decline in rates during the recession. This represents another challenge to a consistently shrinking refinance market. Refinance lending declined significantly in 2017, with the total number of originations down 29 percent, and total volume down by $355 billion, a 34 percent year-over-year decline.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of the number of refinance candidates.

From Black Knight:

• Closing out a very steady second half of the year, the population of refinance candidates varied by less than 3.0 percent over the final 12 weeks of 2017There is much more in the mortgage monitor.

• However, the recent spike in interest rates cut the population of borrowers with an interest rate incentive to refinance by nearly 40 percent in 40 days

• Approximately 1.4 million borrowers lost the interest rate incentive to refinance in just the first six weeks of 2018

• 2.65 million potential candidates could still both benefit from and likely qualify for a refinance at today’s rates

• That is the smallest this population has been since late 2008, prior to the initial decline in rates during the recession

• Though the population is only 10 percent off its February 2017 mark, rate/term refinance production could see a more significant impact than this might suggest due to increasing burnout in the market

• A corresponding drop in the average credit score of refinance originations is typically observed when rates rise

Sunday, March 04, 2018

Sunday Night Futures

by Calculated Risk on 3/04/2018 08:09:00 PM

Weekend:

• Schedule for Week of Mar 4, 2018

• Housing Industry Concerned about Tariffs

Monday:

• 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down6, and DOW futures are down 20 (fair value).

Oil prices were down over the last week with WTI futures at $61.62 per barrel and Brent at $64.75 per barrel. A year ago, WTI was at $53, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.52 per gallon. A year ago prices were at $2.31 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

Housing Industry Concerned about Tariffs

by Calculated Risk on 3/04/2018 10:28:00 AM

On Thursday, NAR chief economist was quoted in Inman News: Trump tariffs on steel and aluminum will be a blow to the construction industry

“Tariffs could measurably raise the cost of building materials and hinder home construction of affordable homes,” said Yu. “But more importantly, tariffs and restrictions to international trade will hold back economic growth and job creations. A better way to raise GDP growth is to produce more homes. Job growth and additional housing inventory will greatly help American workers and American consumers.”And from the NAHB: Statement from NAHB Chairman Randy Noel on New Steel and Aluminum Tariffs

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.As a noted in When the Story Changes, Be Alert, housing is facing several headwinds in 2018: higher mortgage rates, a negative impact from tax changes, higher labor costs, and higher material costs (especially lumber), and now tariffs on steel and aluminum.

“Tariffs hurt consumers and harm housing affordability."

Saturday, March 03, 2018

Schedule for Week of Mar 4, 2018

by Calculated Risk on 3/03/2018 08:11:00 AM

The key report this week is the February employment report on Friday.

Other key indicators include the January Trade deficit, and the February ISM non-manufacturing index and the February ADP employment report.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in February, down from 234,000 added in January.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $55.1 billion in January from $53.1 billion in December.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.8 billion in January.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Employment Report for February. The consensus is for an increase of 205,000 non-farm payroll jobs added in February, up from the 200,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In January the year-over-year change was 2.114 million jobs.

A key will be the change in wages.