by Calculated Risk on 11/07/2017 04:30:00 PM

Tuesday, November 07, 2017

First Look: 2018 Housing Forecasts

Towards the end of each year I collect some housing forecasts for the following year. This is just a beginning (I'll gather many more).

First a review of the previous five years ...

Here is a summary of forecasts for 2017. It is early (just nine months), but in 2017, new home sales will probably be around 600 to 610 thousand, and total housing starts will be around 1.200 to 1.210 million. Wells Fargo and Brad Hunter (HomeAdvisor) appear very close on New Home sales, and Merrill Lynch and NAR appear close on starts.

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2017:

From Fannie Mae: Housing Forecast: October 2017

From Freddie Mac: Freddie Mac September 2017 Outlook

From NAHB: NAHB’s housing and economic forecast

Note: For comparison, new home sales in 2017 will probably be around 605 thousand, and total housing starts around 1.205 million.

| Housing Forecasts for 2018 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 651 | 945 | 1,300 | 5.1%2 |

| Freddie Mac | 1,330 | 4.9%2 | ||

| NAHB | 628 | 903 | 1,253 | |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy |

||||

CoreLogic: House Prices up 7.0% Year-over-year in September

by Calculated Risk on 11/07/2017 11:58:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Reveals Nearly Half of the Nation’s Largest 50 Markets are Overvalued

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2017, which shows home prices are up strongly both year over year and month over month. Home prices nationally increased year over year by 7 percent from September 2016 to September 2017, and on a month-over-month basis, home prices increased by 0.9 percent in September 2017 compared with August 2017, according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.7 percent on a year-over-year basis from September 2017 to September 2018, and on a month-over-month basis home prices are expected to decrease by 0.1 percent from September 2017 to October 2017. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Heading into the fall, home price growth continues to grow at a brisk pace,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This appreciation reflects the low for-sale inventory that is holding back sales and pushing up prices. The CoreLogic Single-Family Rent Index rose about 3 percent over the last year, less than half the rise in the national Home Price Index.”

emphasis added

The year-over-year comparison has been positive for over five consecutive years since turning positive year-over-year in February 2012.

BLS: Job Openings Unchanged in September

by Calculated Risk on 11/07/2017 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.1 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.3 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.2 million in September. The quits rate was 2.2 percent. The number of quits was little changed for total private and for government. Quits rose in professional and business services (+82,000) and state and local government, excluding education (+10,000). Quits fell in other services (-45,000) and real estate and rental and leasing (-16,000).

...

Hurricane Irma made landfall in Florida during September, the reference month for the preliminary estimates in this release. All possible efforts were made to contact and collect data from survey respondents in the hurricane-affected areas. A review of the data indicated that Hurricane Irma had no discernible effect on the JOLTS estimates for September.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased slightly in September to 6.093 million from 6.090 in August.

The number of job openings (yellow) are up 7.5% year-over-year.

Quits are up 3.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing year-over-year. This is another strong report.

Black Knight Mortgage Monitor: 2017 Hurricane Impact on Mortgage Performance Worse than Katrina

by Calculated Risk on 11/07/2017 08:01:00 AM

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 4.40% of mortgages were delinquent in September, up from 4.27% in September 2016. Black Knight also reported that 0.7o% of mortgages were in the foreclosure process, down from 1.00% a year ago.

This gives a total of 5.10% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Despite Continued Home Price Acceleration, Housing Remains More Affordable Than Long-Term Benchmarks

Today, the Data & Analytics division of Black Knight, Inc. (NYSE: BKI) released its latest Mortgage Monitor Report, based on data as of the end of September 2017. Given continued acceleration in the rate of home price appreciation observed across most of the country, Black Knight thought it pertinent to examine both the current state of home affordability as well as potential impacts of future home price and interest rate increases on the home affordability landscape.

“Rising home prices continue to offset the majority of would-be savings from recent interest rate declines, which has kept home affordability near a post-recession low,” said Ben Graboske, Executive Vice President - Data & Analytics, Black Knight. “That being said, when viewing the market through a longer-term lens, affordability across most of the country still remains favorable to long-term benchmarks.”

...

In looking at the affordability landscape across the country, we certainly see varying levels of affordability in each market compared to their own long-term benchmarks,” Graboske explained. “But, by and large, the overall theme is that affordability in most areas, while tightening, remains favorable to long-term norms.” When looking at state-level data, payment-to-income ratios in 47 of 50 states remain below their 1995-2003 averages. Only Hawaii, California, Oregon, and Washington, D.C., have higher payment-to-income ratios today than their longer-term benchmarks.

...

In addition to affordability, Black Knight also took an in-depth look at the effect of recent hurricanes on mortgage performance and determined that Hurricanes Harvey and Irma have likely accounted for an increase of 135,800 past-due mortgages nationwide. The combined impacts of these two storms, which are being credited with a 27 bps rise in the national non-current rate – has already surpassed that of Hurricane Katrina in 2005 and is expected to increase further in October results, where the heaviest impact from Hurricane Irma is expected to be seen.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graphic from Black Knight looks at the delinquency roll count over time.

From Black Knight:

• Over 621,000 borrowers that were current on mortgage payments as of August became 30 days delinquent in September. This marks the highest single month inflow of delinquent loans in nearly 3 yearsThere is much more in the mortgage monitor.

• Increases in delinquent loan volumes are common for the month of September, but this month’s inflow was also impacted by the effects of hurricanes Harvey and Irma

• Later-stage delinquency rolls also increased with 30day to 60-day delinquency rolls hitting a 21-month high and 60-day to 90-day delinquency rolls hitting a 10-month high

Monday, November 06, 2017

Tuesday: Job Openings

by Calculated Risk on 11/06/2017 06:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drift Calmly Down to 3-Week Lows

Mortgage rates continued lower today, despite a blatant lack of underlying motivation in financial markets. By that, I mean that we haven't seen any obvious cause and effect relationships between news, economic data, and bond market movements (which, in turn, drive interest rate movements). Instead, bonds moved of their own volition. While the move was modest, it was the 6th improvement in the past 7 business days. The net effect is the best mortgage rate offerings in 3 weeks.Tuesday:

Several of the more aggressive lenders are again quoting top tier 30yr fixed rates of 3.875% while many remain at 4.0%.

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for September from the BLS.

• Also at 10:00 AM, Corelogic House Price index for September.

• At 2:30 PM, Speech by Fed Chair Janet Yellen, Acceptance Remarks, At the presentation of the Paul H. Douglas Award for Ethics in Government, Washington, D.C.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.4 billion in September.

NAHB: Builder Confidence decreases for the 55+ Housing Market in Q3

by Calculated Risk on 11/06/2017 01:35:00 PM

This is a quarterly index that was released last week by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: 55+ Housing Builders and Developers Stay Confident in Third Quarter

Builder confidence in the single-family 55+ housing market continued to be positive in the third quarter of 2017, according to the National Association of Home Builders (NAHB) 55+ Housing Market Index (HMI), released [last week].

While the index measuring builder confidence in the single-family 55+ market dropped from a reading of 66 in the second quarter to 59 this quarter, it’s the 14th quarter in a row in which the reading was above 50, the break-even point at which more respondents see conditions as good than poor.

The effects of destructive hurricanes and a series of wildfires earlier this fall are likely reflected in this quarter’s survey, which was conducted in September, said Dennis Cunningham, chairman of NAHB’s 55+ Housing Industry Council and president of ActiveWest Builders in Coeur d’Alene, Idaho.

“However, this is a temporary effect. Overall confidence remains high and builders continue to be optimistic about the 55+ market in the long run.”

...

“The decline in the 55+ single-family HMI is consistent with slight softening of other measures of single-family construction seen recently, driven by the effect of the natural disasters on top of ongoing issues with the supply of labor, lots and some building materials,” said NAHB Chief Economist Robert Dietz. “However, market conditions on balance remain favorable, and we expect gradual continued growth in the 55+ housing sector.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q3 2017. And reading above 50 indicates that more builders view conditions as good than as poor. The index decreased to 59 in Q3 down from 66 in Q2.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 11/06/2017 10:55:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through October 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 25% from a year ago, and CME futures are up about 45% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

It looks like we will see record prices in 2018.

Hotel Occupancy Rate increases YoY, On Pace for Record Year

by Calculated Risk on 11/06/2017 08:35:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 28 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 22-28 October 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 October 2016, the industry recorded the following:

• Occupancy: +4.0% to 69.8%

• Average daily rate (ADR): +2.6% to US$129.44

• Revenue per available room (RevPAR): +6.7% to US$90.32

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+34.9% to 85.9%), ADR (+14.0% to US$120.89) and RevPAR (+53.8% to US$103.82). Post-Hurricane Harvey demand continues to drive performance levels in the market.

Tampa/St. Petersburg, Florida, experienced the second-highest increase in occupancy (+13.4% to 77.7%) and the second-largest rise in RevPAR (+23.9% to US$94.42).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, November 05, 2017

Sunday Night Futures

by Calculated Risk on 11/05/2017 08:06:00 PM

Something to watch: What is happening in Saudi Arabia?

Weekend:

• Schedule for Week of Nov 5, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $55.82 per barrel and Brent at $62.27 per barrel. A year ago, WTI was at $44, and Brent was at $43 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.53 per gallon. A year ago prices were at $2.22 per gallon - so gasoline prices are up 31 cents per gallon year-over-year.

AAR: Rail Carloads decreased Slightly, Intermodal at Record Levels, in October

by Calculated Risk on 11/05/2017 08:19:00 AM

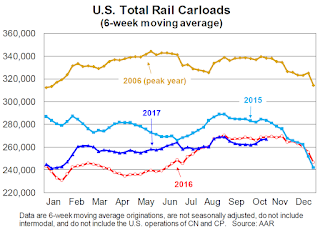

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

If you care about total U.S. rail carloads, October 2017 was not a particularly good month — total carloads were down 0.1%, or 1,220 carloads, from October 2016. Average weekly total carloads in October 2017 (266,444) were the lowest for October since sometime before 1988 when our records begin. Three main reasons for October’s decline? Coal (down 4.9%, or 17,764 carloads); grain (down 11.8%, or 12,528 carloads); and petroleum products (down 4.9%, or 1,989 carloads). But if you care about rail carloads as a gauge for the health of the U.S. economy, October 2017 was actually pretty good. That’s because carloads of coal, grain, and petroleum products tend to rise and fall for reasons that have little to do with the state of the economy. If you exclude them, U.S. rail carloads in October 2017 were up 5.6%, or 31,061 carloads, over October 2016. That’s the biggest such increase since January 2015 and supports the view that the economy has picked up steam lately. The fact that October 2017 was the best month in history for intermodal (in terms of average weekly container and trailer volume) is another good sign.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,065,777 carloads in October 2017, down 0.1%, or 1,220 carloads, from October 2016. Total carloads averaged 266,444 per week in October 2017, the lowest weekly average for October since sometime prior to 1988, when our data begin. October saw the fourth straight year-over-year monthly decline for total carloads.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1.14 million containers and trailers in October 2017, up 6.4%, or 68,328 units, over October 2016. Average weekly volume in October 2017 of 286,039 intermodal units was the most in history, ahead of August 2017 (280,216) and June 2015 (279,285). In week 42, the third week of October, intermodal volume was 291,046 units, the highest single week in U.S. rail history.