by Calculated Risk on 11/10/2017 01:21:00 PM

Friday, November 10, 2017

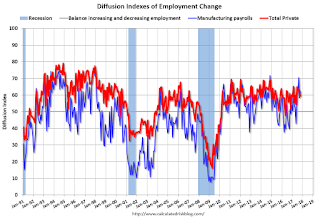

Employment: October Diffusion Indexes

I haven't posted this in some time. Here is some more positive news in the employment report.

The BLS diffusion index for total private employment was at 59.6 in October, down from 61.1 in September.

For manufacturing, the diffusion index was at 62.2, up from 58.3 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth was widespread in October.

Overall both total private and manufacturing job growth was widespread in October.

Preliminary November Consumer Sentiment declines to 97.8

by Calculated Risk on 11/10/2017 10:09:00 AM

The preliminary University of Michigan consumer sentiment index for November was at 97.8, down from 100.7 in October.

Consumer sentiment declined slightly in early November due to widespread losses across current and expected economic conditions. The losses were quite small as the Sentiment Index remained at its second highest level since January. Overall, the Sentiment Index has remained trendless since the start of the year, varying by less that 4.0 Index-points around its 2017 average of 96.8. Consumers (and policy makers) have four key concerns: prospective trends in jobs, wages, inflation, and interest rates.

emphasis added

Click on graph for larger image.

This was below the consensus forecast.

Consumer sentiment is a concurrent indicator (not a leading indicator).

Prime Working-Age Population nears 2007 Peak

by Calculated Risk on 11/10/2017 08:01:00 AM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of October 2017, according to the BLS, there were still fewer people in the 25 to 54 age group than in 2007.

At the beginning of this year - based on demographics - it looked like the prime working age (25 to 54) would probably hit a new peak in 2017.

However, since the end of last year, the prime working age population has declined slightly.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through October 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should start growing at 0.5% per year - and this should boost economic activity.

Thursday, November 09, 2017

Hotel Occupancy Rate decreases YoY

by Calculated Risk on 11/09/2017 01:55:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 November

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 29 October through 4 November 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 30 October through 5 November 2016, the industry recorded the following:

• Occupancy: -0.9% to 63.3%

• Average daily rate (ADR): +0.4% to US$124.08

• Revenue per available room (RevPAR): -0.4% to US$78.57

Among the Top 25 Markets, Houston, Texas, reported the largest increase in RevPAR (+40.4% to US$90.28), due primarily to the only double-digit increase in occupancy (+28.2% to 79.1%). Post-Hurricane Harvey demand continues to drive performance levels in the market.

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Is the stock market a bubble?

by Calculated Risk on 11/09/2017 10:22:00 AM

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Over a week ago I posted five economic questions I'm frequently asked.

Last week I discussed: Are house prices in a new bubble? and Is a recession imminent (within the next 12 months)?

Here are a few thoughts on "Is the stock market a bubble?"

First, as long term readers know, I rarely comment directly on the stock market (although I did post on the market in 2009 since that was a turning point). I'll be brief here.

Second, I write about the economy, and the stock market is not the economy. This is usually my first comment to people when they ask about the market. However - in general - the stock market does well when the economy is expanding, and poorly during economic downturns.

There are exceptions: in 1987, the economy was fine, but the stock market crashed in October 1987. However the crash followed a very strong rally of over 30% from the beginning of 1987, and the market actually finished up for the year (although well off the peak). There were reasons for the crash - like portfolio insurance - that exacerbated the sell-off. In addition, there weren't any trading curbs (aka circuit breakers) in 1987, so the market could fall over 20% in one day.

Note: Some people say the 1987 proposed changes in the tax law - and a new Fed Chair - contributed to the 1987 crash. Echoes of history?

Third, the general rule is don't invest based on your political views. Those who sold, or didn't buy, because they didn't like Obama missed an historical rally. And those who sold, or didn't buy, because they don't like Trump missed solid gains this year.

Since I don't think a recession is imminent, I'd generally expect further gains in the market over the next year. The PE ratio is high (around 25), and that is well above average. However it is typical for the PE ratio to expand during an economic expansion.

As I noted in the Are house prices in a new bubble?, a bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value (like the PE ratio), but the real key for detecting a bubble is speculation. Back in the late '90s, stock speculation was obvious. Not only was margin debt high, but everyone was talking about investing in stocks - especially tech stocks. I knew the bubble was over when my mom called me and asked what "QQQ" stood for (NASDAQ ETF)? All her friends were buying it! (My shoeshine boy story).

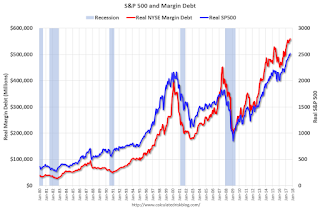

Another possible indicator of speculation is margin debt.

This graph shows the real S&P 500 (inflation adjusted, right axis), and real NYSE margin debt (left axis).

The high level of margin debt might suggest too much leverage.

The bottom line is the U.S. economy is doing well (the global economy is doing well too). There might be some speculation with margin debt, but everyone isn't talking stocks (like in 1999). So, in general, I don't think this is a bubble. Of course, as always, we could see a 10% to 20% correction starting at any time. I'll now go back to avoiding discussing the stock market.

Weekly Initial Unemployment Claims increase to 239,000

by Calculated Risk on 11/09/2017 08:34:00 AM

The DOL reported:

In the week ending November 4, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 10,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 231,250, a decrease of 1,250 from the previous week's unrevised average of 232,500. This is the lowest level for this average since March 31, 1973 when it was 227,750.The previous week was unrevised.

Claims taking procedures continue to be severely disrupted in the Virgin Islands. The ability to take claims has improved in Puerto Rico and they are now processing backlogged claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 231,250 - the lowest since 1973.

This was above the consensus forecast. The very low level of claims suggest relatively few layoffs.

Wednesday, November 08, 2017

The Future is still Bright!

by Calculated Risk on 11/08/2017 04:45:00 PM

I wrote this one year ago in November 2016. Not much has changed (no major policies have been enacted), and the economy remains on cruise control.

In January 2013 I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic. I updated that post earlier this year (with a discussion of demographics).

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I predicted a recession in 2007, and then I started looking for the sun in early 2009, and I've been fairly positive since then (although I expected a sluggish recovery).

I've also been optimistic about next year (2017), with most economic indicators improving - more jobs, lower unemployment rate, rising wages and much more - and with more room to run for the current expansion. Also the demographics in the U.S. are becoming more favorable (see here for more on improving demographics).

Now Mr. Trump has been elected President. How does that change the outlook?

In the long term, there is little or no change to the outlook. The future is still bright! Although I'm concerned about the impact of global warming.

In the short term, there is also no change (Mr Obama will be President until January, and it takes time for new policies to be implemented).

The intermediate term might be impacted. The general rule is don't invest based on your political views, however it is also important to look at the impact of specific policies.

I will probably disagree with most of Mr. Trump's proposals for both normative reasons (different values), and for positive reasons (because Mr. Trump rejects data that doesn't fit his view - and that is not good).

With Mr. Trump, no one knows what he will actually do. He has said he'd "build a wall" along the border with Mexico, renegotiate all trade deals, cut taxes on high income earners, repeal Obamacare and more. As an example, repealing the ACA - without a replacement - would lead to many millions of Americans without health insurance. And those with preexisting conditions would be uninsurable. This seems politically unlikely (without a replacement policy), but it is possible.

Since Trump is at war with the data (he rejects data that doesn't fit his views), I don't expect evidence based policy proposals - and that almost always means bad results. However bad results might mean higher deficits with little return - not an economic downturn. Until we see the actual policy proposals, it is hard to predict the impact. I will not predict a recession just because Trump is elected. In fact, additional infrastructure spending might give the economy a little boost over the next year or two. On the other hand, deporting 10+ million people would probably lead to a recession. We just have to wait and see what is enacted.

In conclusion: The future is still bright, but there might be a storm passing through.

Leading Index for Commercial Real Estate "Recovers" in October

by Calculated Risk on 11/08/2017 11:58:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Recovers in October

The Dodge Momentum Index rose in October, climbing 13.2% to 130.9 (2000=100) from the revised September reading of 115.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move higher in October nearly reversed the erosion of the past four months (including September’s 7.9% decline), with October posting healthy gains in both sectors. From September to October the commercial portion of the Momentum Index advanced 16.8%, while the institutional portion grew 8.3%. On a year-over-year basis, the Momentum Index is now 6.1% higher, with the commercial portion up 5.5% and the institutional portion up 6.9%. October’s increase supports the belief that building activity has further room to grow during this cycle. While month-to-month activity could continue to be volatile, there are enough projects in the pipeline to sustain growth into 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 130.9 in October, up from 115.6 in September.

The index is up 6.1% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth into 2018.

Las Vegas Real Estate in October: Sales up 13% YoY, Inventory down 32%

by Calculated Risk on 11/08/2017 09:20:00 AM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local Home Prices Cool Down in October, Still Well Up from One Year Ago, GLVAR Housing Statistics for October 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices cooled down a bit in October, though home prices and sales are still well up from one year ago.1) Overall sales were up about 13% year-over-year.

...

By the end of October, GLVAR reported 4,795 single-family homes listed for sale without any sort of offer. That’s down 32.3 percent from one year ago. For condos and townhomes, the 770 properties listed without offers in October represented a 32.0 percent drop from one year ago.

The total number of existing local homes, condos and townhomes sold during October was 3,633, up from 3,225 in October 2016. Compared to one year ago, sales were up 13.3 percent for homes and up 16.1 percent for condos and townhomes.

According to GLVAR, home sales so far in 2017 continue to run about 10 percent ahead of the pace from 2016, when 41,720 total properties were sold in Southern Nevada. At this rate, GLVAR statistics show that 2017 is on pace to be the best year for local home sales since at least 2012.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in October, when 2.9 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 5.1 percent of all sales in October 2016. Another 2.3 percent of all October sales were bank-owned, down from 5.6 percent one year ago.

As these declining percentages indicate, [GLVAR President David] Tina said “distressed sales now make up such a small share of the local housing market that they’ve really become a non-issue.”

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago.

3) Fewer distressed sales.

MBA: Mortgage Applications "Flat" in Latest Weekly Survey

by Calculated Risk on 11/08/2017 07:00:00 AM

From the MBA: Mortgage Applications Flat in Latest MBA Weekly Survey

Mortgage applications remained unchanged from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 3, 2017.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.18 percent from 4.22 percent, with points decreasing to 0.38 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.