by Calculated Risk on 12/09/2016 05:59:00 PM

Friday, December 09, 2016

Goldman: FOMC Preview

A few excerpts from a research piece by Goldman Sachs economists Zach Pandl and Jan Hatzius:

Markets have reacted strongly to the presidential election, and fiscal easing may eventually warrant a quicker pace of rate hikes by the FOMC. However, Fed officials will have few policy details at this stage, and will undoubtedly want to see the first rate increase in a year go off smoothly. Therefore, we look for the committee to offer a mostly steady message next week, and to delay incorporating fiscal policy changes into the outlook until next year.I'll have more previews this weekend.

Fortunately, there is already enough data in hand to make a strong case for a rate increase at the meeting: (1) growth momentum has picked up from earlier this year, (2) spare capacity has diminished further, and (3) inflation news has been mostly encouraging. ...

We therefore expect a unanimous vote for an increase in the funds rate range to 0.50-0.75%. The statement will likely upgrade its description of the risks to the outlook to “balanced” from “roughly balanced”. The committee may adjust its assessment of the policy stance to “moderately accommodative” from “accommodative”, as many officials have already done in their public comments.

In the Summary of Economic Projections, we expect (1) upward revisions to GDP growth, (2) downward revisions to the unemployment rate, including the median estimate of the structural rate, (3) slight upward revisions to headline and core PCE inflation, and (4) unchanged median projections for the funds rate.

In the press conference, look for Chair Yellen to highlight the incoming data and to repeat the committee’s existing outlook that the pace of rate hikes will be gradual. We see little incentive for Yellen to dwell on the uncertain outlook for fiscal policy at this stage.

Nomura: FOMC Preview

by Calculated Risk on 12/09/2016 02:51:00 PM

Note: The FOMC meets next week, and almost every expects a rate hike at the December meeting.

A few excerpts from a research note from Nomura:

In line with market expectations, we expect the FOMC will raise the federal funds rate target to 0.50-0.75% at the conclusion of the 13-14 December meeting. We think that the incoming data since the last meeting has been sufficiently positive for the Committee to conclude that the case for rate hike has been finally met.I'll post more previews, but a rate hike next week seems almost certain.

On the policy statement, we expect the paragraph on current economic conditions to point to continued growth. Additionally, we expect the Committee to highlight two notable developments – a sharp drop in the unemployment rate and a pickup in market-based measures of inflation compensation – in the statement. On the economic outlook, we expect no substantive changes, although the Committee may acknowledge a shift in the balance of risks to the positive side given the potential fiscal stimulus that will likely be realized under a Republican-led Congress and a Trump White House.

In addition, we will receive a new set of forecasts from the FOMC participants. ...

Our base scenario is that FOMC participants will not change their outlook for 2017 and beyond as we do not think the Committee will incorporate the possibility of fiscal expansion. It's unclear when and how FOMC participants will take into account potential changes in fiscal policy. In that sense, there is some risk that some participants could raise real GDP projections for 2017 and 2018 in anticipation of fiscal expansion. And, given the recent decline in the unemployment rate, the unemployment rate forecast for 2017 could be also revised lower.

...

Last, Chair Yellen will hold a press conference after the conclusion of the two-day policy meeting. ... We will also listen for any clues on how the FOMC may change its outlook in response to the major fiscal stimulus that will likely be enacted next year.

Fed's Flow of Funds: Household Net Worth increased in Q3

by Calculated Risk on 12/09/2016 12:18:00 PM

The Federal Reserve released the Q3 2016 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q3 compared to Q2:

The net worth of households and nonprofits rose to $90.2 trillion during the third quarter of 2016. The value of directly and indirectly held corporate equities increased $494 billion and the value of real estate increased $554 billion.Household net worth was at $90.2 trillion in Q3 2016, up from $88.0 trillion in Q2 2016.

The Fed estimated that the value of household real estate increased to $22.7 trillion in Q3. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and also including new construction.

Click on graph for larger image.

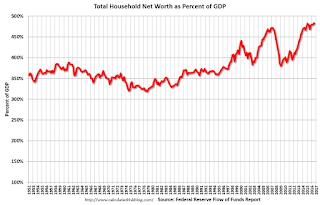

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2016, household percent equity (of household real estate) was at 57.3% - up from Q2, and the highest since Q2 2006. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 57.3% equity - and about 3 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $86 billion in Q3.

Mortgage debt has declined by $1.21 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q3, and is above the average of the last 30 years (excluding bubble).

Preliminary November Consumer Sentiment increases to 98.0

by Calculated Risk on 12/09/2016 10:14:00 AM

The preliminary University of Michigan consumer sentiment index for December was at 98.0, up from 93.8 in November.

Consumer confidence surged in early December to just one-tenth of an Index point below the 2015 peak—which was the highest level since the start of 2004. The surge was largely due to consumers’ initial reactions to Trump’s surprise victory. When asked what news they had heard of recent economic developments, more consumers spontaneously mentioned the expected positive impact of new economic policies than ever before recorded in the long history of the surveys. To be sure, an equal number volunteered negative judgments about prospective economic policies, but the frequency of those negative references was less than half its prior peak levels whereas positive references were about twice its prior peak. There were a few exceptions to the early December surge in optimism, mainly among those with a college degree and among residents of the Northeast, although no group has adopted a pessimistic outlook for the economy. The most important implication of the increase in optimism is that it has raised expectations for the performance of the economy. President-elect Trump must provide early evidence of positive economic growth as well as act to keep positive consumer expectations aligned with performance. Either too slow growth or too high expectations represent barriers to maintaining high levels of consumer confidence. Until specific policies are proposed, there is no reason to alter the 2017 forecast of 2.5% for real consumption.

emphasis added

Click on graph for larger image.

Thursday, December 08, 2016

Friday: Flow of Funds

by Calculated Risk on 12/08/2016 09:39:00 PM

Friday:

• At 8:30 AM ET, University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 94.1, up from 93.8 in November.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% decrease in inventories.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Goldman: Fiscal Boost: Mainly a 2018 Story

by Calculated Risk on 12/08/2016 04:01:00 PM

A few excerpts from a research piece by Goldman Sachs economist Alec Phillips: Fiscal Boost: Mainly a 2018 Story

We expect fiscal policy to become more expansionary next year, but the timing is uncertain. Our preliminary expectation is that the growth effects from looser fiscal policy would be concentrated in Q4 2017 and the first half of 2018. The timing depends mainly on how long it takes tax legislation to become law, and whether Congress legislates a prolonged phase-in or implements the full tax cut in the first year. ...

Infrastructure and federal spending are also potential factors. On the former, the lags are often quite long ... On the latter, a boost to defense spending looks likely sometime between Q2 and Q4 2017, but this may be partly offset with cuts to non-defense spending in the same timeframe.

The effect of Obamacare “repeal and replace” is less clear, but seems likely to provide a modest net stimulus in the near term—potentially as soon as Q2 2017—as a result of the likely repeal of the taxes used to pay for some of the program. Other changes are likely but seem unlikely to be implemented until 2019.

Animal Spirits and Business Confidence

by Calculated Risk on 12/08/2016 01:05:00 PM

A few excerpts from two research reports this morning:

From Merrill Lynch: Animal spirits matter

Anecdotes and surveys suggest that business and consumer confidence has improved following the election. The gain in animal spirits could amplify the boost to the economy from fiscal stimulus, creating upside risk to our forecast. We will have to wait for the "hard data" from November and December to have clarity on the timing and magnitude.From Wells Fargo: Small Business Confidence Jumps Following the Presidential Election

emphasis added

Small business owners are feeling much more optimistic about the prospects for the economy and their business in the coming year. The latest Wells Fargo/Gallup Small Business Index, which was conducted from Nov. 11 to Nov. 17, jumped 12 points to 80 from the previous quarter and is up 26 points over the past year. Small business optimism is now at its highest level since January 2008, when the index was coming down as the economy slid into recession. The latest reading marks the largest quarterly increase in a little over a year and is one of the largest quarterly gains in the series’ history.

...

While political factors likely influenced the magnitude of the improvement in small business confidence, business owners’ attitudes about the economy and their business have been gradually improving for the past few years. All of the improvement in the most recent quarter, however, came from the expectations series, which jumped 17 points in the fourth quarter. The present situation index fell 5 points, essentially reversing the prior quarter’s gain.

CoreLogic: 384,000 borrowers moved out of negative equity in Q3

by Calculated Risk on 12/08/2016 10:05:00 AM

From CoreLogic: CoreLogic Reports Home Equity Increased $726 billion in the Third Quarter Compared With a Year Ago

CoreLogic ... today released a new analysis showing that U.S. homeowners with mortgages (roughly 63 percent of all homeowners) saw their equity increase by a total of $227 billion in Q3 2016 compared with the previous quarter, an increase of 3.1 percent. Additionally, 384,000 borrowers moved out of negative equity, increasing the percentage of homes with positive equity to 93.7 percent of all mortgaged properties, or approximately 47.9 million homes. Year over year, home equity grew by $726 billion, representing an increase of 10.8 percent in Q3 2016 compared with Q3 2015.On states:

In Q3 2016, the total number of mortgaged residential properties with negative equity stood at 3.2 million, or 6.3 percent of all homes with a mortgage. This is a decrease of 10.7 percent quarter over quarter from 3.6 million homes, or 7.1 percent of mortgaged properties, in Q2 2016 and a decrease of 24.1 percent year over year from 4.2 million homes, or 8.4 percent of mortgaged properties, in Q3 2015. ...

...

Negative equity peaked at 26 percent of mortgaged residential properties in Q4 2009, based on CoreLogic negative equity data, which goes back to Q3 2009.

...

“Home equity rose by $12,500 for the average homeowner over the last four quarters,” said Dr. Frank Nothaft, chief economist for CoreLogic. “There was wide geographic variation with homeowners in California, Oregon and Washington gaining an average of at least $25,000 in home equity wealth, while owners in Alaska, North Dakota and Connecticut had small declines, on average.”

“Price appreciation is the main ingredient for home equity wealth creation, and home prices rose 5.8 percent in the year ending September 2016 according to the CoreLogic Home Price Index,” said Anand Nallathambi, president and CEO of CoreLogic. “Paydown of principal is the second key component of equity building. Many homeowners have refinanced into shorter-term loans, such as a 15-year loan, and by doing so, they have significantly fewer mortgage payments and are able to build equity wealth faster.”

emphasis added

"Nevada had the highest percentage of mortgaged properties in negative equity at 14.2 percent, followed by Florida (12.5 percent), Illinois (10.6 percent), Arizona (10.6 percent) and Rhode Island (10 percent). These top five states combined accounted for 30.6 percent of negative equity mortgages in the U.S., but only 16.3 percent of outstanding mortgages."Note: The share of negative equity is still high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q3 2016 compared to Q2 2016.

Just over 2% of properties have 25% or more negative equity. For reference, about four years ago, in Q3 2012, 9.6% of residential properties had 25% or more negative equity.

A year ago, in Q3 2015, there were 4.2 million properties with negative equity - now there are 3.2 million. A significant change.

Weekly Initial Unemployment Claims decrease to 258,000

by Calculated Risk on 12/08/2016 08:33:00 AM

The DOL reported:

In the week ending December 3, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 10,000 from the previous week's unrevised level of 268,000. The 4-week moving average was 252,500, an increase of 1,000 from the previous week's unrevised average of 251,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 92 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 252,500.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, December 07, 2016

Thursday: Unemployment Claims

by Calculated Risk on 12/07/2016 09:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fall Ahead of European Central Bank Announcement

Mortgage rates moved moderately lower today, as financial markets positioned themselves for an important announcement from the European Central Bank (ECB) tomorrow regarding the possibility of tapering its asset purchases.Thursday:

...

4.125% remains the most prevalent conventional 30yr fixed rate on top tier scenarios with 4.25% not too far behind. 4.0% is a distant third. Today's rates are most similar to those seen on December 2nd. Things could change in a big way depending on what the ECB says tomorrow, for better or worse.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 268 thousand the previous week.

• At 10:00 AM, The Q3 Quarterly Services Report from the Census Bureau.