by Calculated Risk on 12/13/2016 10:53:00 AM

Tuesday, December 13, 2016

Mortgage Equity Withdrawal Positive in Q3

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2016, the Net Equity Extraction was a positive $39 billion, or a positive 1.1% of Disposable Personal Income (DPI) . This is only the second positive MEW since Q1 2008.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $86 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.2 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/13/2016 08:32:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Soars Post Election

The full November index, calculated as it is every month, improved 3.5 points to 98.4, which is just above the 42-year average and only the third time since 2007 that it has broken into above average territory.

Plans to hire jumped five points from the previous month. Expected higher sales rose from a net one percent in October to net 11 percent in November. But the blockbuster was expected better business conditions, which shot from a net -7 percent to 12.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.4 in November.

This is the highest level since 2014.

Monday, December 12, 2016

Duy: December FOMC Preview

by Calculated Risk on 12/12/2016 07:30:00 PM

A few excerpts from long post by Tim Duy at Fed Watch: December FOMC Preview

The Federal Reserve will nudge rates 25bp higher this week. This will not end the policy tension among FOMC members. How will that unfold in 2017? My expectation is that whereas 2016 began with excessively high expectations for rate hikes, 2017 will be the opposite. My tendency is think that the risks to the Fed’s median forecast of 50bp of rate hikes in 2017 are more weighted to the upside than the downside. Beware then of a more aggressive than expected Fed.Other FOMC previews from Goldman Sachs, Merrill Lynch, Nomura, and a review of projections.

...

Bottom Line: The Fed will hike rates this week; the unemployment drop will give added weight to case for a preemptive rate hike. They will play it close to the vest regarding future policy; although the stars are beginning to align for stronger growth next year, this represents more of a risk than a reality. Expect Federal Reserve Chair Yellen to emphasize that policy is data dependent.

The consensus is the Fed will hike rates this week. Currently expectations are the Fed will hike twice next year ...

Update: Prime Working-Age Population Growing Again, Near Previous Peak

by Calculated Risk on 12/12/2016 01:39:00 PM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of November 2016, there are still fewer people in the 25 to 54 age group than in 2007.

However the prime working age (25 to 54) will probably hit a new peak in December!

An update: in 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through November 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

Note: If we expand the prime working age to 25 to 64, the story is a little different. The 55 to 64 age group is still expanding, but that will change in a few years - and that will slow growth in the 25 to 64 total age group.

Demographics are now improving in the U.S., and this is a reason for optimism.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 12/12/2016 11:55:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2016 are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 5% from a year ago, and CME futures are up about 30% year-over-year.

Hotels: Close to Record Year for Occupancy

by Calculated Risk on 12/12/2016 08:47:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 3 December

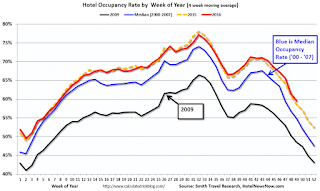

The U.S. hotel industry reported mostly negative results in the three key performance metrics during the week of 27 November through 3 December 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy fell 1.5% to 56.0%. Average daily rate (ADR) increased 0.5% to US$117.31. Revenue per available room (RevPAR) declined 1.0% to US$65.65.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate. With a solid finish over the next few weeks, 2016 could be the best year on record.

Year-to-date, the three best years are:

1) 2015: 66.85% average occupancy.

2) 2016: 66.84% average.

3) 2000: 66.1% average.

For hotels, the Fall business travel season is over and the occupancy rate will decline into the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, December 11, 2016

Sunday Night Futures: Oil Prices up Sharply

by Calculated Risk on 12/11/2016 07:58:00 PM

From Bloomberg: Oil Surges as Saudis Eye Deeper Cuts While Non-OPEC Joins Deal

Oil jumped to the highest since July 2015 after Saudi Arabia signaled it’s ready to cut output more than earlier agreed while non-OPEC countries including Russia pledged to pump less next year, strengthening the coordinated commitment by the world’s largest producers to tighten supply.Weekend:

Futures rose as much as 5.8 percent in New York and 6.6 percent in London.

• Schedule for Week of Dec 11, 2016

Monday:

• No economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 6, and DOW futures are up 75 (fair value).

Oil prices were up over the last week with WTI futures at $53.73 per barrel and Brent at $56.59 per barrel. A year ago, WTI was at $36, and Brent was at $37 - so oil prices are up about 50% year-over-year!

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon - a year ago prices were at $2.01 per gallon - so gasoline prices are up about 20 cents per gallon year-over-year.

Review of FOMC Projections

by Calculated Risk on 12/11/2016 08:11:00 AM

The consensus is that the Fed will raise the Fed Funds Rate 25 bps following the FOMC meeting this coming week.

Since the rate hike is expected (and assuming it happens), the focus this month will be on hints about the next move from the wording of the statement, the projections, and Fed Chair Janet Yellen's press conference. My guess is, as far as the impact of fiscal stimulus, the Fed will wait and see what the actual proposals will be.

Here are the September FOMC projections. Since the release of those projections, Q3 GDP was reported at a 3.2% annual rate.

Currently GDP is tracking around 2.6% annualized in Q4. That would put real GDP up 2.0% in Q4 2016 over Q4 2015. 2016 GDP will probably be revised up slightly, but it will be interesting to see if projections for 2017 and 2018 are revised up due to possible fiscal stimulus.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | 2019 |

| Sept 2016 | 1.7 to 1.9 | 1.9 to 2.2 | 1.9 to 2.2 | 1.7 to 2.0 |

| Jun 2016 | 1.9 to 2.0 | 1.9 to 2.2 | 1.8 to 2.1 | n.a. |

The unemployment rate was at 4.6% in November and 4.9% in October, so the unemployment rate projection for Q4 2016 will probably be revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | 2019 |

| Sept 2016 | 4.7 to 4.9 | 4.5 to 4.7 | 4.4 to 4.7 | 4.4 to 4.8 |

| Jun 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.4 to 4.8 | n.a. |

As of October, PCE inflation was up 1.4% from October 2015. With oil prices up year-over-year, PCE inflation has been moving up. It appears inflation will be revised up for 2016, but the key will be if inflation is revised up for 2017 and 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Sept 2016 | 1.2 to 1.4 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

| Jun 2016 | 1.3 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | n.a. |

PCE core inflation was up 1.7% in October year-over-year. This is still in the September projection range, and will probably only be changed slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Sept 2016 | 1.6 to 1.8 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

| Jun 2016 | 1.6 to 1.8 | 1.7 to 2.0 | 1.9 to 2.0 | n.a. |

In general, it appears GDP and inflation will be revised up slightly, and the unemployment rate revised lower. If this continues, look for the Fed to raise rates again in the first half of 2017.

Saturday, December 10, 2016

Schedule for Week of Dec 11, 2016

by Calculated Risk on 12/10/2016 08:09:00 AM

The key economic reports this week are October Retail Sales, Housing Starts, and the Consumer Price Index (CPI).

For manufacturing, October industrial production, and the November New York, and Philly Fed manufacturing surveys, will be released this week.

The FOMC meets on Tuesday and Wednesday, and the FOMC is expected to raise rates at this meeting.

No economic releases are scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for November will be released. The consensus is for 0.4% increase in retail sales in November.

8:30 AM ET: Retail sales for November will be released. The consensus is for 0.4% increase in retail sales in November.This graph shows retail sales since 1992 through October 2016.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0..2% increase in prices, and a 0.2% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.0%.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for no change in inventories.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 258 thousand the previous week.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 3.0, up from 1.5.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 10.0, up from 7.6.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 63, unchanged from 63 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. Total housing starts increased to 1.323 million (SAAR) in October. Single family starts increased to 869 thousand SAAR in October.

The consensus is for 1.230 million, down from the October rate.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2016

Friday, December 09, 2016

Merrill: FOMC Preview

by Calculated Risk on 12/09/2016 08:59:00 PM

A few excerpts from another FOMC preview, this once from Merrill Lynch:

It is the day we have all been waiting for – the FOMC is very likely to hike 25bp to a range of 50 – 75bp at the December 14th meeting. This is the second hike in the cycle, following the move last December. Since the rate hike is considered a foregone conclusion and is unlikely to move the markets, the focus will be on the statement, SEP (specifically the dots) and the press conference. While we are expecting the decision to be unanimous, it is possible that there is a dovish dissent with Fed Governor Brainard as the most likely candidate.

...

Medium-term forecasts: We think the median unemployment forecast will fall to 4.7% from 4.8% given the recent drop in the unemployment rate. We also expect GDP growth to be revised higher this year to either 1.9% or 2.0% on the back of stronger 2H GDP tracking. Looking ahead to the next three years, we think the risk is for upward revisions to inflation.

Long-term forecasts: We do not expect a change to long-term growth or unemployment rate. The median expectation for long-run GDP growth fell to 1.8% from 2.0% in the September SEP and we do not think conditions have changed since then to warrant a revision. While fiscal policy could alter trend growth, Fed officials do not yet have details.