by Calculated Risk on 12/04/2016 12:40:00 PM

Sunday, December 04, 2016

Poor Gretchen on Fannie and Freddie

My former co-blogger Tanta wrote several posts pointing out questionable reporting in articles by "poor Gretchen" Morgenson of the NY Times. Tanta would have a field day with GM's article today: Trump Treasury May Mean Independence for Fannie and Freddie

With an apology to Tanta (who knew far more about the mortgage market than I ever will, and was a far better writer than me), here are a few comments on the article today.

Gretchen starts by quoting Steven Mnuchin, the nominee to run the Treasury Department for the next administration:

“We got to get Fannie and Freddie out of government ownership,” he told Fox Business. “It makes no sense that these are owned by the government and have been controlled by the government for as long as they have.”We got to get Steve in an English class, but lets focus on the substance.

Mr. Mnuchin is right.

Is Mnuchin right? "It makes no sense that these are owned by the government" is a declarative statement without any backing. Perhaps Gretchen and Steve could study a little history. Fannie Mae was started in 1938 as a government agency to provide liquidity in the mortgage market. Over time Fannie was changed into a public-private organization, and finally into a private, for-profit, corporation with an implied government backing.

This privatization has been described as "privatizing profits, and socializing losses". If something made no sense, it was a structure that gave the profits to private investors, with the risks borne by the taxpayers. It should be obvious to all that the original privatization was a mistake.

Instead of putting Fannie and Freddie into bankruptcy during the crisis - and wiping out the shareholders while putting a stranglehold on the housing market at exactly the wrong time - the government put Fannie and Freddie into conservatorship. This kept the housing market on life support. The taxpayers took all of the risk, and therefore the taxpayers deserve all of the profits. That should be the end of that story.

Note: For the funny naming history of Fannie and Freddie, see Tanta's: On Maes and Macs

Back to Gretchen:

So what might happen now? In his comments, Mr. Mnuchin nodded to a crucial issue regarding Fannie and Freddie: safety and soundness. “We’ll make sure that when they’re restructured, they’re absolutely safe and they don’t get taken over again,” he said, “But we got to get them out of government control.”Out of "government control"? Does me mean no government backing if they collapse again? Then what entity would provide liquidity during the next crunch? Or is Steve suggesting going back to privatizing profits (enriching the investors), and socializing the risks (all of of us taxpayers)?

What makes sense is for most of the mortgage market - most of the time - to be in the private sector, and for the government to provide liquidity during a credit crunch. We need government organizations operating all the time (hopefully as a small portion of the overall market), so that they can ramp up quickly during a crunch. But that doesn't appear to be what Steve is considering.

Saturday, December 03, 2016

Schedule for Week of Dec 4, 2016

by Calculated Risk on 12/03/2016 08:11:00 AM

This will be a light week for economic data.

The key reports are the ISM non-manufacturing index, Job Openings, and the October trade deficit.

The Q3 Quarterly Services and the Fed's Q3 Flow of Funds reports will be released this week.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for index to increase to 55.5 from 54.8 in October.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $42.0 billion in October from $36.4 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 2.7% increase in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 5.486 million from 5.453 million in August.

The number of job openings (yellow) were up 2% year-over-year, and Quits were up 12% year-over-year.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $19.0 billion increase in credit.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 268 thousand the previous week.

10:00 AM: The Q3 Quarterly Services Report from the Census Bureau.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 94.1, up from 93.8 in November.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% decrease in inventories.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, December 02, 2016

Brad Hunter: The 2017 Housing Market Forecast

by Calculated Risk on 12/02/2016 06:46:00 PM

From Brad Hunter (formerly of MetroStudy) at HomeAdvisor: The 2017 Housing Market Forecast

The 2017 housing outlook is one of diverging trends. HomeAdvisor’s forecast calls for single-family housing to rise at a rate similar to the 2016 rate, but for multifamily construction (apartments and condos) to fall, as the recent apartment boom finally winds down. The single-family home increase is because of job growth and rising household formations, while the multifamily story has more to do with cyclicality. Single-family starts rising 12.2% in 2017, to just shy of 900,000, while multifamily construction falls by 10.7% to 343,000.CR Note: Hunter describes three scenarios for 2017: Base case, Overshoot and Slow Climb. I also think the multifamily has peaked.

I'll be posting several 2017 forecasts on Monday.

Zillow Forecast: Expect Case-Shiller Index to "continue to accelerate" in October

by Calculated Risk on 12/02/2016 03:55:00 PM

The Case-Shiller house price indexes for September were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: October Case-Shiller Forecast: Continuing to put the Recession in the Rearview

According to Zillow’s October Case-Shiller forecast, annual growth in the national index is expected to continue to accelerate, along with upticks in monthly growth in both smaller 10-city and 20-city indices. Sustained growth in the national index will continue to put pre-recession housing peaks in the rearview mirror, as September marked the first month in which national home prices exceeded those set prior to the recession.The year-over-year change for the 10-city and 20-city indexes will probably be about the same or slightly lower in the October report as in the September report. The change for the National index will probably be slightly higher.

The September Case-Shiller national index is expected to grow 5.7 percent year-over-year and 0.8 percent month-to-month (seasonally adjusted), even with the pace of monthly growth and up from 5.5 percent annual growth pace set in September. We expect the 10-city index to grow 4.2 percent year-over-year and 0.4 percent (SA) from September. The 20-City Index is expected to grow 5 percent between October 2015 and October 2016, and rise 0.5 percent (SA) from Septmber.

Zillow’s October Case-Shiller forecast is shown in the table below. These forecasts are based on today’s September Case-Shiller data release and the October 2016 Zillow Home Value Index. The October S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, December 27.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 12/02/2016 01:00:00 PM

By request, here is another update of an earlier post through the November 2016 employment report including all revisions. And, yes, I will post these graphs during the next Presidential term.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton.

The third best growth for the private sector is Obama's 2nd term.

Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,082 |

| GW Bush 1 | -811 |

| GW Bush 2 | 415 |

| Obama 1 | 1,921 |

| Obama 2 | 9,4881 |

| 146 months into 2nd term: 9,901 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Forty six months into Mr. Obama's second term, there are now 11,409,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 334,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -708 |

| Obama 2 | 3741 |

| 146 months into 2nd term, 390 pace | |

Looking forward, I expect the economy to continue to expand through the two months of Mr. Obama's presidency, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are over. Right now I'm expecting some further increase in public employment during the last months of Obama's 2nd term, but obviously nothing like what happened during Reagan's second term.

Below is a table of the top four presidential terms for total non-farm job creation.

Currently Obama's 2nd term is on pace to be the 3rd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fifth best for total job creation.

Note: Only 374 thousand public sector jobs have been added during the forty six months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 25% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,082 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| 4 | Carter | 9,041 | 1,304 | 10,345 |

| 5 | Obama 21 | 9,488 | 374 | 9,862 |

| Pace2 | 9,901 | 390 | 10,291 | |

| 146 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top four presidential terms. Right now it looks like Obama's 2nd term will be the 3rd best for private employment (behind Clinton's two terms, and ahead of Reagan) and probably 5th for total employment.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 698 | 857 | ||

| #2 | 297 | 731 | ||

| #3 | -66 | 467 | ||

| #4 | -224 | 242 | ||

Comments: Solid November Employment Report, Sharp Drop in Unemployment Rate

by Calculated Risk on 12/02/2016 10:01:00 AM

The headline jobs number was solid. Job growth was somewhat above the consensus forecast (178,000 vs forecast of 170,000), amd the unemployment rate declined sharply to 4.6%.

Earlier: November Employment Report: 178,000 Jobs, 4.6% Unemployment Rate

Job growth has averaged 180,000 per month this year.

In November, the year-over-year change was 2.25 million jobs.

A negative was the decline in hourly earnings, but this was probably just seasonal noise - and payback for the strong gain in October. This is a noisy series, and the trend is clearly up.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in November.

Note: CPI has been running around 2%, so there has been real wage growth.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October and November at a lower pace than the last few years.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 522 thousand workers (NSA) net in October and November, this is down from just over 600 thousand for the same period over the last several years. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are a little cautious about the holiday season. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales. Maybe retailers are having trouble finding seasonal hires.

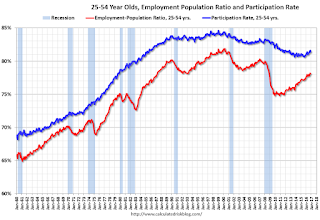

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in October to 81.4%, and the 25 to 54 employment population ratio decreased to 78.1%.

The participation rate has been trending down for this group since the late '90s, however, with more younger workers (and fewer older workers), the participation rate might move up some more.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 5.7 million, changed little in November but was down by 416,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons declined in November, and this is the lowest level since June 2008. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 9.3% in November. This is the lowest level for U-6 since April 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.856 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.979 million in October.

This is trending down, and is at the lowest level since July 2008.

Overall this was another solid report.

November Employment Report: 178,000 Jobs, 4.6% Unemployment Rate

by Calculated Risk on 12/02/2016 08:40:00 AM

From the BLS:

The unemployment rate declined to 4.6 percent in November, and total nonfarm payroll employment increased by 178,000, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in professional and business services and in health care.

...

The change in total nonfarm payroll employment for September was revised up from +191,000 to +208,000, and the change for October was revised down from +161,000 to +142,000. With these revisions, employment gains in September and October combined were 2,000 less than previously reported. Over the past 3 months, job gains have averaged 176,000 per month.

...

In November, average hourly earnings for all employees on private nonfarm payrolls declined by 3 cents to $25.89, following an 11-cent increase in October. Over the year, average hourly earnings have risen by 2.5 percent. Average hourly earnings of private- sector production and nonsupervisory employees edged up by 2 cents to $21.73 in November.

emphasis added

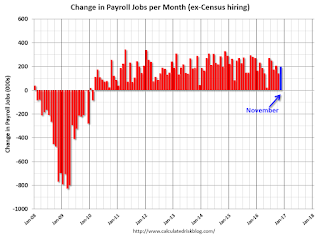

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 178 thousand in November (private payrolls increased 156 thousand).

Payrolls for September and October were revised down by a combined 2 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.25 million jobs. This has been moving down, but still a solid gain.

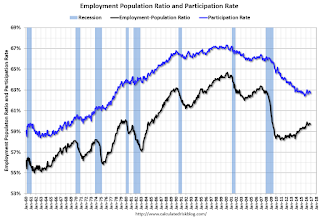

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased in November to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate decreased in November to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was unchanged at 59.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in November to 4.6%.

This was slightly above expectations of 170,000 jobs, and the unemployment rate dropped sharply. Another solid report.

I'll have much more later ...

Thursday, December 01, 2016

November Employment Preview

by Calculated Risk on 12/01/2016 07:05:00 PM

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for an increase of 170,000 non-farm payroll jobs added in November, up from the 161,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to be unchanged at 4.9%.

Earlier I posted an employment preview from Goldman Sachs.

Here is a summary of recent data:

• The ADP employment report showed an increase of 216,000 private sector payroll jobs in November. This was well above expectations of 160,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in November to 52.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased about 7,000 in November. The ADP report indicated 10,000 manufacturing jobs lost in November.

The ISM non-manufacturing employment index will not be released until next week.

• Initial weekly unemployment claims averaged 251,000 in November, down from 258,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 233,000, down from 252,000 during the reference week in October.

The decrease during the reference suggests less labor stress in November than in October. This is positive for the employment report.

• The final November University of Michigan consumer sentiment index increased to 93.8 from the October reading of 87.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and weekly claims suggest stronger job growth. There also might be a little bounce back from Hurricane related weakness in October.

My guess is the November report will be above the consensus forecast.

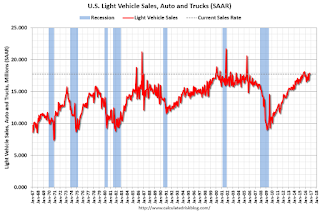

U.S. Light Vehicle Sales decrease to 17.75 million annual rate in November

by Calculated Risk on 12/01/2016 03:58:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.75 million SAAR in November.

That is down about 2% from November 2015, and down 0.9% from the 17.91 million annual sales rate last month.

From John Sousanis at WardsAuto November 2016 U.S. LV Sales Thread: Light Trucks, Extra Days Boost November Volumes

With two extra selling days in November, U.S. automakers outpaced same-month year-ago sales on a volume basis, despite a 4.6% decline in the daily sales rate (DSR).

Strong light-truck sales were a key factor in November sales, as the industry delivered 1,372,402 LVs - 48,904 more than it did a year-ago, over the course of 25 selling days (vs. 23 last year).

...

Year-to-date sales for the industry reached 15.783 million units, giving the first 11 months of 2016 a lead of just 17,542 units over like-2015 heading into December - and keeping alive the prospect that 2016 will break the single-year sales record set last year.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 17.75 million SAAR from WardsAuto).

This was at the consensus forecast.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Sales for 2016 - through the first eleven months - are close to unchanged from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now moving mostly sideways ...

Goldman's November NFP Preview

by Calculated Risk on 12/01/2016 02:46:00 PM

A few excerpts from Goldman Sachs' November Payroll Preview by economists Avisha Thakkar and Daan Struyven:

We forecast that nonfarm payroll growth increased to 200k in November, after an increase of 161k in October. We have revised up our forecast from 180k previously reflecting stronger data this week, in particular the ADP report. Our above-consensus forecast reflects an improvement in most labor market indicators last month, positive weather effects and possible residual seasonality.The November employment report will be released tomorrow, and the consensus is for an increase of 170,000 non-farm payroll jobs in November, and for the unemployment rate to be unchanged at 4.9%.

We expect a one-tenth decline in the U3 unemployment rate to 4.8%. Average hourly earnings likely rose at a softer 0.1% last month, primarily due to negative calendar effects, below the strong gain of 0.4% in October. The year-over-year rate is likely to edge down to 2.7%.

emphasis added