by Calculated Risk on 12/01/2016 12:19:00 PM

Thursday, December 01, 2016

Construction Spending increased in October

Earlier today, the Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2016 was estimated at a seasonally adjusted annual rate of $1,172.6 billion, 0.5 percent above the revised September estimate of $1,166.5 billion. The October figure is 3.4 percent above the October 2015 estimate of $1,134.4 billion.Private spending decreased and public spending increased in October:

During the first 10 months of this year, construction spending amounted to $972.2 billion, 4.5 percent above the $930.7 billion for the same period in 2015.

Spending on private construction was at a seasonally adjusted annual rate of $885.9 billion, 0.2 percent below the revised September estimate of $887.4 billion ...September was revised up to no change from a 0.5% decrease, and August revised up sharply to a 0.5% increase from -0.5%.

In October, the estimated seasonally adjusted annual rate of public construction spending was $286.8 billion, 2.8 percent above the revised September estimate of $279.1 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, but is 31% below the bubble peak.

Non-residential spending is now 1% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 12% below the peak in March 2009, and 9% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5%. Non-residential spending is up 5% year-over-year. Public spending is down 1% year-over-year.

Looking forward, all categories of construction spending should increase in the coming year. Residential spending is still fairly low, non-residential is increasing - although there has been a recent decline in public spending.

This was slightly below the consensus forecast of a 0.6% increase for October, however spending for August and September were revised up. A solid report.

ISM Manufacturing index increased to 53.2 in November

by Calculated Risk on 12/01/2016 10:07:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 53.2% in November, up from 51.9% in October. The employment index was at 52.3%, down from 52.9% last month, and the new orders index was at 53.0%, up from 52.1%.

From the Institute for Supply Management: November 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 90th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The November PMI® registered 53.2 percent, an increase of 1.3 percentage points from the October reading of 51.9 percent. The New Orders Index registered 53 percent, an increase of 0.9 percentage point from the October reading of 52.1 percent. The Production Index registered 56 percent, 1.4 percentage points higher than the October reading of 54.6 percent. The Employment Index registered 52.3 percent, a decrease of 0.6 percentage point from the October reading of 52.9 percent. Inventories of raw materials registered 49 percent, an increase of 1.5 percentage points from the October reading of 47.5 percent. The Prices Index registered 54.5 percent in November, the same reading as in October, indicating higher raw materials prices for the ninth consecutive month. Comments from the panel cite increasing demand, some tightness in the labor market and plans to reduce inventory by the end of the year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 52.3%, and suggests manufacturing expanded at as faster pace in November than in October.

Another solid economic report.

Weekly Initial Unemployment Claims increase to 268,000

by Calculated Risk on 12/01/2016 08:50:00 AM

The DOL reported:

In the week ending November 26, the advance figure for seasonally adjusted initial claims was 268,000, an increase of 17,000 from the previous week's unrevised level of 251,000. The 4-week moving average was 251,500, an increase of 500 from the previous week's unrevised average of 251,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 91 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 251,500.

This was above the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, November 30, 2016

Thursday: ISM Mfg, Auto sales, Unemployment claims, Construction Spending

by Calculated Risk on 11/30/2016 07:20:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC:

"OPEC today struck what increasingly appears to be a historic deal, with both cuts and participation well in excess of earlier expectations. Total OPEC cuts, compared to OPEC production as recorded by secondary sources for October 2016, are forecast at 1.2 mbpd. To this is added 0.3 mbpd from Russia, and another, yet-to-be-confirmed 275 kpbd from Mexico, Oman and Kazakhstan.Thursday:

In total, this would represent a cut of over 1.7 mbpd. Compliance should be expected at 70% based on historical precedent, representing an effective cut of 1.2 mbpd compared to October 2016 levels. This is a big deal, and may be enough to balance markets (which some think are already drawing in any event). With these cuts, global excess crude and product inventories should be run off as soon as the end of Q2 2017, and not later than Q4 2017.

This implies that a robust recovery for the global oil sector is in store, with a strong H2 2017 in the outing."

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, up from 251 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October. The ISM manufacturing index indicated expansion at 51.9% in October. The employment index was at 52.9%, and the new orders index was at 52.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in October

by Calculated Risk on 11/30/2016 04:21:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined to 1.21% in October, down from 1.24% in September. The serious delinquency rate is down from 1.58% in October 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.37 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 7 more months.

Note: Freddie Mac reported yesterday.

Fed's Beige Book: Modest to moderate expansion, Tightening labor market

by Calculated Risk on 11/30/2016 02:33:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Cleveland based on information collected on or before November 18, 2016."

Reports from the twelve Federal Reserve Districts indicate that the economy continued to expand across most regions from early October through mid-November. Activity in the Boston, Minneapolis, and San Francisco Districts grew at a moderate pace, while Atlanta, Chicago, St. Louis, and Dallas cited modest growth. Philadelphia, Cleveland, and Kansas City cited a slight pace of growth. Richmond characterized economic activity as mixed, and New York said activity has remained flat since the last report. Outlooks were mainly positive, with six Districts expecting moderate growth.And on real estate:

...

A tightening in labor market conditions was reported by seven Districts, with modest employment growth on balance. Districts noted slight upward pressure on overall prices..

emphasis added

Residential real estate activity improved across Districts. Reports about existing- and new-home sales were mixed, but most Districts noted a slight to modest increase during the period. Residential construction was up in the Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, and Dallas Districts. Home prices grew in many Districts, including Boston, Philadelphia, Cleveland, Atlanta, St. Louis, Kansas City, and San Francisco. Philadelphia reported that the strength of the single-family market is in high-end housing. In contrast, Kansas City reported that sales of low- and medium-priced homes continued to outpace sales of higher-priced homes. Dallas reported that the sales of lower-priced homes remained solid. Home inventories were generally reported to be low or declining and restraining sales growth. Boston, Philadelphia, Cleveland, Richmond, and Minneapolis reported low or decreasing inventories. Reports on inventory levels varied in Atlanta, while inventories held steady in Kansas City.Real estate is decent.

Commercial construction activity moved higher in the New York, Cleveland, Richmond, Atlanta, St. Louis, Kansas City, and San Francisco Districts. In contrast, Minneapolis noted a slowing in commercial construction. The Boston, Richmond, Minneapolis, and San Francisco Districts reported increases in leasing activity, while Philadelphia noted a lull in nonresidential leasing growth compared with the prior period. Dallas reported leasing activity as mostly unchanged. Commercial sales activity continued to be robust in Minneapolis and grew modestly in Kansas City. Ongoing multifamily construction has been steady at a fairly high level in New York. Multifamily construction varied in the Atlanta District and slowed somewhat in Richmond, Minneapolis, and San Francisco.

NY Fed: Household Debt Increased Slightly in Q3 2016, Mortgage Delinquency Rates Declined

by Calculated Risk on 11/30/2016 11:16:00 AM

The Q3 report was released today: Household Debt and Credit Report.

From the NY Fed: Total Household Debt Remains Sluggish Yet Non-Housing Debt Continues Expanding

The Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased modestly by $63 billion (a 0.5% increase) to $12.35 trillion during the third quarter of 2016. There were increases across every type of non-housing debt, with a 2.9% increase in auto loan balances, a 2.5% increase in credit card balances, and a 1.6% percent increase in student loan balances this quarter. This report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

...

Mortgage delinquencies continued to decline as seen since the financial crisis, while new foreclosure notations reached another new low for the 18-year history of this series.

...

Overall delinquency rates worsened slightly this quarter, while the rate of bankruptcy notations continued its overall trend of improving since the financial crisis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q3, from the NY Fed:

Mortgage balances, the largest component of household debt saw a 0.1% decline during the quarter. Mortgage balances shown on consumer credit reports on September 30 stood at $8.35 trillion, a $12 billion drop from the second quarter of 2016. Balances on home equity lines of credit (HELOC) declined by $6 billion, to $472 billion. By contrast, balances on every type of non-housing debt grew in the second quarter, boosting up the total.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate increased slightly in Q3 to 4.9%. From the NY Fed:

Overall delinquency rates worsened slightly in 2016Q3, reflecting an uptick in early delinquencies. As of September 30, 4.9% of outstanding debt was in some stage of delinquency. Of the $609 billion of debt that is delinquent, $400 billion is seriously delinquent (at least 90 days late or “severely derogatory”).

NAR: Pending Home Sales Index increased 0.1% in October, up 1.8% year-over-year

by Calculated Risk on 11/30/2016 10:02:00 AM

From the NAR: Pending Home Sales Crawl Forward in October

Pending home sales were mostly unchanged in October, but did squeak out a meager gain for the second consecutive month, according to the National Association of Realtors®.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched up 0.1 percent to 110.0 in October from a slight downward revision of 109.9 in September. With last month's small increase, the index is now 1.8 percent higher than last October (108.1).

...

The PHSI in the Northeast nudged forward 0.4 percent to 96.9 in October, and is now 3.9 percent above a year ago. In the Midwest the index rose 1.6 percent to 106.3 in October, and is now 1.2 percent higher than October 2015.

Pending home sales in the South declined 1.3 percent to an index of 120.1 in October but are still 0.8 percent higher than last October. The index in the West climbed 0.7 percent in October to 108.3, and is now 2.5 percent above a year ago.

emphasis added

Personal Income increased 0.6% in October, Spending increased 0.3%

by Calculated Risk on 11/30/2016 08:37:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $98.6 billion (0.6 percent) in October according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $38.1 billion (0.3 percent).The October PCE price index increased 1.4 percent year-over-year (compared to 1.2 percent YoY in September) and the October PCE price index, excluding food and energy, increased 1.7 percent year-over-year (same as in September).

...

Real PCE increased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

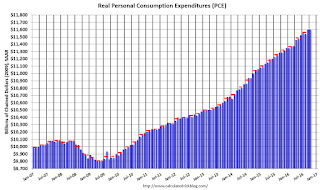

The following graph shows real Personal Consumption Expenditures (PCE) through October 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above consensus, and the increase in PCE was at consensus expectations.

A solid increase in personal income.

ADP: Private Employment increased 216,000 in November

by Calculated Risk on 11/30/2016 08:19:00 AM

Private sector employment increased by 216,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well abvoe the consensus forecast for 160,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses hired aggressively in November and there is little evidence that the uncertainty surrounding the presidential election dampened hiring. In addition, because of the tightening labor market, retailers may be accelerating seasonal hiring to secure an adequate workforce to meet holiday demand, although total expected seasonal hiring may be no higher than last year’s.”

The BLS report for November will be released Friday, and the consensus is for 170,000 non-farm payroll jobs added in November.