by Calculated Risk on 8/05/2016 10:01:00 AM

Friday, August 05, 2016

Employment Comments: Another Strong Report

The headline jobs number was strong, and there were upward revisions to job growth for prior months. Both the participation rate and employment-population ratio ticked up, and wages increased.

A few negatives were U-6 increased slightly, and the number of both long term unemployed and part time workers increased slightly. But overall this was a strong report.

Earlier: July Employment Report: 255,000 Jobs, 4.9% Unemployment Rate

In July, the year-over-year change was 2.45 million jobs.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.6% YoY in July. This series is noisy, however overall wage growth is trending up.

Note: CPI has been running around 2%, so there has been real wage growth.

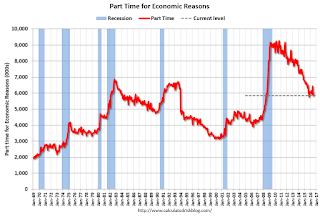

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 5.9 million in July. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased slightly in July. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 9.7% in July.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.020 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 1.979 million in June.

This is generally trending down, but is still high.

There are still signs of slack (as example, elevated level of part time workers for economic reasons and U-6), but there also signs the labor market is tightening.

Overall this was a strong report. Job growth averaged 274,000 over the last two months, and 186,000 per month this year.

July Employment Report: 255,000 Jobs, 4.9% Unemployment Rate

by Calculated Risk on 8/05/2016 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 255,000 in July, and the unemployment rate was unchanged at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, and financial activities. Employment in mining continued to trend down.

...

The change in total nonfarm payroll employment for May was revised from +11,000 to +24,000, and the change for June was revised from +287,000 to +292,000. With these revisions, employment gains in May and June combined were 18,000 more than previously reported.

...

In July, average hourly earnings for all employees on private nonfarm payrolls increased by 8 cents to $25.69. Over the year, average hourly earnings have risen by 2.6 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 255 thousand in July (private payrolls increased 217 thousand).

Payrolls for May and June were revised up by a combined 18 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 2.45 million jobs. A solid gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in July to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in July to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio increased to 59.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in July at 4.9%.

This was way above expectations of 185,000 jobs. Another strong report.

I'll have much more later ...

Thursday, August 04, 2016

Friday: Jobs and Wages

by Calculated Risk on 8/04/2016 06:30:00 PM

Earlier: Goldman's July NFP Preview (190,000 jobs, 4.9% unemployment rate, and 2.6% YoY wages).

Preview of July Employment Report

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for an increase of 185,000 non-farm payroll jobs added in July, down from the 287,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to decrease to 4.8%.

• Also at 8:30 AM, Trade Balance report for June from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.1 billion in May.

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $15.5 billion increase in credit.

NAHB: Builder Confidence "Remains in Positive Territory" for 55+ Housing Market in Q2

by Calculated Risk on 8/04/2016 03:25:00 PM

This is a quarterly index that was released yesterday by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: Second Quarter Results Show 55+ Housing Market Remains in Positive Territory

Builder confidence in the single-family 55+ housing market remains in positive territory in the second quarter with a reading of 57, up one point from the previous quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) released today. This is the ninth consecutive quarter with a reading above 50.

“Builders and developers for the 55+ housing sector continue to report steady demand,” said Jim Chapman, chairman of NAHB's 55+ Housing Industry Council and president of Jim Chapman Homes LLC in Atlanta. “However, there are many places around the country facing labor and lot shortages, which are hindering production.”

...

“Much like the overall housing market, this quarter’s 55+ HMI results show that this segment continues its gradual, steady recovery,” said NAHB Chief Economist Robert Dietz. “A solid labor market, combined with historically low mortgage rates, are enabling 55+ consumers to be able to sell their homes at a favorable price and buy or rent a home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q2 2016. Any reading above 50 indicates that more builders view conditions as good than as poor. The index increased to 57 in Q2 up from 56 in Q1.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that has moved into the 55 to 70 age group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable right now for the 55+ market.

Fannie and Freddie: REO inventory declined in Q2, Down 33% Year-over-year

by Calculated Risk on 8/04/2016 12:57:00 PM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 13,284 at the end of Q2 2106 compared to 19,484 at the end of Q2 2015.

For Freddie, this is down 82% from the 74,897 peak number of REOs in Q3 2010. For Freddie, this is the lowest since 2007.

Fannie Mae reported the number of REO declined to 45,981 at the end of Q2 2016 compared to 68,717 at the end of Q2 2015.

For Fannie, this is down 72% from the 166,787 peak number of REOs in Q3 2010. For Fannie, this is the lowest since Q1 2008.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 for both Fannie and Freddie, and combined inventory is down 33% year-over-year.

Delinquencies are falling, but there are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is getting close to normal levels of REOs.

Goldman's July NFP Preview

by Calculated Risk on 8/04/2016 10:34:00 AM

A few excerpts from Goldman Sachs' July Payroll Preview by economist David Mericle:

We expect a 190k increase in nonfarm payroll employment in July, slightly above consensus expectations for a 180k gain. ...

The unemployment rate is likely to remain at 4.9%, though we see the risks as tilted to the downside. Average hourly earnings likely rose 0.3% in July and 2.6% over the past year.

...

Our wage tracker—which aggregates four measures of wage growth—has accelerated to 2.8% year-on-year in our preliminary Q2 estimate, a sign that diminishing slack is boosting wage growth.

Weekly Initial Unemployment Claims increased to 269,000

by Calculated Risk on 8/04/2016 08:33:00 AM

The DOL reported:

In the week ending July 30, the advance figure for seasonally adjusted initial claims was 269,000, an increase of 3,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 260,250, an increase of 3,750 from the previous week's unrevised average of 256,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 74 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 260,250.

This was above the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 03, 2016

Preview of July Employment Report

by Calculated Risk on 8/03/2016 06:35:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 185,000 non-farm payroll jobs in July (with a range of estimates between 150,000 to 215,000, and for the unemployment rate to decrease to 4.8%.

The BLS reported 287,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 179,000 private sector payroll jobs in July. This was above expectations of 165,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in June to 49.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 22,000 in July. The ADP report indicated 4,000 manufacturing jobs added in July.

The ISM non-manufacturing employment index decreased in July to 52.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 110,000 in June.

Combined, the ISM indexes suggests employment gains of about 88,000. This suggests employment growth well below expectations.

• Initial weekly unemployment claims averaged 256,000 in July, down from 267,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 252,000, down from 258,000 during the reference week in June.

The decrease during the reference suggests fewer layoffs in July as compared to June. This suggests a positive employment report.

• The final July University of Michigan consumer sentiment index decreased to 90.0 from the June reading of 93.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and unemployment claims suggest stronger job growth. The ISM reports suggests weaker job growth in July.

My guess is the July report will be close to the consensus forecast.

Off-Topic: Update on Litmus Test Moments

by Calculated Risk on 8/03/2016 03:53:00 PM

Back in May I outlined a few "litmus test" moments in life - moments that define us - and I concluded that we are seeing a political litmus test moment right now (see: Off-Topic: A Comment on Litmus Test Moments)

Since then Mr. Trump has made many more disqualifying statements (too numerous to list).

For example, I wrote that post before Mr. Trump criticized U.S. District Judge Gonzalo Curiel calling him a "Mexican" (although he is an American citizen born in Indiana), and suggesting Curiel was biased because Trump was going to build a wall between the U.S. and Mexico. Trump went on to repeat the same accusations several times, even as many Americans criticized his comments. As Rep Paul Ryan noted, claiming that a person's heritage makes them biased, is "the textbook definition of a racist comment."

I've spoken to several lawyers in San Diego, and Judge Curiel is considered one the best. He was first appointed as a Judge by Republican Governor Arnold Schwarzenegger who wrote after Trump's attack: "Judge Curiel is an American hero who stood up to the Mexican cartels. I was proud to appoint him when I was Gov."

Mr Trump never apologized or backed down.

And the most recent attack on the Khan family is even worse. The VFW statement says what all Americans feel:

Presidential candidate Donald J. Trump has a history of lashing out after being attacked, but to ridicule a Gold Star Mother is out-of-bounds, said the new national commander of the near 1.7 million-member Veterans of Foreign Wars of the United States and its Auxiliary.Once again Trump is unwilling to apologize.

“Election year or not, the VFW will not tolerate anyone berating a Gold Star family member for exercising his or her right of speech or expression,” said Brian Duffy, of Louisville, Ky., who was elected July 27 to lead the nation’s oldest and largest major war veterans organization.

“There are certain sacrosanct subjects that no amount of wordsmithing can repair once crossed,” he said. “Giving one’s life to nation is the greatest sacrifice, followed closely by all Gold Star families, who have a right to make their voices heard.”

My advice for politicians and American citizens who supported Trump: If you haven't abandoned Trump yet, do it now. If your family, friends and co-workers know you supported Trump - tell them you've had enough. They will respect you for changing your mind (if not now, in the near future). If you have a Trump sign in your yard, take it down. If you have a Trump bumper sticker on your car, take it off.

I'm voting for Hillary Clinton, but if you can't stomach voting for her - still vote! - but vote for a 3rd party candidate or write-in another candidate. If you can't stand Hillary (I think she will be fine), maybe you can console yourself that she won without 50% of the vote.

But it is important for our future that Trump loses and loses badly. This vote will be a message to the future that people like Trump are not acceptable. And I guarantee you that you will feel better about yourself in a few years when you can honestly say you didn't vote for Trump.

Q2 2016 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/03/2016 12:45:00 PM

The BEA has released the underlying details for the Q2 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 7.9% annual pace in Q1. However most of the decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $62.4 billion annual rate in Q1 to a $50.2 billion annual rate in Q2 - and is down from $106 billion in Q2 2015 (declined more than 50%).

Excluding petroleum, non-residential investment in structures increased at a 5.5% annual rate in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, and is up 22% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 19% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $242 billion (SAAR) (about 1.3% of GDP), and was down in Q2 compared to Q1, but is up 7.3% year-over-year.

Investment in home improvement was at a $220 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.1% of GDP), and is up 9.0% year-over-year.