by Calculated Risk on 7/26/2016 10:00:00 AM

Tuesday, July 26, 2016

New Home Sales increased to 592,000 Annual Rate in June, Highest since 2008

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised up by a total of 22 thousand (SAAR).

"Sales of new single-family houses in June 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised May rate of 572,000 and is 25.4 percent above the June 2015 estimate of 472,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in June to 4.9 months.

The months of supply decreased in June to 4.9 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 244,000. This represents a supply of 4.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

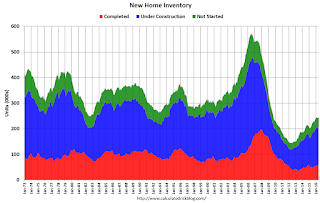

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2016 (red column), 54 thousand new homes were sold (NSA). Last year 44 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for May was 28 thousand in June 2010 and June 2011.

This was above expectations of 562,000 sales SAAR in June, and prior months were revised up. A solid report. I'll have more later today.

Case-Shiller: National House Price Index increased 5.0% year-over-year in May

by Calculated Risk on 7/26/2016 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Increases Ease in May According to the S&P Corelogic Case-Shiller Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in May, the same as the prior month. The 10-City Composite posted a 4.4% annual increase, down from 4.7% the previous month. The 20-City Composite reported a year-over-year gain of 5.2%, down from 5.4% in April.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.2% in May. The 10-City Composite recorded a 0.8% month-over-month increase, while the 20-City Composite posted a 0.9% increase in May. After seasonal adjustment, the National Index recorded a 0.2% month-over month increase, the 10-City Composite posted a 0.2% decrease, and the 20-City Composite reported a 0.1% month-over-month decrease. After seasonal adjustment, 12 cities saw prices rise, two cities were unchanged, and six cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.9% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 9.0% from the peak, and down 0.1% (SA) in May.

The National index is off 2.8% from the peak, and up 0.2% (SA) in May. The National index is up 31.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.4% compared to May 2015.

The Composite 20 SA is up 5.2% year-over-year..

The National index SA is up 5.0% year-over-year.

Note: According to the data, prices increased in 12 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Black Knight's First Look at June Mortgage Data

by Calculated Risk on 7/26/2016 08:21:00 AM

From Black Knight: Black Knight Financial Services’ First Look at June Mortgage Data: Foreclosure Starts Up for Second Consecutive Month; Prepays Rise on Historically Low Rates

• Despite June’s increase, first-time foreclosure starts in Q2 2016 were at their lowest level in over 16 yearsAccording to Black Knight's First Look report for June, the percent of loans delinquent increased 1.3% in June compared to May, and declined 10.0% year-over-year.

• Prepayment speeds (historically a good indicator of refinance activity) jumped to a 12-month high, mirroring an overall rise in refinance activity driven by historically low interest rates

• Early-stage delinquencies saw a seasonal increase in June, while 90-day delinquencies and foreclosure inventories continued to decline

The percent of loans in the foreclosure process declined 2.6% in June and were down 29.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.31% in June, up from 4.25% in May.

The percent of loans in the foreclosure process declined in June to 1.10%.

The number of delinquent properties, but not in foreclosure, is down 237,000 properties year-over-year, and the number of properties in the foreclosure process is down 231,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2016 | May 2016 | June 2015 | June 2014 | |

| Delinquent | 4.31% | 4.25% | 4.79% | 5.71% |

| In Foreclosure | 1.10% | 1.13% | 1.56% | 2.00% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,178,000 | 2,153,000 | 2,415,000 | 2,876,000 |

| Number of properties in foreclosure pre-sale inventory: | 558,000 | 574,000 | 789,000 | 1,006,000 |

| Total Properties | 2,736,000 | 2,727,000 | 3,204,000 | 3,882,000 |

Monday, July 25, 2016

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 7/25/2016 08:54:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for May. The Zillow forecast is for the National Index to increase 5.0% year-over-year in May.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 562 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 551 thousand in May.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Sideways Slide Ahead of Fed

Mortgage rates were unchanged again today, making three out of the past 4 days where rates haven't budged and 6 out of the past 7 days where rates moved by 0.01% or less, on average. That's an exceptionally narrow range, and it speaks to indecision in financial markets ahead of this week's major central bank announcements. That's where the Fed and the Bank of Japan give the official word on their monetary policy, which includes setting short term rates and spelling out various stimulus efforts.Here is a table from Mortgage News Daily:

The Fed isn't expected to hike rates this week, but chances increase as the year progresses. As such, it wouldn't be a surprise to see this week's announcement telegraph their intentions for the coming announcements. Although the Fed's policy rate does not directly control mortgage rates, there is typically upward pressure on all interest rates if Fed rate hike expectations increase.

In terms of specific levels, the average conventional 30yr fixed quote moved up to 3.5% for top tier scenarios late last week. Quite a few lenders are still quoting 3.375%, while just a few are up to 3.625%. Keep in mind, "top tier" means there are absolutely no "hits" to loan pricing (i.e. 25% equity, 760+ credit score, etc). Most loans in the real world have some hits (or adjustments to the 'perfect' pricing), meaning that a lot of 3.625-3.75% rates are being quoted. We track the top tier rate because that's the easiest way to capture the true day-over-day movement (especially considering the effect of certain adjustments has varied over time, and to some extent, between lenders).

emphasis added

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in June

by Calculated Risk on 7/25/2016 02:50:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in June.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | |

| Las Vegas | 4.4% | 6.7% | 5.9% | 7.6% | 10.3% | 14.3% | 27.0% | 28.4% |

| Reno** | 3.0% | 5.0% | 2.0% | 3.0% | 5.0% | 8.0% | ||

| Phoenix | 1.6% | 2.8% | 1.9% | 3.6% | 3.4% | 6.4% | 20.9% | 23.1% |

| Sacramento | 2.8% | 5.8% | 2.6% | 4.6% | 5.4% | 10.4% | 16.1% | 17.8% |

| Minneapolis | 1.2% | 2.0% | 3.8% | 5.7% | 5.0% | 7.7% | 10.9% | 12.1% |

| Mid-Atlantic | 2.7% | 3.1% | 8.1% | 8.7% | 10.8% | 11.7% | 14.4% | 15.2% |

| Florida SF | 2.2% | 3.5% | 8.0% | 16.6% | 10.2% | 20.1% | 27.2% | 33.3% |

| Florida C/TH | 1.4% | 2.4% | 7.1% | 14.8% | 8.6% | 17.2% | 54.5% | 60.9% |

| Miami MSA SF | 3.2% | 6.0% | 9.5% | 17.2% | 12.7% | 23.3% | 28.8% | 34.8% |

| Miami MSA C/TH | 1.8% | 2.9% | 10.3% | 19.3% | 12.1% | 22.2% | 58.8% | 62.9% |

| So. California* | 5.3% | 6.9% | ||||||

| Bay Area CA* | 2.2% | 4.3% | ||||||

| Chicago (city) | 9.8% | 12.4% | ||||||

| Spokane | 7.6% | 10.8% | ||||||

| Rhode Island | 9.2% | 10.4% | ||||||

| Northeast Florida | 15.1% | 25.4% | ||||||

| Orlando | 27.9% | 35.8% | ||||||

| Tucson | 23.1% | 26.5% | ||||||

| Toledo | 23.2% | 27.0% | ||||||

| S.C. Wisconsin | 14.1% | 14.3% | ||||||

| Knoxville | 18.9% | 18.9% | ||||||

| Peoria | 15.6% | 16.1% | ||||||

| Georgia*** | 18.1% | 20.3% | ||||||

| Omaha | 15.1% | 14.6% | ||||||

| Pensacola | 25.3% | 31.6% | ||||||

| Richmond VA | 5.6% | 7.6% | 13.5% | 13.8% | ||||

| Memphis | 9.0% | 11.4% | ||||||

| Springfield IL** | 4.7% | 5.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FOMC Preview: No Rate Hike, Possibly Preparing for September Rate Hike

by Calculated Risk on 7/25/2016 12:23:00 PM

The FOMC will meet on Tuesday and Wednesday, and no change to policy is expected.

There will no economic projections released at this meeting, and there is no scheduled press conference by Fed Chair Janet Yellen (in the unlikely event there is a change to policy, Yellen will probably hold a press conference).

So the focus will be on the FOMC statement.

Here is the first paragraph from the April FOMC statement:

Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed. Growth in household spending has moderated, although households' real income has risen at a solid rate and consumer sentiment remains high. Since the beginning of the year, the housing sector has improved further but business fixed investment and net exports have been soft. A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and falling prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.And the first paragraph from the June FOMC statement:

emphasis added

Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up. Although the unemployment rate has declined, job gains have diminished. Growth in household spending has strengthened. Since the beginning of the year, the housing sector has continued to improve and the drag from net exports appears to have lessened, but business fixed investment has been soft. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.Since the June meeting, the economic data has been mostly positive, and the June employment report showed a gain of 287,000 jobs. The Q2 GDP report will be released on Friday, and is expected to show real GDP growth picked up in the second quarter.

The key for a possible September rate hike is if the first paragraph in the FOMC statement is more positive than in June. If the first sentence is changed to something like "Information received since the Federal Open Market Committee met in June indicates that labor market conditions have improved and growth in economic activity appears to have picked up", then the FOMC is probably preparing - if the improved data flow continues - to raise rates in September.

Dallas Fed: Regional Manufacturing Activity "Stabilizes" in July

by Calculated Risk on 7/25/2016 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Activity Stabilizes

Texas factory activity held steady in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in near zero after two months of negative readings, suggesting output stopped falling this month.Still difficult conditions in the Dallas region, but a little better than previous months. The impact of lower oil prices is still impacting manufacturing.

Some other measures of current manufacturing activity also reflected stabilization, and demand declines abated somewhat. The capacity utilization and shipments indexes posted near-zero readings, up from negative territory in May and June. The new orders index rose six points to –8.0, while the growth rate of orders index rose nine points to –9.7.

Perceptions of broader business conditions were notably less pessimistic. While the general business activity index remained negative for a nineteenth month in a row, it jumped 17 points to –1.3 in July. The company outlook index also remained negative but rose, climbing from –11 to –2.3.

Labor market measures indicated slight employment declines and stable workweek length. The employment index came in at –2.6, up from a post-recession low of –11.5 last month. ...

emphasis added

Black Knight: House Price Index up 1.1% in May, Up 5.4% year-over-year

by Calculated Risk on 7/25/2016 08:01:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: May 2016 Transactions, U.S. Home Prices Up 1.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• U.S. home prices were up 1.1% for the month, and 5.4% from a year agoThe year-over-year increase in this index has been about the same for the last year.

• At $263K, the U.S. HPI is up nearly 32% from the bottom of the market at the start of 2012 and is now just 1.8% off its June 2006 peak

• 15 of the 40 largest metros hit new peaks:

◦Austin, TX ($303K)

◦Boston, MA ($424K)

◦Charlotte, NC ($209K)

◦Columbus, OH ($183K)

◦Dallas, TX ($234K)

◦Denver, CO ($357K)

◦Houston, TX ($227K)

◦Kansas City, MO ($182K)

◦Nashville, TN ($235K)

◦Pittsburgh, PA ($194K)

◦Portland, OR ($352K)

◦San Antonio, TX ($202K)

◦San Francisco, CA ($771K)

◦San Jose, CA ($920K)

◦Seattle, WA ($405K)

Sunday, July 24, 2016

Sunday Night Futures

by Calculated Risk on 7/24/2016 07:37:00 PM

Weekend:

• Schedule for Week of July 24, 2016

• The Future is Still Bright!

Monday:

• At 10:30 AM ET: Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $44.26 per barrel and Brent at $45.69 per barrel. A year ago, WTI was at $48, and Brent was at $54 - so prices are down 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.16 per gallon (down over $0.50 per gallon from a year ago).

The Future is still Bright!

by Calculated Risk on 7/24/2016 10:12:00 AM

Three and a half years ago I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic. It is time for another update!

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I started looking for the sun in early 2009, and recently I've been more optimistic.

Here are some updates to the graphs I posted 3+ years ago. Several of these graphs have changed direction since that original post. As example, state and local government employment is now increasing, and household deleveraging is over (as predicted).

This graph shows total and single family housing starts. Even though starts are up about 150% from the bottom, starts are still below the average level of 1.5 million per year from 1959 through 2000.

Demographics and household formation suggests starts will increase to around 1.5 million over the next few years. That means starts will probably increase another 25% or so from the June 2016 level of 1.19 million starts (SAAR).

Residential investment and housing starts are usually the best leading indicator for the economy, so this suggests the economy will continue to grow.

Since January 2013, state and local employment has increased 259,000.

So, in the aggregate, state and local government layoffs are over - and the economic drag on the economy is over. However state and local government employment is still 464,000 below the pre-recession peak.

As we've been discussing, the US deficit as a percent of GDP declined significantly over the last few years, and will probably remain under 3% for several years.

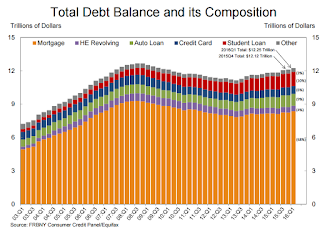

Here are a couple of graph on household debt (and debt service):

From the NY Fed: Household Debt Steps Up, Delinquencies Drop

Household indebtedness continued to advance during the first three months of 2016 according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, ...There will be a little more deleveraging ahead for certain households (mostly from foreclosures and distressed sales), but in the aggregate, household deleveraging ended almost 3 years ago.

...

"Delinquency rates and the overall quality of outstanding debt continue to improve," said Wilbert van der Klaauw, senior vice president at the New York Fed. "The proportion of overall debt that becomes newly delinquent has been on a steady downward trend and is at its lowest level since our series began in 1999. This improvement is in large part driven by mortgages."

emphasis added

This graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

This graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.The overall Debt Service Ratio has been moving sideways and is near the record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than several years ago.

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and the readings over the last year suggest more increases in CRE investment at least through mid-2017 (except oil and power with the recent decline in oil prices).

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and the readings over the last year suggest more increases in CRE investment at least through mid-2017 (except oil and power with the recent decline in oil prices).Overall it appears the economy is poised for more growth.

And in the longer term I remain very optimistic.

In 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

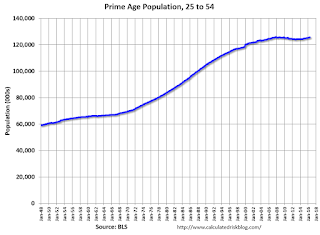

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through June 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s. The prime working age population peaked in 2007, and bottomed at the end of 2012, and is almost back to the previous peak (this has nothing to do with the recession - just demographics).

There was a huge surge in the prime working age population in the '70s, '80s and '90s. The prime working age population peaked in 2007, and bottomed at the end of 2012, and is almost back to the previous peak (this has nothing to do with the recession - just demographics).The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

These young workers are well educated and tech savvy. And they will have babies and buy homes soon. For more, see from Joe Weisenthal: The Analyst Who Nailed The Housing Crash Is Quietly Revealing The Next Big Thing

And a couple of graphs from The Projected Improvement in Life Expectancy

Instead of look at life expectancy, here is a graph of survivors out of 100,000 born alive, by age for three groups: those born in 1900-1902, born in 1949-1951 (baby boomers), and born in 2010.

There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.

There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.The CDC is projecting further improvement for childhood and prime working age for those born in 2010, but they are also projecting that people will live longer.

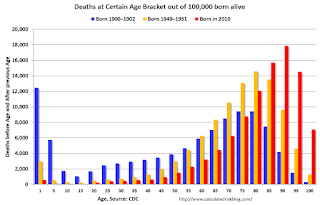

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5. That is 18.2% of those born in 1900 died before age 5.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5. That is 18.2% of those born in 1900 died before age 5.In 1950, only 3.5% died before age 5. In 2010, it was 0.7%.

The peak age for deaths didn't change much for those born in 1900 and 1950 (between 76 and 80, but many more people born in 1950 will make it).

Now the CDC is projection the peak age for deaths - for those born in 2010 - will increase to 86 to 90!

Also the number of deaths for those younger than 20 will be very small (down to mostly accidents, guns, and drugs). Self-driving cars might reduce the accident components of young deaths.

In 1900, 25,2% died before age 20. And another 26.8% died before 55.

In 1950, 5.3% died before age 20. And another 18.7% died before 55. A dramatic decline in early deaths.

In 2010, 1.5% are projected to die before age 20. And only 9.7% before 55. A dramatic decline in prime working age deaths.

An amazing statistic: for those born in 1900, about 13 out of 100,000 made it to 100. For those born in 1950, 199 are projected to make to 100 - an significant increase. Now the CDC is projecting that 1,968 out of 100,000 born in 2010 will make it to 100. Stunning!

Some people look at this data and worry about supporting all the old people. To me, this is all great news - the vast majority of people can look forward to a long life - with fewer people dying in childhood or during their prime working years. Awesome!

Three and a half years ago I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.