by Calculated Risk on 6/30/2016 10:12:00 PM

Thursday, June 30, 2016

Friday: Auto Sales, ISM Mfg, Construction Spending

From Paul Krugman: The Macroeconomics of Brexit: Motivated Reasoning?. From the intro:

I believe that Brexit is a tragic development, which will do substantial long-run economic harm. But what we’re hearing overwhelmingly from economists is the claim that it will also have severe short-run adverse impacts. And that claim seems dubious.Friday:

• At 10:00 AM ET, ISM Manufacturing Index for June. The consensus is for the ISM to be at 51.5, up from 51.3 in May. The ISM manufacturing index indicated expansion at 51.3% in May. The employment index was at 49.2%, and the new orders index was at 55.7%.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in June from 17.4 million in May (Seasonally Adjusted Annual Rate).

Restaurant Performance Index declined in May

by Calculated Risk on 6/30/2016 03:50:00 PM

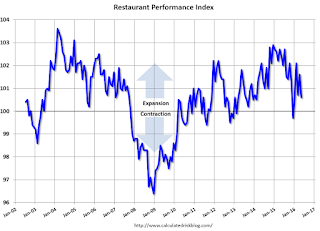

Here is a minor indicator I follow from the National Restaurant Association: RPI drops in May

Due in large part to softer same-store sales and customer traffic results, the National Restaurant Association’s Restaurant Performance Index (RPI) declined in May. The RPI stood at 100.6 in May, down 0.9 percent from a level of 101.6 in April.

"The RPI continued along a choppy trend line in May, with the index bouncing between moderate gains and losses in recent months," said Hudson Riehle, senior vice president of research for the National Restaurant Association.

"Much of the May dip came from declines in the same-store sales and customer traffic indicators, which softened from their stronger April performance. In addition, operators’ expectations for future business conditions are at the lowest level in three and a half years," he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.6 in May, down from 101.6 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

CoStar: Commercial Real Estate prices increased in May

by Calculated Risk on 6/30/2016 12:21:00 PM

Here is a price index for commercial real estate that I follow.

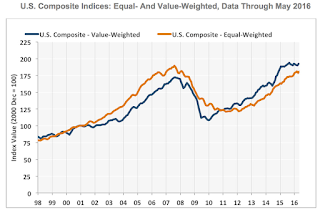

From CoStar: Composite Price Indices Resume Solid Growth Boosted By Strong Net Absorption

PRICE INDICES RESUMED SOLID GROWTH IN MAY. Both of CCRSI’s two major composite price indices advanced by more than 1% in the month of May 2016, erasing earlier-year declines. After the two major indices backtracked in the first quarter of 2016 amid global economic uncertainty and a seasonal slowdown in investment activity, price growth within the commercial real estate sector during May 2016 returned to the average monthly pace set in the previous several years. The equal-weighted U.S. Composite Index rose 1.1% and the value-weighted U.S. Composite Index advanced 1.2% in May 2016, placing the value-weighted index at its highest level this cycle.

HEALTHY CRE SPACE ABSORPTION CONTRIBUTED TO STRONG PRICE GAINS. Demonstrating the overall demand for CRE space, net absorption across the three major property types—office, retail and industrial—is projected to total 688.5 million square feet for the 12-month period ending in June 2016, a 9.5% increase from the same period ending in June 2015. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index increased 1.2% in May and is up 2.2% year-over-year.

The equal-weighted index increased 1.1% in May and is up 6.7% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Chicago PMI increased in June

by Calculated Risk on 6/30/2016 09:53:00 AM

Chicago PMI: June Chicago Business Barometer Up 7.5 Points to 56.8

The MNI Chicago Business Barometer rose 7.5 points to 56.8 in June from 49.3 in May, the highest since January 2015, led by strong gains in New Orders and Production.This was above the consensus forecast of 50.5.

June’s rebound was just enough to offset the previous two months of weakness, leaving the Barometer broadly unchanged over the quarter at an average of 52.2 in Q2 compared with 52.3 in Q1. New Orders increased sharply on the month to the highest since October 2014 ...

...

Chief Economist of MNI Indicators Philip Uglow said, “June’s sharp increase in the MNI Chicago Business Barometer needs to be viewed in the context of the weakness seen in April and May. Looking at the three-month average provides a better guide this month to the underlying trend in the economy with activity broadly unchanged between Q1 and Q2. Still, on a trend basis activity over the past four months is running above the very low levels seen around the turn of the year.”

emphasis added

Weekly Initial Unemployment Claims increase to 268,000

by Calculated Risk on 6/30/2016 08:34:00 AM

The DOL reported:

In the week ending June 25, the advance figure for seasonally adjusted initial claims was 268,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 259,000 to 258,000. The 4-week moving average was 266,750, unchanged from the previous week's revised average. The previous week's average was revised down by 250 from 267,000 to 266,750.The previous week was revised down by 1,000.

There were no special factors impacting this week's initial claims. This marks 69 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 266,750.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, June 29, 2016

Zillow Forecast: Expect About the Same Growth in May for the Case-Shiller Indexes

by Calculated Risk on 6/29/2016 04:35:00 PM

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: May Case-Shiller Forecast: April's Modest Monthly Slowdown Should Continue

April Case-Shiller data showed seasonally adjusted monthly home price growth that was slightly weaker than expected, and annual growth at a pace in line with recent months. Looking ahead, Zillow’s May Case-Shiller forecast calls for more of the same, with seasonally adjusted monthly growth in the 10- and 20-city indices falling slightly from April while annual growth stays largely flat.The year-over-year change for the 20-city index will probably be slightly lower in the May report than in the April report. The change for the National index will probably be about the same.

The May Case-Shiller National Index is expected to grow 5 percent year-over-year and 0.1 percent month-to-month, both unchanged from April. We expect the 10-City Index to grow 4.7 percent year-over-year and 0.1 percent from April. The 20-City Index is expected to grow 5.3 percent between May 2015 and May 2016 and 0.1 percent from April.

Zillow’s May Case-Shiller forecast is shown in the table below. These forecasts are based on today’s April Case-Shiller data release and the May 2016 Zillow Home Value Index (ZHVI). The May Case-Shiller Composite Home Price Indices will not be officially released until Tuesday, July 26.

Freddie Mac: Mortgage Serious Delinquency rates declined in May

by Calculated Risk on 6/29/2016 01:01:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate decreased in May to 1.11% from 1.15% in April. Freddie's rate is down from 1.58% in May 2015.

This is the lowest rate since August 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.47 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will be below 1% in a few months.

Note: Fannie Mae reported yesterday.

NAR: Pending Home Sales Index decreased 3.7% in May, down 0.2% year-over-year

by Calculated Risk on 6/29/2016 10:02:00 AM

From the NAR: Pending Home Sales Skid in May

After steadily increasing for three straight months, pending home sales letup in May and declined year-over-year for the first time in almost two years, according to the National Association of Realtors®. All four major regions experienced a cutback in contract activity last month.This was below expectations of a 1.0% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slid 3.7 percent to 110.8 in May from a downwardly revised 115.0 in April and is now slightly lower (0.2 percent) than May 2015 (111.0). With last month’s decline, the index reading is still the third highest in the past year, but declined year-over-year for the first time since August 2014.

...

The PHSI in the Northeast dropped 5.3 percent to 93.0 in May, and is now unchanged from a year ago. In the Midwest the index slipped 4.2 percent to 108.0 in May, and is now 1.8 percent below May 2015.

Pending home sales in the South declined 3.1 percent to an index of 126.6 in May but are still 0.6 percent higher than last May. The index in the West decreased 3.4 percent in May to 102.6, and is now 0.1 percent below a year ago..

emphasis added

Personal Income increased 0.2% in May, Spending increased 0.4%

by Calculated Risk on 6/29/2016 08:37:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $37.1 billion, or 0.2 percent ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $53.5 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in May, compared with an increase of 0.8 percent in April. ... The price index for PCE increased 0.2 percent in May, compared with an increase of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.2 percent, the same increase as in April.

The May PCE price index increased 0.9 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.6 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly less than expected. And the increase in PCE was at the 0.4% increase consensus.

On inflation: The PCE price index increased 0.9 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in May.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 4.1% annual rate in Q2 2016 (using the mid-month method, PCE was increasing 4.1%). This suggests solid PCE growth in Q2.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 6/29/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 24, 2016.

...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) to its lowest level since May 2013, 3.75 percent, from 3.76 percent, with points increasing to 0.36 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

30-year fixed rates would probably have to fall below 3.35% (the previous low - getting close) before there is a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "13 percent higher than the same week one year ago".