by Calculated Risk on 4/24/2016 07:54:00 PM

Sunday, April 24, 2016

Monday: New Home Sales

An interesting article from the WSJ: Home-Price Surge Stymies First-Time Buyers

Home prices in the Dallas metro area, historically one of the nation’s most stable and affordable markets, have climbed at one of the fastest rates in the U.S. since 2014. Inventories of houses on the market are under two months’ supply, the lowest in 25 years.With prices "escalating", where is the supply? There are probably several reasons supply hasn't picked up. As housing economist Tom Lawler noted several years, there has been a significant number of single family houses that have been converted to rentals. These properties are mostly still being rented, reducing the potential pool.

...

“The demand is staggering,” said Ms. Durnal, an agent with real-estate brokerage firm Redfin.

The escalating prices and tightening availability of homes in Dallas point to the challenges facing many of the nation’s largest real-estate markets as the crucial spring selling season heats up.

Another reason for low supply is that new home sales are still historically low - partly because builders have focused on higher priced homes (this is changing a little with more entry level homes coming on the market).

And low supply can be self-fulfilling for a period of time since people only want to list their home for sale if they know they can find one to buy.

There could be a demographic reason too: Baby boomers are mostly aging in place and waiting until they are older (maybe closer to 80) to downsize.

Eventually this will change, and more inventory will come on the market.

Weekend:

• Schedule for Week of April 24, 2016

Monday:

• 10:00 AM ET, New Home Sales for March from the Census Bureau. The consensus is for an increase in sales to 522 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 512 thousand in February.

• 10:30 AM, Dallas Fed Manufacturing Survey for April.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 3 and DOW futures are up 15 (fair value).

Oil prices were up over the last week with WTI futures at $43.49 per barrel and Brent at $45.11 per barrel. A year ago, WTI was at $56, and Brent was at $62 - so prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.14 per gallon (down about $0.35 per gallon from a year ago).

FOMC Preview: No Rate Hike, Risks "Nearly Balanced"

by Calculated Risk on 4/24/2016 11:33:00 AM

The FOMC will meet on Tuesday and Wednesday, and no change to policy is expected.

There will no economic projections released at this meeting, and there is no scheduled press conference by Fed Chair Janet Yellen (in the unlikely event there is a change to policy, Yellen will probably hold a press conference).

So the focus will be on the FOMC statement.

The FOMC dropped the phrase about "balanced" risks from the statements in January and March, and the FOMC is expected to add the phrase back in the statement this week - to prepare the markets for a possible rate hike in June or July.

Here is the sentence from last October:

"The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced ..."Another key will be the discussion of "global" risks. The March statement mentioned global risks twice:

"Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months."and

"However, global economic and financial developments continue to pose risks."There might be less concern in the statement about global risks in the April statement.

Also the FOMC might mention that growth has slowed in Q1 (Q1 GDP growth will be released on Thursday and is expected to show 0.7% annualized growth rate), and the statement might mention the pickup in the labor force participation rate.

The key - for a possible June rate hike - will be if the FOMC sees the risks as "balanced".

Saturday, April 23, 2016

Schedule for Week of April 24, 2016

by Calculated Risk on 4/23/2016 08:09:00 AM

The key economic reports this week are the first estimate of Q1 GDP, March New Home sales, and the Case-Shiller House Price Index for February.

The FOMC is meeting on Tuesday and Wednesday, and no change in policy is expected at this meeting.

10:00 AM: New Home Sales for March from the Census Bureau.

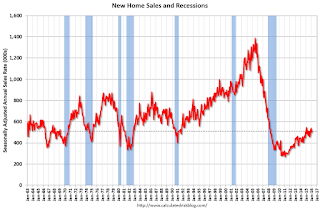

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for a increase in sales to 522 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 512 thousand in February.

10:30 AM: Dallas Fed Manufacturing Survey for April.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.5% year-over-year increase in the Comp 20 index for February. The Zillow forecast is for the National Index to increase 5.3% year-over-year in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 0.5% increase in the index.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to make no change to policy at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, up from 247 thousand the previous week.

8:30 AM ET: Gross Domestic Product, 1st quarter 2016 (Advance estimate). The consensus is that real GDP increased 0.7% annualized in Q1.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for April. This is the last of the regional Fed manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 53.4, down from 53.6 in March.

10:00 AM: University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 90.4, up from the preliminary reading 89.7.

Friday, April 22, 2016

Year 5: It Never Rains in California

by Calculated Risk on 4/22/2016 08:42:00 PM

Update: The Dumb Money recommends reading The California Weather Blog: California drought update; April showers in NorCal; and La Niña Looms. Much more detail and analysis (not a bad year in NorCal) ...

El Niño was a bust this winter in California. Although the state received more precipitation than the previous four years - that isn't saying much.

Here are a few resources to track the drought. These tables show the snowpack in the North, Central and South Sierra. Currently the snowpack is about 56% of normal for this date.

And here are some plots comparing the current and previous years to the average, a very dry year ('76-'77) and a wet year ('82-'83). This winter was close to an average year in the North and Central Sierra, but below average in the southern section.

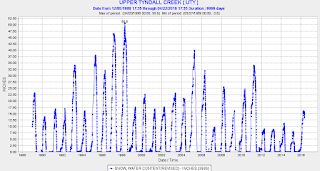

This graph shows the snow water content for Upper Tyndall Creek for the last 20 years. There is more snow than the previous four years, but that isn't saying much. Note: I hiked the trail in September 1998 - a very wet year - and there was snow all year on Whitney.

Goldman: Expect FOMC statement next week to say risks are "nearly balanced"

by Calculated Risk on 4/22/2016 02:35:00 PM

The FOMC meets next week and no change in policy is expected. The focus will be on the wording and for any hint of a June rate increase.

Here are a few brief excerpts from a research note by Goldman Sachs economists Zach Pandl and Jan Hatzius:

Financial markets once again expect the FOMC to stand pat at its upcoming meeting. Indeed, minutes from the March FOMC meeting essentially ruled out any action next week ... Nonetheless, the statement accompanying Wednesday’s decision could offer important signals for the near-term policy outlook.

The key question will be what the committee does with its balance of risks assessment, which has been excluded from the statements following the last two meetings. We expect the statement to say that risks to the outlook are “nearly balanced”, or to otherwise indicate that downside risks have receded somewhat since early this year.

ATA Trucking Index decreased in March

by Calculated Risk on 4/22/2016 12:23:00 PM

From the ATA: ATA Truck Tonnage Index Fell 4.5% in March

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 4.5% in March, following a 7.2% surge during February. In March, the index equaled 137.6 (2000=100), down from 144 in February. February’s level is an all-time high.

Compared with March 2015, the SA index was up 2.2%, which was down from February’s 8.6% year-over-year gain. Year-to-date, compared with the same period in 2015, tonnage was up 3.9%.

...

As expected, tonnage came back to earth in March from the jump in February,” said ATA Chief Economist Bob Costello. “These things tend to correct, and March took back more than half of the surprisingly large gain in February.

“The freight economy continues to be mixed, with housing and consumer spending generally giving support to tonnage, while new fracking activity and factory output being drags,” he said. “In addition, freight volumes are softer than the overall economy because of the current inventory overhang throughout the supply chain.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 2.2% year-over-year.

Black Knight's First Look at March Mortgage Data: Delinquency rate lowest in 9 Years

by Calculated Risk on 4/22/2016 09:10:00 AM

From Black Knight: Black Knight Financial Services’ First Look at March 2016 Mortgage Data: Delinquencies at Lowest Level in Nine Years; 30-Day Delinquency Rate Lowest Since Pre-2000

• National delinquency rate fell 8 percent in March; at 4.08 percent, it is at its lowest point since March 2007According to Black Knight's First Look report for March, the percent of loans delinquent decreased 8.4% in March compared to February, and declined 12.4% year-over-year.

• At just under 2 percent, the rate of 30-day delinquencies is at lowest level in over 15 years

• Spurred by declining interest rates, prepayment speeds (historically a good indicator of refinance activity) were up 46 percent from one month ago

• Foreclosure starts were down 14 percent from February; still driven primarily by repeat foreclosure activity

The percent of loans in the foreclosure process declined 3.7% in March and were down 25.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.08% in March, down from 4.48% in February. This is the lowest delinquency rate since March 2007.

The percent of loans in the foreclosure process declined in March to 1.25%.

The number of delinquent properties, but not in foreclosure, is down 287,000 properties year-over-year, and the number of properties in the foreclosure process is down 215,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for March in early May.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2016 | Feb 2016 | Mar 2015 | Mar 2014 | |

| Delinquent | 4.08% | 4.45% | 4.66% | 5.49% |

| In Foreclosure | 1.25% | 1.30% | 1.68% | 2.21% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,062,000 | 2,252,000 | 2,349,000 | 2,766,000 |

| Number of properties in foreclosure pre-sale inventory: | 631,000 | 655,000 | 846,000 | 1,112,000 |

| Total Properties | 2,693,000 | 2,907,000 | 3,195,000 | 3,878,000 |

Thursday, April 21, 2016

NMHC: Apartment Market Tightness Index declined in April Survey

by Calculated Risk on 4/21/2016 03:50:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Mixed in the April NMHC Quarterly Survey

Apartment markets appeared mixed in the April 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions, with two of four indexes landing below the breakeven level of 50. The Market Tightness (43) and Equity Financing (45) indexes showed declining conditions for the second quarter in a row, while Sales Volume (53) and Debt Financing (50) indicated improving and steady conditions, respectively.

“We continue to see some softening in the market relative to one of the strongest runs in recent memory for the apartment industry,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “As new apartment construction catches up with demand, we expect to see moderation from record rent growth as well as more selectivity from equity and debt financing sources.”

Consumer demand for apartments declined in the Market Tightness Index, dropping four points to 43. After seven quarters reporting tighter conditions, this marks the second quarter indicating a looser market.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the second consecutive month of looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow (the vacancy rate is also starting to increase).

Earlier: Chicago Fed: "Index shows economic growth below average in March"

by Calculated Risk on 4/21/2016 02:32:00 PM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth below average in March

The Chicago Fed National Activity Index (CFNAI) edged down to –0.44 in March from –0.38 in February. Three of the four broad categories of indicators that make up the index decreased from February, and all four categories made nonpositive contributions to the index in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in March from –0.11 in February. March’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in March (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Earlier: Philly Fed Manufacturing Survey showed Slight Contraction in April

by Calculated Risk on 4/21/2016 11:05:00 AM

Earlier from the Philly Fed: April 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey reported no improvement in business conditions this month. The indicator for general activity, which rose sharply in March, fell to a slightly negative reading in April. Other broad indicators suggested a similar relapse in growth that was reported last month. The indicators for both employment and work hours also fell notably. Despite weakness in current conditions, the survey’s indicators of future activity showed continued improvement, suggesting that the fallback is considered temporary.This was below the consensus forecast of a reading of 9.0 for April.

...

The diffusion index for current activity decreased from 12.4 in March to -1.6 this month. The index had turned positive last month following six consecutive negative readings ...

The survey’s indicators of employment corroborate weakness in the other broad indicators this month. The employment index decreased 17 points and registered its fourth consecutive negative reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys remained positive in April (yellow). This suggests the ISM survey will probably be above 50 again this month.