by Calculated Risk on 4/26/2016 07:34:00 PM

Tuesday, April 26, 2016

Wednesday: FOMC Announcement, Pending Home Sales

A few FOMC previews ...

From Tim Duy: The Fed Is Meeting in April to Talk About June

From Goldman Sachs: Goldman: Expect FOMC statement next week to say risks are "nearly balanced"

From me: FOMC Preview: No Rate Hike, Risks "Nearly Balanced"

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 0.5% increase in the index.

• At 2:00 PM, the FOMC Meeting Announcement. The FOMC is expected to make no change to policy at this meeting.

Duy: Fed Is Meeting Today, Talking About June

by Calculated Risk on 4/26/2016 04:54:00 PM

From Professor Tim Duy writing at Bloomberg: The Fed Is Meeting in April to Talk About June

The Fed will stand pat this week. We know it, they know it. So what then will the Fed talk about[?]

...

The April meeting of the Federal Open Market Committee (FOMC) will be about the June meeting. Policymakers' fundamental challenge is that the FOMC doesn't want to rule out a June hike, but the markets already have.

...

Bottom Line: Look for the Fed to hold steady this meeting, but be aware it is probably not comfortable with the market’s assessment of potential rate hikes this year. It will likely want to increase the uncertainty surrounding the June meeting in particular. The improving financial situation gives it room to do so by moving to a balanced assessment of risks. ...

Chemical Activity Barometer "Accelerated" in April

by Calculated Risk on 4/26/2016 02:31:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Accelerated in April; Signaling Increased U.S. Business Activity Into Fourth Quarter

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.6 percent in April following a revised 0.1 percent increase in March and 0.2 percent decline in February. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.8 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 2.7 percent year-over-year gain from 2014. On an unadjusted basis the CAB jumped 1.4 percent, following a solid 0.8 percent gain in March.

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB is up slightly year-over-year, and this suggests an increase in Industrial Production over the next year is possible.

Real Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/26/2016 11:54:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.3% year-over-year in February

Note: There was an error in the Case-Shiller press release this morning. From the press release:

"Fourteen of 20 cities reported increases in February before seasonal adjustment; after seasonal adjustment, only 10 cities increased for the month."The NSA count is correct (14 of 20 cities increased before seasonal adjustment), but the SA number is incorrect. After seasonal adjustment, all 20 cities increased in February (not 10).

The year-over-year increase in prices is mostly moving sideways now around 5%. In February, the index was up 5.3% YoY.

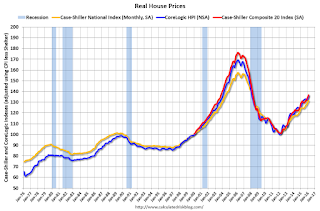

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $273,000 today adjusted for inflation (36%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.0% below the bubble peak. However, in real terms, the National index is still about 17% below the bubble peak.

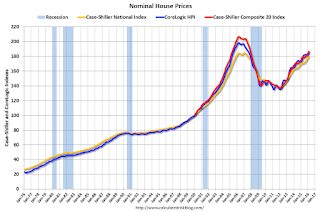

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through February) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through February) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to April 2005 levels, and the CoreLogic index (NSA) is back to July 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to February 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to May 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 and early 2004 levels - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.3% year-over-year in February

by Calculated Risk on 4/26/2016 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Increases Slow Down in February According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 5.3% annual gain in February, unchanged from the previous month. The 10-City Composite increased 4.6% in the year to February, compared to 5.0% previously. The 20-City Composite’s year-over-year gain was 5.4%, down from 5.7% the prior month.

...

Before seasonal adjustment, the National Index posted a gain of 0.2% month-over-month in February. The 10-City Composite recorded a 0.1% month-over-month increase while the 20-City Composite posted a 0.2% increase in February. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase. The 10-City Composite posted a 0.6% increase and the 20-City Composite reported a 0.7% month-over-month increase after seasonal adjustment. Fourteen of 20 cities reported increases in February before seasonal adjustment; after seasonal adjustment, only 10 cities increased for the month.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 11.4% from the peak, and up 0.6% in February (SA).

The Composite 20 index is off 9.7% from the peak, and up 0.7% (SA) in February.

The National index is off 3.0% from the peak, and up 0.4% (SA) in February. The National index is up 31.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.6% compared to February 2015.

The Composite 20 SA is up 5.3% year-over-year..

The National index SA is up 5.3% year-over-year.

I'll have more on house prices later.

Monday, April 25, 2016

Tuesday: Case-Shiller House Prices, Durable Goods

by Calculated Risk on 4/25/2016 06:49:00 PM

Earlier from the Dallas Fed: Texas Manufacturing Activity Expands Again

Texas factory activity increased for a second month in a row in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 3.3 to 5.8, suggesting a slight pickup in output growth.This is the second consecutive month of manufacturing growth in Texas.

Most other indexes of current manufacturing activity also reflected growth this month. The new orders index rebounded into positive territory after four months of negative readings, coming in at 6.2. ...

Labor market indicators reflected persistent weakness in April. The employment and hours worked indexes remained negative for the fourth straight month but rose to -3.7 and -1.0, respectively. Fourteen percent of firms noted net hiring, and 18 percent noted net layoffs in April.

• At 8:30 AM ET, Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices. The consensus is for a 5.5% year-over-year increase in the Comp 20 index for February. The Zillow forecast is for the National Index to increase 5.3% year-over-year in February.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for April.

Vehicle Sales Forecast: "April Sales to Return to 17 Million SAAR Trend"

by Calculated Risk on 4/25/2016 03:15:00 PM

The automakers will report April vehicle sales on Tuesday, May 3rd.

Note: There were 27 selling days in April, up from 26 in April 2015.

From WardsAuto: Forecast: April Sales to Return to 17 Million SAAR Trend

WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles in April, a record-high volume for the month.From J.D. Power: New-Vehicle Retail Sales Won’t Grow in April; Revised Full-Year Forecast Calls For Modest Increase Over 2015

The report puts the seasonally adjusted annual rate of sales for the month at 17.6 million units, well above last month’s 16.5 million and year-ago’s 16.7 million.

...

The monthly volume will be 5.0% above last year. Beyond an extra selling day, this April lacks the Easter holiday, allowing full sales over five weekends.

emphasis added

Total light-vehicle sales in April are expected to reach 1,523,000, up 1% on a selling-day adjusted basis from 1,452,241 from a year ago and the strongest total sales in April on record.Looks like a strong month for vehicle sales.

The SAAR for total sales is projected at 17.6 million units in April 2016, up 0.8 million units from 16.7 million a year ago.

Comments on March New Home Sales

by Calculated Risk on 4/25/2016 12:29:00 PM

The new home sales report for March was eleven thousand below expectations at 511,000 on a seasonally adjusted annual rate basis (SAAR), however combined sales for December, January and February were revised up by 23 thousand SAAR - so overall this was a decent report.

Sales were up 5.4% year-over-year (YoY) compared to March 2015. And sales are up 1.3% year-to-date compared to the same period in 2015.

Earlier: New Home Sales decreased to 511,000 Annual Rate in March.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate).

So far 2016 is barely ahead of 2015, although the comparisons for the first two months were difficult. The comparisons through the summer will be easier. Overall I expect lower growth this year, probably in the 4% to 8% range.

Slower growth is likely this year because Houston (and other oil producing areas) will have a problem this year. Inventory of existing homes is increasing quickly and prices will probably decline in those areas. And that means new home construction will slow in those areas too.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 511,000 Annual Rate in March

by Calculated Risk on 4/25/2016 10:11:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 511 thousand.

The previous three months were revised up by a total of 23 thousand (SAAR).

"Sales of new single-family houses in March 2016 were at a seasonally adjusted annual rate of 511,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent below the revised February rate of 519,000, but is 5.4 percent above the March 2015 estimate of 485,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply was increased in March to 5.8 months.

The months of supply was increased in March to 5.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of March was 246,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2016 (red column), 48 thousand new homes were sold (NSA). Last year 46 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was below expectations of 522,000 sales SAAR in March, however prior months were revised up. A decent report. I'll have more later today.

Black Knight: House Price Index up 0.7% in February, Up 5.3% year-over-year

by Calculated Risk on 4/25/2016 08:12:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: February 2016 Transactions -- U.S. Home Prices Up 0.7 Percent for the Month; Up 5.3 Percent Year-Over-Year

• U.S. home prices showed stronger monthly gains than they have since last April, rising 0.7% from January, and were up 5.3% from last yearThe year-over-year increase in the index has been about the same for the last year.

• National home prices are now 27.5% above where they were at the bottom of the market at the start of 2012

• At $254K, the national level HPI is now just 5% off its June 2006 peak of $267K

• Strong upward monthly price movement was observed in many states and metro areas in February

• Of the nation’s 40 largest metros, 10 hit new peaks:

◦Austin, TX ($291K)

◦Dallas, TX ($224K)

◦Denver, CO ($339K)

◦Houston, TX ($223K)

◦Kansas City, MO ($174K)

◦Nashville, TN ($224K)

◦Portland, OR ($332K)

◦San Antonio, TX ($195K)

◦San Francisco, CA ($745K)

◦San Jose, CA ($891K)