by Calculated Risk on 1/06/2016 04:36:00 PM

Wednesday, January 06, 2016

Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

5) Monetary Policy: The Fed raised rates in December, and now the question is how much will the Fed raise rates in 2016? The market is pricing in two 25 bps rate hikes in 2016, and most analysts expect three to four hikes in 2016. However, some analysts think the Fed is finished, the so-called "one and done" view. Will the Fed raise rates in 2016, and if so, by how much?

For years I made fun of those predicting an imminent Fed Funds rate increase. Based on high unemployment and low inflation, I argued it would be a "long time" before the first rate hike. A long time passed ... and last year I finally argued a rate hike was likely (although I thought we'd see more than one). Now it seems likely the Fed will raise rates further in 2016.

Tim Duy at Fed Watch expects four rate hikes in 2016:

The Federal Reserve will continue to hike rates, slowly. I expect that economic conditions will be sufficient for the Federal Reserve to justify 100bp of rate hikes in 2016. Although the Fed will not want to appear mechanical in its normalization process, they will likely find themselves hiking every other meeting beginning in March. They will be slow to begin the process of "normalizing" the balance sheet, although I expect that they will be fully engaged in that conversation by the middle of the year. That conversation will take on more urgency if they have difficulty controlling short rates with their new tools.And Fed Vice Chairman Stanley Fischer thinks four hikes is "in the ballpark", from Bloomberg: Fed's Fischer Says Four Rate Hikes in 2016 ‘in the Ballpark’

Federal Reserve Vice Chairman Stanley Fischer said policy makers’ forecasts predicting four interest-rate increases in 2016 were “in the ballpark,” though China’s slowing economy and other sources of uncertainty make it difficult to predict the path of policy.Of course the Fed will be data dependent and inflation is the key to the number of rate hikes in 2015. From the December FOMC minutes:

“The reason we meet eight times a year is because things happen, and as they happen you want to adjust your policy,” Fischer said in an interview Wednesday on CNBC.

In determining the size and timing of further adjustments to monetary policy, some members emphasized the importance of confirming that inflation would rise as projected and of maintaining the credibility of the Committee's inflation objective.If inflation picks up, then four rate hikes is probably "in the ballpark". If inflation stays low, then we will see fewer rate hikes.

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.

As an aside, the old saying on Wall Street with regards to rate hikes is "3 steps and a stumble" meaning three hikes and the stock market stumbles. I don't think there is an validity to the saying, but I expect to hear it on CNBC in 2016!

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

FOMC Minutes: "some members said that their decision to raise the target range was a close call"

by Calculated Risk on 1/06/2016 02:11:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 15-16. Excerpts:

After assessing the outlook for economic activity, the labor market, and inflation and weighing the uncertainties associated with the outlook, members agreed to raise the target range for the federal funds rate to 1/4 to 1/2 percent at this meeting. A number of members commented that it was appropriate to begin policy normalization in response to the substantial progress in the labor market toward achieving the Committee's objective of maximum employment and their reasonable confidence that inflation would move to 2 percent over the medium term. Members agreed that the postmeeting statement should report that the Committee's decision reflected both the economic outlook and the time it takes for policy actions to affect future economic outcomes. If the Committee waited to begin removing accommodation until it was closer to achieving its dual-mandate objectives, it might need to tighten policy abruptly, which could risk disrupting economic activity. Members observed that after this initial increase in the federal funds rate, the stance of monetary policy would remain accommodative. However, some members said that their decision to raise the target range was a close call, particularly given the uncertainty about inflation dynamics, and emphasized the need to monitor the progress of inflation closely.

Members also discussed their expectations for the size and timing of adjustments in the target range for the federal funds rate going forward. Based on their current forecasts for economic activity, the labor market, and inflation, as well as their expectation that the neutral short-term real interest rate will rise slowly over the next few years, members expected economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate. However, they also recognized that the appropriate path for the federal funds rate would depend on the economic outlook as informed by incoming data. Members stressed the potential need to accelerate or slow the pace of normalization as the economic outlook evolved. In the current situation, because of their significant concern about still-low readings on actual inflation and the uncertainty and risks present in the inflation outlook, they agreed to indicate that the Committee would carefully monitor actual and expected progress toward its inflation goal. In determining the size and timing of further adjustments to monetary policy, some members emphasized the importance of confirming that inflation would rise as projected and of maintaining the credibility of the Committee's inflation objective. Based on their current economic outlook, they continued to anticipate that the federal funds rate was likely to remain, for some time, below levels that the Committee expected to prevail in the longer run.

emphasis added

Reis: Apartment Vacancy Rate increased in Q4 to 4.4%

by Calculated Risk on 1/06/2016 11:57:00 AM

Reis reported that the apartment vacancy rate increased in Q4 2015 to 4.4%, up from 4.3% in Q3, and up from 4.3% in Q4 2014. The vacancy rate peaked at 8.0% at the end of 2009, and appears to have bottomed at 4.2%.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

Fourth quarter data provides yet more evidence that the national vacancy rate has already bottomed out and is set to keep increasing. As we noted last quarter, vacancy technically started rising during the second quarter of 2014, but had fallen back before bottoming out again during the second quarter of 2015. However, the national vacancy rate has now increased for two consecutive quarters. This marks is the first time that has happened since the fourth quarter of 2009 and truly represents a turning point in the apartment market. With construction outpacing demand the national vacancy rate should slowly drift higher over the coming years.

Vacancy once again increased by 10 basis points to 4.4% during the quarter with construction slightly outpacing net absorption. While demand and supply had been largely in balance between mid-2013 and mid-2015, that has started to change over the last two quarters. Gradually, construction is overtaking net absorption by a wider margin, putting increasing upward pressure on vacancy. During the second quarter construction exceed demand by 3,471 units. During the third quarter that difference had risen to 12,350 units and during the fourth quarter it registered 15,263 units. With construction continuing to increase and net absorption generally stabilizing, this rift should continue to widen over time putting further upward pressure on the national vacancy rate.

Asking and effective rents both grew by 0.8% during the fourth quarter. This was a bit slower than the scorching performance during the last two quarters, but still represents an annualized rate in excess of 3%, well ahead of even core inflation. This slight pullback is not entirely unexpected due to the seasonality typically observed in the apartment market - apartment rent growth tends to be strongest during the two middle quarters of the calendar year when people have a propensity to move while the weather is more conducive and children are out of school. The slight pullback in rent growth during the fourth quarter is more of a testament to how strong rent growth was during those two middle quarters than any weakness exhibited during the fourth quarter....

On a calendar-year basis, rent growth continues to accelerate. Asking and effective rents grew by 4.5% and 4.6%, respectively, during 2015.This is greater than 2014's growth rates of 3.7% and 3.9% for asking and effective rents and is the strongest performance during a calendar year since 2007 before the recession. The low vacancy rate, improving economy, tightening labor market and gradually rising income growth is providing all of the fodder for continued rent growth, even in the face of rising construction.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. Now that completions are catching up with starts, the vacancy rate has started to increase.

Apartment vacancy data courtesy of Reis.

ISM Non-Manufacturing Index Decreased to 55.3% in December

by Calculated Risk on 1/06/2016 10:05:00 AM

The December ISM Non-manufacturing index was at 55.3%, down from 55.9% in November. The employment index increased in December to 55.7%, up from 55.0% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 71st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.3 percent in December, 0.6 percentage point lower than the November reading of 55.9 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 58.7 percent, which is 0.5 percentage point higher than the November reading of 58.2 percent, reflecting growth for the 77th consecutive month at a slightly faster rate. The New Orders Index registered 58.2 percent, 0.7 percentage point higher than the reading of 57.5 percent in November. The Employment Index increased 0.7 percentage point to 55.7 percent from the November reading of 55 percent and indicates growth for the 22nd consecutive month. The Prices Index decreased 0.6 percentage point from the November reading of 50.3 percent to 49.7 percent, indicating prices decreased in December for the third time in the last four months. According to the NMI®, 11 non-manufacturing industries reported growth in December. Faster deliveries in December contributed to the overall slight slowing in the rate of growth according to the NMI® composite index. All of the other component indexes increased in the month of December. The majority of respondents’ comments remain positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.5 and suggests slightly slower expansion in December than in November. Still a solid report.

Trade Deficit Decreased in November to $42.4 Billion

by Calculated Risk on 1/06/2016 08:40:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $42.4 billion in November, down $2.2 billion from $44.6 billion in October, revised. November exports were $182.2 billion, $1.6 billion less than October exports. November imports were $224.6 billion, $3.8 billion less than October imports.The trade deficit was smaller than the consensus forecast of $44.4 billion.

The first graph shows the monthly U.S. exports and imports in dollars through November 2015.

Click on graph for larger image.

Click on graph for larger image.Imports and exports decreased in November.

Exports are 10% above the pre-recession peak and down 7% compared to November 2014; imports are 3% below the pre-recession peak, and down 5% compared to November 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier last year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier last year were due to West Coast port slowdown).Oil imports averaged $39.24 in November, down from $40.12 in October, and down from $82.92 in November 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.3 billion in November, from $30.2 billion in November 2014. The deficit with China is a substantial portion of the overall deficit.

ADP: Private Employment increased 257,000 in December

by Calculated Risk on 1/06/2016 08:19:00 AM

Private sector employment increased by 257,000 jobs from November to December according to the December ADP National Employment Report® ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 190,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 23,000 jobs in December, well up from a downwardly revised -2,000 the previous month. The construction industry added 24,000 jobs, which was roughly in line with the 21,000 average monthly jobs gained for the year. Meanwhile, manufacturing stayed in positive territory for the second straight month adding 2,000 jobs.

Service-providing employment rose by 234,000 jobs in December, up from an upwardly revised 213,000 in November. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Strong job growth shows no signs of abating. The only industry shedding jobs is energy. If this pace of job growth is sustained, which seems likely, the economy will be back to full employment by mid-year. This is a significant achievement, given that the last time the economy was at full employment was nearly a decade ago.”

The BLS report for December will be released Friday, and the consensus is for 200,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey, Purchase Applications up 22% YoY

by Calculated Risk on 1/06/2016 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 27 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 1, 2016. The most recent week’s results include an adjustment to account for the New Year’s Day holiday, while the previous week’s results were adjusted for the Christmas holiday.

...

The Refinance Index decreased 37 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 15 percent from two weeks earlier. The unadjusted Purchase Index decreased 40 percent compared with two weeks ago and was 22 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.20 percent, its highest level since July 2015, from 4.19 percent, with points decreasing to 0.42 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 22% higher than a year ago.

Tuesday, January 05, 2016

Wednesday: Trade Deficit, ADP Employment, FOMC Minutes, ISM Non-Mfg Index

by Calculated Risk on 1/05/2016 08:32:00 PM

It never rains in California, oh wait ... from the LA Times: El Niño storms slam Southern California

The first major El Niño storm of the season brought heavy rainfall that closed roads, caused flooding and gave Southern California a good drenching.This is just the beginning - it looks like this will be a wet year for the West.

And that's not all -- the storms are expected to continue throughout the week, forecasters say.

...

The wet walloping delivered to Southern California on Tuesday, courtesy of El Niño, made for the wettest day Los Angeles has seen in almost four months.

There was more rain in Los Angeles on Tuesday than every day in 2015 except for one, Sept. 15, when the remnants of Hurricane Linda washed ashore, said Bill Patzert, a climatologist with the NASA Jet Propulsion Laboratory in La Cañada Flintridge.

...

“This is not a bashful El Niño. This is a brash El Niño,” Patzert said. “Definitely, it’s impressive.”

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in December, down from 217,000 in November.

• At 8:30 AM, Trade Balance report for November from the Census Bureau. The consensus is for the U.S. trade deficit to be at $44.4 billion in November from $43.9 billion in October.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for index to increase to 56.5 from 55.9 in November.

• Also at 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is a 0.2% decrease in orders.

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of December 15-16, 2015

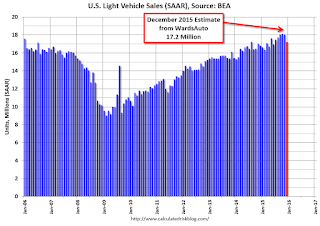

U.S. Light Vehicle Sales at 17.2 million annual rate in December

by Calculated Risk on 1/05/2016 03:33:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 17.2 million SAAR in December.

That is up about 2% from December 2014, and down about 5% from the 18.06 million annual sales rate last month.

This is probably a record year for light vehicle sales (more on that when the official data is released).

It looks like the best years were:

1) 2015 with 17.39 million sold

2) 2000 with 17.35 million

3) 2001 with 17.12 million

4) 2005 with 16.95 million

5) 1999 with 16.89 million

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.2 million SAAR from WardsAuto).

This was below the consensus forecast of 18.1 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was a below expectations, however 2015 was the best year ever for light vehicle sales.

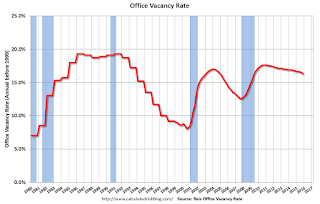

Reis: Office Vacancy Rate declined in Q4 to 16.3%

by Calculated Risk on 1/05/2016 11:48:00 AM

Reis released their Q4 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.3% in Q4, from 16.5% in Q3. This is down from 16.7% in Q4 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

The ongoing decline in the national vacancy rate finally gained momentum this quarter, falling by 20 basis points to 16.3%. This marks the first time since the market began to recover in early 2011 that the quarterly vacancy rate fell by more than 10 basis points. The vacancy rate has now declined in five of the last six quarters and is at its lowest level since the second quarter of 2009. The quiet acceleration in the office market recovery is now beginning to make more noise. Both net absorption and new construction are increasing, but absorption is beginning to pull ahead of construction by a wider margin. By many measures, including absorption, construction, and vacancy compression, 2015 was the best year in the office market in recent history. The acceleration in improvement will persist in 2016 as the labor market remains near full employment, the economy expands, and office jobs are created.

...

Occupied stock increased by 15.322 million square feet during the fourth quarter. This was an increase versus last quarter and was the highest level for quarterly net absorption since the third quarter of 2007. The calendar-year total for 2015 of 42.436 million square feet was the highest annual total since 2007. In short, 2015 was the best year for demand in the office market since before the recession. Moreover, the improvement is accelerating - roughly 11 million more square feet were absorbed in 2015 versus 2014. That is the largest increase between calendar years since 2005. This should accelerate in 2016 as the continued gains in the labor market translate into greater demand for office space.

New construction of 9.597 million SF is a bit of a decline from last quarter. However, the trend over time is still upward. Construction has exceeded 9 million square feet in each of the last three quarters. That has not happened since the third quarter of 2009 when construction was slowing due to the recession. Slowly, but surely, investors and developers are feeling more confident about their prospects, spurred on by the recovery in fundamentals. Over time, speculative projects are making a return to the market, evidence of this turnabout in sentiment. Confidence will continue to grow over time, resulting in a greater number of office space being constructed going forward.

...

4Q2015 asking rent growth: +0.8% / 12-month change: +3.1%

4Q2015 effective rent growth: +0.8% / 12-month change: +3.2%

Asking and effective rents both grew by 0.8% during the fourth quarter, marking the twenty-first consecutive quarter of asking and effective rent growth. These growth rates were slightly ahead of the growth rates from last quarter. On a year-over-year basis, both asking and effective rent growth slowed versus third quarter figures. However, this is more due to the weak rent growth that was observed during the third quarter of 2014 than any slowdown in rent. In eight of the last nine quarters, both asking and effective rent growth have been at least 0.7%. Annual growth rates in excess of 3% is still strong for a market with a vacancy rate greater than 16%. Nonetheless, these growth rates should accelerate as the market continues to tighten in the coming years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4.

Office vacancy data courtesy of Reis.