by Calculated Risk on 1/05/2016 11:48:00 AM

Tuesday, January 05, 2016

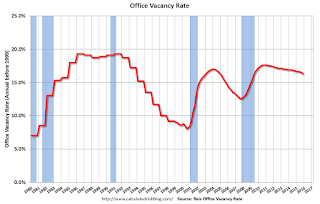

Reis: Office Vacancy Rate declined in Q4 to 16.3%

Reis released their Q4 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.3% in Q4, from 16.5% in Q3. This is down from 16.7% in Q4 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

The ongoing decline in the national vacancy rate finally gained momentum this quarter, falling by 20 basis points to 16.3%. This marks the first time since the market began to recover in early 2011 that the quarterly vacancy rate fell by more than 10 basis points. The vacancy rate has now declined in five of the last six quarters and is at its lowest level since the second quarter of 2009. The quiet acceleration in the office market recovery is now beginning to make more noise. Both net absorption and new construction are increasing, but absorption is beginning to pull ahead of construction by a wider margin. By many measures, including absorption, construction, and vacancy compression, 2015 was the best year in the office market in recent history. The acceleration in improvement will persist in 2016 as the labor market remains near full employment, the economy expands, and office jobs are created.

...

Occupied stock increased by 15.322 million square feet during the fourth quarter. This was an increase versus last quarter and was the highest level for quarterly net absorption since the third quarter of 2007. The calendar-year total for 2015 of 42.436 million square feet was the highest annual total since 2007. In short, 2015 was the best year for demand in the office market since before the recession. Moreover, the improvement is accelerating - roughly 11 million more square feet were absorbed in 2015 versus 2014. That is the largest increase between calendar years since 2005. This should accelerate in 2016 as the continued gains in the labor market translate into greater demand for office space.

New construction of 9.597 million SF is a bit of a decline from last quarter. However, the trend over time is still upward. Construction has exceeded 9 million square feet in each of the last three quarters. That has not happened since the third quarter of 2009 when construction was slowing due to the recession. Slowly, but surely, investors and developers are feeling more confident about their prospects, spurred on by the recovery in fundamentals. Over time, speculative projects are making a return to the market, evidence of this turnabout in sentiment. Confidence will continue to grow over time, resulting in a greater number of office space being constructed going forward.

...

4Q2015 asking rent growth: +0.8% / 12-month change: +3.1%

4Q2015 effective rent growth: +0.8% / 12-month change: +3.2%

Asking and effective rents both grew by 0.8% during the fourth quarter, marking the twenty-first consecutive quarter of asking and effective rent growth. These growth rates were slightly ahead of the growth rates from last quarter. On a year-over-year basis, both asking and effective rent growth slowed versus third quarter figures. However, this is more due to the weak rent growth that was observed during the third quarter of 2014 than any slowdown in rent. In eight of the last nine quarters, both asking and effective rent growth have been at least 0.7%. Annual growth rates in excess of 3% is still strong for a market with a vacancy rate greater than 16%. Nonetheless, these growth rates should accelerate as the market continues to tighten in the coming years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4.

Office vacancy data courtesy of Reis.