by Calculated Risk on 1/08/2016 08:01:00 PM

Friday, January 08, 2016

Merrill: Warm Weather "added nearly 100,000 jobs in December"

A few excerpts from a research note by Merrill Lynch economists Michelle Meyer and Alexander Lin: Melting snowmen

After two brutal winters, we have been enjoying an unprecedented warm winter start. The average temperature in December was 38.6 degrees, versus the previous record of 37.7 and the historical average of 33.2. If we create a national aggregate for temperature which is weighted by state population instead of area, we see an even bigger divergence from the norm in December. The appeal of using population weights is that it will put more emphasis on the temperature in the areas which have a greater economic contribution.

Another proxy for gauging the weather in the winter is to show heating degree days, which measures the demand for energy to heat houses or businesses ... the deviation from the norm for heating degree days in December and this past month was literally off the charts.

...

In a research note released February last year, Chicago Fed economists Justin Bloesch and François Gouri provide an insightful methodology for examining the impact of weather on economic indicators. Using daily data from the more than 1,200 weather stations that make up the US Historical Climatology Network, they constructed temperature and snowfall indices based on deviations from historical levels. ... They test the impact of this deviation on economic indicators – both in winter months and in April, May and June, to understand the potential payback. There is strong evidence of a weather impact on nonfarm payrolls as well as claims, housing starts, and permits. Focusing on payrolls, they estimated that a 1 standard deviation increase in temperature resulted in a 0.04% boost to nonfarm payroll growth during the current month, which would translate into roughly 60,000 additional jobs at today’s levels. Similarly, a 1 standard deviation decline in snowfall would result in a 0.03% bump to job growth, or 45,000 additional jobs.

Plugging in the December temperature and snowfall data to the output of the model from Bloesch and Gouri, we find that the weather can explain about 97,000 of job growth. This would imply that without the weather distortion, the economy would have added 195,000 jobs. While we don’t want to give a false sense of precision, this seems like a reasonable approximation. Before the sharp acceleration the past three months, job growth was trending at around 200,000 a month.

emphasis added

Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

by Calculated Risk on 1/08/2016 03:48:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Although there are different measure for inflation (including some private measures) they all show that inflation is now close to the Fed's 2% inflation target - except Core PCE.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

On a year-over-year basis in November, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 2.0%. Core PCE is for October and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.4% annualized, and core CPI was at 2.2% annualized..

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 1/08/2016 12:41:00 PM

By request, here is another update of an earlier post through the December employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 7,8251 |

| 135 months into 2nd term: 10,731 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Thirty five months into Mr. Obama's second term, there are now 9,843,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 578,000 jobs). These job losses had mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 1241 |

| 135 months into 2nd term, 170 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are clearly. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 124 thousand public sector jobs have been added during the first thirty five months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 8% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 7,825 | 124 | 7,949 | |

| Pace2 | 10,731 | 170 | 10,901 | |

| 135 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 235 | 279 | ||

| #2 | 173 | 259 | ||

| #3 | 118 | 219 | ||

Comments: Another Strong Employment Report

by Calculated Risk on 1/08/2016 09:39:00 AM

This was a strong employment report with 292,000 jobs added, and employment gains for October and November were revised up.

However wages were mostly unchanged, from the BLS: "In December, average hourly earnings for all employees on private nonfarm payrolls, at $25.24, changed little (-1 cent), following an increase of 5 cents in November. Over the year, average hourly earnings have risen by 2.5 percent."

Earlier: December Employment Report: 292,000 Jobs, 5.0% Unemployment Rate

Note: The warm weather might have had a positive impact on this report. As an example, very few people reported they had a full time job, but worked part time due to bad weather (an indicator of the impact of weather).

A few more numbers: Total employment is now 4.9 million above the previous peak. Total employment is up 13.6 million from the employment recession low.

Private payroll employment increased 275,000 in December, and private employment is now 5.3 million above the previous peak. Private employment is up 14.1 million from the recession low.

In December, the year-over-year change was 2.65 million jobs.

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 746 thousand workers (NSA) net in October, November and December. Note: this is NSA (Not Seasonally Adjusted).

This is slightly below the number last year, and suggests retailers were reasonably optimistic about sales.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in October to 80.9%, and the 25 to 54 employment population ratio was unchanged at 77.4%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in December - and although the series is noisy - it does appear wage growth is trending up.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 6.0 million in December but was down by 764,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons was little changed in December. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 9.9% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.08 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.05 million in November.

This is generally trending down, but is still high.

State and Local Government

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.) In December 2015, state and local governments added 13 thousand jobs. State and local government employment is now up 209,000 from the bottom, but still 549,000 below the peak.

State and local employment is now increasing. And Federal government layoffs appear to have ended and, with the recent budget deal, Federal employment will probably increase in 2016. (Federal payrolls increased by 4,000 in December, and Federal employment was up 17,000 in 2015).

Overall this was another strong employment report.

December Employment Report: 292,000 Jobs, 5.0% Unemployment Rate

by Calculated Risk on 1/08/2016 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 292,000 in December, and the unemployment rate was unchanged at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in several industries, led by professional and business services, construction, health care, and food services and drinking places. Mining employment continued to decline.

...

The change in total nonfarm payroll employment for October was revised from +298,000 to +307,000, and the change for November was revised from +211,000 to +252,000. With these revisions, employment gains in October and November combined were 50,000 higher than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls, at $25.24, changed little (-1 cent), following an increase of 5 cents in November. Over the year, average hourly earnings have risen by 2.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 292 thousand in December (private payrolls increased 275 thousand).

Payrolls for October and November were revised up by a combined 50 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.65 million jobs.

This was the 2nd best year since the '90s.

1) 2014: 3.116 million jobs added

2) 2015: 2.650 million

3) 2005: 2.506 million

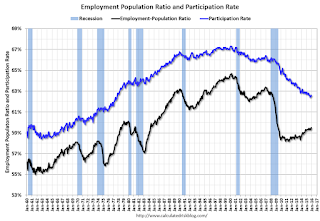

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in December to 62,6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in December at 5.0%.

This was above expectations of 200,000 jobs, and revisions were up ... a strong report.

I'll have much more later ...

Thursday, January 07, 2016

Friday: Employment Report

by Calculated Risk on 1/07/2016 08:09:00 PM

An employment report preview from Goldman Sachs economists Elad Pashtan and Daan Struyven:

We expect a 215k gain in nonfarm payroll employment in December, slightly above expectations of 200k. ... The unemployment rate is likely to remain unchanged at 5.0%. Average hourly earnings are likely to rise a relatively soft 0.1% month-over-month due to calendar effects. However, we expect the year-over-year rate to rise to a new cyclical high of 2.6%, boosted by favorable base effects.Friday:

• At 8:30 AM, Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs added in December, down from the 211,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to be unchanged at 5.0%.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a no change in inventories.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for an increase of $19 billion in credit.

Reis: Mall Vacancy Rate Declined in Q4

by Calculated Risk on 1/07/2016 04:11:00 PM

Reis reported that the vacancy rate for regional malls declined to 7.8% in Q4 2015, down from 7.9% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.0% in Q4 2015, down from 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points during the fourth quarter to 10.0%. Although both net absorption and construction remain at weak levels, net absorption is slowly starting to pull ahead of construction and push the vacancy rate down again. The vacancy rate for malls also declined by 10 basis points to 7.8%, also demonstrating a bit of resurgence. Malls have had a better recovery than neighborhood and community centers up to this juncture, but neither has had a strong recovery on a widespread basis.

...

Asking and effective rents once again grew by 0.5% during the fourth quarter. There has not been much change in the rental growth rates for neighborhood and community centers over the last five quarters. Given such an elevated vacancy rate these results are in line with expectations. Over the last 12 months asking and effective rents grew by 2.0% and 2.2%, respectively, which is a bit of an improvement from the 1.8% and 2.0% that they respectively increased during 2014. This was the best calendar-year performance for rent growth since 2007, before the recession.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Preview: Employment Report for December

by Calculated Risk on 1/07/2016 12:37:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus, according to Bloomberg, is for an increase of 200,000 non-farm payroll jobs in December (with a range of estimates between 170,000 to 249,000), and for the unemployment rate to be unchanged at 5.0%.

The BLS reported 211,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 257,000 private sector payroll jobs in December. This was above expectations of 190,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 48.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 30,000 in December. The ADP report indicated a 2,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index increased in December to 55.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 230,000 in December.

Combined, the ISM indexes suggests employment gains of 200,000. This suggests employment growth close to expectations.

• Initial weekly unemployment claims averaged close to 275,000 in December, up from 270,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 271,000, down slightly from 272,000 during the reference week in November.

The slight decrease during the reference suggests about the same level of layoffs in December as in November.

• The final December University of Michigan consumer sentiment index increased to 92.6 from the November reading of 91.3. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like lower gasoline prices.

• Trim Tabs reported that the U.S. economy added between 120,000 to 150,000 jobs in December, down from their estimate of 168,000 jobs in November. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. Based on these indicators, it appears job gains should be around 200 thousand again in December.

Las Vegas Real Estate in December: Sales Increased 20% YoY, Inventory Down

by Calculated Risk on 1/07/2016 10:31:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR Reports Local Home Prices and Sales End 2015 Up From 2014

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in December 2015 was 3,290, up from 2,734 in December 2014. Compared to the previous year, 20.4 percent more homes and 20.0 percent more condos and townhomes sold in December 2015.1) Overall sales were up sharply year-over-year. Sales in the previous month (November) were probably impacted by the new TILA-RESPA Integrated Disclosure (TRID). In early October, this new disclosure rule pushed down mortgage applications sharply, however applications have since bounced back. Note: TILA: Truth in Lending Act, and RESPA: the Real Estate Settlement Procedures Act of 1974.

...

By the end of December, GLVAR reported 7,224 single-family homes listed without any sort of offer. That’s down 11.2 percent from one year ago. [CR NOTE: GLVAR Corrected the percent change for listings] For condos and townhomes, the 2,091 properties listed without offers in December represented a 9.4 percent decrease from one year ago.

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That continued in December, when 6.8 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10 percent of all sales one year ago. Another 6.9 percent of all December sales were bank-owned, down from 8 percent one year ago.

emphasis added

2) Conventional (equity, not distressed) sales were up 27% year-over-year. In Dec 2014, 82.0% of all sales were conventional equity. In Dec 2015, 86.3% were standard equity sales.

3) The percent of cash sales decreased year-over-year from 31.9% in Dec 2014 to 33.2% in Dec 2015. This has been trending down.

4) Non-contingent inventory is down 11.2% year-over-year. This was the fourth month in a row with a YoY decline in inventory. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is over.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

| Jul-15 | 5.1% |

| Aug-15 | 3.5% |

| Sep-15 | -0.8% |

| Oct-15 | -7.1% |

| Nov-15 | -5.2% |

| Dec-15 | -11.2% |

Weekly Initial Unemployment Claims decrease to 277,000

by Calculated Risk on 1/07/2016 08:33:00 AM

The DOL reported:

In the week ending January 2, the advance figure for seasonally adjusted initial claims was 277,000, a decrease of 10,000 from the previous week's unrevised level of 287,000. The 4-week moving average was 275,750, a decrease of 1,250 from the previous week's unrevised average of 277,000.The previous week was unrevised at 287,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 275,750.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.