by Calculated Risk on 11/27/2015 04:05:00 PM

Friday, November 27, 2015

Zillow Forecast: Expect October Year-over-year Change for Case-Shiller Index Similar to September

The Case-Shiller house price indexes for September were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Forecast Calls for Similar Annual, Monthly Gains in October

The September S&P Case-Shiller (SPCS) data published [on Tuesday] showed home prices rising on a seasonally-adjusted monthly basis, with month-over-month rises of 0.6 percent for both the 10- and 20- city indices and 0.8 percent for the national index.This suggests the year-over-year change for the October Case-Shiller National index will be about the same as in the September report.

The October Case-Shiller forecast calls for similar monthly increases of 0.4 percent for the 10- and 20-City Indices in October from from September (seasonally adjusted). The national index is expected to gain another 0.8 percent in October from September. We expect the 10-City Index to grow 5 percent year-over-year, and the 20-City Index to grow 5.4 percent over the same period. The national Index looks set to gain 5.1 percent since October 2014.

All SPCS forecasts are shown in the table below. These forecasts are based on today’s September SPCS data release and the October 2015 Zillow Home Value Index (ZHVI), released November 20. The SPCS Composite Home Price Indices for October will not be officially released until Tuesday, December 29.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| September Actual YoY | 5.0% | 5.0% | 5.5% | 5.5% | 4.9% | 4.9% |

| October Forecast YoY | 5.0% | 5.0% | 5.4% | 5.4% | 5.1% | 5.1% |

| September Forecast MoM | -0.2% | 0.4% | -0.1% | 0.4% | 0.0% | 0.8% |

Vehicle Sales Forecast for November: Over 18 Million Annual Rate Again?

by Calculated Risk on 11/27/2015 11:16:00 AM

The automakers will report November vehicle sales on Tuesday, December 1st. Sales in October were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it possible sales in October will be over 18 million SAAR again.

Note: There were 23 selling days in November, down from 25 in November 2014. Here are two forecasts:

From WardsAuto: Forecast: U.S. Light Vehicle Sales on Track for Record Year

A WardsAuto forecast calls for U.S. light-vehicle sales to reach an 18.4 million-unit seasonally adjusted annual rate in November, leading to the first 3-month streak of 18 million-plus results. The forecasted SAAR would be the highest monthly outcome since July 2005’s 20.6-million.From J.D. Power: U.S Auto Sales Projected to Increase 7% in November

otal and retail new light-vehicle sales in November are expected to increase 7% on a selling-day-adjusted basis, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.Another strong month for car sales. The only question is if the sales rate will be over 18 million for three consecutive months - for the first time ever.

Despite a couple of calendar curveballs—November has only four selling weekends for the first time since 2012 and has the fewest selling days (23) of any month since September 2013—the industry continues to show strength, with retail light-vehicle sales approaching 1.1 million units and total light-vehicle sales nearing 1.3 million units this month. [17.7 million SAAR]

emphasis added

Thursday, November 26, 2015

Something I'm very thankful for ...

by Calculated Risk on 11/26/2015 10:26:00 AM

A&E has a new reality show "illustrating the every day lives of individuals with Down Syndrome" that starts on December 9th. The show is called Born This Way!

One of the cast members is Steven Clark, the son of my college roommate.

I'm biased but I think Steven will be the star of show. He is an awesome and loving young man.

For a preview of the show, see the clip below (Steven is shown several times including in the final shot).

I'm thankful for knowing Steven. I'm thankful he has such incredible parents. And I'm thankful that he has this opportunity on A&E.

Happy Thanksgiving to all!

Wednesday, November 25, 2015

2016: Updated Housing Forecasts

by Calculated Risk on 11/25/2015 07:20:00 PM

Towards the end of each year I collect some housing forecasts for the following year, and it looks like analysts are optimistic for 2016 (many more forecasts will be added).

First a review of the previous three years ...

Here is a summary of forecasts for 2015. In 2015, new home sales will probably be just over 500 thousand, and total housing starts will be something over 1.1 million. It is early, but CoreLogic, Zillow and the MBA were very close on New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all close on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows a few forecasts for 2016 (I'll add many more of the next several weeks).

From Fannie Mae: Housing Forecast: October 2015

From NAHB: Housing Recovery to Pick Up Steam in 2016, but Challenges Remain

UCLA Ziman Center.

Note: For comparison, new home sales in 2015 will probably be just over 500 thousand, and total housing starts over 1.1 million.

I haven't worked up a forecast yet for 2016, however I think the UCLA forecast for housing starts is too high.

| Housing Forecasts for 2016 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 562 | 827 | 1,224 | 4.9%2 |

| Merrill Lynch | 555 | 1,275 | 3.0% | |

| MetroStudy | 625 | 820 | 1,235 | 3.1% |

| NAHB | 914 | 1,292 | ||

| UCLA Ziman Center | 1,420 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index | ||||

Philly Fed: State Coincident Indexes increased in 43 states in October

by Calculated Risk on 11/25/2015 03:31:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2015. In the past month, the indexes increased in 43 states, decreased in six, and remained stable in one, for a one-month diffusion index of 74. Over the past three months, the indexes increased in 42 states, decreased in seven, and remained stable in one, for a three-month diffusion index of 70.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In October, 44 states had increasing activity (including minor increases).

The worst performing states over the last 6 months are Wisconsin and North Dakota (oil).

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now. Source: Philly Fed.

Comments on October New Home Sales

by Calculated Risk on 11/25/2015 01:11:00 PM

The new home sales report for October was slightly below expectations, however sales for July, August and September were revised down. Sales were up 4.9% year-over-year in October (SA).

Earlier: New Home Sales increased to 495,000 Annual Rate in October.

Even though the October report was somewhat disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through October, were 430,000, not seasonally adjusted (NSA). That is up 15.7% from 371,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for 2015 through October.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain was small in October, and I expect the year-over-year increases to be lower over the last two months of 2015 compared to earlier this year - but the overall year-over-year gain should be solid in 2015.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 495,000 Annual Rate in October

by Calculated Risk on 11/25/2015 10:12:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 495 thousand.

The previous three months were revised down by a total of 40 thousand (SAAR).

"SSales of new single-family houses in October 2015 were at a seasonally adjusted annual rate of 495,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.7 percent (±17.7%)* above the revised September rate of 447,000 and is 4.9 percent (±17.6%)* above the October 2014 estimate of 472,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in October to 5.5 months.

The months of supply decreased in October to 5.5 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

" The seasonally adjusted estimate of new houses for sale at the end of October was 226,000. This represents a supply of 5.5 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

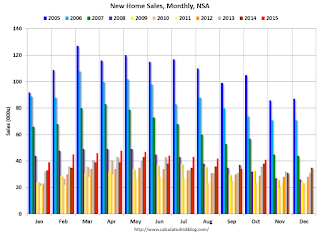

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2015 (red column), 41 thousand new homes were sold (NSA). Last year 38 thousand homes were sold in October.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2011.

This was close to expectations of 499,000 sales SAAR in October, however prior months were revised down - a somewhat disappointing report. I'll have more later today.

Personal Income increased 0.4% in October, Spending increased 0.1%

by Calculated Risk on 11/25/2015 08:50:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $68.1 billion, or 0.4 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $15.2 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in October, the same increase as in September. ... The price index for PCE increased 0.1 percent in October, in contrast to a decrease of 0.1 percent in September. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared to an increase of 0.2 percent.

The October price index for PCE increased 0.2 percent from October a year ago. The October PCE price index, excluding food and energy, increased 1.3 percent from October a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at consensus expectations. And the increase in PCE was below the consensus.

On inflation: The PCE price index increased 0.2 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.3 percent year-over-year in October.

Weekly Initial Unemployment Claims declined to 260,000

by Calculated Risk on 11/25/2015 08:38:00 AM

The DOL reported:

In the week ending November 21, the advance figure for seasonally adjusted initial claims was 260,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 271,000 to 272,000. The 4-week moving average was 271,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 270,750 to 271,000.The previous week was revised up to 272,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 271,000.

This was below the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Purchase Applications up 24% YoY

by Calculated Risk on 11/25/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 3.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 20, 2015. The previous week’s results included an adjustment for the Veteran’s Day holiday.

...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 24 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.14 percent from 4.18 percent, with points increasing to 0.49 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 24% higher than a year ago.