by Calculated Risk on 10/05/2015 04:44:00 PM

Monday, October 05, 2015

Update: Prime Working-Age Population Growing Again

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2015.

The prime working age population peaked in 2007, and bottomed at the end of 2012. The prime working age population is almost back to the previous peak (this is population and has nothing to do cyclical weakness - this is just demographics).

The good news is the prime working age group is now growing at 0.5% per year - and this should boost economic activity a little going forward.

Note: There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s! So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

Black Knight August Mortgage Monitor

by Calculated Risk on 10/05/2015 02:36:00 PM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for August today. According to BKFS, 4.83% of mortgages were delinquent in August, down from 4.71% in July. BKFS reported that 1.37% of mortgages were in the foreclosure process, down from 1.80% in August 2014.

This gives a total of 6.20% delinquent or in foreclosure. It breaks down as:

• 1,582,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 865,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 696,000 loans in foreclosure process.

For a total of 3,142,000 loans delinquent or in foreclosure in August. This is down from 3,908,000 in August 2014.

Press Release: Black Knight’s August Mortgage Monitor: Cash-Out Refinances Up 68 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of August 2015. ... As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, borrowers have been capitalizing on increased equity available in their homes and still historically low rates.

“In the second quarter of 2015, we saw cash-out refinance volumes rise almost 70 percent from the same period last year,” said Graboske. “While this is the highest volume in cash-out refinances we’ve seen in five years, it’s still nearly 80 percent below the peak in Q3 2005. Even so, it’s clear that borrowers have been capitalizing on the increased equity available to them. As we reported in last month’s Mortgage Monitor, total equity of mortgage holders has risen by about $1 trillion over the last year, and ‘tappable’ equity stands at $4.5 trillion. Borrowers today are pulling out an average of $67,000 of equity through cash-out refis, nearly the levels we saw back in 2006. What’s really interesting though, is that even after pulling out that equity, resulting average LTVs are at 68 percent, the lowest level we’ve seen in over 10 years. During this same time span, we’ve seen second lien HELOC lending rise, albeit at a lesser rate; that volume is up 40 percent from last year. However, as interest rates rise, we could see an increase in HELOC lending and corresponding slowing in first lien cash-out refis, as borrowers will likely want to hang on to lower rates for their first mortgage while still being able to tap available equity.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows average cash out and the resulting LTV. Cash outs are up, but the LTVs are still very low.

From Black Knight:

Borrowers today are pulling out an average of $67,000 of equity through cash-out refinances, nearly at the levels seen back in 2006There is much more in the mortgage monitor.

Even after pulling out equity, resulting average LTVs are at 68 percent, the lowest level in over 10 years

Less than 10 percent of all cash-out refinances have LTVs above 80 percent, also at the lowest level in over 10 years.

Nearly 60 percent of cash-out refinance volume is coming from borrowers with UPBs below $200K

Reis: Mall Vacancy Rate unchanged in Q3

by Calculated Risk on 10/05/2015 11:36:00 AM

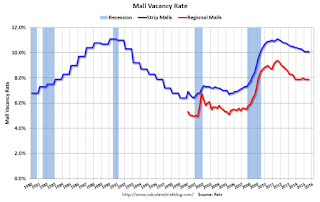

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q3 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate for neighborhood and community shopping centers was unchanged during the third quarter at 10.1%. The market is mired in this incredibly slow recovery whereby net absorption exceeds new supply, but not by a wide enough margin to cause vacancy to decline in a meaningful fashion. The vacancy rate for malls also was unchanged again at 7.9%, indicating that this issue is not just confined to one retail subsector.

So where is the demand? To be sure, the market is absorbing space, but not at the pace one would have hoped at this juncture in the cycle. A few things have transpired. First, space in the best centers leased up relatively quickly during this recovery and is largely gone. What remains to be leased is space that is a bit more challenging. Second, ecommerce, though not the leviathan that it is often portrayed to be, is not helping. Many services that people purchase online, such as apps, simply are not available for purchase in a physical store. Ecommerce slowly takes market share away from bricks‐and‐mortar buildings with every passing quarter. Third, the rise of different retail subtypes such as town centers, lifestyle centers, and power centers has given consumers options that they previously did not have. Does that mean we should expect structurally higher vacancy rates for the traditional retail subtypes? Likely yes. Those property subtypes are not likely to reach the same low vacancy rates during this cycle that they have attained in previous cycles. Although retail sales and demand for goods and services continues to increase, it is now spread through many more distribution channels than in the past.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

ISM Non-Manufacturing Index decreased to 56.9% in September

by Calculated Risk on 10/05/2015 10:04:00 AM

The September ISM Non-manufacturing index was at 56.9%, down from 59.0% in August. The employment index increased in September to 58.3%, up from 56.0% in August. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: September 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the 68th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.9 percent in September, 2.1 percentage points lower than the August reading of 59 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 60.2 percent, which is 3.7 percentage points lower than the August reading of 63.9 percent, reflecting growth for the 74th consecutive month at a slower rate. The New Orders Index registered 56.7 percent, 6.7 percentage points lower than the reading of 63.4 percent in August. The Employment Index increased 2.3 percentage points to 58.3 percent from the August reading of 56 percent and indicates growth for the 19th consecutive month. The Prices Index decreased 2.4 percentage points from the August reading of 50.8 percent to 48.4 percent, indicating prices decreased in September for the first time since February of this year. According to the NMI®, 13 non-manufacturing industries reported growth in September. There has been a cooling off in the rate of growth during the month of September. Also, the trend of lower costs and little pricing power continues as reflected in the contraction of the pricing index. Overall, respondents continue to remain positive about current business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 57.7% and suggests slower expansion in September than in August. Still a solid report.

Sunday, October 04, 2015

Sunday Night Futures

by Calculated Risk on 10/04/2015 08:17:00 PM

Reading articles this weekend on the payroll report, I'm reminded of a sentence I wrote back in March: Why the Prime Labor Force Participation Rate has Declined

"Complaining about the decline in the overall labor force participation rate is the last refuge of scoundrels."Still true.

Weekend:

• Schedule for Week of October 4, 2015

Monday:

• Early: Reis Q3 2015 Mall Survey of rents and vacancy rates.

• At 10:00 AM, the Fed will release the monthly Labor Market Conditions Index (LMCI).

• Also at 10:00 AM ET, the ISM non-Manufacturing Index for September. The consensus is for index to decrease to 57.7 from 59.0 in August.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 2 and DOW futures are down 14 (fair value).

Oil prices were down slightly over the last week with WTI futures at $45.29 per barrel and Brent at $47.85 per barrel. A year ago, WTI was at $90, and Brent was at $91 - so prices are down about 50% year-over-year (It was a year ago that prices started falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.29 per gallon (down about $1.00 per gallon from a year ago).

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 10/04/2015 01:11:00 PM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• September Employment Report: 142,000 Jobs, 5.1% Unemployment Rate

• Employment Report Comments and more Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and the "less than 5 weeks", "6 to 14 weeks" and "15 to 26 weeks" are all close to normal levels.

The long term unemployed is close to 1.3% of the labor force, however the number (and percent) of long term unemployed remains elevated.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 964 thousand.

Construction employment is still far below the bubble peak - and below the level in the late '90s.

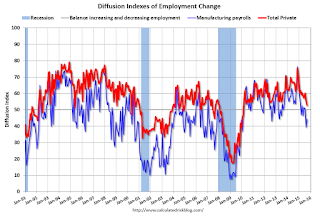

The BLS diffusion index for total private employment was at 52.9 in September, down from 55.5 in August.

The BLS diffusion index for total private employment was at 52.9 in September, down from 55.5 in August.For manufacturing, the diffusion index was at 44.4, up from 39.4 in August.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was not very widespread in September.

Saturday, October 03, 2015

Schedule for Week of October 4, 2015

by Calculated Risk on 10/03/2015 08:11:00 AM

This will be light week for economic data.

Early: Reis Q3 2015 Mall Survey of rents and vacancy rates.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: the ISM non-Manufacturing Index for September. The consensus is for index to decrease to 57.7 from 59.0 in August.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $48.6 billion in August from $41.9 billion in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for an increase of $20.5 billion in credit.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 271 thousand initial claims, down from 275 thousand the previous week.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of September 16-17, 2015

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.1% increase in inventories.

Friday, October 02, 2015

Bank Failures by Year

by Calculated Risk on 10/02/2015 08:33:00 PM

First, a second failure today from the FDIC that makes eight in 2015: Twin City Bank, Longview, Washington, Assumes All of the Deposits of Hometown National Bank, Longview, Washington

As of June 30, 2015, Hometown National Bank had approximately $4.9 million in total assets and $4.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.6 million. ... Hometown National Bank is the eighth FDIC-insured institution to fail in the nation this year, and the first in Washington.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year, so the 8 failures this year is close to normal.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. A large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s, the recent financial crisis was much worse (large banks failed and were bailed out).

The second graph includes pre-FDIC failures. In a typical year - before the Depression - 500 banks would fail and the depositors would lose a large portion of their savings.

The second graph includes pre-FDIC failures. In a typical year - before the Depression - 500 banks would fail and the depositors would lose a large portion of their savings.Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Bank Failure #7 in 2015: Bank of Georgia, Peachtree City, Georgia

by Calculated Risk on 10/02/2015 05:43:00 PM

It has been some time since a bank failed ...

From the FDIC: Fidelity Bank, Atlanta, Georgia, Assumes All of the Deposits of the Bank of Georgia, Peachtree City, Georgia

As of June 30, 2015, The Bank of Georgia had approximately $294.2 million in total assets and $280.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.2 million. ... The Bank of Georgia is the seventh FDIC-insured institution to fail in the nation this year, and the second in Georgia.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 10/02/2015 04:12:00 PM

By request, here is another update of an earlier post through the September employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,9261 |

| 132 months into 2nd term: 10,389 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Thirty two months into Mr. Obama's second term, there are now 8,944,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 550,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 1521 |

| 132 months into 2nd term, 228 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 118 thousand public sector jobs have been added during the first thirty one months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 10% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,926 | 152 | 7,078 | |

| Pace2 | 10,389 | 183 | 10,617 | |

| 132 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 247 | 281 | ||

| #2 | 197 | 265 | ||

| #3 | 152 | 232 | ||