by Calculated Risk on 8/24/2015 01:47:00 PM

Monday, August 24, 2015

Catching Up: Housing Starts increased to 1.206 Million Annual Rate in July

While I was on vacation, there were several major economic releases. I'm catching up ...

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,206,000. This is 0.2 percent above the revised June estimate of 1,204,000 and is 10.1 percent above the July 2014 rate of 1,095,000.

Single-family housing starts in July were at a rate of 782,000; this is 12.8 percent above the revised June figure of 693,000. The July rate for units in buildings with five units or more was 413,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,119,000. This is 16.3 percent below the revised June rate of 1,337,000, but is 7.5 percent above the July 2014 estimate of 1,041,000.

Single-family authorizations in July were at a rate of 679,000; this is 1.9 percent below the revised June figure of 692,000. Authorizations of units in buildings with five units or more were at a rate of 412,000 in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July. Multi-family starts were down slightly year-over-year.

Single-family starts (blue) increased in July and are up about 19% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),Total housing starts in July were above expectations, and, including the upward revisions to May and June, starts were solid - especially single family starts.

This third graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 11.3% ahead of 2014 through July.

Even with weak housing starts in February and March, total starts are still running 11.3% ahead of 2014 through July.Single family starts are running 11.2% ahead of 2014 through July.

Starts for 5+ units are up 12.2% for the first six months compared to last year.

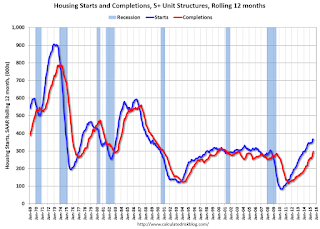

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked - although I expect solid multi-family starts for a few more years (based on demographics).

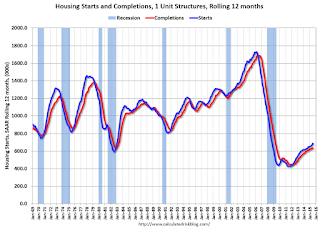

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong report, especially for single family starts.

Black Knight: House Price Index up 0.9% in June, 5.1% year-over-year

by Calculated Risk on 8/24/2015 11:14:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.9 Percent for the Month; Up 5.1 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Home Price Index (HPI) report, based on June 2015 residential real estate transactions. The Black Knight HPI combines the company's extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 0.9% percent in June, and is off 5.8% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month’s home price trends, including detailed looks at the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report.

The year-over-year increase in the index has been about the same for the last nine months.

The report has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 38.5% from the peak in Las Vegas, off 31.5% in Orlando, and 27.9% off from the peak in Riverside-San Bernardino, CA (Inland Empire).

Note: Case-Shiller for June will be released tomorrow.

Chicago Fed: Index shows "Economic growth picked up in July"

by Calculated Risk on 8/24/2015 09:55:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in July

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.34 in July from –0.07 in June. Two of the four broad categories of indicators that make up the index increased from June, and three of the four categories made positive contributions to the index in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged up to a neutral reading in July from –0.08 in June. July’s CFNAI-MA3 suggests that growth in national economic activity was at its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Black Knight's First Look at July: Foreclosure Inventory at Lowest Level Since 2007

by Calculated Risk on 8/24/2015 07:01:00 AM

From Black Knight: Black Knight Financial Services' First Look at July Mortgage Data: Foreclosure Inventory Down 24 Percent Year-Over-Year; Lowest Level Since 2007

According to Black Knight's First Look report for July, the percent of loans delinquent decreased 2% in July compared to June, and declined 16.5% year-over-year.

The percent of loans in the foreclosure process declined 4% in July and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.71% in July, down from 4.82% in June.

The percent of loans in the foreclosure process declined in July to 1.40%. This was the lowest level of foreclosure inventory since 2007.

The number of delinquent properties, but not in foreclosure, is down 460,000 properties year-over-year, and the number of properties in the foreclosure process is down 224,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for July in early September.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2015 | June 2015 | July 2014 | July 2013 | |

| Delinquent | 4.71% | 4.82% | 5.64% | 6.41% |

| In Foreclosure | 1.40% | 1.46% | 1.85% | 2.82% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,503,000 | 1,549,000 | 1,713000 | 1,846,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 886,000 | 895,000 | 1,136,000 | 1,347,000 |

| Number of properties in foreclosure pre-sale inventory: | 711,000 | 739,000 | 935,000 | 1,406,000 |

| Total Properties | 3,100,000 | 3,183,000 | 3,785,000 | 4,599,000 |

Sunday, August 23, 2015

Sunday Night Futures

by Calculated Risk on 8/23/2015 11:32:00 PM

I take a one week vacation, and the market turns ugly. Oh well ...

From the WSJ: Refinery Woes Stall Gasoline Price Drops

U.S. oil prices briefly dropped below $40 a barrel on Friday—hitting a six-year low that adds to pressure on pump prices for Labor Day road trips. But cheap gasoline isn’t a sure bet everywhere.Weekend:

Even as most drivers around the country are spending 25% less on fuel than they did a year ago, California drivers have missed out on the gasoline price windfall because of refinery outages. ... Production woes are spreading to other parts of the country, including the Midwest. ...

“Gas prices are not as low as they should be because of unexpected problems at major refineries and strong demand from drivers,” said Michael Green, a AAA spokesman. The group says the nationwide average could fall to $2 a gallon this year, but only if there are no more production hiccups.

• Schedule for Week of August 23, 2015

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 46 and DOW futures are down 400 (fair value).

Oil prices were down over the last week with WTI futures at $39.43 per barrel and Brent at $44.52 per barrel. A year ago, WTI was at $94, and Brent was at $100 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.60 per gallon (down about $0.84 per gallon from a year ago). Gasoline prices should follow oil prices down - once the refinery issues are resolved.

Schedule for Week of August 23, 2015

by Calculated Risk on 8/23/2015 07:29:00 PM

I'm back from vacation and starting to catch up!

The key reports this week are July New Home sales on Tuesday, the second estimate of Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June prices.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the May 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.2% year-over-year increase in the Comp 20 index for June. The Zillow forecast is for the National Index to increase 4.3% year-over-year in June.

9:00 AM: FHFA House Price Index for June 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an increase in sales to 516 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 482 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.4% decrease in durable goods orders.

All day: the Kansas City Fed Hosts Symposium in Jackson Hole, Wyoming (Thursday, Friday, and Saturday).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 277 thousand the previous week.

8:30 AM: Gross Domestic Product, 2nd quarter 2015 (second estimate). The consensus is that real GDP increased 3.2% annualized in Q2, revised up from 2.3% in the advance estimate.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 1.0% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM ET: Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 93.3, up from the preliminary reading of 92.9.

Saturday, August 22, 2015

On Recession Calls

by Calculated Risk on 8/22/2015 09:41:00 AM

Note: CR is on vacation, and I will return on Sunday, August 23rd.

No one is perfect, although in January 2007 I did forecast a recession starting in 2007. And I was able to call the bottom in 2009.

Here are some recent posts on recessions:

From January 2015: Predicting the Next Recession

Recently there has been some discussion of a recession in 2015. That seems very unlikely to me - I'm not even on "recession watch".From March 2013: Business Cycles and Markets

I've been asked several times about the recent ECRI recession call (obviously I disagreed with their incorrect recession call in 2011 - I wasn't even on recession watch then and I'm not on recession watch now - and I also think ECRI is wrong about a recession starting in mid-2012). ...Note: From June 2015: ECRI Admits Incorrect Recession Call

It seems to me ECRI is trying to make this an academic exercise and hoping for some significant downward revisions. Right now the data doesn't indicate a recession in 2012, but, as Menzie Chinn notes, "all of these series will be revised, so one wouldn’t want to state definitively we are not in a recession – therein lies the path to embarrassment. But the case still has to be made for recession."

But why do we care? ...

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment.

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

...

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

CR Note: I will be returning tomorrow (unless I change my mind), and I should start posting Sunday evening or Monday morning. Best to all!

Friday, August 21, 2015

2012: Calling the House Price Bottom

by Calculated Risk on 8/21/2015 09:21:00 AM

Note: CR is on vacation, and I will return on Sunday, August 23rd.

In 2005 and 2006, I was researching previous housing bubble / busts to try to predict what would happen following the bursting of the housing bubble.

So, in April 2008, when many pundits were calling the housing bottom, I wrote: Housing Bust Duration

After another year (or two) of rapidly falling prices, it's very likely that real prices will continue to fall - but at a slower pace. During the last few years of the bust, real prices will be flat or decline slowly - and the conventional wisdom will be that homes are a poor investment.And then in February 2012 I wrote: The Housing Bottom is Here

The Los Angeles bust took 86 months in real terms from peak to trough (about 7 years) using the Case-Shiller index. If the Composite 20 bust takes a similar amount of time, the real price bottom will happen in early 2013 or so.

There are several reasons I think that house prices are close to a bottom. First prices are close to normal looking at the price-to-rent ratio and real prices (especially if prices fall another 4% to 5% NSA between the November Case-Shiller report and the March report). Second the large decline in listed inventory means less downward pressure on house prices, and third, I think that several policy initiatives will lessen the pressure from distressed sales (the probable mortgage settlement, the HARP refinance program, and more).And in March 2013, I wrote about the two bottoms - one for activity and the other for prices: Housing: The Two Bottoms

I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

...

[I]t appears activity bottomed in 2009 through 2011 (depending on the measure) and house prices bottomed in early 2012.

Thursday, August 20, 2015

2009: Calling the Bottom for the Economy

by Calculated Risk on 8/20/2015 09:27:00 AM

Note: CR is on vacation, and I will return on Sunday, August 23rd.

In early 2009, many analysts were predicting the 2nd Great Depression. However I started seeing some positive signs ... and I was able to call the end of the recession in mid-2009.

From January 2009: Vehicle Sales

David Rosenberg at Merrill Lynch wrote a research piece last week: "Not Your Father’s Recession ...(But Maybe Your Grandfather’s)" (no link)And from February 2009: Looking for the Sun

Needless to say, the piece wasn't too upbeat.

But I was intrigued by some of the comments on vehicle sales.

...

Currently this ratio is at 23.9 years, the highest ever. This is an unsustainable level (I doubt most vehicles will last 24 years!), and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of a sales increase.

...

Sales won't increase right away (look at the depressed sales during the early '80s), but this does suggest that auto sales are closer to the bottom than the top, and that auto sales will increase significantly in the future - although sales in 2009 will probably be dismal.

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.CR Note: I do not have a crystal ball, but I was looking past the horrible day-to-day numbers and starting to see the end of the recession.

...

Even though most of the economic news will be ugly in 2009, my guess is all three of these series will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

Wednesday, August 19, 2015

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 8/19/2015 09:01:00 PM

NOTE: CR is on vacation this week and will return on Sunday, August 23rd.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released.

• At 10:00 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 7.0, up from 5.7.

• Also at 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). Sales in June were at a 5.49 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.64 million SAAR. The consensus is for 5.41 million SAAR, down from 5.49 million in June.

Take the over on existing home sales!