by Calculated Risk on 12/23/2014 10:21:00 AM

Tuesday, December 23, 2014

Personal Income increased 0.4% in November, Spending increased 0.6%

The BEA released the Personal Income and Outlays report for November:

Personal income increased $54.4 billion, or 0.4 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $67.9 billion, or 0.6 percent.The following graph shows real Personal Consumption Expenditures (PCE) through November 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.7 percent in November, compared with an increase of 0.2 percent in October. ... The price index for PCE decreased 0.2 percent in November, in contrast to an increase of less than 0.1 percent in October. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared within an increase of 0.2 percent. ... The November price index for PCE increased 1.2 percent from November a year ago. The November PCE price index, excluding food and energy, increased 1.4 percent from November a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 4.3% annual rate in Q4 2014 (using the mid-month method, PCE was increasing 4.5%). It looks like Q4 will be a strong quarter for PCE growth - revise up those Q4 GDP forecasts!

New Home Sales at 438,000 Annual Rate in November

by Calculated Risk on 12/23/2014 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 438 thousand.

October sales were revised down from 458 thousand to 445 thousand, and September sales were unchanged at 455 thousand.

"Sales of new single-family houses in November 2014 were at a seasonally adjusted annual rate of 438,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.6 percent below the revised October rate of 445,000 and is 1.6 percent below the November 2013 estimate of 445,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in November to 5.8 months from 5.7 months in October.

The months of supply increased in November to 5.8 months from 5.7 months in October. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 213,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

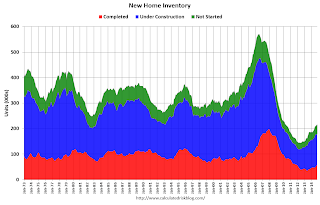

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2014 (red column), 31 thousand new homes were sold (NSA). Last year 32 thousand homes were sold in Novembe.

The high for November was 86 thousand in 2005, and the low for November was 20 thousand in 2010.

This was below expectations of 460,000 sales in November, and there were downward revisions to sales in August and October. Another weak report.

I'll have more later today.

Q3 GDP Revised Up to 5.0%

by Calculated Risk on 12/23/2014 08:34:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2014 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 5.0 percent in the third quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.Here is a Comparison of Third and Second Estimates. PCE was revised up from 2.2% to 3.2%, and private investment was revised up. A very strong report.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.9 percent. With the third estimate for the third quarter, both personal consumption expenditures (PCE) and nonresidential fixed investment increased more than previously estimated

Monday, December 22, 2014

Tuesday: New Home Sales, Personal Income and Outlays, GDP, and much more

by Calculated Risk on 12/22/2014 07:56:00 PM

First, from Tim Duy: Fed Watch: Looking Backward to See the Future

[In 20004] Patient" lasted for two meetings before being replaced by "measured." This is fairly consistent with my expectations. My baseline scenario is that the Fed drops "considerable" entirely in January, retains "patient" in March, drops "patient" in April, and raise rates in June.Tuesday:

...

Bottom Line: Assuming the data holds, maybe history will repeat itself.

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.9% increase in durable goods orders.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2014 (third estimate). The consensus is that real GDP increased 4.3% annualized in Q3, revised up from the second estimate of 3.9%.

• At 9:00 AM, FHFA House Price Index for October 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.2% increase.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 93.0, down from the preliminary reading of 93.8, and up from the November reading of 88.8.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 458 thousand in October.

• Also at 10:00 AM, Personal Income and Outlays for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

Philly Fed: State Coincident Indexes increased in 44 states in November

by Calculated Risk on 12/22/2014 03:41:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2014. In the past month, the indexes increased in 44 states, decreased in two, and remained stable in four, for a one-month diffusion index of 84. Over the past three months, the indexes increased in 48 states and decreased in two, for a three-month diffusion index of 92.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 47 states had increasing activity (including minor increases). This measure declined sharply during the winter, but is close to normal for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again. In will be interesting to see if several oil producing states - such as Texas, North Dakota, Alaska and Oklahoma - turn read in 2015.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again. In will be interesting to see if several oil producing states - such as Texas, North Dakota, Alaska and Oklahoma - turn read in 2015.

A Few Comments on November Existing Home Sales

by Calculated Risk on 12/22/2014 12:41:00 PM

• Once again housing economist Tom Lawler's forecast of 4.90 million SAAR was closer than the consensus (5.20 million) to the NAR reported sales (4.93 million).

• The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 2.0% year-over-year in November. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data. Also it isn't always clear what is included in "inventory" (some areas report "active" listings, others all listings including pending short sales). Also, some sources are reporting more inventory, as an example, Zillow's data shows inventory was up 12% year-over-year in November. That is a big difference!

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 9.1% from the bottom. On a seasonally adjusted basis, inventory was down 2.5% in November compared to October.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

And another key point: The NAR reported total sales were up 2.1% from November 2013, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales – foreclosures and short sales – were unchanged in November from October (9 percent) and remained in the single digits for the fourth month this year; they were 14 percent a year ago. Six percent of November sales were foreclosures and 3 percent were short sales.Last year in November the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in November 2013 were reported at 4.83 million SAAR with 14% distressed. That gives 676 thousand distressed (annual rate), and 4.15 million equity / non-distressed. In November 2014, sales were 4.93 million SAAR, with 9% distressed. That gives 444 thousand distressed - a decline of about 34% from November 2013 - and 4.49 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 8%..

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in November (red column) were below the levels for November in 2012 and 2013.

Earlier:

• Existing Home Sales in November: 4.93 million SAAR, Inventory up 2.0% Year-over-year

Existing Home Sales in November: 4.93 million SAAR, Inventory up 2.0% Year-over-year

by Calculated Risk on 12/22/2014 10:00:00 AM

The NAR reports: Existing-Home Sales Lose Momentum in November as Inventory Slightly Tightens

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 6.1 percent to a seasonally adjusted annual rate of 4.93 million in November from a downwardly-revised 5.25 million in October. Sales dropped to their lowest annual pace since May (4.91 million) but are above year-over-year levels (up 2.1 percent from last November) for the second straight month. ...

Total housing inventory at the end of November fell 6.7 percent to 2.09 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace – unchanged from last month. Despite the tightening in supply, unsold inventory remains 2.0 percent higher than a year ago, when there were 2.05 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (4.93 million SAAR) were 6.1% lower than last month, and were 2.1% above the November 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.09 million in November from 2.24 million in October. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.09 million in November from 2.24 million in October. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 2.0% year-over-year in November compared to November 2013.

Inventory increased 2.0% year-over-year in November compared to November 2013. Months of supply was at 5.1 months in November.

This was below expectations of sales of 5.20 million (but you were warned). For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Chicago Fed: Index shows "Economic Growth Accelerated" in November

by Calculated Risk on 12/22/2014 08:38:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth accelerated in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.73 in November from +0.31 in October. Two of the four broad categories of indicators that make up the index increased from October, and only one of the four categories made a negative contribution to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, rose to +0.48 in November from +0.09 in October, reaching its highest level since May 2010. November’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests modest inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, December 21, 2014

Monday: Existing Home Sales

by Calculated Risk on 12/21/2014 07:01:00 PM

From James Hamilton at Econbrowser: Do falling oil prices raise the threat of deflation?

If gasoline prices stay where they are and if we buy the same number of gallons of gasoline this year as last, that leaves us with an additional $160 billion to spend over the course of the year on other items. If we restate the total savings for U.S. consumers and businesses in terms of the 116 million U.S. households, that works out to almost $1400 per household.Monday:

It’s a particularly big deal for the lower-income households, who spend a much higher fraction of their income on energy.

Historically consumers have responded to windfalls like this by becoming more open to the big-ticket purchases that play a huge role in cyclical economic swings.

• At 8:30 AM ET, the Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 10:00 AM, the Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.20 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.26 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

Weekend:

• Schedule for Week of December 21st

• Existing Home Sales: A Likely "Miss"

From CNBC: Pre-Market Data and Bloomberg futures.

Oil prices were up over the last week with WTI futures at $57.13 per barrel and Brent at $61.38 per barrel. A year ago, WTI was at $99, and Brent was at $111 - so prices are down 42% and 45% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.41 per gallon (down about 80 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Katie Couric and the Net Petroleum Exporter Myth

by Calculated Risk on 12/21/2014 09:59:00 AM

To understand what the general public is hearing about oil, I watched a Yahoo video yesterday with Katie Couric explaining the decline in oil prices.

In general the piece was very good. Couric started by explaining that the decline in oil prices could be explained in two words: Supply and Demand. She discussed reasons for more supply and softening demand.

Note: from Professor Hamilton "[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy."

I'd add to the discussion that the short run supply and demand curves are both very steep for oil, so small changes in supply and / or demand can cause a large change in price (see A Comment on Oil Prices).

But then Couric mentioned a myth I've heard several times recently. She said:

In fact, [the U.S.] is now the world’s largest producer of petroleum, and for the last two years, it has been selling more to other countries than it’s been buying. Who knew?"Who knew?" No one, because it is not true. Yes, the U.S. is the largest producer this year (ahead of Saudi Arabia and Russia), but the U.S. is NOT "selling more to other countries than it's been buying".

The source of this error is that the U.S. is a net exporter of refined petroleum products, such as refined gasoline. Here is the EIA data on Weekly Imports & Exports of crude oil and petroleum products. The U.S. is importing around 9 million barrels per day of crude oil and products, and exporting around 4 million per day (mostly refined products). The U.S. is a large net importer!

Note: Here is some data on natural gas (the U.S. is net importer).

Another data source is the monthly trade balance report from the Department of Commerce that shows about a net petroleum trade deficit of about $15 to $20 billion per month this year. The good news is the petroleum contribution to the trade deficit has been declining, but it is still very large.

Couric was correct about supply and demand, but it is important to note the U.S. is still a large importer of oil.