by Calculated Risk on 12/20/2014 04:51:00 PM

Saturday, December 20, 2014

Existing Home Sales: A Likely "Miss"

The NAR will report November Existing Home Sales on Monday, December 22nd. The consensus is the NAR will report sales at 5.20 million seasonally adjusted annual rate (SAAR), however economist Tom Lawler estimates the NAR will report sales of 4.90 million on a SAAR basis.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 4 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last four years, the consensus average miss was 150 thousand with a standard deviation of 160 thousand. Lawler's average miss was 70 thousand with a standard deviation of 45 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has been doing a little better recently! Looking at the consensus for November, maybe some of the analysts took an early vacation this week.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | --- |

| 1NAR initially reported before revisions. | |||

Schedule for Week of December 21st

by Calculated Risk on 12/20/2014 12:19:00 PM

The key reports this week are November Existing Home Sales on Monday, November Personal Income and Outlays on Tuesday, November New Home Sales on Tuesday, and the third estimate of Q3 GDP also on Tuesday.

Merry Christmas and Happy Holidays to All!

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.20 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.26 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.9% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (third estimate). The consensus is that real GDP increased 4.3% annualized in Q3, revised up from the second estimate of 3.9%.

9:00 AM: FHFA House Price Index for October 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.2% increase.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 93.0, down from the preliminary reading of 93.8, and up from the November reading of 88.8.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 458 thousand in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 289 thousand.

The NYSE and the NASDAQ will close at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

No economic releases scheduled.

Unofficial Problem Bank list declines to 401 Institutions

by Calculated Risk on 12/20/2014 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 19, 2014.

Changes and comments from surferdude808:

The OCC released an update on its latest enforcement action activity that contributed to many changes to the Unofficial Problem Bank List this week. Also, the FDIC closed a bank this Friday in what will likely will be the last closure of the year. In all, there were nine removals and four additions that leave the list with 401 institutions with assets of $125.1 billion. A year ago, the list held 633 institutions with assets of $216.7 billion. Assets on the list increased by $1.2 billion this week and one would have to go all the way back about two years to the week ending November 16, 2012 for a similar increase in assets.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 401.

Actions were terminated against The First National Bank of Layton, Layton, UT ($276 million); Stephens Federal Bank, Toccoa, GA ($147 million); First Federal Savings and Loan Association of Independence, Independence, KS ($137 million Ticker: FFSL); First Federal Bank, A FSB, Tuscaloosa, AL ($128 million); First National Community Bank, Chatsworth, GA ($124 million); Community Federal Savings Bank, Woodhaven, NY ($123 million); The Citizens National Bank of Meyersdale, Meyersdale, PA ($76 million); and Port Byron State Bank, Port Byron, IL ($75 million).

The FDIC shuttered Northern Star Bank, Mankato, MN ($19 million) today making it the 18th failure this year. A total of 23 institutions headquartered in Minnesota have failed since the on-set of the Great Recession, which ranks fifth after Georgia (88), Florida (71), Illinois (61), and California (40).

Additions this week were CertusBank, National Association, Easley, SC ($1.5 billion); Bank of Manhattan, N.A., El Segundo, CA ($496 million Ticker: MNHN); Solera National Bank, Lakewood, CO ($148 million Ticker: SLRK); and First Scottsdale Bank, National Association, Scottsdale, AZ ($95 million).

Next week we anticipate the FDIC will release an update on its enforcement action activity.

Friday, December 19, 2014

ATA Trucking Index increased 3.5% in November

by Calculated Risk on 12/19/2014 07:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Surged 3.5% in November

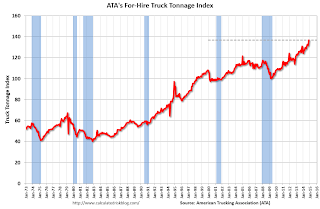

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 3.5% in November, following an increase of 0.5% during the previous month. In November, the index equaled 136.8 (2000=100), which was the highest level on record.

Compared with November 2013, the SA index increased 4.4%, down slightly from October’s 4.5% increase but still was the second highest year-over-year gain in 2014. Year-to-date, compared with the same period last year, tonnage is up 3.3%. ...

“With strong readings for both retail sales and factory output in November, I’m not surprised that tonnage increased as well,” said ATA Chief Economist Bob Costello. “However, the strength in tonnage did surprise to the upside.”

“The index has increased in four of the last five months for a total gain of 6.4%,” Costello said. “Clearly, the economy is doing well with tonnage on such a robust trend-line.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.4% year-over-year.

Lawler Update: Read on November Existing Home Sales, Distressed Sales and Cash buyers for Selected Cities

by Calculated Risk on 12/19/2014 02:54:00 PM

CR Note: The consensus is that on Monday, the NAR will report 5.20 million existing home sales for November, on a seasonally adjusted annual rate basis (SAAR). Housing economist Tom Lawler isn't always correct, but usually he is much closer than the consensus - so I expect a consensus miss on Monday.

From Tom Lawler: "Based on local realtor/MLS reports released through this morning, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.90 million in November, down 6.8% from October’s pace and up 1.4% from last November’s pace. Unadjusted sales last month should be down slightly from a year ago."

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a selected cities in November.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales (the Mid-Atlantic and Orlando were unchanged).

Short sales are down significantly in these areas.

Foreclosures are up in several areas (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | |

| Las Vegas | 9.5% | 21.0% | 8.7% | 7.0% | 18.2% | 28.0% | 32.8% | 43.7% |

| Reno** | 6.0% | 17.0% | 6.0% | 6.0% | 12.0% | 23.0% | ||

| Phoenix | 4.1% | 7.8% | 5.7% | 8.0% | 9.7% | 15.8% | 28.0% | 34.0% |

| Sacramento | 6.1% | 11.0% | 5.4% | 4.6% | 11.5% | 15.6% | 16.9% | 25.0% |

| Minneapolis | 3.1% | 5.0% | 10.2% | 16.9% | 13.4% | 21.9% | ||

| Mid-Atlantic | 4.7% | 7.5% | 11.0% | 8.1% | 15.7% | 15.7% | 19.1% | 19.6% |

| Orlando | 6.2% | 13.7% | 27.8% | 20.3% | 34.0% | 34.0% | 42.1% | 46.2% |

| California * | 6.2% | 10.2% | 5.8% | 6.8% | 12.0% | 17.0% | ||

| Bay Area CA* | 4.3% | 7.2% | 2.8% | 3.7% | 7.1% | 10.9% | 18.9% | 22.4% |

| So. California* | 6.2% | 10.5% | 5.3% | 6.3% | 11.5% | 16.8% | 23.9% | 28.1% |

| Miami MSA SF | 8.9% | 15.0% | 20.8% | 15.8% | 29.7% | 30.8% | 41.9% | 45.5% |

| Miami MSA C/TH | 5.0% | 9.2% | 22.4% | 18.3% | 27.4% | 27.5% | 67.8% | 74.6% |

| Chicago (City) | 20.2% | 32.8% | ||||||

| Hampton Roads | 20.4% | 26.9% | ||||||

| Northeast Florida | 29.7% | 38.1% | ||||||

| Tucson | 26.3% | 32.2% | ||||||

| Toledo | 35.4% | 37.2% | ||||||

| Wichita | 26.6% | 26.5% | ||||||

| Des Moines | 19.3% | 19.9% | ||||||

| Peoria | 19.7% | 21.8% | ||||||

| Georgia*** | 26.5% | N/A | ||||||

| Omaha | 21.1% | 21.6% | ||||||

| Pensacola | ||||||||

| Knoxville | ||||||||

| Memphis* | 15.1% | 20.5% | ||||||

| Birmingham AL | 14.9% | 21.0% | ||||||

| Springfield IL** | 11.8% | 17.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DOT: Vehicle Miles Driven increased 2.6% year-over-year in October

by Calculated Risk on 12/19/2014 02:12:00 PM

With lower gasoline prices, vehicle miles driven might reach a new peak in 2015.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.6% (6.6 billion vehicle miles) for October 2014 as compared with October 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 264.2 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.9% (23.2 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 83 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.6% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon. Prices will really be down year-over-year in November and December too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a little more time before we see a new peak in miles driven - but it is possible that a new peak could happen in 2015.

Kansas City Fed: Regional Manufacturing "Activity Expanded at a Moderate Pace" in December

by Calculated Risk on 12/19/2014 11:05:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Moderate Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a moderate pace in December, and producers’ expectations for future activity remained at solid levels.Two more regional Fed manufacturing surveys for December will be released this month (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated decent growth in December and optimism about the future.

“This month’s results are similar to what we’ve seen most of the year, said Wilkerson. The main change in December, which we started to see in November, is that input price pressures have come down.”

The month-over-month composite index was 8 in December, up slightly from 7 in November and 4 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The employment index jumped from 10 to 18, its highest level in nearly two years. ...

Future factory indexes were mostly stable at solid levels. The future composite index was unchanged at 22, while the future shipments, new orders, and employment indexes increased further. The future capital spending index jumped from 15 to 23, its highest level in five months. In contrast, the future production index eased from 34 to 30, and the future order backlog index also inched lower.

emphasis added

BLS: Forty-one States had Unemployment Rate Decreases in November

by Calculated Risk on 12/19/2014 10:03:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

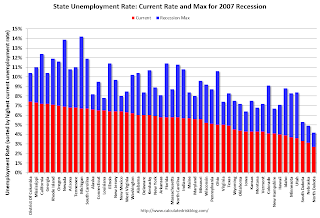

Regional and state unemployment rates were little changed in November. Forty-one states and the District of Columbia had unemployment rate decreases from October, three states had increases, and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Mississippi had the highest unemployment rate among the states in November, 7.3 percent. The District of Columbia had a rate of 7.4 percent. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi, at 7.3%, had the highest unemployment rate replacing Georgia with the highest unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Five states and D.C. are still at or above 7% (dark blue).

Thursday, December 18, 2014

Freddie Mac: "Mortgage Rates Find New Lows for 2014"

by Calculated Risk on 12/18/2014 07:46:00 PM

Friday:

• At 10:00 AM ET, Regional and State Employment and Unemployment (Monthly) for November 2014

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

From Freddie Mac: Mortgage Rates Find New Lows for 2014

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates falling to new lows for this year as 10-year Treasury yields closed at their lowest level since May 2013.

30-year fixed-rate mortgage (FRM) averaged 3.80 percent with an average 0.6 point for the week ending December 18, 2014, down from last week when it averaged 3.93 percent. A year ago at this time, the 30-year FRM averaged 4.47 percent.

Click on graph for larger image.

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Many borrowers who took out mortgages over the last 18 months can refinance now - but that is a small number of total borrowers. However, for a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 2.20%, I don't expect a significant increase in refinance activity any time soon.

CoStar: Commercial Real Estate prices increased in October

by Calculated Risk on 12/18/2014 03:27:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Post Steady Gains In October

CRE PRICES ROSE STEADILY IN OCTOBER, SUPPORTED BY BROAD BASE OF POSITIVE TRENDS. Most major property types continued to benefit from minimal speculative construction, a firming economic recovery and rising rental rates. Meanwhile, benchmark interest rates such as the 10-year Treasury continued to decline in October, a positive underlying trend for commercial real estate cap rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — increased by 0.8% and 0.9%, respectively, for October 2014.

...

VALUE-WEIGHTED U.S. COMPOSITE INDEX HITS RECORD HIGH IN OCTOBER, SIGNALING STRONG DEMAND FOR LARGE, INSTITUTIONAL-GRADE PROPERTIES. After climbing 0.9% in the month of October, the value-weighted U.S. Composite Index reached a record high, thanks to steady gains in recent months. The index now stands 3.9% above its prerecession peak in 2007, reflecting strong competition among investors for large, high-end commercial properties.

EQUAL-WEIGHTED U.S. COMPOSITE INDEX MOVES WITHIN 15% OF ITS PRERECESSION HIGH. While its recovery began later, the equal-weighted U.S. Composite Index, which is influenced by smaller property sales, has made solid gains and is now back to 2005 levels, although it remains 15% below its 2007 prerecession peak. This reflects the general movement of investment capital in search of higher yields into secondary markets and property types, as pricing for commercial property has escalated in the core coastal markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 15% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.