by Calculated Risk on 12/15/2014 02:20:00 PM

Monday, December 15, 2014

A Comment on Oil Prices

Recently there has been a dramatic decline in oil prices. This has led to some wild and confusing articles. As an example, Barry Ritholtz excerpted from an article that started: "Most observers thought the Organization of Petroleum Exporting Countries (OPEC) would cut its production to protect its members’ incomes and slash frackers’ profits."

That is wrong. If OPEC cut production, that would help the frackers (not hurt them). And most analysts I know didn't except OPEC to cut production.

For example, from Professor Hamilton on Oct 19th: How will Saudi Arabia respond to lower oil prices?

Oil prices (along with prices of many other commodities) have fallen dramatically since last summer. Some observers are waiting to see if Saudi Arabia responds with significant cutbacks in production. I say, don’t hold your breath.So it was no surprise that OPEC didn't cut production.

...

[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy.

As far as Libya is concerned, the politics on the ground remain quite unsettled. It makes sense to wait and see if anticipated production gains are really going to hold before anybody makes major adjustments.

In terms of surging U.S. production, the key question is how low the price can get before significant numbers of U.S. producers decide to pull out. If world economic growth indeed slows, and if most of the frackers are willing to keep going strong ... trying to maintain the price ... could be a losing bet for the Saudis. They’d be giving up their own revenue just in order to keep the money flowing into ever-growing operations in Texas and North Dakota.

...

And as for worries of another global economic downturn, so far they are only that– worries. If and when we see a downturn materialize, then I would expect to see the Saudis cut back production.

But until then it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production as long as that’s the name of the game.

emphasis added

And the speculation that oil producers are trying to hurt Iran, Russia, or terrorists ... that is also incorrect.

The reason prices have fallen sharply is supply and demand. It is important to remember that the short term supply and demand curves for oil are very steep.

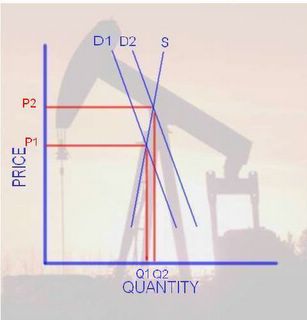

If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

Click on graph for larger image.

Click on graph for larger image.This is a graph I post in 2005. Back in 2005, I pointed out that with a small increase in Demand (from D1 to D2), we would see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would also occur if we had a small decrease in supply such as a disruption to production, transport or refining.

And the opposite is also true. A relatively small decrease in demand or increase in supply (fracking) could cause a significant decline in prices. Especially now with OPEC's diminished role (since cutting production helps other producers).

In the long run, supply and demand will adjust to price changes. But if someone asks why prices have fallen so sharply recently, the answer is "supply and demand" and that the short term supply and demand curves are steep for oil.