by Calculated Risk on 6/18/2014 02:14:00 PM

Wednesday, June 18, 2014

FOMC Projections and Press Conference

Statement here ($10 billion in additional tapering as expected).

As far as the "Appropriate timing of policy firming", participant views were mostly unchanged (12 participants expect the first rate hike in 2015, and 3 in 2016 - so one participant moved from 2015 to 2016).

The FOMC projections for inflation are still on the low side through 2016.

Yellen press conference here.

On the projections, GDP for 2014 was revised down significantly, the unemployment rate was revised down again, and inflation projections were increased slightly. Note: These projections were submitted before the most recent CPI report.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.3% in May.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of April, PCE inflation was up 1.6% from April 2013, and core inflation was up 1.4%. The FOMC expects inflation to increase in 2014, but remain below their 2% target (Note: the FOMC target is symmetrical around 2%).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

FOMC Statement: More Tapering

by Calculated Risk on 6/18/2014 02:00:00 PM

Not much change ... another $10 billion reduction in asset purchases.

FOMC Statement:

Information received since the Federal Open Market Committee met in April indicates that growth in economic activity has rebounded in recent months. Labor market indicators generally showed further improvement. The unemployment rate, though lower, remains elevated. Household spending appears to be rising moderately and business fixed investment resumed its advance, while the recovery in the housing sector remained slow. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and labor market conditions will continue to improve gradually, moving toward those the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions since the inception of the current asset purchase program, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in July, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $15 billion per month rather than $20 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $20 billion per month rather than $25 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy remains appropriate. In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Richard W. Fisher; Narayana Kocherlakota; Loretta J. Mester; Charles I. Plosser; Jerome H. Powell; and Daniel K. Tarullo.

emphasis added

AIA: Architecture Billings Index increased in May

by Calculated Risk on 6/18/2014 10:12:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Three Point Jump for Architecture Billings Index

On the heels of consecutive months of decreasing demand for design services, the Architecture Billings Index (ABI) has returned to positive territory. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 52.6, up sharply from a mark of 49.6 in April. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.2, up from the reading of 59.1 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in May was 52.5.

“Volatility continues to be the watchword in the design and construction markets, with firms in some regions of the country, and serving some sectors of the industry, reporting strong growth, while others are indicating continued weakness,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, overall, it appears that activity has recovered from the winter slump, and design professions should see more positive than negative numbers in the coming months.”

• Regional averages: South (58.1), Midwest (51.3), Northeast (47.6) , West (46.9) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.6 in May, up from 49.6 in April. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 17 of the last 22 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The index has been moving sideways near the expansion / contraction line recently. However, the readings over the last year suggest some increase in CRE investment in 2014.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/18/2014 08:59:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 13, 2014. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ...

...

“Interest rates increased relative to the previous week, as incoming economic data continues to suggest a pickup in the pace of growth,” said Mike Fratantoni, MBA’s Chief Economist. “Although the average rate for the week was up only a few basis points, the increase was matched by a large drop in refinance volume, and purchase application volume also declined. Some lenders continue to report that they have pre-approved borrowers who have been unable to find a property given the tight inventory in certain markets.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.36 percent from 4.34 percent, with points increasing to 0.24 from 0.16 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, June 17, 2014

Wednesday: Fed Day

by Calculated Risk on 6/17/2014 07:25:00 PM

On Sunday, I posted FOMC Preview: More Tapering. It is important to note that the updated projections were submitted prior to the CPI report this morning.

It will be interesting to see if the FOMC changes this sentence from the previous statement:

Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.The FOMC uses the PCE price index, and PCE prices show inflation still running below the FOMC's 2% objective. But they might mention some pickup in inflation.

Other inflation mentions in the previous statement included:

The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.And

If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Statement. The FOMC is expected to reduce monthly QE3 asset purchases from $45 billion per month to $35 billion per month at this meeting.

• Also at 2:00 PM, the FOMC projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

LA area Port Traffic: Imports increasing

by Calculated Risk on 6/17/2014 05:12:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for May since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% compared to the rolling 12 months ending in April. Outbound traffic was up 0.1% compared to 12 months ending in April.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports were up 5% year-over-year in May, however imports were only up 1% year-over-year.

Imports were 4% below the all time high for May (set in May 2006), and it is possible that imports will be at a record high later this year.

A few comments on Housing Starts

by Calculated Risk on 6/17/2014 01:28:00 PM

There were 396 thousand total housing starts during the first five months of 2014 (not seasonally adjusted, NSA), up 6.5% from the 372 thousand during the same period of 2013. Single family starts are up 2.5%, and multi-family starts up 17%.

This was just the fourth month with starts at over a 1 million annual pace since early 2008 (Seasonally adjusted annual rate, SAAR). Starts were over 1 million in November and December of 2013 - and then starts were a little weaker in Q1 - and then were at or above 1 million in April and May.

The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that the year-over-year comparison will be easier for housing starts for the next several months. There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

The bottom line is the housing recovery is ongoing and will continue.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to continue to increase (Q1 will probably be the weakest quarter) - and more starts combined with an easier comparison means starts will probably be up double digits year-over-year.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

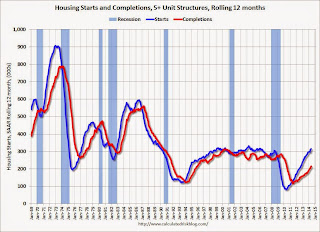

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up (but the increase has slowed recently), and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Inflation Measures Show Increase, Year-over-year still mostly below the Fed Target in May

by Calculated Risk on 6/17/2014 11:12:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in May. The 16% trimmed-mean Consumer Price Index also increased 0.3% (3.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.3% annualized rate) in May. The CPI less food and energy increased 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for April and increased just 1.4% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 3.2% annualized, and core CPI increased 3.1% annualized.

There key measures of inflation have moved up over the last few months, but on a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

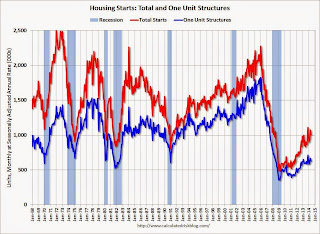

Housing Starts at 1.001 Million Annual Rate in May

by Calculated Risk on 6/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,001,000. This is 6.5 percent below the revised April estimate of 1,071,000, but is 9.4 percent above the May 2013 rate of 915,000.

Single-family housing starts in May were at a rate of 625,000; this is 5.9 percent below the revised April figure of 664,000. The May rate for units in buildings with five units or more was 366,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 991,000. This is 6.4 percent below the revised April rate of 1,059,000 and is 1.9 percent below the May 2013 estimate of 1,010,000.

Single-family authorizations in May were at a rate of 619,000; this is 3.7 percent above the revised April figure of 597,000. Authorizations of units in buildings with five units or more were at a rate of 347,000 in May.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in May (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in May.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was Below expectations of 1.036 million starts in May. Note: Starts for March and April were revised slightly. I'll have more later.

Monday, June 16, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 6/16/2014 07:31:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014 (I've already "won", and NDD made a donation to the Tanta Memorial Fund - but he could still win too):

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.In May 2013, starts were at a 915 thousand seasonally adjusted annual rate (SAAR). For me to win again (only one win counts), starts would have to be up 20% or at 1.098 million SAAR in May (possible). For NDD to win, starts would have to fall to 815 thousand SAAR (not likely). NDD could also "win" if permits fall to 910 thousand SAAR from 1.010 million SAAR in May 2013.

Tuesday:

• At 8:30 AM, Housing Starts for May. Total housing starts were at 1.072 million (SAAR) in April. Single family starts were at 649 thousand SAAR in April. The consensus is for total housing starts to decrease to 1.036 million (SAAR) in May.

• Also at 8:30 AM, Consumer Price Index for May. The consensus is for a 0.2% increase in CPI in May and for core CPI to increase 0.2%.