by Calculated Risk on 2/08/2014 10:57:00 AM

Saturday, February 08, 2014

Schedule for Week of Feb 9th

Th key reports this week are January retail sales on Thursday and industrial production on Friday.

New Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress this week.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in November to 4.001 million from 3.931 million in October. The number of job openings (yellow) is up 5.6% year-over-year compared to November 2012 and this was the first time job openings have been above 4 million since 2008.

Quits increased in November and are up about 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.5% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: the Monthly Treasury Budget Statement for January. The CBO estimates that the Treasury ran a deficit of $10 billion in January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand.

8:30 AM ET: Retail sales for January will be released.

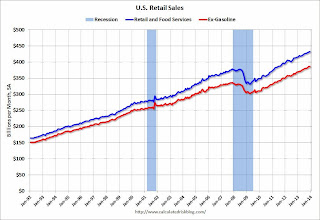

8:30 AM ET: Retail sales for January will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.2% from November to December (seasonally adjusted), and sales were up 4.7% from December 2012.

The consensus is for retail sales to decrease 0.1% in December, and to increase 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 80.0, down from 81.2 in January.

Unofficial Problem Bank list declines to 588 Institutions

by Calculated Risk on 2/08/2014 08:42:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 7, 2014.

Changes and comments from surferdude808:

Only two removals to report from the Unofficial Problem Bank List this week. The list includes 588 institutions with assets of $195.1 billion, which is down from 820 institutions with assets of $305.0 billion a year ago. Both banks -- GCF Bank, Sewell, NJ ($301 million) and First Community Bank of Crawford County, Van Buren, AR ($67 million) -- found merger partners in order to exit the list. So we did not have a fourth consecutive week with a bank failure.

This week, the Wall Street Journal published an article (Small Banks Face TARP Hit) stating that 27 small banks will have their quarterly TARP dividend doubled next week with another 32 by May 15th. Back on September 27, 2013 we provided the last semi-annual update on banks with outstanding TARP monies on the Unofficial Problem Bank List. A near doubling of the dividend rate will put additional financial pressure on these weak banks. As a result, many will likely need to find a merger partner.

Friday, February 07, 2014

CBO: Federal Deficit at $10 Billion in January

by Calculated Risk on 2/07/2014 06:39:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for January 2013

The federal government ran a budget deficit of $184 billion for the first four months of fiscal year 2014, CBO estimates—$107 billion less than the shortfall recorded in the same span last year. Revenues are higher and outlays are lower than they were at this time a year ago. Without shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the four-month period would have been $141 billion less this year than it was in fiscal year 2013. If lawmakers enact no further legislation affecting spending or revenues, the federal government will end fiscal year 2014 with a deficit of $514 billion, or 3.0 percent of gross domestic product (GDP), CBO estimates. That figure compares with a deficit of $680 billion, or 4.1 percent of GDP, in 2013. (For more details about CBO’s most recent budget projections, see The Budget and Economic Outlook: 2014 to 2024.)And for January 2014:

The federal government incurred a deficit of $10 billion in January 2014, CBO estimates—a $13 billion difference from the $3 billion surplus realized in January 2013. Because February 1 fell on a weekend in 2014, and January 1 is a holiday, certain payments that ordinarily would have been made in February this year were instead made in January, and certain payments that would ordinarily be made in January were made in December in both 2012 and 2013. Without those shifts in the timing of payments, the federal government would have realized an $8 billion surplus in January 2014 and a $15 billion deficit in January 2013—a $23 billion difference.After accounting for timing, that is a significant reduction in the deficit in January. My guess is the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

emphasis added

Reasons for a 2014 Pickup in Economic Growth Intact

by Calculated Risk on 2/07/2014 04:42:00 PM

I am expecting economic growth to increase in 2014 for a number of reasons:

1) I expect the housing recovery to continue.

2) Household balance sheets are in much better shape. This means less deleveraging, and probably a little more borrowing.

3) State and local government austerity is over (in the aggregate).

4) There will be less Federal austerity in 2014.

5) Commercial real estate (CRE) investment will probably make a small positive contribution in 2014.

I'll write more about this ... and of course I will change my mind if the data doesn't improve - but all of these reasons are intact, and I expect to see better economic data soon.

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 2/07/2014 01:56:00 PM

By request, here is an update on an earlier post through the January employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is just starting the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue) and 14,717,000 under President Reagan (yellow).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. One year into Mr. Obama's second term, there are now 4,289,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 766,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014.