by Calculated Risk on 2/08/2014 10:57:00 AM

Saturday, February 08, 2014

Schedule for Week of Feb 9th

Th key reports this week are January retail sales on Thursday and industrial production on Friday.

New Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress this week.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in November to 4.001 million from 3.931 million in October. The number of job openings (yellow) is up 5.6% year-over-year compared to November 2012 and this was the first time job openings have been above 4 million since 2008.

Quits increased in November and are up about 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.5% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: the Monthly Treasury Budget Statement for January. The CBO estimates that the Treasury ran a deficit of $10 billion in January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand.

8:30 AM ET: Retail sales for January will be released.

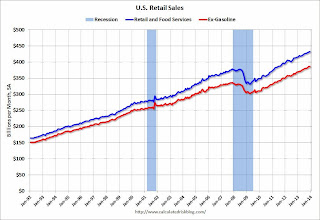

8:30 AM ET: Retail sales for January will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.2% from November to December (seasonally adjusted), and sales were up 4.7% from December 2012.

The consensus is for retail sales to decrease 0.1% in December, and to increase 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 80.0, down from 81.2 in January.