by Calculated Risk on 2/10/2014 05:03:00 PM

Monday, February 10, 2014

The California Budget Surplus: Stock and Flow

Over a year ago, I predicted that California would run an annual budget surplus soon. Several people wrote to me and said that can't be correct ... they heard California still had a significant amount of debt. That is also correct. This is a stock and flow issue. The cash deficit is the stock, and the annual budget surplus is the flow.

Even with a budget surplus, California still has $12.6 billion in debt. From California State Controller John Chiang:

The State ended the month with a General Fund cash deficit of $12.6 billion, which was covered with both internal and external borrowing. That figure was down from last year, when the State faced a cash deficit of $15.7 billion at the end of January 2013.It will take some time to pay down the cash deficit, but the state is running an annual budget surplus.

And on January cash update:

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in January 2014. Revenues for the month totaled $12.2 billion, surpassing estimates in the 2014-15 Governor's Budget by $387.7 million, or 3.3 percent.This is just one state, but I expect local and state governments (in the aggregate) to add to both GDP and employment in 2014.

"Strong revenues for the month of January confirm California is continuing its slow climb out of the wreckage of the Great Recession," said Chiang. "Better-than-expected income tax receipts -- particularly those straight from paychecks – could indicate Californians are working and earning more."

emphasis added

Las Vegas Real Estate in January: Year-over-year Non-contingent Inventory up 96.2%

by Calculated Risk on 2/10/2014 12:18:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home prices started 2014 where they left off in 2013

GLVAR said the total number of existing local homes, condominiums and townhomes sold in the traditionally slow month of January was 2,527, down from 2,915 in December and down from 2,821 one year ago....There are several key trends that we've been following:

...

GLVAR has been reporting fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. For instance, in January, 17 percent of all existing local home sales were short sales, down from 20.7 percent in December. Another 11 percent of all January sales were bank-owned properties, up from 8.5 percent in December.

GLVAR said 46.3 percent of all existing local homes sold in January were purchased with cash. That’s up from 44.4 percent in December, but down from a peak of 59.5 percent set in February 2013.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service in January was 13,537. That’s up 1.8 percent from 13,303 single-family homes listed for sale at the end of December, but down 6.2 percent from 14,433 homes one year ago. ...

GLVAR reported many more available homes listed for sale without any sort of pending or contingent offer. By the end of January, GLVAR reported 6,541 single-family homes listed without any sort of offer. That’s down 0.7 percent from 6,587 such homes listed in December, but still up 96.2 percent from one year ago.

emphasis added

1) Overall sales were down about 10.4% year-over-year.

2) Conventional sales are up solidly year-over-year. In January 2013, only 51.3% of all sales were conventional. This year, in January 2014, 72% were conventional. That is an increase in conventional sales of about 26% year-over-year.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 96.2% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow.

Home Sales Reports: What Matters

by Calculated Risk on 2/10/2014 10:40:00 AM

First here are some excepts from a post I wrote in June 2012 that is relevant today:

The key number in the existing home sales report is not sales, but inventory. ...A few key points:

When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales.

However, for the new home sales report, the key number is sales! An increase in sales adds to both GDP and employment (completed inventory is at record lows, so any increase in sales will translate to more single family starts).

...

Some people think housing will recover rapidly to the 1.2+ million rate we saw in 2004 and 2005. I think that is incorrect for two reasons. First, I think the recovery will be sluggish - 2012 will probably be the third worst year ever. Second, the 1.2 million in annual sales was due to an increasing homeownership rate and speculative buying. With a stable homeownerhip rate, and little speculative buying, sales will probably only rise to around 800 thousand at full recovery.

• If existing home sales are flat this year, or even decline - that doesn't mean the housing recovery is over. For existing home sales we need to look at the composition of sales (distressed vs. conventional), and the percent of conventional sales are increasing (and investor buying has slowed too). This is a positive sign.

• New Home sales were up 16.4% in 2013 (strong growth rate), but were only at 428 thousand. This was the sixth worst year since 1963. I don't expect sales to increase to 1.2+ million that we saw in 2004 and 2005, but I do expect sales to increase to close to 800 thousand - so I expect significant growth over the next few years.

• There was a slowdown in new home sales in the 2nd half of 2013, and I expect downward revisions to the Census Bureau reports - see Lawler: Expect Downward Revisions to Census Q4 New Home Sales, Broad-Based Builder Optimism for 2014 - but that was due to a combination of factors (builders increased prices rapidly, higher mortgage rates, constrained supply of entitled land) - but I expect a solid increase in sales in 2014.

Sunday, February 09, 2014

Sunday Night Futures

by Calculated Risk on 2/09/2014 08:41:00 PM

From Joe Weisenthal at Business Inside: Janet Yellen Will Be In The Spotlight This Week

Starting Tuesday, new Fed Chief Janet Yellen gives her first semiannual Humphrey-Hawkins testimony.The next FOMC meeting is March 18th and 19th (followed by Dr. Yellen's first press conference as Fed Chair). So there is just the February employment report in early March (one report, not two) between now and then.

Morgan Stanley's Vincent Reinhart writes:

Fed Chair Janet Yellen gives her first semiannual testimony on monetary policy on Tuesday, February 11. With two weak payroll prints in a row, she will feel no need to defend policy accommodation. ... With considerable confusion about the role of weather on the last two employment reports and two more to come before the next FOMC meeting, a modest show of empathy should be sufficient. Traditionally, these events are the peaks in the landscape of Fed communication.

Note: Personally I think the after meeting press conferences are more effective Fed communication than the testimony to Congress (the press mostly asks better questions, whereas the questions from Congress are mostly political posturing).

Weekend:

• Schedule for Week of Feb 9th

From MarketWatch: Asia Markets live blog: Stocks rolling higher

Tokyo equities are starting the week in the plus column, leading the Nikkei Average up 1.2% at 14,642.From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are unchanged (fair value).

Oil prices are up with WTI futures at $100.24 per barrel and Brent at $109.72 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.28 per gallon (moving up, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 2/09/2014 11:41:00 AM

Payroll employment is getting close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow), but reaching new highs in employment will be a significant milestone in the recovery.

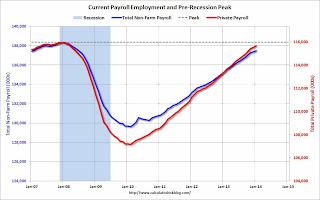

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.499 million total non-farm payroll jobs, or 866 thousand fewer than the pre-recession peak.

At the recent annual pace (about 2.2 million jobs added per year), total non-farm payroll will be at a new high in mid-2014.

The pre-recession peak for private payroll employment was 115.977 million. Currently there are 115.686 million total non-farm payroll jobs, or 291 thousand fewer than the pre-recession peak. It seems likely private sector employment that will be at a new high by March.