by Calculated Risk on 6/30/2013 10:14:00 PM

Sunday, June 30, 2013

Monday: ISM Manufacturing Index, Construction Spending

Monday:

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for June will be released. The consensus is for the index to be unchanged at 52.3.

• At 10:00 AM, the ISM Manufacturing Index for June. The consensus is for an increase to 50.5 from 49.0 in May. Based on the regional surveys, a reading above 50 seems likely.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.6% increase in construction spending.

Weekend:

• Schedule for Week of June 30th

The Asian markets are red tonight with the Nikkei down 0.2%, and Shanghai Composite down 0.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 25 (fair value).

Oil prices have mostly moved sideways recently with WTI futures at $96.07 per barrel and Brent at $101.70 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down to about $3.50 per gallon. Based on Brent prices and the calculator at Econbrowser, I expect gasoline prices to fall a little more.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

How many Jobs are Needed to Reach Fed's December Unemployment Rate Target for QE3 Tapering?

by Calculated Risk on 6/30/2013 06:18:00 PM

This is a common question, and I suggest using the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level.

As an example, for the unemployment rate to decline to 7.3% in December (the high end of the Fed's forecast), with the participation rate staying steady at 63.4%, would require about 150,000 jobs per month for the next seven months. This seems very possible.

If the participation rate increases to 63.6%, than the economy would need to add 210,000 jobs per month for the unemployment rate to fall to 7.3% in December (this is just an estimate).

You can put in your own assumptions to the calculator.

Another frequent question is when will the unemployment rate fall to 6.5% (the Fed's threshold, but not trigger, for raising the Fed's funds rate). If the participation rate stays steady, the unemployment rate will fall to 6.5% in December 2014 if the economy adds around 185,000 jobs per month. This is consistent with the Fed not raising rates until 2015 or later.

Unofficial Problem Bank list declines to 749 Institutions, Q2 Transition Matrix

by Calculated Risk on 6/30/2013 09:54:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 28, 2013.

Changes and comments from surferdude808:

With the FDIC releasing its enforcement actions through May 2013, there were many changes to the Unofficial Problem Bank List. For the week, there were seven removals and five additions that leave the at 749 institutions with assets of $273.3 billion. For the month of June, the list fell by a net 12 institutions after seven additions, seven action terminations, six unassisted mergers, five failures, and one voluntary liquidation. Assets fell by $4.02 billion, which is the smallest decline since a $3.99 billion in November 2012. In addition, there was a noticeable slowdown in action terminations, which were last at this level in November 2011.

This week actions were terminated against Farmers Bank, Ault, CO ($232 million); Peoples Bank & Trust Company, Owenton, KY ($64 million); Lakeview Bank, Lakeville, MN ($54 million); Park State Bank, Duluth, MN ($30 million); and Roxbury Bank, Roxbury, KS ($14 million). Also, the FDIC terminated a Prompt Corrective Action order against First Sound Bank, Seattle, WA ($123 million), but it is still subject to a Consent Order. Other removals from finding merger partners include First National Bank of Illinois, Lansing, IL ($374 million) and Community State Bank, Norwalk, WI ($24 million).

Additions this week were Bay Cities Bank, Tampa, FL ($534 million); Oswego Community Bank, Oswego, IL ($194 million); SunSouth Bank, Dothan, AL ($178 million); VistaBank, Aiken, SC ($109 million); and First State Bank of Swanville, Swanville, MN ($30 million).

As promised last week, we have updated the transition matrix with the passage of the second quarter of 2013. Full details may be found in the accompanying table. As depicted, there have been a total of 1,644 institutions with assets of $811.4 billion that have appeared on the list. A little more the 54 percent of the institutions that have appeared on the list have been removed. A total of 895 institutions are no longer on the list. Since the publishing start of this list in 2009, failure has been the primary manner of exit; however, at this point, terminations are now responsible for more removals at 377. Close behind are failures at 363 while finding a merger partner has been responsible for 144 removals. While failures have slipped as the primary form of exit from the list, the amount of assets removed for failure total $292.6 billion, which dwarfs $164.4 billion in assets from institutions where actions were terminated.

As discussed above, there was a discernible slowdown in the pace of action terminations this month and quarter. There were 34 terminations during the quarter, which represented 4.5 percent of the 757 institutions that were on the list at the start of the quarter. During the first quarter of 2013, the termination rate was 6.1 percent. The 34 terminations were the lowest quarterly count since 32 in the first quarter of 2012. There were 108 institutions still hanging around from the original publication at the start of the second quarter of 2013, but only four were removed this quarter because of action termination, which was a much lower termination rate of 3.7 percent. The transition methods of the 389 institutions on the original list in August 2009 does differ significantly from the pool of subsequent additions.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 108 | (31,933,282) | |

| Unassisted Merger | 27 | (4,452,830) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 150 | (183,316,242) | |

| Asset Change | (8,734,399) | ||

| Still on List at 6/30/2013 | 100 | 37,292,562 | |

| Additions | 649 | 235,975,860 | |

| End (6/30/2013) | 749 | 273,268,422 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 269 | 132,439,197 | |

| Unassisted Merger | 117 | 55,560,134 | |

| Voluntary Liquidation | 7 | 1,760,816 | |

| Failures | 213 | 109,331,508 | |

| Total | 606 | 299,091,655 | |

| 1Institution not on 8/7/2009 or 6/30/2013 list but appeared on a weekly list. | |||

Saturday, June 29, 2013

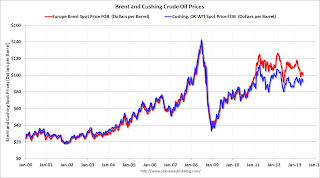

Oil: The Disappearing Brent / WTI Spread

by Calculated Risk on 6/29/2013 05:54:00 PM

The WSJ Real Time Economics has an article today on the declining spread between Brent crude oil and West Texas Intermediate (WTI). (note: this is something we discussed a few weeks ago).

From Ben Casselman at the WSJ: Number of the Week: U.S. Oil Boom Affecting Global Prices

The U.S. pumped 6.5 million barrels a day of oil last year, according to the Energy Information Administration, the most since the mid-1990s, and production has continued to surge; April’s figure of 7.4 million barrels per day marked the best month in more than two decades.But, until the gap disappears completely, we still need to use Brent crude prices to forecast U.S. gasoline prices.

...

The industry wasn’t expecting the huge surge in production from North Dakota, so companies didn’t have the pipelines in place to handle all the new oil. So rather than flow into the global market, much of the oil stayed in the middle of the U.S.

Now, however, the gap between WTI and Brent is starting to narrow, as a new report from the Energy Information Administration makes clear. The industry has expanded pipeline capacity and found other ways, such as rail cars, to get oil from the middle of the country to major demand centers on the coasts. Meanwhile, coastal refineries are shifting to use more domestic crudes, leading to lower demand for Brent. The result: The gap between the two prices has narrowed to under $10 per barrel.

Click on graph for larger image.

Click on graph for larger image.Here is an update to the graph in the previous post that shows the divergence between Brent and Cushing starting in 2011.

Recently the spread has been closing. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Now the difference is under 7% (and less than $7 per barrel).

Schedule for Week of June 30th

by Calculated Risk on 6/29/2013 08:05:00 AM

Happy Independence Day! The key report this week is the June employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, auto sales on Tuesday, the Trade Balance report on Wednesday, and the ISM service index also on Wednesday.

Also Reis will release their Q2 2013 Mall vacancy rate survey this week.

9:00 AM: The Markit US PMI Manufacturing Index for June. The consensus is for the index to be unchanged at 52.3.

10:00 AM ET: ISM Manufacturing Index for June. The consensus is for an increase to 50.5 from 49.0 in May. Based on the regional surveys, a reading above 50 seems likely.

10:00 AM ET: ISM Manufacturing Index for June. The consensus is for an increase to 50.5 from 49.0 in May. Based on the regional surveys, a reading above 50 seems likely.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction in May at 49.0%. The employment index was at 50.1%, down from 50.2%, and the new orders index was at 48.8%, down from 52.3% in April.

10:00 AM: Construction Spending for May. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to increase to 15.5 million SAAR in June (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in May.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to increase to 15.5 million SAAR in June (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in May.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 2.0% increase in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in June.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. The graphs shows both exports and imports increased in April, but have mostly been moving sideways.

The consensus is for the U.S. trade deficit to increase to $40.8 billion in May from $40.3 billion in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 346 thousand last week.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a reading of 54.5, up from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Early: Reis Q2 2013 Mall Survey of rents and vacancy rates.

All US markets are closed in observance of the Independence Day holiday.

8:30 AM: Employment Report for June. The consensus is for an increase of 161,000 non-farm payroll jobs in June; the economy added 175,000 non-farm payroll jobs in May.

The consensus is for the unemployment rate to decrease to 7.5% in June.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through May.

The economy has added 6.9 million private sector jobs since employment bottomed in February 2010 (6.3 million total jobs added including all the public sector layoffs).

The economy has added 6.9 million private sector jobs since employment bottomed in February 2010 (6.3 million total jobs added including all the public sector layoffs).There are still 1.9 million fewer private sector jobs now than when the recession started in 2007.

Friday, June 28, 2013

Goldman on The Impact on GDP of Higher Mortgage Rates

by Calculated Risk on 6/28/2013 09:59:00 PM

A few brief excerpts from a research note by economists Kris Dawsey and Hui Shan at Goldman Sachs: The Drag from Higher Mortgage Rates

The rise in mortgage rates may impact the economy through two broad channels: (1) the direct impact on construction activity and home sales, which feed into the residential investment component of GDP, and (2) the indirect effects of lower home prices and less refinancing activity on consumption.My view - as I noted in House Prices and Mortgage Rates earlier this week - is that higher mortgage rates might slow price increases, but not lead to a decline in prices. I'll look into the relationship between mortgage rates and activity, but my first guess is the recent increase in rates will not slow the recovery in residential investment.

Complementing our past research on the impact of mortgage rates on various aspects of housing, we use a vector autoregression (VAR)-based approach to trace out the potential impact of the rise in mortgage rates. This analysis points to a manageable total impact on real GDP growth over the coming year of roughly two tenths of a percentage point. The direct effects of higher mortgage rates are likely to be larger in magnitude than the indirect effects.

Our estimate is subject to uncertainty. On the one hand, factors other than housing affordability―such as origination capacity constraints and borrower credit quality issues―are at present probably more important constraints than they have been historically. As a result, the sensitivity of housing indicators to changes in mortgage rates may be lower than historical estimates suggest. On the other hand, for technical reasons the nature of our statistical analysis may understate the magnitude of the potential impact.

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rates declined in May, Lowest since early 2009

by Calculated Risk on 6/28/2013 04:20:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in May to 2.83% from 2.93% in April. The serious delinquency rate is down from 3.57% in May 2012, and this is the lowest level since January 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.85% from 2.91% in April. Freddie's rate is down from 3.50% in May 2012, and this is the lowest level since May 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or even 2017.

Zillow: Case-Shiller House Price Index expected to show over 12% year-over-year increase in May

by Calculated Risk on 6/28/2013 02:19:00 PM

The Case-Shiller house price indexes for May will be released Tuesday, July 30th. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Zillow Predicts Another 12% Annual Increase in Case-Shiller Indices for May

The Case-Shiller data for April came out [Tuesday] and, based on this information and the May 2013 Zillow Home Value Index (released last week), we predict that next month’s Case-Shiller data (May 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 12.1 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 12.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from April to May will be 1.3 percent for the 20-City Composite and 1.6 percent for the 10-City Composite Home Price Indices (SA).The following table shows the Zillow forecast for the May Case-Shiller index.

...

The Case-Shiller indices are giving an inflated sense of national home value appreciation because they are biased toward the large, coastal metros currently seeing such enormous home value gains, and because they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for May 2013 up 5.4 percent from year-ago levels. We expect home value appreciation to continue to moderate in 2013, rising only 4.1 percent between May 2013 and May 2014. Further details on our forecast of home values can be found here, and more on Zillow’s full May 2013 report can be found here.

To forecast the Case-Shiller indices, we use the March Case-Shiller index level, as well as the April Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with April foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow May Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | May 2012 | 151.75 | 152.67 | 139.2 | 140.06 |

| Case-Shiller (last month) | Apr 2013 | 165.63 | 168.76 | 152.37 | 155.37 |

| Zillow Forecast | YoY | 12.2% | 12.2% | 12.1% | 12.1% |

| MoM | 2.8% | 1.6% | 2.4% | 1.3% | |

| Zillow Forecasts1 | 170.3 | 171.4 | 156.0 | 157.2 | |

| Current Post Bubble Low | 146.46 | 149.55 | 134.07 | 136.85 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 16.3% | 14.6% | 16.4% | 14.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Restaurant Performance Index at 14 month high in May

by Calculated Risk on 6/28/2013 11:54:00 AM

From the National Restaurant Association: Restaurant Performance Index Hits 14-Month High on Positive Sales and Customer Traffic Results

Buoyed by stronger same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) hit a 14-month high in May. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.8 in May, up 0.9 percent from April and the third consecutive monthly gain. May also represented the third straight month that the RPI surpassed the 100 level, which signifies expansion in the index of key industry indicators.

“The May increase in the Restaurant Performance Index was driven by broad-based gains in the current situation indicators, most notably positive same-store sales and customer traffic results,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “In addition, restaurant operators remain optimistic about continued sales growth and a majority plan to make a capital expenditure in the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 101.6 in May – up 1.6 percent from a level of 100.1 in April. May represented the strongest Current Situation Index reading since March 2012, and signifies expansion in the current situation indicators.

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.8 in May from 101.0 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Final June Consumer Sentiment at 84.1, Chicago PMI declines to 51.6

by Calculated Risk on 6/28/2013 10:00:00 AM

Click on graph for larger image.

• The final Reuters / University of Michigan consumer sentiment index for June decreased to 84.1 from the May reading of 84.5, but up from the preliminary June reading of 82.7.

This was above the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

• From the Chicago ISM:

June 2013:

The Chicago Business BarometerTM declined to 51.6 in June, the largest monthly drop since October 2008, and down from a 14-month high of 58.7 in May. The gyrations seen over the past few months are not typical for the Barometer and some of this might be attributable to the unseasonable weather conditions.PMI: Decreased to 51.6 from 58.7. (Above 50 is expansion).

...

Of the five Business Activity measures which make up the Barometer, four declined with only the Employment indicator posting an increase. Order Backlogs plunged deep into contraction to the lowest level since September 2009 and was the single biggest drag on Barometer. Faster Supplier Delivery times and declines in Production and New Orders also contributed to the Barometer’s weakness.

This was well below the consensus estimate of 55.0.