by Calculated Risk on 3/05/2013 12:39:00 PM

Tuesday, March 05, 2013

Trulia: Asking House Prices increased in February, Inventory not expected to bottom in 2013

Press Release: Trulia Reports Asking Home Price Gains Accelerating While Housing Inventory No Longer in Free Fall

Since bottoming 12 months ago, national asking home prices rose 7.0 percent year-over-year (Y-o-Y) in February. Seasonally adjusted, asking prices also increased 1.4 percent month-over-month (M-o-M) and 3.0 percent quarter-over-quarter (Q-o-Q) – marking two post-recession highs. Asking prices locally are up in 90 of the 100 largest U.S. metros, rising fastest in Phoenix, Las Vegas, and Oakland.More on inventory from Jed Kolko, Trulia Chief Economist: Rising Prices Mean Falling Inventory … in the Short Term

Meanwhile, rent increases are slowing down. In February, rents rose just 3.2 percent Y-o-Y. This is a notable decrease from three months ago, in November, when rents were up 5.4 percent Y-o-Y. Among the 25 largest rental markets, rents rose the most in Houston, Oakland, and Miami, while falling slightly in San Francisco and Las Vegas.

...

Inventory Will Not Turn Around in 2013 Even Though Decline Is Slowing Down

Inventory falls most sharply just after prices bottom, creating an “inventory spiral”: rising prices reduce inventory as would-be home sellers hold off in the hopes of selling later at a higher price, and falling inventory boosts prices further as buyers compete for a limited number of for-sale homes. Nationally, the annualized rate of inventory decline was 23 to 29 percent from March to September 2012, the months after home prices first bottomed one year ago, but has softened to a 14 to 21 percent rate since October [1]

emphasis added

Inventory and prices affect each other in three ways:These are important points on inventory, and I now think inventory will not bottom this year (this is why I've been tracking inventory weekly). This probably means more price appreciation in 2013 than most analysts expect (I think the consensus was around 3% price increase in 2013), and this is also positive for new home sales.

1.Less inventory leads to higher prices. That’s because buyers are competing for a limited number of for-sale homes.In the short term, the first two reasons create an “inventory spiral”: less inventory leads to higher prices, which leads to less inventory, and so on. But the inventory spiral can’t go on forever because eventually rising prices will encourage homeowners to sell and builders to build, which add to inventory and breaks the spiral. The critical question for the housing market – especially for buyers fighting over tight inventories – is how long until that kicks in? How long do prices have to rise before sellers and builders start adding to inventory?

2.Higher prices lead to less inventory – at least in the short term. Everyone wants to buy at the bottom; no one wants to sell at the bottom. When prices start to rise, buyers get impatient while many would-be sellers want to hold out in the hopes of selling later at a higher price.

3.Higher prices lead to more inventory – in the long term. As prices keep rising, more homeowners decide it’s worthwhile to sell, especially those who get back above water, which adds to inventory. Also, builders take rising prices as a cue to rev up construction activity, which also adds to inventory.

...

How long until inventory turns positive, rather than becoming just less negative? ... it could be at least another year until national inventory starts expanding. Of course, inventory will probably turn up this spring and summer because of the regular seasonal pattern, but the underlying trend will be less inventory than is typical for each season, not more.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

ISM Non-Manufacturing Index indicates faster expansion in February

by Calculated Risk on 3/05/2013 10:00:00 AM

The February ISM Non-manufacturing index was at 56.0%, up from 55.2% in January. The employment index decreased in February to 57.2%, down from 57.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 38th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56 percent in February, 0.8 percentage point higher than the 55.2 percent registered in January. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. This month's reading also reflects the highest NMI™ since February 2012, when the index registered 56.1 percent. The Non-Manufacturing Business Activity Index registered 56.9 percent, which is 0.5 percentage point higher than the 56.4 percent reported in January, reflecting growth for the 43rd consecutive month. The New Orders Index increased by 3.8 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 57.2 percent, indicating growth in employment for the seventh consecutive month. The Prices Index increased 3.7 percentage points to 61.7 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI™, 13 non-manufacturing industries reported growth in February. The majority of respondents' comments reflect a growing optimism about the trend of the economy and overall business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in February than in January.

CoreLogic: House Prices up 9.7% Year-over-year in January

by Calculated Risk on 3/05/2013 09:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by Almost 10 Percent Year Over Year in January

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 9.7 percent in January 2013 compared to January 2012. This change represents the biggest increase since April 2006 and the 11th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.7 percent in January 2013 compared to December 2012. The HPI analysis shows that all but two states, Delaware and Illinois, are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 9.0 percent in January 2013 compared to January 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.8 percent in January 2013 compared to December 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that February 2013 home prices, including distressed sales, are expected to rise by 9.7 percent on a year-over-year basis from February 2012 and fall by 0.3 percent on a month-over-month basis from January 2013, reflecting a seasonal winter slowdown.

...

“The HPI showed strong growth during the typically slow winter season,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in January, and is up 9.7% over the last year.

The index is off 26.4% from the peak - and is up 10.1% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in January - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, March 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 3/04/2013 09:09:00 PM

The kids are alright! From the WSJ: Young Adults Retreat From Piling Up Debt

Young people are racking up larger amounts of student debt than ever before, but fresh data suggest they are becoming warier of borrowing in general: Total debt among young adults dropped in the last decade to the lowest level in 15 years.Student debt is a significant problem, but less overall debt is good news.

A typical young U.S. household—defined as one led by someone under age 35—had $15,000 in total debt in 2010, down from $18,000 in 2001 and the lowest since 1995, according to a recent Pew Research Center report and government data. Total debt includes mortgage loans, credit cards, auto lending, student loans and other consumer borrowing.

In addition, fewer young adults carried credit-card balances and 22% didn't have any debt at all in 2010—the most since government tracking began in 1983.

The lower overall debt comes despite an increase in student borrowing, which ballooned to $966 billion last year from $253 billion at the end of 2003, according to the Federal Reserve.

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Also at 10:00 AM, ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

Existing Home Inventory is only up 3.4% year-to-date in early March

by Calculated Risk on 3/04/2013 03:24:00 PM

Dude, Where's my inventory?

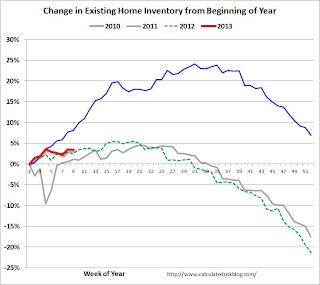

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through early March - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -23.2% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is only up 3.4%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Fannie Mae Mortgage Serious Delinquency rate declined in January, Lowest since early 2009

by Calculated Risk on 3/04/2013 02:02:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.18% from 3.29% in December 2012. The serious delinquency rate is down from 3.90% in January 2012, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac has not reported for January yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

Update: Seasonal Pattern for House Prices

by Calculated Risk on 3/04/2013 09:53:00 AM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both Case-Shiller and CoreLogic through December). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

The CoreLogic index was positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November and turned positive in the December report. This shows that the "off-season" for prices has been pretty strong this year.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Fed's Yellen: Challenges Confronting Monetary Policy

by Calculated Risk on 3/04/2013 08:53:00 AM

From Fed Vice Chair Janet Yellen: Challenges Confronting Monetary Policy. A few excerpts on asset purchases and what a "Substantial Improvement in the Outlook for the Labor Market" means:

The first imperative will be to judge what constitutes a substantial improvement in the outlook for the labor market. Federal Reserve research concludes that the unemployment rate is probably the best single indicator of current labor market conditions. In addition, it is a good predictor of future labor market developments. Since 1978, periods during which the unemployment rate declined 1/2 percentage point or more over two quarters were followed by further declines over the subsequent two quarters about 75 percent of the time.CR Notes: Defining a "substantial improvement" is helpful in trying to determine when the Fed when end the asset purchase program. Obviously the program will continue for some time ...

That said, the unemployment rate also has its limitations. As I noted before, the unemployment rate may decline for reasons other than improved labor demand, such as when workers become discouraged and drop out of the labor force. In addition, while movements in the rate tend to be fairly persistent, recent history provides several cases in which the unemployment rate fell substantially and then stabilized at still-elevated levels. For example, between the fourth quarter of 2010 and the first quarter of 2011, the unemployment rate fell 1/2 percentage point but was then little changed over the next two quarters. Similarly, the unemployment rate fell 3/4 percentage point between the third quarter of 2011 and the first quarter of 2012, only to level off over the subsequent spring and summer.

To judge whether there has been a substantial improvement in the outlook for the labor market, I therefore expect to consider additional labor market indicators along with the overall outlook for economic growth. For example, the pace of payroll employment growth is highly correlated with a diverse set of labor market indicators, and a decline in unemployment is more likely to signal genuine improvement in the labor market when it is combined with a healthy pace of job gains.

The payroll employment data, however, also have shortcomings. In particular, they are subject to substantial revision. When the Labor Department released its annual benchmarking of the establishment survey data last month, it revised up its estimate of employment in December 2012 by 647,000.

In addition, I am likely to supplement the data on employment and unemployment with measures of gross job flows, such as job loss and hiring, which describe the underlying dynamics of the labor market. For instance, layoffs and discharges as a share of total employment have already returned to their pre-recession level, while the hiring rate remains depressed. Therefore, going forward, I would look for an increase in the rate of hiring. Similarly, a pickup in the quit rate, which also remains at a low level, would signal that workers perceive that their chances to be rehired are good--in other words, that labor demand has strengthened.

I also intend to consider my forecast of the overall pace of spending and growth in the economy. A decline in unemployment, when it is not accompanied by sufficiently strong growth, may not indicate a substantial improvement in the labor market outlook. Similarly, a convincing pickup in growth that is expected to be sustained could prompt a determination that the outlook for the labor market had substantially improved even absent any substantial decline at that point in the unemployment rate.

emphasis added

Sunday, March 03, 2013

Sunday Night Futures

by Calculated Risk on 3/03/2013 09:29:00 PM

I thought US Fiscal Policy was the biggest question mark for 2013, and that fiscal policy posed the biggest downside risk to the US economy (I still think fiscal policy is the biggest risk).

First there was the "fiscal cliff", and then the threat of default and not paying the bills (aka "debt ceiling"), then "sequestration", followed by the March 27th threat to shut down the government (really just a small portion of the government, but will be very disruptive). As I've noted several times, the deficit is declining fairly quickly, and the key risk is too much deficit reduction too quickly (this can't be repeated enough).

Hopefully something will be worked out to reverse the "sequestration" cuts, and maybe the government shutdown will be avoided ...

From the WaPo: Deal to avert government shutdown likely, officials say

Congress returns to work this week with no plan to reverse across-the-board spending cuts that took effect Friday, but with hope on both sides of the aisle of averting an end-of-the-month showdown that could result in a government shutdown.Weekend:

...

It would provide funding through the end of the fiscal year on Sept. 30 ...

• Summary for Week Ending March 1st

• Schedule for Week of March 3rd

The Asian markets are mixed tonight with the Nikkei up 0.8%, and Shanghai Composite down 1.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 40 (fair value).

Oil prices have moved down a little recently with WTI futures at $90.61 per barrel and Brent at $110.55 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down a few cents over the last week after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q4 2012 GDP Details: Commercial Real Estate investment very low, Single Family investment increases

by Calculated Risk on 3/03/2013 04:30:00 PM

Here is some investment data from the BEA (Note: The BEA released the underlying details for the Q4 second GDP report on Friday). The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 55% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 63% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 73%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is now increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $159 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.0% of GDP), still above the level of investment in single family structures of $143 billion (SAAR) (or 0.9% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment later this year.

Brokers' commissions increased slightly in Q4 as a percent of GDP. And investment in multifamily structures increased in Q4. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.