by Calculated Risk on 3/07/2013 08:58:00 AM

Thursday, March 07, 2013

Trade Deficit increased in January to $44.4 Billion

The Department of Commerce reported:

[T]otal January exports of $184.5 billion and imports of $228.9 billion resulted in a goods and services deficit of $44.4 billion, up from $38.1 billion in December, revised. January exports were $2.2 billion less than December exports of $186.6 billion. January imports were $4.1 billion more than December imports of $224.8 billion.The trade deficit was above the consensus forecast of $43.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2013.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in January, and imports increased (most of the increase was petroleum).

Exports are 11% above the pre-recession peak and up 3.3% compared to January 2012; imports are near the pre-recession peak, and down 1% compared to January 2012.

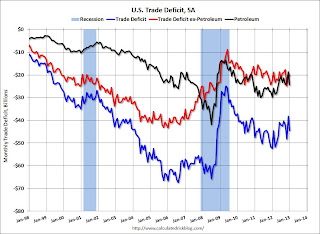

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The increase in the trade deficit in January was mostly due to an increase in the volume of petroleum imports.

Oil averaged $94.08 per barrel in January, down slightly from $95.16 in December.

The trade deficit with China increased to $27.8 billion in January, up from $26.0 billion in January 2012. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $7.7 billion in January, up slightly from $7.6 billion in January 2012.

Weekly Initial Unemployment Claims decrease to 340,000

by Calculated Risk on 3/07/2013 08:30:00 AM

The DOL reports:

In the week ending March 2, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 7,000 from the previous week's revised figure of 347,000. The 4-week moving average was 348,750, a decrease of 7,000 from the previous week's revised average of 355,750.The previous week was revised up from 344,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 348,750 - this is the lowest level since March 2008.

Weekly claims were below the 355,000 consensus forecast. Note: Claims might increase soon due to the "sequestration" budget cuts.

Wednesday, March 06, 2013

Thursday: Trade Deficit, Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/06/2013 08:45:00 PM

With housing for sale inventory still low, I expect to see some upward revisions to 2013 house price forecasts. The consensus is for prices to increase about 3% this year. From Merrill Lynch tonight:

Paying homage to home prices. Our mortgage strategists and economists provide an upbeat assessment of the January CoreLogic release that showed US home prices rising nearly 10% annually (Jan-Jan). That leaves "substantial upside risk to our 2013 HPA forecast of 4.7%".Thursday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 355 thousand from 344 thousand last week. This is pre "sequester", and unemployment claims might increase soon.

• Also at 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $43.0 billion in January from $38.5 billion in December.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve will be released.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion in January.

No Government Shutdown on March 27th?

by Calculated Risk on 3/06/2013 06:20:00 PM

Imagine going six months without a manufactured crisis? Maybe it will happen. I expect the Senate will restore some of the sequestration cuts, but this sounds like a little progress.

From the NY Times: Moving First on Budget, House Passes Funding Bill

The House on Wednesday easily passed legislation to keep the government financed through September, raising pressure on the Senate to quickly follow suit before the current financing runs out on March 27.

The House bill gives military and veterans programs some breathing room under the automatic spending cuts that took effect on Friday by increasing financing for Pentagon priorities.

But domestic programs are left largely unprotected from cuts of up to 11 percent under the so-called sequestration.

Senator Barbara Mikulski of Maryland ... said she would demand the kind of changes the House afforded military programs for at least some of the domestic side of the spending bill. That way Congress can prioritize programs that lift economic growth now, like transportation and infrastructure, and strengthen future economic growth through science and technology, even within the strictures of across-the-board cuts.

...

Senator Mitch McConnell of Kentucky, the Republican leader, said Republican leaders in the House and Senate accepted that Senate Democrats would want to put their mark on the spending plan. He was still sanguine that a final measure would reach President Obama in time for Congress’s two-week spring recess, set to begin on March 23.

Fed's Beige Book: Economic activity expanded at "modest to moderate" pace

by Calculated Risk on 3/06/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Kansas City and based on information collected on or before February 22, 2013"

Reports from the twelve Federal Reserve Districts indicated that economic activity generally expanded at a modest to moderate pace since the previous Beige Book. ...And on real estate:

Most Districts reported expansion in consumer spending, although retail sales slowed in several Districts. Automobile sales were strong or solid most Districts, and tourism strengthened in a number of Districts. The demand for services was generally positive across Districts, most notably for technology and logistics firms. ... Many Districts noted rising gasoline prices and fiscal policy as having a negative effect on consumer sales, and contacts in the Boston, New York, and Minneapolis Districts said severe weather depressed sales somewhat.

Residential real estate activity continued to strengthen in most Districts, although the pace of growth varied. Contacts in the Boston, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco Districts noted strong growth in home sales, while New York and Chicago reported slight improvements. A realtor in the Richmond District indicated that low interest rates continued to motivate home buyers, and potential buyers in the Philadelphia District expressed greater confidence, including entry-level purchasers who had been increasingly opting to rent since mid-summer. Contacts in the Cleveland and Atlanta Districts said sales were higher than a year ago. Home construction increased in most Districts, with the exception of the Kansas City District where it was reported as unchanged. Several Districts noted ongoing strength in multifamily construction, although contacts in the Atlanta and Cleveland Districts mentioned continued financing difficulties for builders. Home prices edged higher in the majority of Districts, with lower inventories generally cited as the primary cause. Richmond and Atlanta Realtors observed multiple offers on many homes. Philadelphia real estate contacts continued to report low-end home prices as firm or rising slightly, while high-end home prices were still falling. Inventories declined in nearly all Districts, with Realtors in several Districts concerned about the impact on future sales volume.This suggests sluggish growth overall, with some negative impact from "fiscal policy" ... and with mostly "strong" growth for residential real estate.

Overall commercial real estate conditions were mixed or slightly improved in most Districts.

Report: Personal Bankruptcy Filings decline 21% year-over-year in February

by Calculated Risk on 3/06/2013 10:47:00 AM

From the American Bankruptcy Institute: February Bankruptcy Filings Decrease 21 Percent from Previous Year, Commercial Filings Fall 29 Percent

Total bankruptcy filings in the United States decreased 21 percent in February over last year, according to data provided by Epiq Systems, Inc. Bankruptcy filings totaled 82,285 in February 2013, down from the February 2012 total of 104,537. Consumer filings declined 21 percent to 78,611 from the February 2012 consumer filing total of 99,378.Personal bankruptcy filings peaked in 2010 at 1.54 million (highest since the bankruptcy law change in 2005). Filings declined to 1.22 million last year, and will probably be just over 1 million this year - the lowest level since 2008. Note: Even in good economic years, there are around 800 thousand personal bankruptcy filings.

...

“The post-recession trends of reduced consumer spending, low interest rates and tighter lending standards continue to be reflected in fewer bankruptcy filings,” said ABI Executive Director Samuel J. Gerdano. “As these trends persist, expect bankruptcy filings to continue to decline in 2013.”

This is another indicator of less economic stress.

ADP: Private Employment increased 198,000 in February

by Calculated Risk on 3/06/2013 08:19:00 AM

Private sector employment increased by 198,000 jobs from January to February, according to the February, according to the January ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The January 2013 report, which reported job gains of 192,000, was revised upward by 23,000 to 215,000 jobs.This was above the consensus forecast for 173,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 171,000 payroll jobs in February, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market remains sturdy in the face of significant fiscal headwinds. Businesses are adding to payrolls more strongly at the start of 2013 with gains across all industries and business sizes. Tax increases and government spending cuts don’t appear to be affecting the job market.”

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Applications Increase Sharply in Latest Weekly Survey

by Calculated Risk on 3/06/2013 07:00:00 AM

From the MBA: Mortgage Applications Increase as Rates Drop in Latest MBA Weekly Survey

The Refinance Index increased 15 percent from the previous week and was at its highest level since mid-January. The seasonally adjusted Purchase Index also increased 15 percent from one week earlier and was at its highest level since the week ending February 1.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.70 percent from 3.77 percent, with points decreasing to 0.39 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

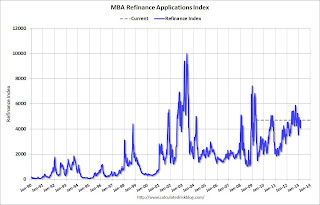

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, March 05, 2013

Wednesday: ADP Employment, Beige Book

by Calculated Risk on 3/05/2013 07:11:00 PM

Back in October, ADP revised their methodology for estimating changes in private employment. Here is a table of the four releases since the methodology was changed.

| Comparison of BLS Private Employment and ADP (000s) | ||||

|---|---|---|---|---|

| ADP Initial | Revised | BLS Initial (Private Only) | BLS Revised (Private) | |

| Oct-12 | 158 | 159 | 184 | 217 |

| Nov-12 | 118 | 173 | 147 | 256 |

| Dec-12 | 215 | 185 | 168 | 202 |

| Jan-13 | 192 | - | 166 | - |

In general it appears the new methodology is better, but it is still too early for a statistical analysis. With this small sample, it appears that the initial BLS report will be +/- 20% of the ADP number or so.

Wednesday economic releases:

• At 10:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 173,000 payroll jobs added in February.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 2.2% decrease in orders.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of an impact from the recent tax increases.

Market Update

by Calculated Risk on 3/05/2013 04:45:00 PM

Click on graph for larger image.

By request - following the new high on the Dow today - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 2007, just before the recession started. We can't call it a "lost decade" for stocks any more.

Another note: A new high doesn't tell us much. Over the last 50 years (starting in 1963) there were 27 years with new highs. If we excluded the miserable '00s, there were new highs in 26 of 38 years. So new highs are not unusual.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...