by Calculated Risk on 1/30/2013 02:15:00 PM

Wednesday, January 30, 2013

FOMC Statement: "Economic activity paused because of transitory factors"

Pretty much the same as last month. The FOMC argues "economic activity paused in recent months, in large part because of weather-related disruptions and other transitory factors".

FOMC Statement:

Information received since the Federal Open Market Committee met in December suggests that growth in economic activity paused in recent months, in large part because of weather-related disruptions and other transitory factors. Employment has continued to expand at a moderate pace but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has shown further improvement. Inflation has been running somewhat below the Committee’s longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. Although strains in global financial markets have eased somewhat, the Committee continues to see downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

Comments on Q4 GDP and Investment

by Calculated Risk on 1/30/2013 10:01:00 AM

The Q4 GDP report was negative, with a 0.1% annualized decline in real GDP, and lower than the expected 1.0% annualized increase. Final demand increased in Q4 as personal consumption expenditures (PCE) increased at a 2.2% annual rate (up from 1.6% in Q3), and residential investment increased at a 15.3% annual rate (up from 13.5% in Q3).

Investment in equipment and software rebounded in Q4 (increased at 12.4% annualized rate), and investment in non-residential structures was slightly negative.

The slight decline in GDP was related to changes in private inventories (subtracted 1.27 percentage points), less Federal Government spending (subtracted 1.25 percentage points), and a negative contribution from trade (subtracted 0.25 percentage points).

Overall this was a weak report, but with some underlying positives (the increase in PCE and private fixed investment). I expect the payroll tax increase to slow PCE growth in the first half of 2013 - and for additional government austerity - but I think the economy will continue to grow this year.

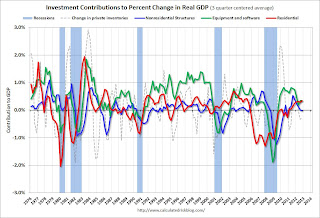

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the seventh consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment increased solidly in Q4, after decreasing in Q3. This followed twelve consecutive quarters with a positive contribution.

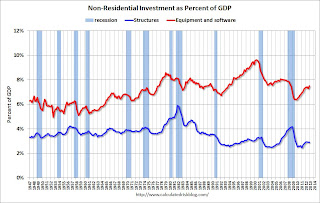

The contribution from nonresidential investment in structures was slightly negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

However the drag from state and local governments is ongoing, although the drag in Q4 was small. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline in state and local government spending has been relentless and unprecedented. The good news is the drag appears to be ending.

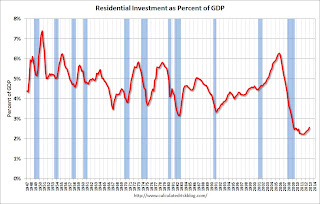

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

In 2011, the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).

Real GDP decreased 0.1% Annualized in Q4

by Calculated Risk on 1/30/2013 08:39:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.1 percent in the fourth quarter of 2012 (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1 percentPersonal consumption expenditures (PCE) increased at a 2.2% annualized rate, and residential investment increased 15.3%, equipment and software increased 12.4%. That is a solid increase in fixed investment.

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and residential fixed investment that were partly offset by a negative contribution from state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The decrease in real GDP in the fourth quarter primarily reflected negative contributions from private inventory investment, federal government spending, and exports that were partly offset by positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

"Change in private inventories" subtracted 1.27 percentage points from GDP in Q4, and the Federal government subtracted 1.25 percentage points (mostly a sharp decrease in defense spending).

This was below expectations, but the internals were decent with PCE and private investment increasing (domestic demand). I'll have more on GDP later ...

ADP: Private Employment increased 192,000 in January

by Calculated Risk on 1/30/2013 08:20:00 AM

Private sector employment increased by 192,000 jobs from December to January, according to the January ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The December 2012 report, which reported job gains of 215,000, was revised downward by 30,000 to 185,000 jobs.This was above the consensus forecast for 172,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 155,000 payroll jobs in January, on a seasonally adjusted (SA) basis.

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is slowly, but steadily, improving. Monthly job gains appear to have accelerated from near 150,000 to closer to 175,000. Construction is finally kicking into gear and more than offsetting the weakness in manufacturing. The recent gains may be overstating any improvement, particularly in the context of recent revivals in growth at the start of the past three years, but the gains are encouraging nonetheless.”

Note: ADP hasn't been very useful in predicting the BLS report.

Tuesday, January 29, 2013

Wednesday: Q4 GDP, FOMC Announcement, ADP Employment

by Calculated Risk on 1/29/2013 07:16:00 PM

Doug Short provides a preview on GDP: WSJ Economists' GDP Forecasts: 1.6% for Q4 2012 and 1.7 in Q1 2013

A big economic announcement this week will be tomorrow's Advance Estimate for Q4 GDP from the Bureau of Economic Analysis. The final number for Q3 GDP was 3.1%. The general consensus is that Q4 will show a significant decline in this broad measure of the economy. Investing.com weighs in at 1.8%. According to Briefing.com, the consensus for Q4 is 1.0%. However, Briefing.com's own estimate, I should point out, is considerably lower at 0.1%.From Merrill Lynch:

The first release of Q4 GDP is likely to show that growth weakened at the end of 2012. We forecast GDP growth of 1.0%, down from the 3.1% pace in Q3. However, much of the slowdown owes to a contraction in inventories and widening in the trade deficit; domestic final sales should hold close to 2.0%. As such, we advise smoothing through the two quarters to gauge the underlying trend of the economy.As always, the details will matter.

We expect a decent gain in consumer spending of 2.3% and a solid increase in residential investment of 17%. ... The healthy gain in residential investment reflects the turn in homebuilding and greater renovation spending. We also expect equipment and software investment to increase after declining in Q3. On the downside, the trade deficit is likely to widen due to a sharp drop in exports. The biggest drag, however, will come from a sharp contraction in inventories.

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January will be released. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in January. Even with the new methodology, the report still hasn't been that useful in predicting the BLS report.

• At 8:30 AM, the Q4 GDP report will be released. This is the advance (first) release from the BEA. The consensus is that real GDP increased 1.0% annualized in Q4.

• Around 11:15 AM, the FOMC Meeting Announcement will be released. No significant changes are expected,

Earlier on House Prices:

• Case-Shiller: House Prices increased 5.5% year-over-year in November

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Lawler on Housing Vacancy Survey

by Calculated Risk on 1/29/2013 03:50:00 PM

CR Note: This is wonkish, but important for those using the HVS. An excerpt from economist Tom Lawler: Housing Vacancy Survey: Vacancy Rates “Mixed” on Quarter, Down from Year Ago; Reported Homeownership Rate Lowest Since 1996 (and “True” Homeownership Even Lower!)

The Census Bureau released the “Residential Vacancies and Homeownership” Report for Q4/2012, which is based on the “Housing Vacancy Survey” supplement to the Current Population Survey. The HVS results have not been consistent with the results from the last two decennial Censuses, with the HVS significantly overstating housing vacancy rates and homeownership rates – with the HVS/Census “gap” growing from 2000 to 2010.

According to the Q4 HVS results, the US rental vacancy rate last quarter was 8.7%, up from 8.6% in the previous quarter but down from 9.4% in Q4/11; the HVS homeowner vacancy rate last quarter ws 1.9%, unchanged from the previous quarter but down from 2.3% in Q4/11; and the US homeownership rate last quarter was 65.4%, down from 65.5% in the previous quarter and 66.0% in Q4/11. Last quarter’s HVS-based homeownership rate estimate was the lowest for a fourth quarter since 1996, and the “actual” homeownership rate last quarter was almost certainly lower.

As highlighted in the “sources and accuracy” page of the CPS/HVS, the HVS results for many key measures vary dramatically from decennial Census results.

| 1990 | 2000 | 2010 | |

|---|---|---|---|

| Rental Vacancy Rate | |||

| HVS first half | 7.2% | 7.9% | 10.6% |

| Census (April 1) | 8.5% | 6.8% | 9.2% |

| HVS - Census | -1.3% | 1.1% | 1.4% |

| Homeowner Vacancy Rate | |||

| HVS first half | 1.7% | 1.5% | 2.6% |

| Census (April 1) | 2.1% | 1.7% | 2.4% |

| HVS - Census | -0.4% | -0.2% | 0.2% |

| Homeownership Rate | |||

| HVS first half | 63.9% | 67.2% | 67.0% |

| Census (April 1) | 64.2% | 66.2% | 65.1% |

| HVS - Census | -0.3% | 1.0% | 1.9% |

While it is generally agreed that the HVS does not provide an accurate picture of the US housing market, and Census analysts are “concerned” about the growing “gap” between the HVS and the decennial Census, to the best of my knowledge no work has been done on identifying whether the HVS inaccuracies are related to sampling errors, non-sampling errors, or both.

The HVS report includes “estimates” of the US housing stock by occupancy and vacancy status, but its estimates for the total housing stock are based on housing stock estimates from the Population Division of Census, which are “benchmarked” to decennial Census results. Stated another way, the HVS assumes that the decennial Census estimates of the housing stock are accurate, but also implicitly assumes that the decennial Census estimates of the number of occupied units – total and by tenure – and the number of vacant units – total and by vacancy status – are “bogus.”

Here is the table on the US housing stock from today’s HVS report.

Click on table for larger image.

Click on table for larger image.It is worth noting that the 90% confidence interval shown in the HVS report are measures of “sampling variability,” and assume that the sample used is an unbiased sample of the entire housing “universe.” Statistical comparisons between the HVS and the ACS reject the hypothesis that both surveys use unbiased samples from the same housing universe, while comparisons of the HVS and the decennial Census reject the hypothesis that the HVS estimates are unbiased estimates of housing vacancy and homeownership rates.

A recent study comparing the housing “universe” used for the 2010 ACS with that of the decennial Census revealed some startling (and troubling) differences in terms of both housing units omitted or erroneously excluded and (especially) “housing” unit erroneously included. The HVS sample almost certainly has even bigger “issues.”

The biggest apparent “bias” in the HVS is that it materially underestimates the number/share of the housing stock that is occupied by renters (and overstates the number/share of the housing stock that is vacant). I am not sure why.

...

Lawler concludes: The “true” US homeownership rate last quarter was probably the lowest since the mid-80’s.

HVS: Q4 Homeownership and Vacancy Rates

by Calculated Risk on 1/29/2013 01:34:00 PM

The Census Bureau released the Housing Vacancies and Homeownership report for Q4 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey. Note: I expect housing economist Tom Lawler to send me some comments on this today.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased slightly to 65.4%, and down from 65.5% in Q3.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate was unchanged at 1.9% in Q4. This is the lowest level since 2005 for this report.

The HVS homeowner vacancy rate was unchanged at 1.9% in Q4. This is the lowest level since 2005 for this report.

The homeowner vacancy rate has peaked and is now declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate was increased in Q4 to 8.7%, from 8.6% in Q3.

The rental vacancy rate was increased in Q4 to 8.7%, from 8.6% in Q3.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: House Prices increased 5.5% year-over-year in November

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

by Calculated Risk on 1/29/2013 11:27:00 AM

There is a clear seasonal pattern for house prices, and earlier this year I predicted that the Case-Shiller indexes would turn negative month-to-month in October on a Not Seasonally Adjusted (NSA) basis. That is the normal seasonal pattern.

Also I expected smaller month-to-month declines this winter than for the same months last year. Sure enough, Case-Shiller reported that the Composite 20 index NSA declined slightly in October, and also declined slightly again in November (a 0.1% decline). In November 2011, the index declined 1.3% on a month-to-month basis, so this is a significant change.

Over the winter the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up over 6% or so year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through November). The CoreLogic index turned negative month-to-month in the September report, and then turned slightly positive in November (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November.

For November, Case-Shiller reported the sixth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in November suggests that house prices probably bottomed earlier in 2012 (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.2% |

| Nov-12 | 5.5% |

| Dec-12 | |

| Jan-13 | |

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to September 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

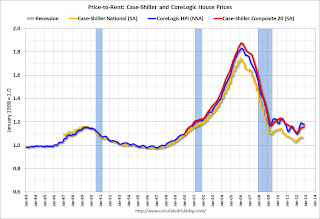

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Case-Shiller: House Prices increased 5.5% year-over-year in November

by Calculated Risk on 1/29/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October and November).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Extend Gains According to the S&P/Case-Shiller Home Price Indices

Data through November 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... showed home prices rose 4.5% for the 10-City Composite and 5.5% for the 20-City Composite in the 12 months ending in November 2012.

“The November monthly figures were stronger than October, with 10 cities seeing rising prices versus seven the month before.” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. Phoenix and San Francisco were both up 1.4% in November followed by Minneapolis up 1.0%. On the down side, Chicago was again amongst the weakest with a drop of 1.3% for November.

“Winter is usually a weak period for housing which explains why we now see about half the cities with falling month-to-month prices compared to 20 out of 20 seeing rising prices last summer. The better annual price changes also point to seasonal weakness rather than a reversal in the housing market. Further evidence that the weakness is seasonal is seen in the seasonally adjusted figures: only New York saw prices fall on a seasonally adjusted basis while Cleveland was flat.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.7% from the peak, and up 0.5% in November (SA). The Composite 10 is up 5.3% from the post bubble low set in March (SA).

The Composite 20 index is off 29.8% from the peak, and up 0.6% (SA) in November. The Composite 20 is up 6.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 4.5% compared to November 2011.

The Composite 20 SA is up 5.5% compared to November 2011. This was the sixth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in November seasonally adjusted (also 10 of 20 cities increased NSA). Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 3.8% from the peak. Note that the red column (cumulative decline through November 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in November seasonally adjusted (also 10 of 20 cities increased NSA). Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 3.8% from the peak. Note that the red column (cumulative decline through November 2012) is above previous declines for all cities.This was slightly below the consensus forecast for a 5.8% YoY increase. I'll have more on prices later.

Monday, January 28, 2013

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/28/2013 08:58:00 PM

From the WSJ: Bank 'Stress Tests' to Be Released Over 2 Days

The Federal Reserve said Monday that it will release the results of the latest "stress tests" for the nation's 19 largest banks over two separate days in March.Here is the Federal Reserve press release.

...

The Fed said it will release on March 7 scores assessing how banks would hold up under deteriorating economic and financial-market conditions. On March 14, the Fed will reveal whether the 19 banks will be permitted to repurchase stock or pay dividends.

...

Unlike previous years, banks whose dividend or share-buyback plans would cause them to fail the central bank's test will essentially be allowed a mulligan, giving them the chance to pare back or alter their plan to meet Fed thresholds before the official results are released.

Tuesday economic releases:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November. The consensus is for a 5.8% year-over-year increase in the Composite 20 index (NSA) for November. The Zillow forecast is for the Composite 20 to increase 5.3% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for January. The consensus is for the index to be unchanged at 65.1.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership report from the Census Bureau will be released. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't match other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.