by Calculated Risk on 7/30/2012 01:47:00 PM

Monday, July 30, 2012

Lawler on Manufactured Housing

From Tom Lawler:

The Commerce Department estimated that manufactured housing shipments ran at a seasonally adjusted annual rate of 54,000 in June, down from 56,000 in May. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 57,000, up from 51,600 in 2011 but just a fraction of the pace prior to last decade’s collapse.

The Commerce Department also estimated that manufactured housing placements ran at a SAAR of 47,000 in May, down from 51,000 in April. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 52,200, up from 47,000 in 2011.

| Manufactured Housing Shipments (Annual Average, 000's) | |

|---|---|

| 1961-1970 | 255.6 |

| 1971-1980 | 348.5 |

| 1981-1990 | 243.7 |

| 1991-2000 | 296.8 |

| 2001-2006 | 154 |

| 2006-2010 | 78.9 |

| 2011 | 51.6 |

| 2012YTD | 57 |

Click on graph for larger image.

Click on graph for larger image.Here is a graph from Lawler showing the annual manufactured housing shipments since 1959. The column for 2012 is the annual sales rate for the first six months of the year.

Although sales are running at about a 10% increase over last year, shipments in 2012 will still be the fourth lowest on record behind only 2009, 2010, and 2011.

Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

by Calculated Risk on 7/30/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth Amid Weaker View of General Business Activity

Texas factory activity continued to increase in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 15.5 to 12, suggesting slightly slower output growth.This was below expectations of a 2.5 reading for the general business activity index.

The new orders index was positive for the second month in a row, although it moved down from 7.9 to 1.4. Similarly, the shipments index posted its second consecutive positive reading but edged down from 9.6 to 7.4. ... The general business activity plummeted to -13.2 after climbing into positive territory in June. Nearly 30 percent of manufacturers noted a worsening in the level of business activity in July, pushing the index to its lowest reading in 10 months.

...

Labor market indicators reflected stronger labor demand. Employment growth continued in July, although the index edged down from 13.7 to 11.8. ... The hours worked index was 4.1, up slightly from its June reading.

The regional manufacturing surveys were mostly weak in July. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The ISM index for July will be released Wednesday, August 1st, and these surveys suggest another weak reading. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).

Europe Update

by Calculated Risk on 7/30/2012 09:10:00 AM

Spanish 10 year bond yields are down to 6.61% this morning. Italian yields are at 6.03%.

A few articles and comments on Europe, first from Tim Duy: Fed Watch: The Euromess Continues

Excitement is almost guaranteed this week, with both the Federal Reserve and the European Central Bank pondering their next moves. At the moment, I am more fascinated with the latter, as it represents the more fast moving policy failure for the moment. In response to that disaster to date, it is now widely expected that the ECB will deliver a significant policy expansion, possibly accepting its responsibility of lender of last resort for sovereign debt in the Eurozone. I think it is widely believed that this will be the turning point in Europe. In some ways, yes, as it would keep the threat of imminent dissolution at bay. But the Eurozone will still be fundamentally hobbled by a devotion to re-balancing via austerity-driven internal devaluation. This does not offer a promising long-run outcome.From Paul Krugman: Crash of the Bumblebee

First of all, Europe’s single currency is a deeply flawed construction. And Mr. Draghi, to his credit, actually acknowledged that. “The euro is like a bumblebee,” he declared. “This is a mystery of nature because it shouldn’t fly but instead it does. So the euro was a bumblebee that flew very well for several years.” But now it has stopped flying. What can be done? The answer, he suggested, is “to graduate to a real bee.”From Reuters: Euro zone crisis heads for September crunch

Never mind the dubious biology, we get the point. In the long run, the euro will be workable only if the European Union becomes much more like a unified country.

...

But the creation of a United States of Europe won’t happen soon, if ever, while the crisis of the euro is now. So what can be done to save the currency?

Over the past couple of years, Europe has muddled through a long series of crunch moments in its debt crisis, but this September is shaping up as a "make-or-break" month as policymakers run desperately short of options to save the common currency.From the WSJ: Greece Seen Facing €30 Billion Shortfall

Crisis or no crisis, many European policymakers will take their summer holidays in August. When they return, a number of crucial events, decisions and deadlines will be waiting.

Greece's chronic recession and the receding hope of an economic recovery in the next two years have blown a hole of at least 30 billion euros ($36.85 billion) in its financial rescue plan, officials familiar with the situation said.

The officials argued that the findings indicate a need for official creditors to write down their claims by at least that amount if they want to keep Greece in the euro zone, as well as finding new money to fund the country for longer. The officials represented two of four parties to the talks: the Greek government and the "troika" of the European Union, European Central Bank and International Monetary Fund.

...

"The haircut on private holders has proved not to be enough," said one official involved in the next round of talks.

Sunday, July 29, 2012

Monday: Dallas Fed Manufacturing Survey

by Calculated Risk on 7/29/2012 09:51:00 PM

This will be a busy week with the two day FOMC meeting ending on Wednesday, the ECB meeting in Europe on Thursday, and several key economic releases including the July employment report on Friday.

First from Reuters: Juncker: Euro zone leaders, ECB to act on euro - paper

[Eurogroup head Jean-Claude] Juncker told Germany's Sueddeutsche Zeitung and France's Le Figaro in reports made available on Sunday that leaders would decide in the next few days what measures to take to tackle Spanish bond yields which last week touched euro-era highs. They had "no time to lose," he said.• On Monday, at 10:30 AM ET, the Dallas Fed Manufacturing Survey for July will be released. This is the last of regional surveys for July. The consensus is for 2.5 for the general business activity index, down from 5.8 in June.

The Asian markets are green tonight, with the Nikkei up 0.8% and the Shanghai Composite up 0.1%. Check out the chart for the Shanghai composite - the index has been drifting down for 2+ years and is at the levels of early 2009.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 5, and the DOW futures down about 30.

Oil: WTI futures are at $90.04(this is down from $109.77 in February, but up last week) and Brent is at $106.51 per barrel.

Yesterday:

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

And the final question for the July economic contest:

FOMC Preview: QE3 now or later?

by Calculated Risk on 7/29/2012 06:19:00 PM

There is a chance that the FOMC will announce QE3 this week although some analysts expect QE3 in September and others after the election in November.

As an example, from Merrill Lynch last week:

There is quite a bit of uncertainty about the exact timing and shape of forthcoming Fed easing. Although there is a good chance of some QE3 at next week’s FOMC meeting, we still think it is an extension of the forward guidance language through “at least late 2015” is (slightly) more likely This would resemble the policy pattern last year, and would keep the Fed’s options open. It also would allow the Fed to make a compelling case that bad data, not politics, are driving QE3.The "politics" argument cuts both ways - delaying action when projections show unemployment too high for years, and inflation too low - is also giving in to "politics".

Some arguments for waiting until September 13th are:

1) There will be more data available (two more employment reports for July and August, and the 2nd estimate of Q2 GDP on August 29th). Of course "waiting" always allows for "more data" - so people can always use this argument.

2) Housing data has been improving, and residential investment is usually the best leading indicator for the economy.

3) The FOMC members will update projections in September, and Fed Chairman Ben Bernanke will hold a news conference to explain the reasons for any action. There is no news conference scheduled following the meeting this week.

4) There are also some arguments that seasonal factors are distorting the recent data.

Probably the most compelling reason for waiting is the housing argument, but even though housing is recovering, the housing market is still very weak.

And the most recent projections are already becoming "untenable" (as Atlanta Fed President Lockhart recently noted). Here were the projections for GDP:

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

Based on the Q2 advance GDP report released on Friday, GDP would have to increase at a 2.1% to 3.1% in the 2nd half of 2012 to meet the FOMC projections for 2012. That suggests a further downward revision in FOMC projections in September.

And the June projections were already very low - "shocking" as Tim Duy wrote) The FOMC members see unemployment in the 7% to 7.7% range at the end of 2014, and inflation also below target through 2014.

The data supports QE3 this week, but the data also supported QE3 in June. One of the reasons I thought QE3 was unlikely in June was the lack of foreshadowing from the Fed. There have been plenty of hints since then, so QE3 is very possible this week - but still uncertain.

Yesterday:

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

When will the Case-Shiller house price index turn positive Year-over-year?

by Calculated Risk on 7/29/2012 10:14:00 AM

The CoreLogic index turned positive year-over-year in March: CoreLogic® Home Price Index Shows Year-Over-Year Increase of Just Over One Percent

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 1.1 percent in April 2012 compared to April 2011. This was the second consecutive year-over-year increase this year ...And the FHFA index turned positive year-over-year in February: FHFA House Price Index Up 0.3 Percent in February

For the 12 months ending in February, U.S. prices rose 0.4 percent, the first 12-month increase since the July 2006 - July 2007 interval.However we are still waiting on Case-Shiller.

On Friday I posted Zillow's forecasts for the May Case-Shiller indexes to be released this coming Tuesday. The year-over-year (YoY) decline in Case-Shiller prices has been getting smaller all year, and the Zillow forecast suggests the YoY decline will be even smaller in the May report - and be the smallest YoY decline since the expiration of the housing tax credit.

I looked at the recent improvement in prices (comparing the month-to-month changes for the NSA index to last year). If the Zillow forecast is close, at the current pace of improvement, it looks like the YoY change will turn positive in the July report - it could even happen in the June report (to be released next month).

Click on graph for larger image.

Click on graph for larger image. Here is a graph of the YoY change in the Case-Shiller Composite 10 and 20 indexes. In April, the indexes were down 2.2% and 1.9%, respectively.

Zillow is forecasting the Composite 10 index will be down 1.3% YoY in the May report, and the Composite 20 index will be down 1.0%.

Earlier this year, when I argued prices were near the bottom for the Not Seasonally Adjusted (NSA) repeat sales indexes, I thought the year-over-year change would turn positive late this year or early in 2013. Right now it looks like the July report.

Saturday, July 28, 2012

Unofficial Problem Bank list declines to 900 Institutions

by Calculated Risk on 7/28/2012 08:57:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 27, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions through June 2012, which led to many change to the Unofficial Problem Bank List. For the week, there were seven removals and two additions leaving the list at 900 institutions with assets of $349.5 billion. A year ago, the list held 995 institutions with $415.4 billion in assets. For the month of July 2012, there were 12 additions and 29 removals, with 20 from action termination, six from failure, two from unassisted mergers, and one from voluntary liquidation.Earlier:

The seven removals this week came from action termination including Community Commerce Bank, Claremont, CA ($299 million); Traverse City State Bank, Traverse City, MI ($188 million); Security Bank, S.B., Springfield, IL ($160 million); Professional Bank, Coral Gables, FL ($152 million); Progrowth Bank, Nicollet, MN ($133 million); Capital Community Bank, Provo, UT ($122 million); and Colonial American Bank, Horsham, PA ($60 million). Professional Bank is only the 5th bank from Florida to be removed from the list because of action termination. Oregon and Georgia have only seen one bank and two banks, respectively, removed from the list. For the second week in a row, there was a failure in Georgia -- Jasper Banking Company, Jasper, GA -- that failed without being under an formal enforcement action.

The two additions were South Valley Bank & Trust, Klamath Falls, OR ($854 million) and First Security Bank of Helena, Helena, MT ($42 million).

The FDIC [issued] Prompt Corrective Action orders against Sevier County Bank, Sevierville, TN ($323 million) and Westside Community Bank, University Place, WA ($113 million).

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

Lawler: Expect "significant" upward revisions for Q2 New Home Sales

by Calculated Risk on 7/28/2012 04:37:00 PM

From economist Tom Lawler:

D.R. Horton, the largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 totaled 6,079, up 24.7% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 23% last quarter, down from 27% a year ago. Home deliveries last quarter totaled 4,957, up 8.8% from the comparable quarter of 2011, at an average sales price of $224,975, up 5.2% from a year ago. The company’s order backlog at the end of June was 7,311, up 30.6% from last June.

Standard Pacific Corp., the 13th largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 (ex JVs) totaled 1,108, up 45.0% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 11% last quarter, down from 14% a year ago. Home deliveries totaled 815, up 33.6% from the comparable quarter of 2011, at an average sales price of $337,000, up 0.6% from a year ago. The company’s order backlog at the end of June was 1,266, up 62.1% from last June.

Here are some summary stats of orders, deliveries, and backlog for builders who have reported results for last year.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 6/12 | 6/11 | 6/10 | 6/12 | 6/11 | 6/10 | 6/12 | 6/11 | 6/10 | |

| D.R. Horton | 4,957 | 4,555 | 6,805 | 6,079 | 4,874 | 4,921 | 7,311 | 5,600 | 4,430 |

| PulteGroup | 3,816 | 3,633 | 5,030 | 5,578 | 4,222 | 4,218 | 7,560 | 5,777 | 5,644 |

| NVR | 2,475 | 2,207 | 3,354 | 2,614 | 2,468 | 2,559 | 5,048 | 3,946 | 3,766 |

| The Ryland Group | 1,149 | 885 | 1,505 | 1,415 | 1,065 | 959 | 2,289 | 1,646 | 1,368 |

| Meritage Homes | 1,042 | 856 | 1,207 | 1,353 | 910 | 900 | 1,611 | 994 | 1,044 |

| Standard Pacific | 815 | 610 | 891 | 1,108 | 764 | 719 | 1,266 | 781 | 649 |

| M/I Homes | 625 | 590 | 790 | 826 | 635 | 602 | 1,168 | 833 | 748 |

| Total | 14,879 | 13,336 | 19,582 | 18,973 | 14,938 | 14,878 | 26,253 | 19,577 | 17,649 |

| YoY % Change | 11.6% | -31.9% | 27.0% | 0.4% | 34.1% | 10.9% | |||

Obviously, the net orders of the above builders showed considerably stronger YOY growth than 19.5% (not seasonally adjusted) YOY growth rate for Q2/12 reported in the preliminary Census Bureau’s new SF home sales reports. While Census’ treatment of cancellations differs from the builders’ net orders, and while historical data suggest there may be a timing difference between when a builder records a sale vs. when Census counts a home as sold, these results in my view suggest (based on past relationships) that Census new SF home sales numbers for the second quarter of 2012 will be revised upward significantly — and by about the same about as Q1 sales were revised upward from the March new SF sales report.

CR Note: Back in April, based on public builder reports, Tom Lawler estimated that the Census Bureau would revise up Q1 New Home sales from the then reported 337 thousand SAAR (seasonally adjusted annual rate) to around 350 thousand. In the most recent report, Census has revised up Q1 to 352 thousand.

For Q2, in the most recent new home sales report, the Census Bureau estimated sales at 363 thousand SAAR. Based on builder reports, Lawler estimates that this will be revised up to around 380 thousand.

Schedule for Week of July 29th

by Calculated Risk on 7/28/2012 01:01:00 PM

Earlier:

• Summary for Week Ending July 27th

The key report for this week will be the July employment report to be released on Friday, Aug 3rd. Other key reports include the May Case-Shiller house price indexes on Tuesday, the ISM manufacturing index on Wednesday, vehicle sales on Wednesday, and the ISM non-manufacturing (service) index on Friday.

On Wednesday, the FOMC concludes a two day meeting, and there is the possibility of additional policy accommodation. The European Central Bank (ECB) holds a meeting on Thursday, and there will be a focus on ECB President Mario Draghi's comments following the meeting.

10:30 AM: Dallas Fed Manufacturing Survey for July. This is the last of regional surveys for July. The consensus is for 2.5 for the general business activity index, down from 5.8 in June.

8:30 AM ET: Personal Income and Outlays for June. The consensus is for a 0.2% increase in personal income in June, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through April 2012 (the Composite 20 was started in January 2000).

The consensus is for a 1.4% decrease year-over-year in Composite 20 prices (NSA) in May. The Zillow forecast is for the Composite 20 to decline 1.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted. The CoreLogic index increased 1.8% in May (NSA).

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a decrease to 52.5, down from 52.9 in June.

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for a decrease to 61.5 from 62.0 last month.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

All day: Light vehicle sales for July. Light vehicle sales are expected to decrease to 14.0 million from 14.1 million in June (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate. TrueCar is forecasting:

The July 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.1 million new car sales, up from 12.2 million in July 2011 and down from 14.1 million in June 2012Edmunds.com is forecasting:

An estimated 1,166,665 new cars will be sold in July for a Seasonally Adjusted Annual Rate (SAAR) of 14.0 million light vehicles, according to the latest auto sales forecast by Edmunds.com.8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 120,000 payroll jobs added in June, down from the 176,000 reported last month.

10:00 AM ET: ISM Manufacturing Index for July.

10:00 AM ET: ISM Manufacturing Index for July. Here is a long term graph of the ISM manufacturing index. Last month saw the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

2:15 PM: FOMC Meeting Announcement. No changes are expected to interest rates, however additional policy accommodation is possible.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 353 thousand last week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.7% increase in orders.

8:30 AM: Employment Report for July. The consensus is for an increase of 100,000 non-farm payroll jobs in July, up from the 80,000 jobs added in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 100,000 non-farm payroll jobs in July, up from the 80,000 jobs added in June.The consensus is for the unemployment rate to remain unchanged at 8.2%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 3.84 million jobs since employment bottomed in February 2010 (4.37 million private sector jobs added, and 0.53 million public sector jobs lost).

The economy has added 3.84 million jobs since employment bottomed in February 2010 (4.37 million private sector jobs added, and 0.53 million public sector jobs lost).There are still 4.5 million fewer private sector jobs now than when the recession started in 2007. (4.9 million fewer total nonfarm jobs).

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a decrease to 52.0 from 52.1 in June. Note: Above 50 indicates expansion, below 50 contraction.

Summary for Week ending July 27th

by Calculated Risk on 7/28/2012 08:02:00 AM

This was one of those weeks were Europe stole the headlines, especially comments from ECB President Mario Draghi. Of course Draghi has said before that the ECB would do “whatever it takes”, so this wasn’t really new news.

Here was Lou Barnes reaction:

Sentiment turned yesterday on ECB President Mario Draghi's "...The ECB is ready to do whatever it takes to preserve the euro. Believe me, it will be enough." He went on to announce his plans to date Jennifer Lopez tonight, Kim Bassinger tomorrow, and win the decathlon gold next week.Once again the economic data was weak. Real GDP for Q2 was reported at a 1.5% annualized rate. And even new home sales were below expectations, although with upward revisions to previous months – and an expected upward revision to the June sales rate – the report was actually fairly solid.

If a central bank has to promise to preserve something, odds are high that it is already dead. This is the talk of 0-10 football coaches. Imagine if an American Fed Chair said he would "preserve the dollar." Not defend its value versus other currencies; not prevent inflation or deflation, but preserve its existence? Elbow the women and children out of the lifeboats.

Manufacturing data was weak again, with the Richmond survey falling off a cliff, and the MarkIt Flash PMI declining in July. However the Kansas City manufacturing survey showed modest growth.

In other data, consumer sentiment was up slightly, weekly initial unemployment claims were down, and the trucking index increased. All of this data suggests more sluggish growth.

Here is a summary of last week in graphs:

• Real GDP increased 1.5% annual rate in Q2

The Q2 GDP report was weak, but slightly better than expected. Final demand weakened in Q2 as personal consumption expenditures increased at only a 1.5% annual rate, and residential investment increased at a 9.7% annual rate.

Click on graph for larger image.

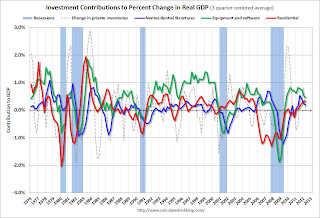

Click on graph for larger image.This graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For this graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential Investment (RI) made a positive contribution to GDP in Q2 for the fifth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Overall the revisions to the last three years were pretty minor.

Overall the revisions to the last three years were pretty minor. This graph shows GDP per quarter as a percent change annualized.

There were some downward revisions in Q1 and Q2 2010, and some upward revisions in 2011.

This was slightly above expectations.

• New Home Sales declined in June to 350,000 Annual Rate

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 350 thousand. This was down from a revised 382 thousand SAAR in May (revised up from 369 thousand). Sales in March and April were revised up too.

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 350 thousand. This was down from a revised 382 thousand SAAR in May (revised up from 369 thousand). Sales in March and April were revised up too.This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 358 thousand SAAR over the first 6 months of 2012, after averaging under 300 thousand for the previous 18 months. All of the recent revisions have been up too.

So even though sales in June were below the consensus forecast of 370,000, this was still a fairly solid report given the upward revisions to previous months. Based on recent revisions, sales in June will probably be revised up too.

• Weekly Initial Unemployment Claims decline to 353,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,250.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,250.The sharp swings over the last few weeks are apparently related to difficulty adjusting for auto plant shutdowns.

This was well below the consensus forecast of 380,000 and is the lowest level for the four week average since March.

• Final July Consumer Sentiment at 72.3

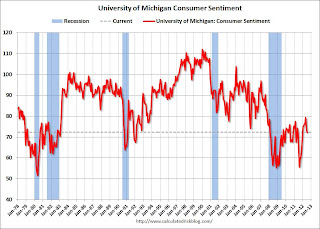

The final Reuters / University of Michigan consumer sentiment index for July increased to 72.3 from the preliminary reading of 72.0, and was down from the June reading of 73.2.

The final Reuters / University of Michigan consumer sentiment index for July increased to 72.3 from the preliminary reading of 72.0, and was down from the June reading of 73.2.This was slightly above the consensus forecast of 72.0 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

• ATA Trucking index increased in June

From ATA: ATA Truck Tonnage Jumped 1.2% in June

From ATA: ATA Truck Tonnage Jumped 1.2% in JuneHere is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and still up 3.7% year-over-year - but has been moving mostly sideways in 2012.

• Other Economic Stories ...

• DataQuick: California Foreclosure Activity Lowest in Five Years

• Markit Flash PMI falls to 51.8

• NAR: Pending home sales index decreased 1.4% in June

• Kansas City Fed: "Modest" Growth in Regional Manufacturing Activity in July

• From the Richmond Fed: Manufacturing Activity Contracted in July; Manufacturers' Optimism Waned