by Calculated Risk on 6/24/2012 01:49:00 PM

Sunday, June 24, 2012

Housing: Jumbo Borrowers Trapped Underwater

From Carolyn Said at the San Francisco Chronicle: Refis on underwater jumbo loans nearly impossible

The four-bedroom split-level they bought for $799,000 has plunged in value to $566,000 - and they owe $648,000. ... The couple, who have perfect credit, don't want to blemish it by walking away from the house or doing a short sale.Since their loan is from a private lender, their only options are 1) Walk away (they can afford the payments and don't want to walk away), 2) try to talk the lender into refinancing (good luck), 3) pay down the loan in one lump sum enough to refinance, or 4) try to pay more each month and get the loan balance down.

... they're trapped in a mortgage with a 6.375 interest rate - sky-high compared with current rates, which average 3.7 percent - and they can't refinance because their house is underwater and their jumbo mortgage is excluded from government plans for underwater refis. ... "It makes me sick when I think about it. We could save between $800 and $1,200 a month," said Pieralde ...

Said gives an example of option 3:

[A] Half Moon Bay couple who ... bought their seaside home in 2005 for slightly more than $1 million with a seven-year adjustable-rate mortgage. Late last year, when they went to refinance, the home appraised at $730,000 - and they still owed $834,000.This is a reasonable option for those with the resources ... but most people probably don't have the resources to make a large lump sum payment.

So they took $140,000 out of their retirement and savings to pay down the mortgage enough to refinance into a 30-year fixed at 4.25 percent.

"We felt we were up against the wall," the woman said. Refinancing "would bring our interest rate down and save a lot of money over the life of the loan. It was a hard decision but we made the financial calculation that it was worth it."

Yesterday:

• Summary for Week ending June 22nd

• Schedule for Week of June 24th

Gasoline Prices: $3 per gallon?

by Calculated Risk on 6/24/2012 08:58:00 AM

The roller-coaster ride for gasoline prices continue ... remember when some forecasters were predicting $5 per gallon? Now we are seeing prediction of $3 per gallon.

From the Atlantic Journal Constitution: Expect gas prices to fall below $3

Is it possible the average price at the pump could be below $3 a gallon by the time leaves begin to change?There are always threats to the oil supply - Iran, a storm in the GOM, a strike in Norway, but right now it looks like prices will continue to decline with adequate supply and week demand growth.

Absolutely, according to experts who follow fuel price trends, and some areas of Georgia have already broken the barrier. At one station in Macon on Friday, unleaded regular was selling for $2.90, and in Duluth and Suwanee prices were as low as $3.04 and $3.05, respectively.

Barring any unforeseen calamity that might disrupt production or distribution ... the price trend should continue, even with the arrival of summer and more vehicles on the road for vacations.

“[T]he market is suggesting gas below $3 by Halloween, and certainly by Thanksgiving,” Tom Kloza of the Oil Price Information Service ...

Oil prices are still moving down. Brent is down to $90.98 per barrel, down another 10% over the last two weeks, and WTI is down to $79.76. The lower oil prices will not only lead to lower gasoline prices, but also a lower trade deficit and lower headline inflation (CPI).

The following graph shows the decline in gasoline prices. Gasoline prices are down significantly from the peak in early April. Gasoline prices in the west had been impacted by refinery issues, but prices are now falling there too.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, June 23, 2012

Summary for Week ending June 22nd

by Calculated Risk on 6/23/2012 11:56:00 AM

In a reversal of fortune, the only recent good news has been from the housing sector. Housing starts were down slightly in May, but that was because of the volatile multi-family sector. The details were better: single family starts were up, revisions to previous reports were up, and permits were up sharply.

The headline number for existing home sales was a little weak, but the key number – inventory – was down in May, and down over 20% from May 2011. However away from housing, the economic data was very weak.

For manufacturing, the Philly Fed index declined sharply to the lowest level since last August. The previous week, the Empire State manufacturing index also declined sharply – and this suggests that manufacturing slowed in June. Three more regional surveys will be released this coming week.

Other indicators were also weak: the four week average for initial weekly unemployment claims is at the highest level for the year, and the Architectural Billings Index declined sharply (mostly a leading indicator for commercial real estate).

The Fed met last week, and decided to “continue through the end of the year its program to extend the average maturity of its holdings of securities” (aka Operation Twist). The bigger story was the sharp downward revision in the FOMC projections – mostly below the levels of the January projections when it appeared the FOMC was moving towards QE3 (before the stronger payroll reports for January and February). The FOMC projections show the unemployment rate well above the Fed’s target for years, and the inflation rate below the Fed’s target rate.

Here is a summary of last week in graphs:

• Housing Starts at 708 thousand in May, Single Family starts increase to 516 thousand

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 708 thousand (SAAR) in May, down 4.8% from the revised April rate of 744 thousand (SAAR). Note that April was revised up from 717 thousand. March was revised up too.

Single-family starts increased 3.2% to 516 thousand in May. April was revised up to 500 thousand from 492 thousand.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up 55% from the bottom start rate, and single family starts are up 41% from the low.

This was below expectations of 720 thousand starts in May, but the decline was because of the volatile multi-family sector. Single family starts were up, and building permits were up sharply. And previous months were revised up. This was a fairly strong report.

• Existing Home Sales in May: 4.55 million SAAR, 6.6 months of supply

The NAR reports: Existing-Home Sales Constrained by Tight Supply in May, Prices Continue to Gain

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in May 2012 (4.55 million SAAR) were 1.5% lower than last month, and were 9.6% above the May 2011 rate.

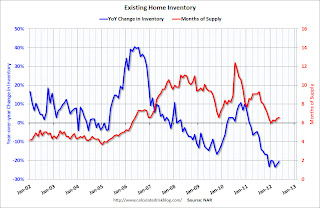

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.Months of supply increased slightly to 6.6 months in May.

This was at expectations of sales of 4.57 million, but the big story is the decline in inventory - inventory (not including "contingent" sales) is below the level for the same month in 2005.

• NY and Philly Manufacturing indexes decline

From the Philly Fed: June 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell from a reading of -5.8 in May to -16.6, its second consecutive negative reading ...And from the NY Fed: Empire State Manufacturing Survey

The June Empire State Manufacturing Survey indicates that manufacturing activity expanded slightly over the month. The general business conditions index fell fifteen points, but remained positive at 2.3.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level since last summer.

• Weekly Initial Unemployment Claims mostly unchanged, Four week average highest this year

The DOL reports:

The DOL reports:In the week ending June 16, the advance figure for seasonally adjusted initial claims was 387,000, a decrease of 2,000 from the previous week's revised figure of 389,000. The 4-week moving average was 386,250, an increase of 3,500 from the previous week's revised average of 382,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 386,250.

The average had been between 363,000 and 384,000 all year, so this is a new high for the year.

• FOMC Projections

Here are the updated projections from the FOMC meeting.

On the projections, GDP was revised down, unemployment rate up, and inflation down. Compare the current projections released this week, not just with the April projections, but with the January projections. GDP is below the projections in January, and inflation is also below the January projections.

Only the unemployment rate is slightly improved from the January projections - and then only for 2012 - 2013 and 2014 are now worse.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

GDP projections have been revised down for 2012, and revised down for 2013 and 2014.

The unemployment rate increased to 8.2% in April, and the projection for 2012 has been revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

The forecasts for overall and core inflation were revised down to reflect the recent decrease in inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

• AIA: Architecture Billings Index declines sharply in May

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment (it will be some time before investment in offices and malls increases).

• BLS: Job Openings declined in April

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.Quits declined slightly in April, and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• At Yahoo: McBride: Total Housing Starts Decline in May, but the Trend Is Positive

• NAHB Builder Confidence increases slightly in June, Highest since May 2007

• FNC: Residential Property Values increase 0.6% in April

• ATA Trucking index declined 0.7% in May

• LPS: Mortgage delinquencies increased in May

• Census: Number of Shared Households increased 2.25 million from 2007 to 2010

• FOMC Statement: Continue Twist through end of Year

Schedule for Week of June 24th

by Calculated Risk on 6/23/2012 08:01:00 AM

The key US economic reports this week are May New Home Sales on Monday, April Case-Shiller house prices on Tuesday, and the May Personal Income and Outlays report on Friday.

With the recent economic weakness, the high frequency manufacturing reports (Richmond, Dallas and Kansas City Fed surveys), the Chicago PMI, weekly initial unemployment claims, and consumer sentiment will be closely watched.

In Europe, there is a summit in Brussels on Thursday and Friday.

8:30 AM: Chicago Fed National Activity Index (May). This is a composite index of other data.

10:00 AM ET: New Home Sales for May from the Census Bureau.

10:00 AM ET: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an increase in sales to 350 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 343 thousand in April.

10:30 AM: Dallas Fed Manufacturing Survey for June. The consensus is for 0.0 for the general business activity index, up from -5.1 in May.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through Marchy 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.3% decrease year-over-year in Composite 20 prices (NSA) in April. The Zillow forecast is for the Composite 20 to decline 1.9% year-over-year, and for prices to increase 0.5% month-to-month seasonally adjusted. The CoreLogic index increased 2.6% in April (NSA).

10:00 AM: Conference Board's consumer confidence index for June. The consensus is for a decrease to 63.5 from 64.9 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June. The consensus is for an increase to 5 for this survey from 4 in May (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Refinance activity has been increasing sharply, and it appears purchase activity is increasing a little too.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1.2% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 385 thousand from 387 thousand last week.

8:30 AM: Q1 GDP (third estimate). This is the third estimate from the BEA. The consensus is that real GDP increased 1.9% annualized in Q1; no change from the 2nd estimate.

11:00 AM: Kansas City Fed regional Manufacturing Survey for June. The consensus is for a decrease to 4 from 9 in May (above zero is expansion). This is the last of the regional Fed manufacturing surveys for June.

8:30 AM ET: Personal Income and Outlays for May. The consensus is for a 0.3% increase in personal income in May, and for no change in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for an increase to 53.1, up from 52.7 in May.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for June). The consensus is for no change from the preliminary reading of 74.1.

Friday, June 22, 2012

Unofficial Problem Bank list increases to 921 Institutions

by Calculated Risk on 6/22/2012 09:20:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. (And only US banks).

Here is the unofficial problem bank list for June 22, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Quiet week for the Unofficial Problem Bank List with three additions and one removal. The changes leave the list with 921 institutions with assets of $354.6 billion, up for the second consecutive week. A year ago, the list held 1,001 institutions with assets of $419.2 billion.Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The Federal Reserve terminated the action against Paradise Bank, Boca Raton, FL ($288 million). Written Agreements were issued to Commercial Bank, Harrogate, TN ($801 million; and Mainstreet Bank, Ashland, MO ($59 million).

Another addition came through the Federal Reserve issuing a Prompt Corrective Action order against First Security Bank of Malta, Malta, MT ($39 million), with this action being unusual in its timing as it has not been preceded by a safety & soundness enforcement action.

Next week, we anticipate the FDIC will release its actions through May 2012, so it would not be surprising to see the list increase for three consecutive weeks.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.