by Calculated Risk on 6/23/2012 11:56:00 AM

Saturday, June 23, 2012

Summary for Week ending June 22nd

In a reversal of fortune, the only recent good news has been from the housing sector. Housing starts were down slightly in May, but that was because of the volatile multi-family sector. The details were better: single family starts were up, revisions to previous reports were up, and permits were up sharply.

The headline number for existing home sales was a little weak, but the key number – inventory – was down in May, and down over 20% from May 2011. However away from housing, the economic data was very weak.

For manufacturing, the Philly Fed index declined sharply to the lowest level since last August. The previous week, the Empire State manufacturing index also declined sharply – and this suggests that manufacturing slowed in June. Three more regional surveys will be released this coming week.

Other indicators were also weak: the four week average for initial weekly unemployment claims is at the highest level for the year, and the Architectural Billings Index declined sharply (mostly a leading indicator for commercial real estate).

The Fed met last week, and decided to “continue through the end of the year its program to extend the average maturity of its holdings of securities” (aka Operation Twist). The bigger story was the sharp downward revision in the FOMC projections – mostly below the levels of the January projections when it appeared the FOMC was moving towards QE3 (before the stronger payroll reports for January and February). The FOMC projections show the unemployment rate well above the Fed’s target for years, and the inflation rate below the Fed’s target rate.

Here is a summary of last week in graphs:

• Housing Starts at 708 thousand in May, Single Family starts increase to 516 thousand

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 708 thousand (SAAR) in May, down 4.8% from the revised April rate of 744 thousand (SAAR). Note that April was revised up from 717 thousand. March was revised up too.

Single-family starts increased 3.2% to 516 thousand in May. April was revised up to 500 thousand from 492 thousand.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up 55% from the bottom start rate, and single family starts are up 41% from the low.

This was below expectations of 720 thousand starts in May, but the decline was because of the volatile multi-family sector. Single family starts were up, and building permits were up sharply. And previous months were revised up. This was a fairly strong report.

• Existing Home Sales in May: 4.55 million SAAR, 6.6 months of supply

The NAR reports: Existing-Home Sales Constrained by Tight Supply in May, Prices Continue to Gain

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in May 2012 (4.55 million SAAR) were 1.5% lower than last month, and were 9.6% above the May 2011 rate.

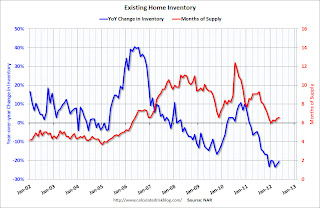

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.Months of supply increased slightly to 6.6 months in May.

This was at expectations of sales of 4.57 million, but the big story is the decline in inventory - inventory (not including "contingent" sales) is below the level for the same month in 2005.

• NY and Philly Manufacturing indexes decline

From the Philly Fed: June 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell from a reading of -5.8 in May to -16.6, its second consecutive negative reading ...And from the NY Fed: Empire State Manufacturing Survey

The June Empire State Manufacturing Survey indicates that manufacturing activity expanded slightly over the month. The general business conditions index fell fifteen points, but remained positive at 2.3.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level since last summer.

• Weekly Initial Unemployment Claims mostly unchanged, Four week average highest this year

The DOL reports:

The DOL reports:In the week ending June 16, the advance figure for seasonally adjusted initial claims was 387,000, a decrease of 2,000 from the previous week's revised figure of 389,000. The 4-week moving average was 386,250, an increase of 3,500 from the previous week's revised average of 382,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 386,250.

The average had been between 363,000 and 384,000 all year, so this is a new high for the year.

• FOMC Projections

Here are the updated projections from the FOMC meeting.

On the projections, GDP was revised down, unemployment rate up, and inflation down. Compare the current projections released this week, not just with the April projections, but with the January projections. GDP is below the projections in January, and inflation is also below the January projections.

Only the unemployment rate is slightly improved from the January projections - and then only for 2012 - 2013 and 2014 are now worse.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

GDP projections have been revised down for 2012, and revised down for 2013 and 2014.

The unemployment rate increased to 8.2% in April, and the projection for 2012 has been revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

The forecasts for overall and core inflation were revised down to reflect the recent decrease in inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

• AIA: Architecture Billings Index declines sharply in May

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment (it will be some time before investment in offices and malls increases).

• BLS: Job Openings declined in April

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.Quits declined slightly in April, and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• At Yahoo: McBride: Total Housing Starts Decline in May, but the Trend Is Positive

• NAHB Builder Confidence increases slightly in June, Highest since May 2007

• FNC: Residential Property Values increase 0.6% in April

• ATA Trucking index declined 0.7% in May

• LPS: Mortgage delinquencies increased in May

• Census: Number of Shared Households increased 2.25 million from 2007 to 2010

• FOMC Statement: Continue Twist through end of Year