by Calculated Risk on 3/05/2012 10:00:00 AM

Monday, March 05, 2012

ISM Non-Manufacturing Index indicates faster expansion in February

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 26th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 57.3 percent in February, 0.5 percentage point higher than the 56.8 percent registered in January, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 62.6 percent, which is 3.1 percentage points higher than the 59.5 percent reported in January, reflecting growth for the 31st consecutive month. The New Orders Index increased by 1.8 percentage points to 61.2 percent, and the Employment Index decreased by 1.7 percentage points to 55.7 percent, indicating continued growth in employment, but at a slower rate. The Prices Index increased 4.9 percentage points to 68.4 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI, 14 non-manufacturing industries reported growth in February. The majority of comments from the respondents reflect a growing level of optimism about business conditions and the overall economy. There is a concern about inflation, rising fuel prices and petroleum-based product costs."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 56.1% and indicates slightly faster expansion in February than in January.

HAMP for Investors

by Calculated Risk on 3/05/2012 09:03:00 AM

From Bloomberg: Boom-Era Property Speculators to Get Foreclosure Aid (ht Mike in Long Island)

The Obama administration will extend mortgage assistance for the first time to investors who bought multiple homes before the market imploded, helping some speculators who drove up prices and inflated the housing bubble.But this example doesn't seem to make sense:

Landlords can qualify for up to four federally-subsidized loan workouts starting around May, as long as they rent out each house or have plans to fill them, under the revamped Home Affordable Modification Program, also known as HAMP, according to Timothy Massad, the Treasury’s assistant secretary for financial stability.

John Russell, 61, of Northville, Michigan, said he was never a speculator seeking to flip houses. He bought four rental properties in neighborhoods in the state more than 10 years ago and said he planned to keep them for decades more. Now the houses are worth far less than he owes, his rents have tumbled, and he has to spend about $20,000 a year to keep them operating.How can this be? I'd like to know more. I wonder how far rents have fallen in "over 10 years", and if Russell took out money during the housing boom. This doesn't appear to add up ...

Russell ... said two houses are in foreclosure and he can’t afford to keep them without the federal government’s help.

Sunday, March 04, 2012

The Fed and QE3

by Calculated Risk on 3/04/2012 06:03:00 PM

I always read Jon Hilsenrath's articles on the Fed very closely. Right now the Fed seems uncertain about QE3, and the decision remains data dependent (as always) ... from Hilsenrath at the WSJ: Fed Takes a Break To Weigh Outlook

Fed officials meeting next week are unlikely to take any new actions to spur the recovery, and they are likely to emerge with a slightly more upbeat—but still very guarded—assessment of the economy's performance.Several economists still expect QE3 to be announced at one of the two day meetings in April or June - or maybe in Q3.

...

A big question is whether the Fed will launch a new bond-buying program in an effort to push down already low long-term interest rates.

...

Mr. Bernanke signaled to Congress last week that he had doubts about the sustainability of the employment gains. Fed officials aren't inclined to move while they try to solve the puzzle. "In light of the somewhat different signals received recently from the labor market than from indicators of final demand and production," he said, "it will be especially important to evaluate incoming information to assess the underlying pace of economic recovery."

Goldman Sachs economists wrote on Friday:

We expect that the Fed will ultimately announce a return to balance sheet expansion sometime in the first half of 2012, likely including purchases of mortgagebacked securities (MBS).And Merrill Lynch noted last week:

In our view, it is wishful thinking to believe the Fed will do QE when the data flow is healthy. We expect renewed QE only after Operation Twist ends in June ... only if the economy is slowing ... Under our growth forecast ... QE3 comes in September.If the economy slows, and key inflation measures start falling again - then QE3 is very likely. But right now, with most data a little better than expected, and inflation a little higher than the Fed's target, the Fed is back to "wait and see". The next FOMC meeting is on Tuesday March 13th.

Yesterday:

• Summary for Week ending March 2nd

• Schedule for Week of March 4th

Report: Small Businesses added 45,000 jobs in February

by Calculated Risk on 3/04/2012 01:17:00 PM

From Reuters: 45,000 Jobs Added By Small Businesses in US

U.S. small businesses added 45,000 employees in February and offered workers more money even as working hours were little changed ... payrolls processing firm Intuit said.Graphs for the Intuit Small Business index are here.

January's small business employment had previously been reported to have increased 50,000.

The Intuit survey is based on responses from about 72,000 small businesses with fewer than 20 employees that use the Intuit Online Payroll system.

Note: This is based on Intuit users, however, as Intuit notes: "Employment for Intuit Online Payroll customers is growing much faster than employment at the average small business." Another small business report, the monthly NFIB survey, has shown much slower growth for small businesses. But the NFIB survey has a very large percentage of real estate related small businesses - and that probably accounts for a large portion of the difference.

The BLS will report on Friday, and the consensus is for an increase of 204,000 non-farm payroll jobs in February.

Personal Saving Rate and Income less Transfer Payments

by Calculated Risk on 3/04/2012 09:37:00 AM

Yesterday:

• Summary for Week ending March 2nd

• Schedule for Week of March 4th

By request, a couple more graphs based on the January Personal Income and Outlays report. The first graph shows real personal income less transfer payments in 2005 dollars. This has been slow to recover - real personal income less transfer payments increased 0.2% in January. This remains 3.9% below the previous peak in early 2008.

Click on graph for larger image.

Click on graph for larger image.

Personal current transfer receipts decreased $3.6 billion in January, in contrast to an increase of $13.8 billion in December. Within personal current transfer receipts, “other” government social benefits to persons decreased $14.9 billion in January, in contrast to an increase of $1.5 billion in December. The January change in “other” government social benefits to persons reflected a decrease of $13.6 billion due to the expiration of the Making Work Pay refundable tax credits. Government social benefits for Medicaid decreased $7.8 billion in January, in contrast to an increase of $0.2 billion in December. Government social benefits for social security increased $20.3 billion in January, compared to an increase of $9.6 billion in December. The January change reflected 3.6-percent cost-of-living adjustments (COLAs) to social security benefits and to several other federal transfer payment programs. Together, these COLAs added $30.2 billion to the January increase in government social benefits to persons.

The second graph is for the personal saving rate.

The saving rate decreased to 4.6% in January.

Personal saving -- DPI less personal outlays -- was $540.6 billion in January, compared with $552.1 billion in December. The personal saving rate -- personal saving as a percentage of disposable income -- was 4.6 percent in January, compared with 4.7 percent in December.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

After increasing sharply during the recession, the saving rate has been moving down for the last two to three years - so spending growth has increased a little faster than income growth.

Saturday, March 03, 2012

Unofficial Problem Bank list at 959 Institutions

by Calculated Risk on 3/03/2012 06:54:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 2, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Very quiet week for the Unofficial Problem Bank List. Only one bank was removed from an unassisted merger -- Brooklyn Federal Savings Bank, Brooklyn, NY ($459 million). The failure of Global Commerce Bank in Georgia surprisingly was not on the list; perhaps it was on double secret probation before it failed. Should anyone be aware of an enforcement action against Global send it along. So the list stands at 959 institutions with assets of $385.4 billion. Assets dropped by $3.8 billion with the release of year-end financials by the FDIC. Also with that release, the FDIC said the Official Problem Bank List had 813 institutions with assets of $319 billion. Next week will likely not have many changes as well.Earlier:

• Summary for Week ending March 2nd

• Schedule for Week of March 4th

Schedule for Week of March 4th

by Calculated Risk on 3/03/2012 01:10:00 PM

Earlier:

• Summary for Week ending March 2nd

The key report this week is the February employment situation report from the Bureau of Labor Statistics (BLS) scheduled for Friday. Other reports include the February ISM service index on Monday, and the January trade balance report on Friday.

The Federal Reserve will release the Q4 Flow of Funds report on Thursday.

On Thursday, March 8th, the €200bn private sector Greek bond swap is scheduled. Also on the 8th, the ECB holds a rate meeting.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a decrease to 56.1 from 56.8 in January. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a decrease to 56.1 from 56.8 in January. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 0.9% decline in orders.

No Releases Scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in February, up from the 170,000 reported last month.

3:00 PM: Consumer Credit for January. The consensus is for a $10.0 billion increase in consumer credit.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 351,000.

12:00 PM: Q4 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Employment Report for February. The consensus is for an increase of 204,000 non-farm payroll jobs in February, down from the 243,000 jobs added in January.

8:30 AM: Employment Report for February. The consensus is for an increase of 204,000 non-farm payroll jobs in February, down from the 243,000 jobs added in January.The consensus is for the unemployment rate to remain unchanged at 8.3%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The economy has added 3.17 million jobs since employment bottomed in February 2010 (3.66 million private sector jobs added, and 510 thousand public sector jobs lost).

The economy has added 3.17 million jobs since employment bottomed in February 2010 (3.66 million private sector jobs added, and 510 thousand public sector jobs lost).There are still 5.2 million fewer private sector jobs now than when the recession started. (5.6 million fewer total nonfarm jobs).

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 9% compared to December 2010; imports are up about 11% compared to December 2010.

The consensus is for the U.S. trade deficit to increase to $49.0 billion in January, up from from $48.8 billion in December. Export activity to Europe will be closely watched.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.6% increase in inventories.

Summary for Week Ending March 2nd

by Calculated Risk on 3/03/2012 08:12:00 AM

Economic data was mostly disappointing last week, indicating more sluggish growth.

The positives included blowout auto and light truck sales, an increase in the pending home sales index, and another slight decline in initial weekly unemployment claims. However the ISM manufacturing index was weaker than expected, personal income and spending growth was sluggish in January, construction spending declined slightly and durable goods orders declined sharply (a combination of fewer airplane sales and the expiration of the investment tax credit).

Case-Shiller reported that house prices fell to a new post-bubble low in December. In real terms (adjusted for inflation), and as a price-to-rent ratio, house prices are now back to 1998 and 1999 levels indicating all of the real increases of the ‘00s is gone. The recent house price declines have put more borrowers “underwater” on their mortgages, and CoreLogic reported last week that 11.1 million borrowers now have negative equity in their home - and negative equity means that borrowers are at risk of default if they are forced to sell.

Overall a disappointing week. Here is a summary in graphs:

• Case Shiller: House Prices fall to new post-bubble lows in December

From S&P: All Three Home Price Composites End 2011 at New Lows According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.0% from the peak, and down 0.5% in December (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and down 0.5% in December (SA). The Composite 20 is also at a new post-bubble low.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next few months (this report was for the three months ending in December).

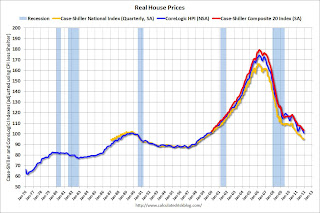

• Real House Prices and Price-to-Rent fall to late '90s Levels

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000, and the CoreLogic index back to December 1999.

In real terms, all appreciation in the '00s - and more - is gone.

This graph shows the price to rent ratio using OER (January 1998 = 1.0).

This graph shows the price to rent ratio using OER (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to December 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

• ISM Manufacturing index indicates slower expansion in February

Here is a long term graph of the ISM manufacturing index.

Here is a long term graph of the ISM manufacturing index.PMI was at 52.4% in February, down from 54.1% in January. The employment index was at 53.2%, down from 54.3%, and new orders index was at 54.9%, down from 57.6%.

This was below expectations of 54.6%. This suggests manufacturing expanded at a slower rate in February than in January (the opposite of all the regional surveys). It appears manufacturing employment expanded slowly in February with the employment index at 53.2%.

• U.S. Light Vehicle Sales at 15.1 million annual rate in February

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).This was well above the consensus forecast of 14.0 million SAAR.

This graph shows light vehicle sales since the BEA started keeping data in 1967. This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Growth in auto sales will make another strong positive contribution GDP in Q1 2012 GDP.

• Construction Spending declines slightly in January

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 62.5% below the peak in early 2006, and up 13% from the recent low. Non-residential spending is 31% below the peak in January 2008, and up about 17% from the recent low.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and it appears the bottom is in for residential investment.

• Personal Income increased 0.3% in January, Spending 0.2%

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars).PCE increased 0.2% in January, and real PCE increased less than 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.6% in January.

Real PCE has been essentially flat since October.

• Weekly Initial Unemployment Claims decline slightly to 351,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 354,000.

The 4-week moving average is at the lowest level since early 2008.

• Other Economic Stories ...

• From the NAR: January Pending Home Sales Rise, Market on Uptrend

• FHFA announces Pilot REO Bulk Sales Offer

• Durable Goods orders decline 4% in January

• Restaurant Performance Index declines in January, Still "solidly positive"

• ATA Trucking index declined in January

• Fannie Mae: REO inventory declines 27% in 2011

• CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

Friday, March 02, 2012

The Dentist Indicator

by Calculated Risk on 3/02/2012 08:21:00 PM

I visited my dentist last week, and he told me business has been picking up. This article from Kelly Evans and Erika Santoro at CNBC reminded me of his comments: Introducing: The Dentist Economic Indicator

Want to know how the economy’s doing? Ask your dentist.My guess is some people put off their regular check-ups during tough economic times, and then start back up again once they find a new job or are feeling better about their economic situation.

That’s how we recently discovered one hopeful sign for the labor market: an increase in new dental patients. Our Manhattan-based dentist said he was seeing about three new patients a day in recent weeks, up from one or two on average last year.

The reason? More people with health insurance as a result of getting full-time jobs.

Manhattan, of course, is not exactly representative of the rest of the country. So we reached out to dentists across the country and heard much the same thing; while business isn’t exactly booming, there has been a noticeable increase in new patients coming through the door.

Bank Failure #12 in 2012: Georgia again

by Calculated Risk on 3/02/2012 05:05:00 PM

Vamonos a Doraville

Swiper’s stole a bank.

by Soylent Green is People

From the FDIC: Metro City Bank, Doraville, Georgia, Assumes All of the Deposits of Global Commerce Bank, Doraville, Georgia

As of December 31, 2011, Global Commerce Bank had approximately $143.7 million in total assets and $116.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.9 million. ... Global Commerce Bank is the 12th FDIC-insured institution to fail in the nation this year, and the third in Georgia.Are there any banks left in Georgia?