by Calculated Risk on 3/03/2012 08:12:00 AM

Saturday, March 03, 2012

Summary for Week Ending March 2nd

Economic data was mostly disappointing last week, indicating more sluggish growth.

The positives included blowout auto and light truck sales, an increase in the pending home sales index, and another slight decline in initial weekly unemployment claims. However the ISM manufacturing index was weaker than expected, personal income and spending growth was sluggish in January, construction spending declined slightly and durable goods orders declined sharply (a combination of fewer airplane sales and the expiration of the investment tax credit).

Case-Shiller reported that house prices fell to a new post-bubble low in December. In real terms (adjusted for inflation), and as a price-to-rent ratio, house prices are now back to 1998 and 1999 levels indicating all of the real increases of the ‘00s is gone. The recent house price declines have put more borrowers “underwater” on their mortgages, and CoreLogic reported last week that 11.1 million borrowers now have negative equity in their home - and negative equity means that borrowers are at risk of default if they are forced to sell.

Overall a disappointing week. Here is a summary in graphs:

• Case Shiller: House Prices fall to new post-bubble lows in December

From S&P: All Three Home Price Composites End 2011 at New Lows According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.0% from the peak, and down 0.5% in December (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and down 0.5% in December (SA). The Composite 20 is also at a new post-bubble low.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next few months (this report was for the three months ending in December).

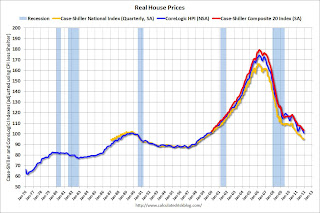

• Real House Prices and Price-to-Rent fall to late '90s Levels

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000, and the CoreLogic index back to December 1999.

In real terms, all appreciation in the '00s - and more - is gone.

This graph shows the price to rent ratio using OER (January 1998 = 1.0).

This graph shows the price to rent ratio using OER (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to December 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

• ISM Manufacturing index indicates slower expansion in February

Here is a long term graph of the ISM manufacturing index.

Here is a long term graph of the ISM manufacturing index.PMI was at 52.4% in February, down from 54.1% in January. The employment index was at 53.2%, down from 54.3%, and new orders index was at 54.9%, down from 57.6%.

This was below expectations of 54.6%. This suggests manufacturing expanded at a slower rate in February than in January (the opposite of all the regional surveys). It appears manufacturing employment expanded slowly in February with the employment index at 53.2%.

• U.S. Light Vehicle Sales at 15.1 million annual rate in February

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).This was well above the consensus forecast of 14.0 million SAAR.

This graph shows light vehicle sales since the BEA started keeping data in 1967. This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Growth in auto sales will make another strong positive contribution GDP in Q1 2012 GDP.

• Construction Spending declines slightly in January

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 62.5% below the peak in early 2006, and up 13% from the recent low. Non-residential spending is 31% below the peak in January 2008, and up about 17% from the recent low.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and it appears the bottom is in for residential investment.

• Personal Income increased 0.3% in January, Spending 0.2%

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars).PCE increased 0.2% in January, and real PCE increased less than 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.6% in January.

Real PCE has been essentially flat since October.

• Weekly Initial Unemployment Claims decline slightly to 351,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 354,000.

The 4-week moving average is at the lowest level since early 2008.

• Other Economic Stories ...

• From the NAR: January Pending Home Sales Rise, Market on Uptrend

• FHFA announces Pilot REO Bulk Sales Offer

• Durable Goods orders decline 4% in January

• Restaurant Performance Index declines in January, Still "solidly positive"

• ATA Trucking index declined in January

• Fannie Mae: REO inventory declines 27% in 2011

• CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4