by Calculated Risk on 3/07/2012 08:56:00 AM

Wednesday, March 07, 2012

CoreLogic: House Price Index declined 1.0% in January to new post-bubble low

Notes: This CoreLogic House Price Index report is for January. The Case-Shiller index released last week was for December. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of the last three months and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® January Home Price Index Shows Sixth Consecutive Monthly Decline

[CoreLogic January Home Price Index (HPI®) report] shows national home prices, including distressed sales, declined on a year-over-year basis by 3.1 percent in January 2012 and by 1.0 percent compared to December 2011, the sixth consecutive monthly decline.

Excluding distressed sales, year-over-year prices declined by 0.9 percent in January 2012 compared to January 2011, but that same metric posted a month-over-month gain, rising 0.7 percent in January. Distressed sales include short sales and real estate owned (REO) transactions.

“Although home price declines are slowly improving and not far from the bottom, home prices are down to nearly the same levels as 10 years ago,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.0% in January, and is down 3.1% over the last year.

The index is off 34% from the peak - and is now at a new post-bubble low.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller. Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 2.5% from January 2011 to March 2011, and there will probably be a similar decline this year.

ADP: Private Employment increased 216,000 in February

by Calculated Risk on 3/07/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 216,000 from January to February on a seasonally adjusted basis. The estimated advance in employment from December to January was revised slightly upwards to 173,000 from the initially reported 170,000.This was slightly above the consensus forecast of an increase of 200,000 private sector jobs in February. The BLS reports on Friday, and the consensus is for an increase of 204,000 payroll jobs in February, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 170,000 in February, and employment in the private, goods-producing sector increased 46,000 in February. Manufacturing employment increased 21,000.

Government payrolls have been shrinking, so the ADP report suggests close to 200,000 nonfarm payroll jobs added in January. Note: ADP hasn't been very useful in predicting the BLS report.

Tuesday, March 06, 2012

Some more comments on Housing Inventory

by Calculated Risk on 3/06/2012 10:12:00 PM

Jon Lansner at the O.C. Register has some comments from Orange County broker Steve Thomas on inventory: Fewest O.C. homes for sale since 2005

"Turn back the clocks to August 2005 to find a lower inventory. At the very beginning of the year, the active listing inventory stood at 8,114 homes. It was a good beginning compared to 2011 with nearly 1,900 fewer listings on the market. There was a subtle sense that something was different right after bringing in the New Year. Since then, the market has shed 925 homes and now stands at 7,189, 33% fewer than last year. To shed homes during this time of year is totally unprecedented during this downturn. It is much more of what we would see during a hot, appreciating market, reminiscent of 2004 and 2005. ATTENTION SELLERS: that does NOT mean that we are looking at 2004 and 2005 all over again. Let’s be perfectly clear, there is still an enormous back log of distressed homes that have not yet hit the market."The sharp decline in inventory is happening just about everywhere. Some of this is because there are fewer foreclosures listed for sale, and some is probably because many potential sellers are "waiting for a better market".

Last month I posted a few reasons for the decline: Comments on Existing Home Inventory. I concluded: "The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year."

Hamilton: The impact of oil prices on the U.S. economy

by Calculated Risk on 3/06/2012 07:12:00 PM

With questions about the impact of oil prices on the economy, I always pay close attention to Professor Hamilton at Econbrowser ...

From Jim Hamilton: Oil prices and the U.S. economy

Although the prices of oil and gasoline have risen significantly from their values in October, they are still not back to the levels we saw last spring or in the summer of 2008. There is a good deal of statistical evidence ... that an oil price increase that does no more than reverse an earlier decline has a much more limited effect on the economy than if the price of oil surges to a new all-time high.

One reason for this is that much of the impact on the economy of an increase in oil prices comes from abrupt changes in the patterns of consumer spending. ... ut if consumers have recently seen even higher prices than they're paying at the moment, their spending plans and firms' production plans are likely already to have incorporated that reality.

... based on what has happened to oil prices so far, I find myself in the unusual position of being less concerned about the impact of oil prices on the U.S. economy than many other analysts.

FHA Reduces Fees to Encourage Refinancing

by Calculated Risk on 3/06/2012 03:05:00 PM

From HUD: FHA ANNOUNCES PRICE CUTS TO ENCOURAGE STREAMLINE REFINANCING

Today, Acting Federal Housing (FHA) Commissioner Carol Galante announced significant price cuts to FHA’s Streamline Refinance Program that could benefit millions of borrowers whose mortgages are currently insured by FHA. Beginning June 11, 2012, FHA will lower its Upfront Mortgage Insurance Premium (UFMIP) to just .01 percent and reduce its annual premium to .55 percent for certain FHA borrowers.A comment from mortgage broker Soylent Green is People:

To qualify, borrowers must be current on their existing FHA-insured mortgages which were endorsed on or before May 31, 2009. Late last month, FHA also announced it will increase its upfront premiums on most other loans by 75 basis points to 1.75 percent. In addition, FHA will raise annual premiums 10 basis points and 35 basis points on mortgages higher than $625,500.

...

Currently, 3.4 million households with loans endorsed on or before May 31, 2009, pay more than a five percent annual interest rate on their FHA-insured mortgages. By refinancing through this streamlined process, it’s estimated that the average qualified FHA-insured borrower will save approximately $3,000 a year or $250 per month. FHA’s new discounted prices assume no greater risk to its Mutual Mortgage Insurance (MMI) Fund and will allow many of these borrowers to refinance into a lower cost FHA-insured mortgage without requiring additional underwriting.

Lenders were limited to refinancing only when a “benefit to borrower” existed. It was a pretty high wall to climb to make deals work. For example, a person with a 4.5% loan couldn’t refinance to 3.75% because the Mortgage Insurance was going to more than double. Now, with a .55 Mortgage Insurance limit, the refinance deals will really start to explode.

The down side is anyone after June 2009 is screwed. If you closed July 2009 to present day, any refinance they want to transact will have mortgage insurance RISE from 1.15 to 1.25!

Can’t wait to see everything in writing.

Greek Update: Collective action clause

by Calculated Risk on 3/06/2012 12:22:00 PM

From the Financial Times: Greece threatens default on PSI holdouts

The Greek public debt management agency said in a statement that Athens “does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI”.And the details from Financial Times Alphaville: Now witness the firepower of this fully armed and operational collective action clause, etc

The threat is aimed in particular at the 14 per cent of investors who own Greek bonds issued under international law.

excerpt with permission

The Republic’s representative noted that Greece’s economic programme does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI. Finally, the Republic’s representative noted that if PSI is not successfully completed, the official sector will not finance Greece’s economic programme and Greece will need to restructure its debt (including guaranteed bonds governed by Greek law) on different terms that will not include co-financing, the delivery of EFSF notes, GDP-linked securities or the submission to English law.The deadline is Thursday, March 8th.

LPS: Foreclosure Starts and Sales increase Sharply in January

by Calculated Risk on 3/06/2012 08:50:00 AM

LPS released their Mortgage Monitor report for January today.

According to LPS, 7.97% of mortgages were delinquent in January, down from 8.15% in December, and down from 8.90% in January 2011.

LPS reports that 4.15% of mortgages were in the foreclosure process, up from 4.11% in December, and down slightly from 4.16% in January 2011.

This gives a total of 12.13% delinquent or in foreclosure. It breaks down as:

• 2.23 million loans less than 90 days delinquent.

• 1.77 million loans 90+ days delinquent.

• 2.08 million loans in foreclosure process.

For a total of 6.08 million loans delinquent or in foreclosure in January.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.97% from the peak in January 2010 of 10.97%, but the decline has halted. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.15%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.08 million).

Foreclosure starts and sales were up sharply in January. This is just one month, but it is possible that the lenders are finally working through the backlog of loans (and this was before the mortgage servicer settlement).

Monday, March 05, 2012

Housing: Year over Year change in Asking Prices

by Calculated Risk on 3/05/2012 09:04:00 PM

Earlier today I noted that existing home inventory, according to HousingTracker, is down 20.5% year-over-year in early March.

I mentioned that HousingTracker / DeptofNumbers also report asking prices for 54 markets, including the median, the 25th percentile, and the 75th percentile. Note: NDD at the Bonddad blog has been watching asking prices since last year.

According to housingtracker, median asking prices are up 3.9% year-over-year in early March. We can't read too much into this increase because these are just asking prices, and median prices can be distorted by the mix. As an example, the median asking price might have increased just because there are fewer low priced foreclosures listed for sale.

But with those caveats, here is a graph of asking prices compared to the year-over-year change in the Case-Shiller composite 20 index.

Click on graph for larger image.

Click on graph for larger image.

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit (notice that asking prices showed a small year-over-year declines before Case-Shiller increased since Case-Shiller is for closed transactions).

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now asking prices have turned positive. We have to be careful about the mix (fewer foreclosures on the market), but it appears sellers are a little more optimistic.

Lawler: Maryland and Foreclosures: Living for Free in the Free State?

by Calculated Risk on 3/05/2012 03:32:00 PM

From economist Tom Lawler:

Yesterday the Washington Post carried two stories on foreclosures that are definitely worth reading. One is entitled “We don’t believe in living for free: Md. couple fight foreclosure on million-dollar home for years without ever making a payment”. It basically chronicles how a Maryland couple (who were real-estate speculators) were (amazingly) able to buy a million dollar plus home with no money down in 2006 (getting a million dollar first mortgage from a now defunct Mississippi lender and a second mortgage from another lender) for their primary residence, and who have not made a mortgage payment in five years. They’ve been able to do this by “using every tactic in the book” to hold off foreclosure. It is a good but disturbing article, and can be read at A million-dollar mortgage goes unpaid for years while couple fights foreclosure. You will probably be amazed that the couple, one of whom was convicted of bankruptcy fraud (related to real estate transactions) in 2000, agreed to be interviewed for the article.

CR Note: These people bought the house with no money down and never made a single mortgage payment. It would NOT be a tragedy if they lost "their" house. Prior to the Depression, people usually put 50% down and financed their homes for 5 years with a balloon payment. During the Depression they couldn't refinance even if they could make their payment. Losing their homes WAS a tragedy. There is no comparison to this couple in Maryland.

Lawler: The second is entitled “The foreclosure crisis: Two strategies,” which discusses how various legislative and other actions have dramatically lengthened Maryland’s foreclosure timelines, which “some economists and housing experts contend” has worked to “stifle” a recovery in the “Free State.“ It also does a comparison of the housing busts in Prince George’s County, Maryland and Prince Williams County, Virginia, that is similar to my “A Tale of Two Counties” piece last year. See: Maryland vs. Virginia: Two different approaches to foreclosure

CR Note: From the 2nd article:

“The real issue is the length of time of the process. If you just keep pushing back foreclosures that would happen anyway, it just delays the inevitable,” said Thomas A. Lawler, whose firm, Lawler Economic & Housing Consulting, provides market data, analysis and forecasts. “I am not saying therefore everyone should have a fast process that is not fair, but a fair process should not leave a house in foreclosure for multiple years.”

Existing Home Inventory declines 21% year-over-year in early March

by Calculated Risk on 3/05/2012 12:55:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), is off 20.5% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

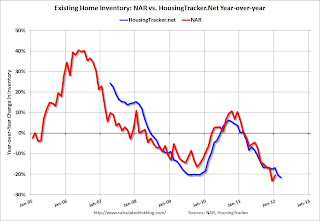

This graph shows the NAR estimate of existing home inventory through January (left axis) and the HousingTracker data for the 54 metro areas through early March.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again through mid to late summer. So inventory should increase over the next 6 months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. But this year-over-year decline is significant.

Note: HousingTracker also reports asking prices. They report the median, 25th percentile, and 75th percentile prices for each metro area. Of course these are just "asking" prices, and the median can be distorted by the mix - but asking prices are up 3.9% year-over-year (something to watch).