by Calculated Risk on 3/05/2012 12:55:00 PM

Monday, March 05, 2012

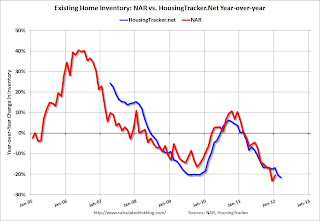

Existing Home Inventory declines 21% year-over-year in early March

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), is off 20.5% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through January (left axis) and the HousingTracker data for the 54 metro areas through early March.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again through mid to late summer. So inventory should increase over the next 6 months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. But this year-over-year decline is significant.

Note: HousingTracker also reports asking prices. They report the median, 25th percentile, and 75th percentile prices for each metro area. Of course these are just "asking" prices, and the median can be distorted by the mix - but asking prices are up 3.9% year-over-year (something to watch).