by Calculated Risk on 2/19/2012 04:46:00 PM

Sunday, February 19, 2012

WSJ: IMF report shows Greek Debt situation worse than expected

Not a surprise ... from the WSJ: IMF Draft Sees Greek Debt Reaching 129% of GDP in 2020

The International Monetary Fund now expects Greece's debt to reach 129% of the country's gross domestic product in 2020 ... That is even further above the level most economists consider sustainable than previously thought, making it more difficult than ever to argue that the country can ever repay its debts.It still sounds like something will be worked out. We will know soon. Here are a few key dates for Greece.

Despite this, a number of signs last week had indicated that there was still enough political will in the euro zone to go ahead with a new, enhanced rescue package.

Yesterday:

• Summary for Week ending February 17th

• Schedule for Week of February 19th

How can builder confidence improve, single family starts increase sharply, and new home sales be unchanged?

by Calculated Risk on 2/19/2012 12:44:00 PM

The Census Bureau will report new home sales on Friday, and the consensus is for sales of 315 thousand on a seasonally adjusted annual rate (SAAR) basis. This is up less than 2% from the 310 thousand SAAR sales reported in January 2011.

That seems a little puzzling. Consider the following ...

First, look at the NAHB builder Housing Market Index. More builders still view sales as "poor" as opposed to "fair" or "good", but the HMI - and all of the components - are up sharply from a year ago (the most recent report was for February, but compare January 2012 to January 2011):

| Housing Market Index | Traffic of Prospective Buyers | Current Sales | |

|---|---|---|---|

| Jan-11 | 16 | 12 | 15 |

| Jan-12 | 25 | 21 | 25 |

| Feb-12 | 29 | 22 | 30 |

This would seem to suggest more than a 1% or 2% increase in sales.

Second, look at the recent builder reports (from Tom Lawler):

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | |

| D.R. Horton | 4,118 | 3,637 | 5,529 | 3,794 | 3,363 | 4,037 | 4,530 | 3,854 | 4,136 |

| PulteGroup | 4,303 | 4,405 | 6,200 | 3,084 | 3,044 | 3,748 | 3,924 | 3,984 | 5,931 |

| NVR | 2,391 | 2,639 | 2,550 | 2,158 | 1,765 | 2,000 | 3,676 | 2,916 | 3,531 |

| The Ryland Group | 1,040 | 909 | 1,666 | 915 | 775 | 969 | 1,514 | 1,187 | 1,732 |

| Meritage Homes | 894 | 837 | 1,202 | 749 | 713 | 621 | 915 | 778 | 1,095 |

| Beazer Homes | 882 | 549 | 961 | 724 | 553 | 728 | 1,309 | 800 | 950 |

| MDC Holdings | 950 | 865 | 1,109 | 523 | 519 | 637 | 1,043 | 842 | 826 |

| Standard Pacific | 782 | 619 | 943 | 615 | 428 | 547 | 681 | 414 | 599 |

| M/I Homes | 667 | 650 | 858 | 505 | 460 | 448 | 676 | 532 | 650 |

| Total | 16,027 | 15,110 | 21,018 | 13,067 | 11,620 | 13,735 | 18,268 | 15,307 | 19,450 |

| YoY % Change | 6.1% | -28.1% | 12.5% | -15.4% | 19.3% | -21.3% | |||

From economist Tom Lawler on February 7th:

The latest Census report on new SF sales showed a YOY increase in Q4/2011 sales of just 3%, and a YOY decline in Q4/2010 sales of 20.5%.

The nine-builder group’s order backlog at the end of 2011 was up 19.3% from the end of 2010.

As I’ve noted many times, Census’ methodology for measured new SF sales is not directly comparable to reports from builders. I’m guessing that part of the “stronger than Census” builder reports reflect gains in market share, but I’m also guessing that overall new home sales were a bit better than preliminary Census data suggested.

The combination of higher order backlogs, stronger sales, and unusually mild weather in much of the country is likely to result in single-family starts numbers in the first few months of 2012 that are significantly higher than “consensus.”

Click on graph for larger image.

Click on graph for larger image.Sure enough. Single family housing starts were revised up sharply for December and were above 500 thousand SAAR in January. As Lawler notes, some of this was probably weather related, but some of the pick up was evident in the builder reports.

So if the builders are reporting a “stronger than Census” increase in sales (even accounting for market share gains), confidence is up (actually less pessimism), and single family starts are up sharply from a year ago, it seems surprising that new home sales were essentially unchanged in January.

Goldman Sachs is forecasting sales of 310 thousand SAAR in January 2012 (no change year-over-year), and Merrill Lynch is forecasting 315 thousand. I think I'll take the over.

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 2/19/2012 09:58:00 AM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression, although there are some annual estimates.

From BLS economist Steven Haugen: Measures of Labor Underutilization from the Current Population Survey

It is estimated that in 1933, at the depth of the Great Depression, about 13 million persons in the U.S. were unemployed, which translates into an unemployment rate of about 25 percent.1 However, those estimates were not available at the time. Throughout the Great Depression, there was little information on the extent of unemployment in the country. More important, there was no good way to assess whether the situation was getting better or worse. The wealth of timely statistical information on the labor market that we now take for granted simply didn’t exist.1 Stanley Lebergott, “Labor Force, Employment, and Unemployment, 1929-39: Estimating Methods,” Monthly Labor Review, July 1948.

However we can use some of the annual estimate to get a rough idea of the comparison to the current recession:

Click on graph for larger image.

Click on graph for larger image. This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression (rough estimate) and the 2007 recession.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

This graph shows the job losses from the start of the employment recession, in percentage terms for the post war recessions. This shows the depth of the employment recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis - similar to the lingering effects of the Depression.

This graph shows the job losses from the start of the employment recession, in percentage terms for the post war recessions. This shows the depth of the employment recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis - similar to the lingering effects of the Depression.Yesterday:

• Summary for Week ending February 17th

• Schedule for Week of February 19th

Saturday, February 18, 2012

A few key dates for the Greek Debt Deal

by Calculated Risk on 2/18/2012 10:51:00 PM

The debt deal needs to be finalized before March 20th when €14.4bn of Greek bonds mature. Without the debt deal, Greece would default on March 20th.

On Monday Feb 20th, euro-area finance ministers are expected to meet in Brussels and approve the deal. According to Reuters:

Some officials in the 17-nation currency union warn chances of a deal at a euro zone meeting on Monday are little higher than 50-50.Obviously approval isn't assured.

Sometime next week the Greek parliament is expected to pass legislation to insert "collective action clauses" in bonds to force all private holders to accept the deal. The final details of the swap are expected to be set at the Monday finance minister meeting, and the swap is scheduled to take place between March 8th and March 11th (cutting it close!). See Financial Times: Greece sets date for €200bn debt swap

Even with all the austerity and severe recession, most Greeks still want to stay in the euro, from Reuters:

A survey by pollster MRB for Sunday's Realnews newspaper showed 72.7 percent of Greeks want the country to stay in the euroHere is a list of key dates:

Feb 20th: Euro-area finance ministers meet in Brussels.

Week of Feb 20th: Greek parliament to vote on legislation to insert "collective action clauses" in bonds.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: ECB holds rate meeting

March 8th - 11th: €200bn private sector bond swap is scheduled.

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds mature.

Earlier:

• Summary for Week ending February 17th

• Schedule for Week of February 19th

Gasoline Prices: $4.50 per gallon by Memorial Day?

by Calculated Risk on 2/18/2012 05:22:00 PM

From the Mercury News: Gas prices surging beyond $4 a gallon -- and they will go higher

Gasoline prices are rising at an almost unheard-of pace, and painfully so in California, where the cost for a fill-up now exceeds $4 a gallon in five cities and is approaching that dreaded mark in numerous others, including San Jose and Oakland.High gasoline prices is one reason American are driving less. Brad Plumer at the WaPo discusses a few other reasons: Driving, gas prices and the end of retail

The statewide average of $3.96 on Friday is 25 cents higher than just a month ago and 46 cents more than this time last year. ... Some oil analysts predict $4.50 a gallon or more by Memorial Day on the West Coast and major cities across the United States such as Chicago, New York and Atlanta.

Americans have cut way back on driving in recent years. Total vehicle-miles traveled has stagnated since 2007. One big question is whether this is a temporary blip due to the downturn — unemployed people, after all, don’t commute — or evidence of a long-term structural shift.And below is a graph of gasoline prices. Gasoline prices bottomed in December and have been moving up again. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

Theories for a structural shift generally involve demographics: America’s swelling ranks of retirees don’t drive as much, while kids these days prefer Facebook to motoring around with friends. But there’s another possible factor: the torrid growth of online shopping. Phil Izzo has the numbers, which are striking.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Schedule for Week of February 19th

by Calculated Risk on 2/18/2012 01:15:00 PM

Earlier:

• Summary for Week ending February 17th

The key reports this week are the January existing home sales report on Wednesday and the new home sales report on Friday. The AIA's Architecture Billings Index for January will also be released on Wednesday.

On Friday, the US Monetary Policy Forum will be held in New York. The discussion will focus on a paper titled: “Housing, Monetary Policy and the Recovery”.

In Europe, the euro-area finance ministers will meet on Monday.

All US markets will be closed in observance of Presidents' Day.

Euro-area finance ministers meet in Brussels to discuss the Greek debt deal.

8:30 AM ET: Chicago Fed National Activity Index (January). This is a composite index of other data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 4.69 million on seasonally adjusted annual rate basis.

Economist Tom Lawler estimates the NAR will report sales of 4.66 million, up slightly from December’s pace. It is possible that months-of-supply will be under 6 months for the first time since early 2006, and that listed inventory will be at the lowest level since early-2005.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 355,000 from 348,000 last week.

10:00 AM: FHFA House Price Index for December 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. The consensus is for an increase in this survey to 9 from 7 in January (above zero is expansion).

10:00 AM ET: New Home Sales for January from the Census Bureau.

10:00 AM ET: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 315 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 307 thousand in December. The consensus might be a little low based on the homebuilder confidence survey.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a slight increase to 72.9 from from the preliminary reading of 72.5.

During the day: 2012 US Monetary Policy Forum

[T]here will be a presentation on this year’s report on housing and the state of the recovery, which explores first, how bad is the physical and debt overhang of housing in the US economy? And secondly, does the peculiar state of the US housing market substantially limit the effectiveness of monetary policy that lowers long rates? The report titled "Housing, Monetary Policy and the Recovery," is being written by Mike Feroli (JP Morgan), Ethan Harris (Bank of America), Amir Sufi (Chicago Booth), and Ken West (University of Wisconsin). James Bullard (Federal Reserve Bank of Saint Louis) and John Williams (Federal Reserve Bank of San Francisco) will discuss the report.

Summary for Week ending February 17th

by Calculated Risk on 2/18/2012 08:11:00 AM

Once again most of the economic data last week was above expectations, and the data suggests some increase in economic activity. We could blame the improvement on better than normal weather – and that was a factor – but with all the bad weather in 2011, it is about time the economy caught a little break.

The strongest data was probably housing starts, especially single family starts. But we have to be careful with the numbers – the weather played a role - and January is seasonally one of the weakest months of the year. The key months for housing starts begin in March. The increase in starts fits with the recent increase in the builder confidence index, but we still haven’t seen a pickup in new home sales (January new home sales will be released next week).

There was some disappointment with the retail sales report for January. Retail sales only increased 0.4%, and that was below expectations for the month. And there was disappointment with inflation as several key measures ticked up a little in January.

Other positive data included another drop in initial weekly unemployment claims, and, for manufacturing, an increase in both the Empire State and Philly Fed manufacturing surveys showing faster expansion in February.

Also the MBA released the results of the Q4 National Delinquency Survey, and mortgage delinquencies declined in Q4 – and according to MBA Chief Economist Jay Brinkmann, delinquencies are about “half way” back to normal. However the number of loans in the foreclosure process is still near record levels.

Overall this was another solid week. Here is a summary in graphs:

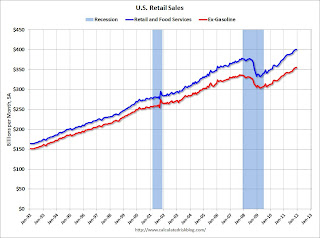

• Retail Sales increased 0.4% in January

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales were up 0.4% from December to January (seasonally adjusted, after revisions), and sales were up 5.8% from January 2011. Sales for December were revised down from a 0.1% increase to "virtually unchanged".

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.7% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted).

This was below the consensus forecast for retail sales of a 0.7% increase in January, but above the consensus for a 0.5% increase ex-auto.

• Housing Starts increased in January

Total housing starts were at 699 thousand (SAAR) in January, up 1.5% from the revised December rate of 689 thousand (SAAR). Note that December was revised up from 657 thousand.

Total housing starts were at 699 thousand (SAAR) in January, up 1.5% from the revised December rate of 689 thousand (SAAR). Note that December was revised up from 657 thousand. Single-family starts declined 1.0% to 508 thousand in January, however December was revised up by 43 thousand from 470 thousand. There were the first two months above 500 thousand since the expiration of the tax credit.

This graph shows total and single unit starts since 1968. It now appears both multi-family and single-family starts are moving up, but from very low levels. This was above expectations of 670 thousand starts in January.

• MBA: Mortgage Delinquencies declined in Q4

From the MBA: Delinquencies and Foreclosures Decline in Latest MBA Mortgage Delinquency Survey

The MBA reported that 11.96 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2011 (delinquencies seasonally adjusted). This is down from 12.41 percent in Q3 2011 and is the lowest level since 2008.

The MBA reported that 11.96 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2011 (delinquencies seasonally adjusted). This is down from 12.41 percent in Q3 2011 and is the lowest level since 2008.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.22% from 3.19% in Q3. This is at about 2007 levels.

Delinquent loans in the 60 day bucket decreased to 1.25% from 1.30% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.11% from 3.50% in Q3 2011. This is the lowest level since 2008, but still way above normal (probably around 1% would be normal).

The percent of loans in the foreclosure process declined slightly to 4.38% from 4.43%. The key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

• Industrial Production unchanged in January, Capacity Utilization declines

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.5% is still 1.8 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production was unchanged in January at 95.9; December was revised up sharply.

The consensus was for a 0.6% increase in Industrial Production in January, and for an increase to 78.6% for Capacity Utilization. Although below consensus, with the December revisions, this was about at expectations.

• Weekly Initial Unemployment Claims declined to 348,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 365,250.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 365,250.The 4-week moving average is at the lowest level since early 2008.

• Key Measures of Inflation increase in January

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index 0.2% (3.0% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.9% annualized rate) during the month. ... The CPI less food and energy increased 0.2% (2.7% annualized rate) on a seasonally adjusted basis."

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index 0.2% (3.0% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.9% annualized rate) during the month. ... The CPI less food and energy increased 0.2% (2.7% annualized rate) on a seasonally adjusted basis."This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.6%, and core CPI rose 2.3%. Core PCE is for December and increased 1.85% year-over-year. These measures show inflation is still above the Fed's 2% target.

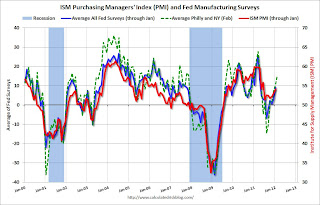

• Empire State and Philly Fed Manufacturing Surveys show stronger expansion

From the NY Fed: Empire State Manufacturing Survey

From the NY Fed: Empire State Manufacturing SurveyThe general business conditions index rose six points to 19.5, its highest level in more than a year.This was above the consensus forecast of a reading of 14.1 (above 0 is expansion) and the highest level since June 2010.

From the Philly Fed: February 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index ofThis indicates expansion in Febraury, at a faster pace than in January, and slightly above the consensus forecast of +8.4.

current activity, edged higher from a reading of 7.3 in January to 10.2, its highest level since October.

Above is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through February. The ISM and total Fed surveys are through January.

The average of the Empire State and Philly Fed surveys increased again in February, and is at the highest level since April 2011.

• NFIB: Small Business Optimism Index increased slightly in January

From the National Federation of Independent Business (NFIB): Small Business Confidence in a Lull

This graph shows the small business optimism index since 1986. The index increased to 93.9 in January from 93.8 in December. This is the fifth increase in a row after declining for six consecutive months.

This graph shows the small business optimism index since 1986. The index increased to 93.9 in January from 93.8 in December. This is the fifth increase in a row after declining for six consecutive months.The optimism index declined sharply in August due to the debt ceiling debate and has now rebounded to about the same level as early in 2011. This index is still low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

• Other Economic Stories ...

• NAHB Builder Confidence index increases in February; Highest in over four years

• Residential Remodeling Index increases 22.8% year-over-year in December

• From San Francisco Fed President John Williams: The Federal Reserve’s Mandate and Best Practice Monetary Policy

• Ceridian-UCLA: Diesel Fuel index declined 1.7% in January

• FHA REO Inventory declines to four-year low in December

Friday, February 17, 2012

Unofficial Problem Bank list declines to 956 Institutions

by Calculated Risk on 2/17/2012 09:07:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 17, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the OCC released its enforcement action activity through mid-January 2012 this week, which contributed to several changes to the Unofficial Problem Bank List this week. Given that the FDIC played nice with community banks by hosting an outreach conference in D.C. this week, it is not surprising they kept the closing teams grounded. In all, there were seven removals and five additions that leave the list with 956 institutions. However, assets were virtually unchanged at $389.56 billion. A year ago, there were 951 institutions with assets of $418.6 billion.After peaking at 1,004 institutions last July, the number of institutions on the unofficial list has slowly declined. But this is still very high.

All of the removals were cures and include Plumas Bank, Quincy, CA ($472 million Ticker: PLBC); The Farmers National Bank of Prophetstown, Prophetstown, IL ($450 million); Resource Bank, National Association, Dekalb, IL ($342 million); The First National Bank of Eagle River, Eagle River, WI ($146 million); The First National Bank of Plainview, Plainview, MN ($140 million); Western National Bank, Cass Lake, MN ($32 million); and The First National Bank of Frederick, Frederick, SD ($18 million).

The additions include Riverview Community Bank, Vancouver, WA ($861 million); Mariners Bank, Edgewater, NJ ($294 million); American National Bank, Oakland Park, FL ($214 million); Commerce National Bank & Trust, Winter Park, FL ($100 million); and First National Bank of Wauchula, Wauchula, FL ($84 million).

Next Friday there is a good chance the FDIC will release its enforcement action activity for January 2012.

Report: Existing Home inventory down 23.3% year-over-year

by Calculated Risk on 2/17/2012 05:56:00 PM

Note: Cardiff Garcia at FT Alphaville has some comments on inventory from several analysts: The decline of US housing inventory

Here is another report on inventory ... from Realtor.com: Real Estate Trends for January 2012

According to real estate data released today by Realtor.com, the national inventory of for-sale single family homes, condominiums, townhouses and co-ops (SFH/CTHCOPS) declined -6.59% from December to January, and is now down -23.20% compared to a year ago. The median age of the inventory also declined on both an annual and monthly basis, and is now -4.80% below the levels observed in January 2011.The NAR report doesn't always match up with other inventory reports - and there is some variability in how inventory is reported (some report include contingent short sales, some don't) - but it does appear inventory is down sharply in most areas. (Contingent short sale inventory is also down sharply).

...

For-sale inventories of SFH/CTHCOPS in January 2012 declined in all but one of the 146 MSAs monitored by Realtor.com compared to a year ago when for-sale inventories in more than half of all markets (85) dropped by 20% or more. ... Springfield, IL, was the only market to register a year-over-year increase in for-sale inventory. However, areas that showed the least signs of improvement tended to be concentrated in the Northeast corridor.

...

The median age of the inventory exceeded 120 days in 46 markets in January, down from 60 markets in December. While many of the markets with the oldest inventories are resort communities, particularly in Florida and the Carolinas, others are in industrialized areas that are experiencing the brunt of the economic downturn.

Lawler: Early Read on January Existing Home Sales

by Calculated Risk on 2/17/2012 01:55:00 PM

Economist Tom Lawler is forecasting that the National Association of Realtors (NAR) will report sales of 4.66 million on a seasonally adjusted annual rate (SAAR) basis for January. The NAR is scheduled to report existing home sales on Wednesday, Feb 22nd at 10 AM ET.

This is a slight increase from the 4.61 million rate in December, and essentially unchanged from the 4.64 million rate reported in January 2011.

Tom didn't send me an estimate for inventory, but based on other reports, I expect inventory to decline slightly from the 2.38 million houses for sale reported for December.

This sales rate, combined with a decline in inventory, could put months-of-supply under 6 months for the first time since early 2006.

Note: Even though there is a seasonal pattern for inventory (inventory usually bottoms in January and peaks in the summer), the months-of-supply metric is calculated using the seasonally adjusted sales rate and the not seasonally adjusted inventory. So the months-of-supply will probably increase again over the next 6 months.