by Calculated Risk on 11/21/2011 06:03:00 PM

Monday, November 21, 2011

Moody's: Commercial Real Estate Prices declined 1.4% in September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In September

U.S. commercial real-estate prices fell 1.4% in September, ending a four-month growth streak ... Moody's expects "multi-family and hotel properties to lead the price recovery," said Nick Levidy, Moody's managing director. "Office and retail will lag mostly because of a very high number of vacancies and the burn-off of above-market rent leases."Below is a graph of the Moodys/REAL Commercial Property Price Index (CPPI) - Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image.

Click on graph for larger image.CRE prices only go back to December 2000.

According to Moody's, CRE prices are up 1.3% from a year ago, and down about 42% from the peak in 2007. This index is very volatile because there are relatively few transactions - but it does appear to be mostly moving sideways.

Earlier:

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

• Existing Home Sales: More on Inventory and NSA Sales Graph

• Existing Home Sales graphs

DOT: Vehicle Miles Driven declined 1.5% in September

by Calculated Risk on 11/21/2011 03:45:00 PM

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by -1.5% (-3.7 billion vehicle miles) for September 2011 as compared with September 2010.The following graph shows the rolling 12 month total vehicle miles driven.

• Travel for the month is estimated to be 244.2 billion vehicle miles.

• Cumulative Travel for 2011 changed by -1.3% (-29.8 billion vehicle miles).

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 46 months - so this is a new record for longest period below the previous peak - and still counting! Talk about moving sideways ...

The second graph shows the year-over-year change from the same month in the previous year.

The current decline is not as a severe as in 2008, but this is significant.

The current decline is not as a severe as in 2008, but this is significant.The year-over-year decline in September wasn't as severe as in July and August, but was still negative for the seventh straight month.

Earlier:

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

• Existing Home Sales: More on Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: More on Inventory and NSA Sales Graph

by Calculated Risk on 11/21/2011 12:56:00 PM

Yesterday I discussed the expected downward revisions to the NAR estimates for sales and inventory. The NAR didn't provide any update on the benchmark revision process in the release today. I expect sales and inventory estimates to be revised down by 10% to 15% for the current year - and less in earlier years - probably about 2% or so in 2006 or 2007.

The NAR reported inventory fell to 3.33 million in October, but if my guess is correct, inventory will be adjusted to something in the 2.85 to 3.0 million range after the benchmark revision. This is close to the same level as in October 2005 (with listed inventory at 2.87 million units).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows inventory by month since 2004. In 2004 (black line), inventory was fairly flat and declined at the end of the year. In 2005 (dark blue line), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red) inventory is at the lowest level since 2005. And with the coming revisions correcting the "drift" in the reported data (both sales and inventory were too high for the last few years), the red line will probably be close to the 2005 (blue) line. Inventory will still be elevated - especially with the much lower sales rate - but this will put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2011.

The red columns are for 2011.

Sales NSA are above last October when sales declined sharply following the expiration of the tax credit in June 2010. Sales are close to the October 2008 level, but will be lower after the benchmark revision is released.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 29 percent of purchases in October, little changed from 30 percent in September and 29 percent in October 2010; investors make up the bulk of cash transactions.Earlier:

Investors purchased 18 percent of homes in October, compared with 19 percent in September and 19 percent in October 2010.

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

• Existing Home Sales graphs

Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

by Calculated Risk on 11/21/2011 10:00:00 AM

The NAR reports: October Existing-Home Sales Rise, Unsold Inventory Continues to Decline

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 1.4 percent to a seasonally adjusted annual rate of 4.97 million in October from a downwardly revised 4.90 million in September, and are 13.5 percent above the 4.38 million unit level in October 2010.

...

Total housing inventory at the end of October fell 2.2 percent to 3.33 million existing homes available for sale, which represents an 8.0-month supply at the current sales pace, down from an 8.3-month supply in September. Inventories have been trending gradually down since setting a record of 4.58 million in July 2008.

Click on graph for larger image in graph gallery.

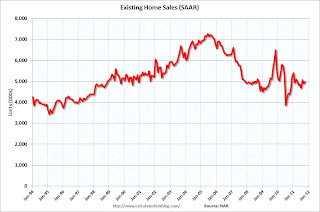

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2011 (4.97 million SAAR) were 1.4% higher than last month, and were 13.5% above the October 2010 rate.

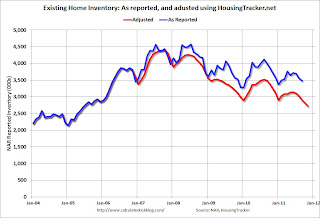

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.33 million in October from 3.41 million in September.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.Months of supply decreased to 8.0 months in October, down from 8.3 months in September. This is still higher than normal. These sales numbers were just above the consensus.

Chicago Fed: Economic activity up slightly in October

by Calculated Risk on 11/21/2011 08:30:00 AM

This is a composite index from the Chicago Fed: Index shows economic activity up slightly in October

Led by improvements in production-related indicators, the Chicago Fed National Activity Index edged up to –0.13 in October from –0.20 in September. Two of the four broad categories of indicators that make up the index improved from September, and only the consumption and housing category remained negative in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

...

The index’s three-month moving average, CFNAI-MA3, decreased to –0.27 in October from –0.16 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. Likewise, the economic slack reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was growing in October, but below trend.

Yesterday:

• Summary for Week Ending Nov 18th

• Schedule for Week of Nov 20th

• Lawler: Household Growth by Age Group: 2010 – 2015 “Conservative” Forecasts

Sunday, November 20, 2011

Europe Update

by Calculated Risk on 11/20/2011 08:42:00 PM

From the Athens News: PM heads for Brussels to try to secure cash

New prime minister headed to Brussels on Sunday to fight for the aid Athens needs to avoid bankruptcy, even as one of his coalition backers refused to give a written pledge to support reforms and a public sector union geared up for strikes.Most analysts think there will a compromise and Greece will receive the next aid tranche before mid-December.

Lucas Papademos must convince the International Monetary Fund and the European Union to give Greece the 8 billion euros it needs to avoid a mid-December default ...

[D]uring the [troika] visit, New Democracy head Antonis Samaras refused to give a written guarantee that he would continue to do whatever it took to meet the terms of the bailout no matter who wins an election tentatively set for Feb. 19.

From the WSJ: EU Paper Offers Options for Euro Bonds

The [European Commission] discussion paper suggests three options for issuing euro bonds. ...And from the BBC: Spain election: Rajoy's Popular Party declares victory

The first option it discusses would be to substitute all national issues by governments with euro bonds carrying what it calls a "joint and several" guarantee, meaning that euro-zone states would pool the credit risk and each government would agree to guarantee the debt of every other government. ... The second option would be to partially substitute national issuance with euro bonds up to a limit, of say 60%, of a country's gross domestic product ... Those two options would require treaty changes ...

[The] third approach would have euro bonds replace some national bond issues—but the euro bonds would receive guarantees from each government only up to specific limits [and would not require a treaty change].

Mr Rajoy, who is expected to tackle the country's debts amid slow growth and high unemployment, said he was aware of the "magnitude of the task ahead".More austerity ...

He told supporters there would be "no miracle" to restore Spain to financial health ... The new government will have little time to show results and people are bracing themselves for a new wave of spending cuts, our correspondent adds.

Over the past week, borrowing rates have risen to the 7% level which is regarded as unsustainable. Unemployment stands at five million.

Miguel Arias, the Popular Party's campaign co-ordinator, said Spain was "going to make all the sacrifices".

"We have been living as a very rich country," he told BBC News.

Yesterday:

• Summary for Week Ending Nov 18th

• Schedule for Week of Nov 20th

• Lawler: Household Growth by Age Group: 2010 – 2015 “Conservative” Forecasts

A few comments on the expected NAR existing home sales revisions

by Calculated Risk on 11/20/2011 03:50:00 PM

"In the near future", the NAR is expected to revise down their estimates of existing home sales for the last few years. Tom Lawler wrote back in January 2011:

As many readers may recall, over the last year and a half I have noted numerous times that the NAR’s estimates for existing home sales appear to have understated the decline in existing home sales since 2006, with the “gap” increasing from 2007 through 2009. The basis for that assertion was that existing home sales based on property records in some key states declined materially more than did the NAR’s estimate of existing home sales in those states. In addition, CoreLogic’s estimates of existing home sales based on property records in its database (which covers “over 80%”of the US housing market) show materially larger declines since 2006 than do the NAR’s estimates.And from CoreLogic in February 2011: CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

The NAR is aware of these “discrepancies” and has been since at least 2009, but changing its methodology is not a trivial task. However, reportedly the NAR (working with others) has been looking into this issue, and is exploring whether it needs to change its methodology to get better estimates of “actual” existing home sales.

Historically, the CoreLogic existing sales data have covered about 85% to 90% of all NAR’s existing home sales data. However, in 2006 NAR’s sales data became elevated relative to the CoreLogic, MBA, HMDA and Census sales related data, and that trend has continued and become more pronounced through 2010. There are several reasons for the divergence, including benchmarking drift, more sales going through MLS systems due to consolidation and a lower share of for sale by owners (FSBO) home sales. Net, NAR’s existing home sales data are overstated by about 15% to 20%.Apparently the NAR is getting close to releasing the new methodology for estimating sales, from the NAR on November 11th:

NAR presently is benchmarking existing-home sales, and downward revisions are expected for totals in recent years, although there will be little change to previously reported comparisons based on percentage change. There will be will be no change to median prices or month’s supply of inventory. Publication of the improved measurement methodology is expected in the near future.The most important aspect of this revision is the "improved measurement methodology" so that we will have more accurate information in the future. The next most important part of the revision is the level of "visible" inventory. According to the NAR release, inventory will be revised down for the last several years by the same amount as sales, keeping the months of supply the same as originally released. With the NAR revisions, I expect listed inventory to be at the lowest level since late 2005.

That means we can estimate the downward revisions to sales by looking at other sources of inventory data. I've been using the monthly inventory data from deptofnumbers (aka housingtracker) for 54 metro areas.

Click on graph for larger image.

Click on graph for larger image.This graph adjusts the reported NAR inventory by the HousingTracker changes, using 2006 as the starting point.

The gap between the NAR reported inventory and the HousingTracker inventory steadily increased over the last 5 years. The "drift" was fairly gradual, but cumulative over the last 5 years or so.

Using the HousingTracker data, here is what the adjustment to the NAR sales would look like (this is NOT the NAR adjustment):

| Year | Sales, as Reported | YoY Change, as Reported | Adjustment | Sales, Adjusted | YoY Change, Adjusted |

|---|---|---|---|---|---|

| 2007 | 5,652,000 | -12.7% | -2.8% | 5,495,000 | -15.2% |

| 2008 | 4,913,000 | -13.1% | -4.5% | 4,691,000 | -14.6% |

| 2009 | 5,156,000 | 4.9% | -10.0% | 4,642,000 | -1.0% |

| 2010 | 4,908,000 | -4.8% | -13.4% | 4,250,000 | -8.4% |

| 20112 | 4,950,000 | 0.9% | -15.1% | 4,201,000 | -1.2% |

| 1An example of adjustment, this is NOT the NAR adjustment, 2estimate for 2011 | |||||

These adjustments might be a little high, but I expect the current year sales to be revised down by 10% to 15%. CoreLogic expects 2010 sales to be revised down by 15% to 20%.

Hopefully the revisions will be released soon.

Report: Not so Super committee to admit defeat as soon as Monday

by Calculated Risk on 11/20/2011 09:15:00 AM

From the WaPo: Supercommittee likely to admit defeat on debt deal

The congressional committee tasked with reducing the federal deficit is poised to admit defeat as soon as Monday ...Just about everyone expected the committee to fail. The key is how much fiscal tightening happens next year - as I've noted before, the two most significant downside risks to the U.S. economy in 2012 are the European financial crisis and more fiscal tightening.

... many economists consider particularly urgent the need to extend jobless benefits and the one-year payroll tax cut. ... the payroll tax cut, enacted last December, allows most American workers to keep an additional 2 percent of their earnings, a boon to tight household budgets as well as the economic recovery. Economists at J.P. Morgan Chase recently estimated that if Congress does not extend the two measures, economic growth next year could take a hit of as much as two percentage points — enough to revive fears of a recession.

As Goldman Sachs economist noted on November 11th, the impact from not extending the payroll tax cut would be significant: "Our forecast assumes that the payroll tax cut is extended for another year; if that failed to happen, the fiscal drag in early 2012 would rise significantly." And their forecast for Q1 2012 is for 0.5% GDP growth ...

Yesterday:

• Summary for Week Ending Nov 18th

• Schedule for Week of Nov 20th

• Lawler: Household Growth by Age Group: 2010 – 2015 “Conservative” Forecasts

Saturday, November 19, 2011

Unofficial Problem Bank list declines to 977 Institutions

by Calculated Risk on 11/19/2011 07:13:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 18, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Activity on the Unofficial Problem Bank List picked-up this week. There were five removals, one addition, and assets were updated through September 30, 2011. After these changes, the list includes 977 institutions with assets of $399.1 billion. During the quarter, assets for remaining banks on the Unofficial Problem Bank List declined by $5.9 billion. A year ago, the list had 903 institutions with assets of $419.6 billion.Earlier:

The removals include one action termination -- Royal Bank America, Narberth, PA ($900 million Ticker: RBPAA); two unassisted mergers -- The Bank of Texas, Devine, TX ($51 million) and United Kentucky Bank of Pendleton County, Inc., Falmouth, KY ($28 million); and two failures -- Central Progressive Bank, Lacombe, LA ($398 million) and Polk County Bank, Johnston, IA ($99 million).

Added this week is Village Bank, Midlothian, VA ($600 million Ticker: VBFC). We do not expect the FDIC to close any banks next week because of the holiday but we do anticipate for the FDIC and OCC to provide an update on their problem bank activities for the past month.

• Summary for Week Ending Nov 18th

• Schedule for Week of Nov 20th

• Lawler: Household Growth by Age Group: 2010 – 2015 “Conservative” Forecasts

Lawler: Household Growth by Age Group: 2010 – 2015 “Conservative” Forecasts

by Calculated Risk on 11/19/2011 03:44:00 PM

Some food for thought from economist Tom Lawler:

The tables below assume continued low immigration and two scenarios for headship rates: 1) an average of Census 2000 and 2010 headship rates, and 2) just Census 2010 headship rates.

CR Note: Under both scenarios - the average of Census 2000 and 2010 headship rates and just using the 2010 headship rates - there will be a fairly strong increase in younger households over the next few years (the apartment analysts have been making this argument).

Even with a 50%+ increase in multi-family starts in 2011, the builders will have only started around 150,000 to 160,000 units this year. Based on these projections, multi-family starts will increase further over the next few years.

And look at the projected increase in 55 to 74 year old households. That will probably be a key segment of growth for households. Of course headships rates could fall further (the older people could move in with their kids), but this suggests positive demographics for housing over the next several years.

Tables and calculations by Tom Lawler:

| US Households by Age Group: Headship Rates Equal to 2000 and 2010 Average | |||

|---|---|---|---|

| Age | 2010 | 2015 | Avg. Annual Change |

| 15-24 | 5,401 | 5,781 | 76 |

| 25-34 | 17,957 | 19,448 | 298 |

| 35-44 | 21,291 | 21,277 | -3 |

| 45-54 | 24,907 | 24,324 | -117 |

| 55-64 | 21,340 | 24,053 | 543 |

| 65-74 | 13,505 | 17,033 | 706 |

| 75+ | 12,315 | 12,692 | 75 |

| Total | 116,716 | 124,608 | 1,578 |

| US Households by Age Group: Headship Rates Stay at 2010 Lows | |||

|---|---|---|---|

| Age | 2010 | 2015 | Avg. Annual Change |

| 15-24 | 5,401 | 5,401 | 0 |

| 25-34 | 17,957 | 18,983 | 205 |

| 35-44 | 21,291 | 21,024 | -53 |

| 45-54 | 24,907 | 24,069 | -168 |

| 55-64 | 21,340 | 24,012 | 534 |

| 65-74 | 13,505 | 16,981 | 695 |

| 75+ | 12,315 | 12,918 | 121 |

| Total | 116,716 | 123,388 | 1,334 |