by Calculated Risk on 10/20/2011 04:35:00 PM

Thursday, October 20, 2011

Builders to deliver record low number of housing units in 2011

Earlier:

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

• Existing Home Sales graphs

On Tuesday, in a discussion of "builder confidence", I mentioned that "the builders delivered a record low number of housing units last year - and will probably break that record again this year."

I should have left out the "probably"; the builders will deliver a record low number of housing units this year (see the table at the bottom).

I am upping my forecast for multi-family deliveries this year. Usually it takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year. I still expect a record low number of multi-family units completed this year, however the builders have clearly accelerated construction on some projects (shorter time to completion).

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The rolling 12 month total for starts (blue line) is now above the rolling 12 month for completions (red line). However completions are now moving up too.

It is important to note that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). Still this is bright spot for construction.

Below is a table of net housing units added to the housing stock since 1990. Note: Demolitions / scrappage estimated.

This means there will be a record low number of housing units added to the housing stock this year (good news with all the excess inventory), and that the overhang of excess inventory should decline significantly in 2011 depending on the rate of household formation (and that depends on jobs).

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 (est) | 430 | 135 | 46 | 611 | 150 | 461 |

Sarkozy: 2nd European Leader Summit to Adopt Plan

by Calculated Risk on 10/20/2011 01:51:00 PM

Via Google Translate:

FRANCO-GERMAN PRESSAnd in French:

The President and German Chancellor spoke today by telephone to prepare the European dates in the coming days.

The President and the Chancellor have agreed to provide a comprehensive and ambitious global response to the current crisis in the euro area.

This response will include the following:

- The operational implementation of new forms of intervention EFSF.

- A plan to strengthen the capital of European banks.

- The implementation of the economic governance of the euro area and the strengthening of economic integration.

For a lasting solution to the situation in Greece, the Greek authorities will have to make ambitious commitments to address the situation of their economies as part of a new program. Based on the report of the troika and the analysis of debt sustainability Greece, France and Germany call for immediately undertake negotiations with the private sector to reach an agreement for strengthening sustainability.

The President and the Chancellor will meet Saturday night in Brussels ahead of the European Council summit in the euro area on Sunday.

France and Germany have agreed that all elements of this ambitious and comprehensive response will be discussed in depth at the summit on Sunday in order to be finally adopted by the Heads of State and Government at a second meeting later than Wednesday.

COMMUNIQUÉ FRANCO-ALLEMANDEarlier:

Le président de la République et la chancelière allemande se sont entretenus ce jour par téléphone pour préparer les échéances européennes de ces prochains jours.

Le président et la chancelière ont marqué leur accord complet pour apporter une réponse globale et ambitieuse à la crise que traverse actuellement la zone euro.

Cette réponse comportera notamment les éléments suivants :

- la mise en œuvre opérationnelle des nouvelles modalités d’intervention du FESF.

- Un plan de renforcement du capital des banques européennes.

- La mise en place de la gouvernance économique de la zone euro et le renforcement de l’intégration économique.

En vue d’une solution durable à la situation de la Grèce, les autorités grecques devront prendre des engagements ambitieux pour redresser la situation de leur économie dans le cadre d’un nouveau programme. Sur la base du rapport de la troïka et de l’analyse de la soutenabilité de la dette grecque, la France et l’Allemagne demandent que les négociations s’engagent immédiatement avec le secteur privé pour trouver un accord permettant de renforcer cette soutenabilité.

Le président de la République et la chancelière se retrouveront samedi soir à Bruxelles en amont du Conseil européen et du sommet de la zone euro de dimanche.

La France et l’Allemagne sont convenues que l’ensemble des éléments de cette réponse globale et ambitieuse sera examiné de manière approfondie lors du sommet de dimanche pour pouvoir être adopté définitivement par les chefs d’Etat et de gouvernement lors d’une deuxième rencontre au plus tard mercredi.

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

• Existing Home Sales graphs

Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

by Calculated Risk on 10/20/2011 11:45:00 AM

The high frequency data and surveys continue to indicate some improvement. Earlier this morning, the 4-week average of initial weekly unemployment claims fell to the lowest level since April - although still elevated - and now the Philly Fed manufacturing survey indicated expansion for the first time in three months - although still weak.

Even if there has been a little rebound from the economic shock in early August, due to the threat of a U.S. default, the rebound is just to sluggish growth. And there are significant downside risks from the European crisis and premature tightening in the U.S.

As a reminder, my most used post title over the last few years has been "Jobs, jobs, jobs", and even if we see sluggish growth, jobs remain priority #1 in the U.S.

• From the Philly Fed: October 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from ‐17.5 in September to 8.7, the first positive reading in three months. The current new orders index paralleled the rise in the general activity index, increasing 19 points and returning to positive territory. The shipments index also recorded a positive reading, increasing from ‐22.8 in September to 13.6 this month.This indicates expansion in October, and was well above the consensus forecast of -9.0.

...

The current employment index remained slightly positive but decreased 4 points from its reading in September. The average workweek index increased notably from ‐13.7 to 3.1.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys rebounded in October, and is now slightly positive.

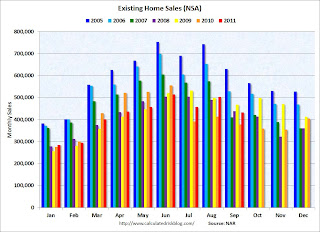

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2011.

The red columns are for 2011. Sales NSA are above last September - of course sales declined sharply last year following the expiration of the tax credit in June 2010.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 30 percent of purchase activity in September, up from 29 percent in August and 29 percent also in September 2010; investors make up the bulk of cash purchases.Earlier:

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Existing Home Sales graphs

Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

by Calculated Risk on 10/20/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Off in September but Higher Than a Year Ago

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 3.0 percent to a seasonally adjusted annual rate of 4.91 million in September from an upwardly revised 5.06 million in August, but are 11.3 percent above the 4.41 million unit pace in September 2010.

...

Total housing inventory at the end of September declined 2.0 percent to 3.48 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, compared with an 8.4-month supply in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2011 (4.91 million SAAR) were 3.0% lower than last month, and were 11.3% above the September 2010 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.48 million in September from 3.55 million in August.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.Months of supply increased to 8.5 months in September, up from 8.4 months in August. This is much higher than normal. These sales numbers were close to the consensus.

I'll have more soon ...

Weekly Initial Unemployment Claims: 4-Week average lowest since April

by Calculated Risk on 10/20/2011 08:30:00 AM

The DOL reports:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 403,000, a decrease of 6,000 from the previous week's revised figure of 409,000. The 4-week moving average was 403,000, a decrease of 6,250 from the previous week's revised average of 409,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 403,000.

This is the lowest level for the 4-week average of weekly claims since April, and this was slightly above the consensus forecast. This is still elevated, and still above the post-recession lows of earlier this year.