by Calculated Risk on 9/22/2011 04:55:00 PM

Thursday, September 22, 2011

House Price Indexes show smaller price increases in July

The Case-Shiller House Price index for July will be released Tuesday. Here are a few other indexes:

• FNC: Home Prices Begin to Lose Momentum; Up 0.1% in July

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicates that single-family home prices were up slightly in July to a seasonally unadjusted rate of 0.1%, following a strong performance in June that saw a 1.1% increase in a single month. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are often sold with large price discounts due to poor property conditions.The FNC index tables for three composite indexes and 30 cities are here.

• CoreLogic reported earlier this month for July: Home Price Index increased 0.8% in July

July Home Price Index (HPI) which shows that home prices in the U.S. increased for the fourth consecutive month, inching up 0.8 percent on a month-over-month basis.• The FHFA reported this morning: FHFA House Price Index Up 0.8 Percent in July

• From RadarLogic today As We Pass the Seasonal Peak in Home Prices, Signs Point to Trouble Ahead

In July, the 25-MSA RPX Composite price remained essentially unchanged on a month-over-month basis, but declined year over year for the 13th month in a row.The consensus is that prices increased in July, but that prices will start falling again soon.

...

Last month, we predicted that the S&P/Case-Shiller 10-City composite for June 2011 would be about 156 and the 20-City composite would be roughly 142. In fact, the 10-City composite was 154.88 and the 20-City composite was 141.30.

This month, we expect the S&P/Case-Shiller composite indices to increase about one percent month over month, but to remain about three percent below their July 2010 levels. The July 2011 10-City composite index will be about 156, and the 20-City index will be roughly 143.

Here is a graph (click on graph for larger image) from Doug Short.

Pretty wild swings over the last couple of months!

Europe Update: Greek Austerity, EU to recapitalise 16 banks

by Calculated Risk on 9/22/2011 03:09:00 PM

Update: from Bloomberg: Europe Officials Weigh Forming Crisis ‘Firewall’

European officials said governments may leverage the region’s bailout program to erect a “firewall” around the sovereign debt crisis once a revamp of the fund is completed.From the Financial Times: EU set to speed recapitalisation of 16 banks

European officials look set to speed up plans to recapitalise the 16 banks that came close to failing last summer’s pan-EU stress tests as part of a co-ordinated effort to reassure the markets about the strength of the 27-nation bloc’s banking sector.From Bloomberg: Greece Speeds Budget Cuts to Ensure Aid

A senior French official said the 16 banks regarded to be close to the threshold would now have to seek new funds immediately. Although there has been widespread speculation that French banks are seeking more capital, none is on the list.

excerpt with permission

Measures announced yesterday following two rounds of talks with the European Union and the IMF include: a 20 percent cut in pensions of more than 1,200 euros ($1,650) a month, according to a government statement; pensions paid to those younger than 55 will be shaved by 40 percent for the amount exceeding 1,000 euros and wages will be lowered for 30,000 state employees.The Greek 2 year yield was up to 66.5%. The Greek 1 year yield is at 135%.

With an 8 billion-euro aid payment in the balance, Greek creditors are also in the final stages of negotiating a bond exchange intended to reduce the country’s debt load of about 350 billion euros.

The Portuguese 2 year yield is up to 17.5% (rising quickly) and the Irish 2 year yield was down to 9.1%.

The Italian 10 year yield was down slightly to 5.7%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Moody's: Commercial Real Estate Prices increased in July

by Calculated Risk on 9/22/2011 11:52:00 AM

From Bloomberg: Commercial Real Estate Prices in U.S. Increased 5% in July, Moody’s Says

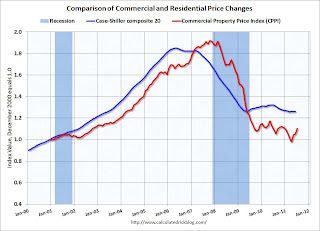

The Moody’s/REAL Commercial Property Price Index advanced 5 percent from June. It’s up 1.2 percent from a year earlier and almost 13 percent from its post-peak low in April, the New York- based company said in a report today.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Demand was driven by middle-market properties that aren’t considered major assets.

...

“This month’s gain is more a continuation of the bottoming process than a harbinger of recovery,” the company said in the report. “Slow job growth will crimp expectations for the absorption of vacant space and for rent increases, which in turn will constrain near term price increases.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 1.2% from a year ago and down about 42% from the peak in 2007. Some of this increase was probably seasonal - also this index is very volatile because there are relatively few transactions. Also, this report was for July, and the index will probably be weaker in August after the debt ceiling debate and the renewed fears about Europe.

Misc: Low Mortgage Rates, Leading Indicators indicate weak growth, FHFA reports house prices increase in July

by Calculated Risk on 9/22/2011 10:21:00 AM

• From Freddie Mac: Fixed-Rate Mortgages Hold Steady, Remain Near Record Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed-rate mortgages changing little amid sluggish economic, mixed housing data, and ongoing concerns over the European debt markets. The 30-year fixed remained unchanged at 4.09 percent, while the 15-year fixed dropped a single basis point to 3.29 percent, marking a new record low.There will be new record low mortgage rates reported next week.

• From MarketWatch: August economic indicators signal weak growth

The economy should exhibit "continued weak growth" through the fall and winter, the Conference Board said Thursday as it reported that its index of leading economic indicators grew 0.3% in August, compared with a 0.1% gain expected by economists polled by MarketWatch. "There is growing risk that sustained weak confidence could put downward pressure on demand and business activity, causing the economy to potentially dip into recession," said Ken Goldstein, a Conference Board economist ...• From the FHFA: FHFA House Price Index Up 0.8 Percent in July

U.S. house prices rose 0.8 percent on a seasonally adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.9 percent increase in June was revised to a 0.7 percent increase. For the 12 months ending in July, U.S. prices fell 3.3 percent.This is the GSE only index. The FHFA “expanded-data” House Price Index (HPI) that covers all homes is only released Quarterly. There will be more house price data released soon - and Case-Shiller next Tuesday.

Weekly Initial Unemployment Claims decline slightly to 423,000

by Calculated Risk on 9/22/2011 08:30:00 AM

The DOL reports:

In the week ending September 17, the advance figure for seasonally adjusted initial claims was 423,000, a decrease of 9,000 from the previous week's revised figure of 432,000. The 4-week moving average was 421,000, an increase of 500 from the previous week's revised average of 420,500.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 421,000.

The 4-week average has been increasing recently and this is the highest level since early July.

Wednesday, September 21, 2011

Misc: Possible Refinance Boom, Update to Reinhart and Rogoff paper

by Calculated Risk on 9/21/2011 08:46:00 PM

• From reader Soylent Green is People (mortgage broker):

"Refinance boom will be much larger than 2009 when the Feds remove the 125% LTV cap on HARP loans. There are so many whispers about it I can hardly hear myself think."• From Tom Petruno at the LA Times: Mortgage rates expected to slide on new Fed move

The shift back to mortgage bonds could bring $20 billion or more a month of Fed buying power into that market, said Walter Schmidt, a bond market analyst at FTN Financial in Chicago.• An update to the widely quoted Carmen Reinhart and Kenneth Rogoff paper from the Oregon Office of Economic Analysis: This Time is Different, An Update

...

“It’s absolutely clear they’re targeting mortgages,” Keith Gumbinger, a principal at mortgage data firm HSH Associates in Pompton Plains, N.Y., said of the Fed.

...

The 4% level is a psychological barrier for the market, but “I think we can breach that” soon, Schmidt said.

I have recreated and updated some of Ms Reinhart and Mr Rogoff’s work. Specifically, what follows (PDF – full version) is based on their draft paper for an American Economic Association presentation in January 2009 “The Aftermath of Financial Crises.“See the post for several tables and graphs.

In order to not bury the lede, first up is a quick summary of the U.S.’ current experience relative to historical financial crises, followed later by graphs for each individual measure.

All told, the recent U.S. financial crisis looks very similar to the historical crises as detailed by Reinhart and Rogoff – just your “garden variety, severe financial crisis” if you will. Across each of the five measures discussed in the Aftermath paper, the current U.S. experience is of the same magnitude

Earlier:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Will there be another Refinance Boom?

• AIA: Architecture Billings Index Turns Positive

• Existing Home Sales graphs

Will there be another Refinance Boom?

by Calculated Risk on 9/21/2011 04:55:00 PM

First, one of the changes in the FOMC statement was the assessment of "downside risks". The August phrase "downside risks to the economic outlook have increased" was changed to "there are significant downside risks to the economic outlook, including strains in global financial markets." (emphasis added). Now the risks are "significant".

The Ten year Treasury yield declined following the FOMC announcement today to 1.875% - another record low. The Fed will not extend maturities, but the Fed will also "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities", and that will probably push mortgage rates down.

A 3 handle for a conforming 30 year fixed rate mortgage is very possible. As of Sept 15, the 30 year fixed rate was at 4.09% for conforming loans according to the Freddie Mac Weekly Primary Mortgage Market Survey®.

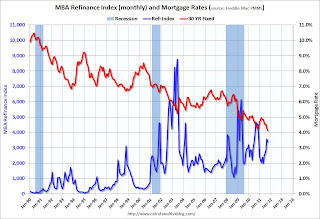

Here are a couple of graphs - the first comparing 30 year conforming mortgage rates to the MBA Refinance index (on a monthly basis), and the 2nd graph is weekly comparing the Refinance index to the Ten Year yield.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years and will probably fall further.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates might not fall that far - but there should be an increase in refinance activity over the next few weeks. Note: 30 year conforming mortgage rates were at 4.23% in October 2010.

The second graph compares refinance activity to the ten year yield.

The second graph compares refinance activity to the ten year yield.

The ten year yield is below the level during the financial crisis.

My guess is we see 30 year mortgage rates under 4% and a significant pickup in mortgage refinance activity - although probably not the level of refinance activity that happened in 2003 or 2009.

Earlier:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

FOMC Statement: Extend Maturities, Reinvest in agency mortgage-backed securities

by Calculated Risk on 9/21/2011 02:22:00 PM

From the Federal Reserve:

Information received since the Federal Open Market Committee met in August indicates that economic growth remains slow. Recent indicators point to continuing weakness in overall labor market conditions, and the unemployment rate remains elevated. Household spending has been increasing at only a modest pace in recent months despite some recovery in sales of motor vehicles as supply-chain disruptions eased. Investment in nonresidential structures is still weak, and the housing sector remains depressed. However, business investment in equipment and software continues to expand. Inflation appears to have moderated since earlier in the year as prices of energy and some commodities have declined from their peaks. Longer-term inflation expectations have remained stable.UPDATE: Statement from NY Fed: Statement Regarding Maturity Extension Program and Agency Security Reinvestments (includes details).

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect some pickup in the pace of recovery over coming quarters but anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, there are significant downside risks to the economic outlook, including strains in global financial markets. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to extend the average maturity of its holdings of securities. The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less. This program should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

To help support conditions in mortgage markets, the Committee will now reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. In addition, the Committee will maintain its existing policy of rolling over maturing Treasury securities at auction.

The Committee also decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action were Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who did not support additional policy accommodation at this time.

Earlier:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Existing Home Sales: Comments and NSA Graph

by Calculated Risk on 9/21/2011 11:59:00 AM

A few comments and a graph (of course):

• The NAR reported that inventory decreased in August from July, and that inventory is off 13.1% from August 2010. Other data sources suggest that the NAR is overstating inventory (inventory will be part of the coming revisions). Also it appears inventory has continued to decline (year-over-year) in September.

This year-over-year decline in inventory is one of the most important stories of the year for the existing home market, and is hardly being mentioned. I suspect many homeowners are "waiting for a better market", but less inventory will put less downward pressure on prices. Of course REO activity is picking up again and distressed sales will put more downward pressure on prices - but this decline in inventory is still important.

• The NAR provided an update on the timing of the "benchmark revisions":

Update on Benchmark Revisions: ... Preliminary data based on the new benchmark is undergoing review by professional economists. This process is expected to take some time before finalized revisions can be published to address any issues that may surface in the review process and to update monthly seasonal adjustment factors; NAR is committed to providing accurate, reliable data. Publication of the revisions is expected in several months, and we will provide a notice several weeks in advance of the publication date.This revision is expected to show significantly fewer homes sold over the last few years (perhaps 10% to 15% fewer homes in 2010 than originally reported), and also fewer homes for sale.

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The red columns are for 2011.

Sales NSA are above last August - of course sales declined sharply last year following the expiration of the tax credit in June 2010 - but sales are also above August 2008 and 2009 (pre-revision).

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 29 percent of transactions in August, unchanged from July; they were 28 percent in August 2010; investors account for the bulk of cash purchases.Earlier:

Investors accounted for 22 percent of purchase activity in August, up from 18 percent in July and 21 percent in August 2010. First-time buyers purchased 32 percent of homes in August, unchanged from July; they were 31 percent in August 2010.

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales graphs

Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

by Calculated Risk on 9/21/2011 10:00:00 AM

The NAR reports: August Existing-Home Sales Rise Despite Headwinds, Up Strongly from a Year Ago

Total existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 7.7 percent to a seasonally adjusted annual rate of 5.03 million in August from an upwardly revised 4.67 million in July, and are 18.6 percent higher than the 4.24 million unit level in August 2010.

...

Total housing inventory at the end of August fell 3.0 percent to 3.58 million existing homes available for sale, which represents an 8.5-month supply4 at the current sales pace, down from a 9.5-month supply in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2011 (5.03 million SAAR) were 7.7% higher than last month, and were 18.6% above the August 2010 rate (depressed in Aug 2010 following expiration of tax credit).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.58 million in August from 3.69 million in July.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.1% year-over-year in August from August 2010. This is the seventh consecutive month with a YoY decrease in inventory.

Inventory decreased 13.1% year-over-year in August from August 2010. This is the seventh consecutive month with a YoY decrease in inventory.Months of supply decreased to 8.5 months in August, down from 9.5 months in July. This is much higher than normal. These sales numbers were well above the consensus, but just slightly above Lawler's forecast using the NAR method.

I'll have more soon ...